3 minutes reading time

ETF industry on the cusp of $300 billion milestone after strong inflows

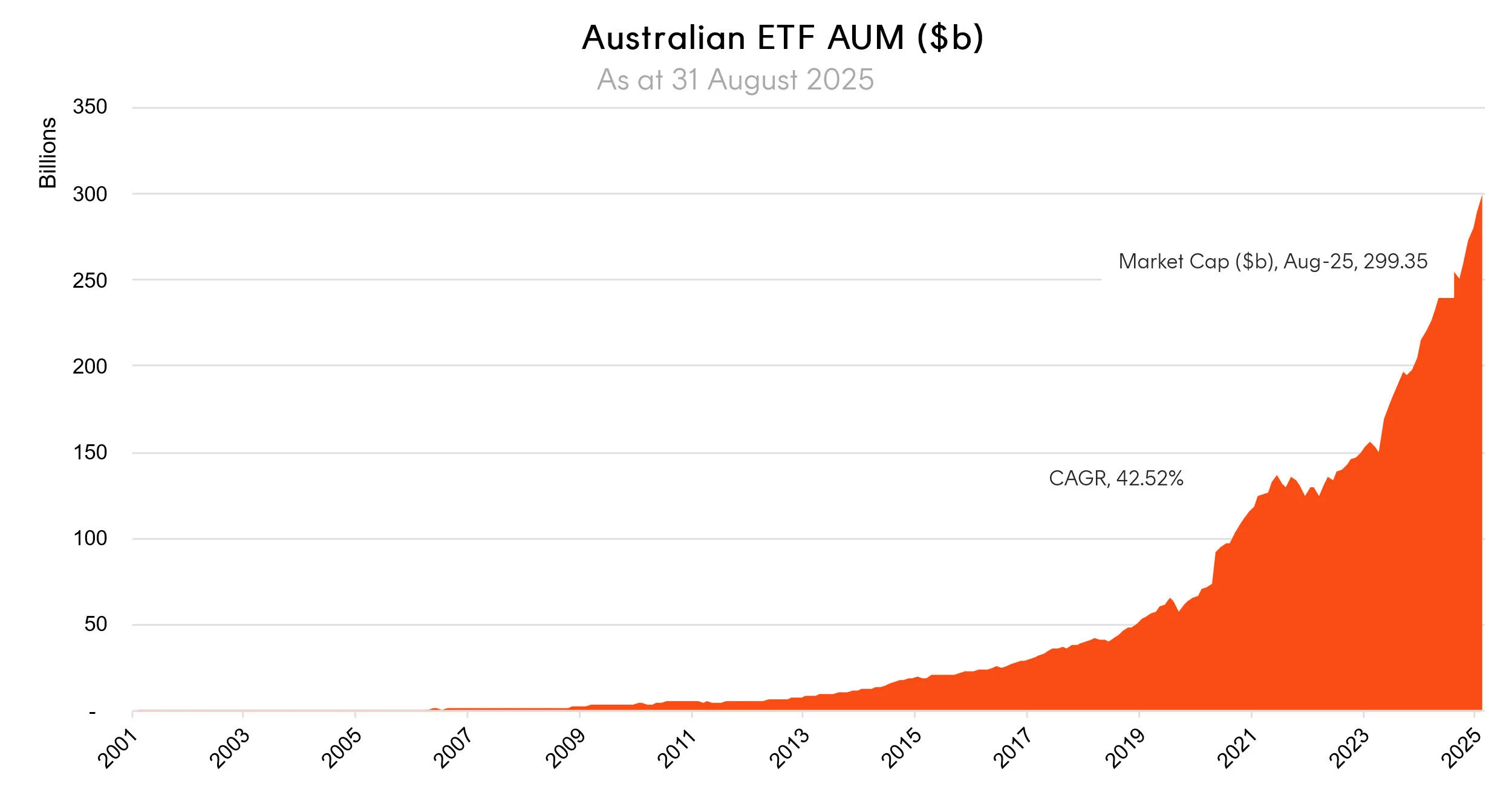

- Elevated inflows, combined with positive market performance, pushed the Australian ETF industry to a new record high of $299.4B in funds under management– a rise of $10.2B or 3.52%

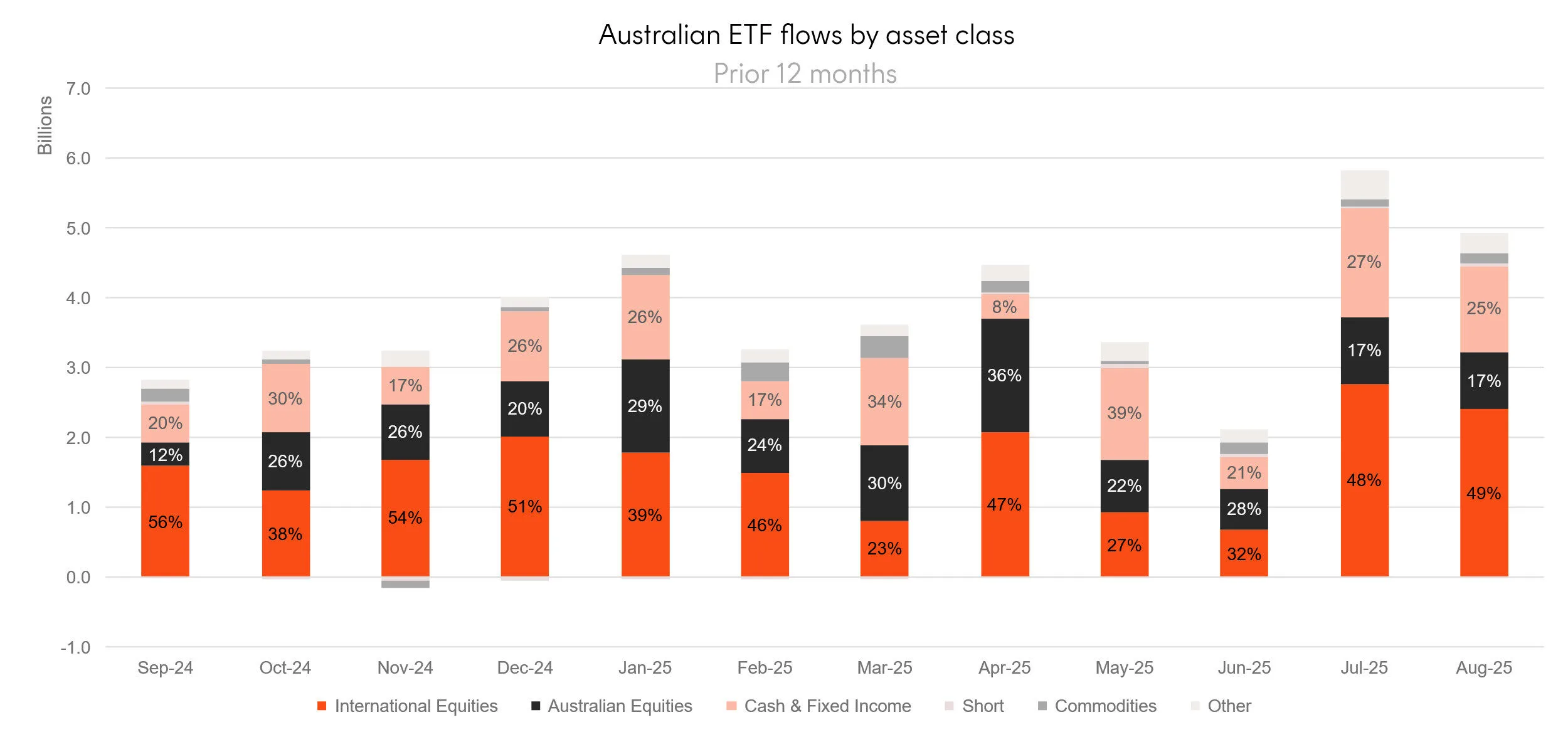

- Industry inflows for the month were an elevated $4.9B – the second highest amount on record, although down on the record $5.8B of inflows last month

- ASX trading value was ~$15B in August – an elevated level but less than the record set in May this year

- Over the last 12 months the Australian ETF industry has grown by 36%, or $79.2B

- Product development returned with 6 new funds launching in August – including a High Yield Australian Shares Fund (ASX: HYLD) , an Emerging Markets Equity Fund (ASX: BEMG) and a Global Bond Fund (ASX: WBND)

- Global gold miner ETFs, including the Betashares Global Gold Miners – Currency Hedged ETF (ASX: MNRS), were the best performers last month

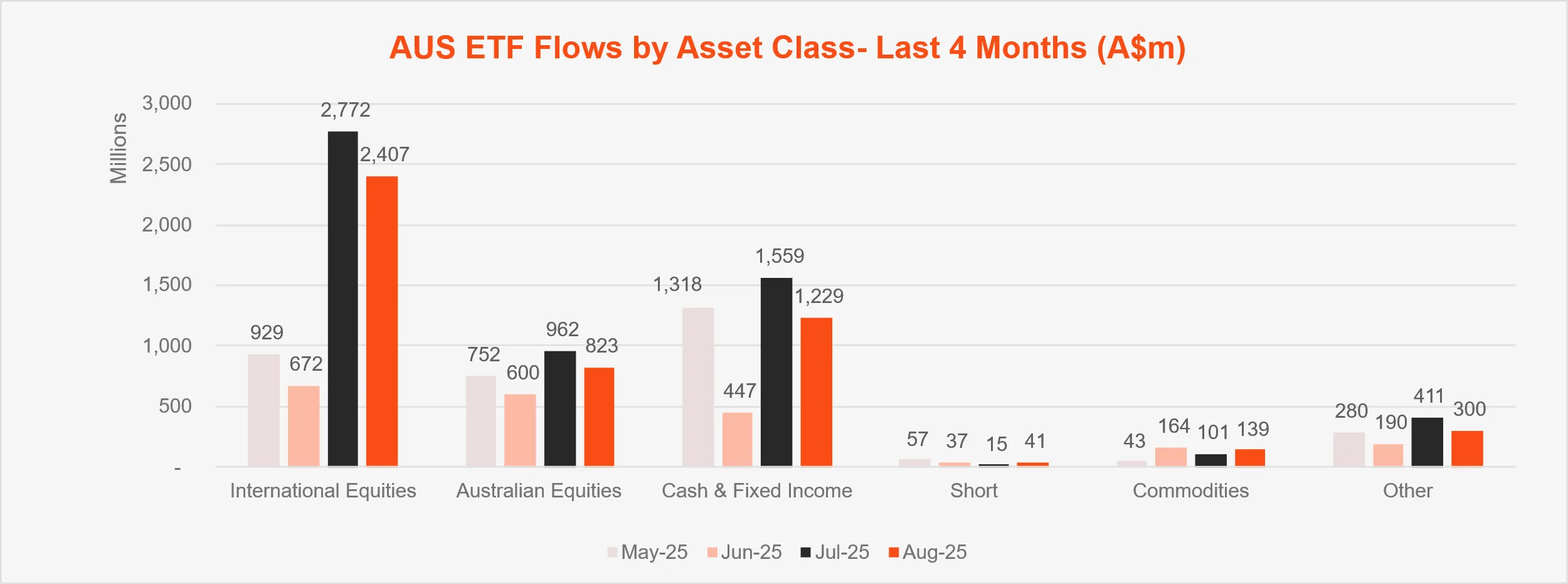

- International Equity ETFs continued their streak of receiving the highest level of flows with $2.4b, while Fixed Income ($1.2b) took second, followed by Australian Equities ($823m) in third.

Australian ETF Industry AuM: July 2001 – August 2025

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE)$299.4B – all time high

- ASX CHESS Market Cap: $255.67B[1]

- Market Cap change for July: 3.52%, $10.2B

- Market cap growth for last 12 months: 36%, or $79.1B

New Money

- Net inflows for month: $4.9B

Products

- 436 Exchange Traded Products trading on the ASX & CBOE

- 6 new funds were launched in August – including a High Yield Australian Shares fund, an Emerging Markets Equity Fund and a Global Bond Fund

Trading Value

- ASX trading value was ~$15B in August

Performance

- Global gold miner ETFs, including MNRS Global Gold Miners Currency Hedged ETF , were the best performing funds last month

Industry Net Flows

Top Category Inflows (by $) – Month

|

Broad Category |

Inflow Value |

|

International Equities |

$2,406,641,783 |

|

Fixed Income |

$1,196,770,226 |

|

Australian Equities |

$823,262,751 |

|

Multi-Asset |

$216,522,883 |

|

Commodities |

$138,795,008 |

Top Sub-Category Inflows (by $) – Month

|

Sub Category |

Inflow Value |

|

International Equities – Developed World |

$1,174,940,817 |

|

Australian Bonds |

$779,849,576 |

|

Australian Equities – Broad |

$688,787,738 |

|

International Equities – US |

$505,296,310 |

|

Global Bonds |

$393,219,903 |

Top Category Outflows (by $) – Month

No outflows recorded by broad category

Top Sub-Category Outflows (by $) – Month

|

Sub-Category |

Inflow Value |

|

Australian Equities – Geared |

-$31,177,336 |

|

Australian Equities – Sector |

-$18,443,075 |

|

International Equities – E&R – Sustainability |

-$9,591,885 |

|

Australian Equities – Large Cap |

-$5,832,502 |

|

International Equities – Geared |

-$2,886,524 |

Performance

Top Performing Products – Month

|

Ticker |

Product Name |

Performance (%) |

|

GDX |

VanEck Gold Miners ETF |

19.70% |

|

MNRS |

Betashares Global Gold Miners Currency Hedged ETF |

19.33% |

|

GMTL |

Global X Green Metal Miners ETF |

16.60% |

|

DRGN |

Global X China Tech ETF |

15.15% |

|

QETH |

Betashares Ethereum ETF |

14.25% |