3 minutes reading time

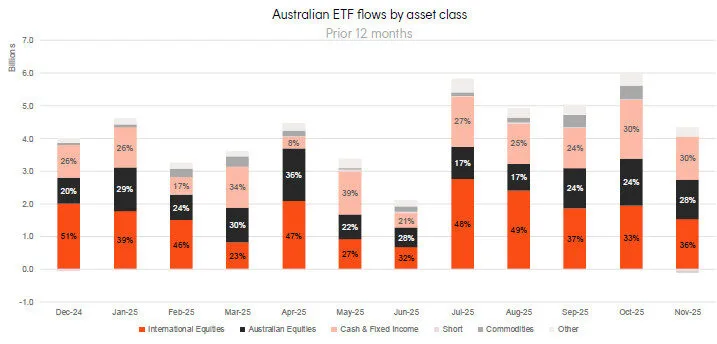

- The Australian ETF industry recorded $4.3 billion of inflows, helping the Australian ETF industry to a new record high of $324.9B in funds under management– a rise of $3.2B or 0.98%

- ETF flows have been above $4 billion for five consecutive months

- Over the last 12 months the Australian ETF industry has grown by 33.8%, or $82B

- 11 new funds, including the Betashares Global Shares Ex US ETF (ASX: EXUS) and the Betashares Australian Enhanced Credit Income Complex ETF (ASX: ECRD), launched in November

- The Betashares Global Gold Miners Currency Hedged ETF (ASX: MNRS) extended its YTD performance lead after being the best performing fund in November, the Betashares Energy Transition Metals ETF (ASX: XMET) also performed strongly and is now the third best performing fund this year.

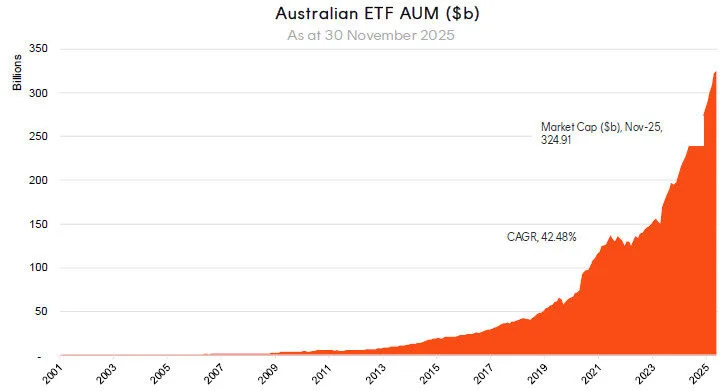

Australian ETF Industry AuM: July 2001 – November 2025

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $324.9B – all time high

- ASX CHESS Market Cap: $277.28B1

- Market Cap change for November: 0.98%, $3.2B

- Market cap growth for last 12 months: 33.8%, or $82B.

New Money

- Net inflows for month: $4.3B.

Products

- 462 Exchange Traded Products trading on the ASX & Cboe

- 11 new funds, including the Betashares Global Shares Ex US ETF (ASX: EXUS) and the Betashares Australian Enhanced Credit Income Complex ETF (ASX: ECRD), launched in November.

Trading Value

- ASX trading value was ~$18B in September.

Performance

- The Betashares Global Gold Miners Currency Hedged ETF (ASX: MNRS) extended its YTD performance lead after being the best performing fund in November, the Betashares Energy Transition Metals ETF (ASX: XMET) also performed strongly and is now the third best performing fund this year.

Industry Net Flows

Top Category Inflows (by $) – Month

|

Broad Category |

Inflow Value |

|

International Equities |

$1,528,412,386 |

|

Australian Equities |

$1,218,067,245 |

|

Fixed Income |

$1,017,737,929 |

|

Cash |

$286,347,100 |

|

Multi-Asset |

$209,811,485 |

Top Sub-Category Inflows (by $) – Month

|

Sub-Category |

Inflow Value |

|

International Equities – Developed World |

$904,845,765 |

|

Australian Bonds |

$640,177,429 |

|

Global Bonds |

$361,639,320 |

|

Australian Equities – Broad |

$323,440,341 |

|

Cash |

$286,347,100 |

Top Category Outflows (by $) – Month

|

Broad Category |

Inflow Value |

|

Short |

-$63,927,994 |

|

Commodities |

-$12,948,662 |

Top Sub-Category Outflows (by $) – Month

|

Sub-Category |

Inflow Value |

|

Australian Equities – Short |

-$65,856,481 |

|

International Equities – Europe |

-$11,524,339 |

|

Gold |

-$10,023,781 |

|

Oil |

-$4,218,242 |

|

Other |

-$1,148,319 |

Top Performing Products – Month

|

Ticker |

Product Name |

Performance (%) |

|

MNRS |

Betashares Global Gold Miners Currency Hedged ETF |

15.35% |

|

GDX |

VanEck Gold Miners ETF |

14.94% |

|

XMET |

Betashares Energy Transition Metals ETF |

11.31% |

|

ETPMAG |

Global X Physical Silver |

9.88% |

|

CURE |

Global X S&P Biotech ETF |

8.86% |