5 minutes reading time

Investors today have smarter tools, greater access and fewer barriers than ever before. Yet some long-held beliefs still shape how we approach the market. And, whether inherited or shaped by experience, these assumptions can quietly limit how we build wealth.

Here are five of the most common investing myths, and why they no longer hold up in today’s environment.

1. You need a fortune to start investing

Investing has long carried the perception that it’s only for the wealthy. But today, thanks to fractional investing and products like ETFs, it has never been easier to build a portfolio and work towards long-term wealth goals.

For example, on Betashares Direct, you can invest brokerage-free in ASX-traded ETFs and 300+ shares. You can also invest the exact amount you want (e.g. deposit $500, invest $500) when you place a market order. Similarly, distributions and dividends can be reinvested in part or in full, with no cash component left sitting uninvested.

2. Holding cash is the safest default

Cash often seems like a safe harbour, especially when term deposit rates are high. But interest rates don’t stay high forever and today’s cash returns may not stick around.

That doesn’t mean cash has no role. It’s essential for short-term needs and emergencies. But for long-term goals like financial independence or maintaining a standard of living, investing is typically much more effective.

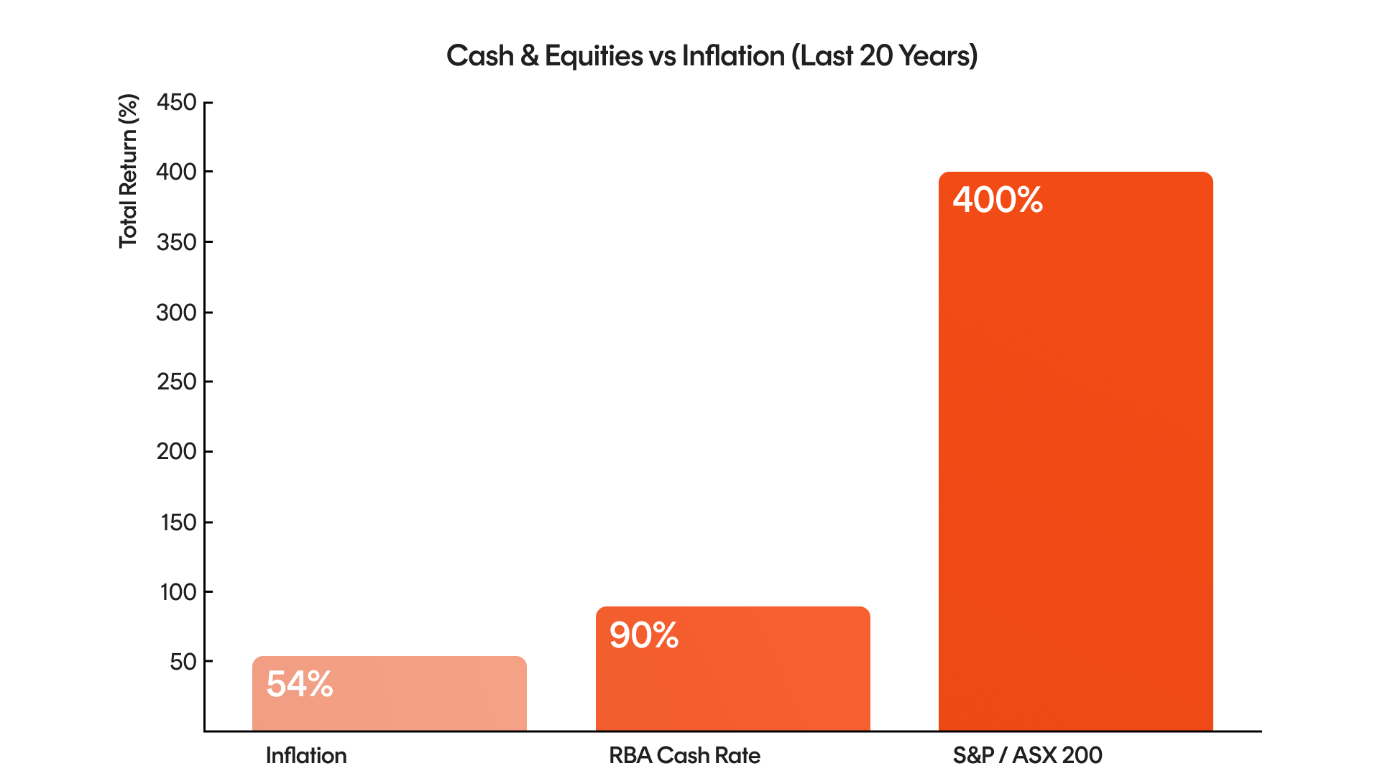

Nowhere is this more apparent than in the following chart, which showcases the returns of cash and equities versus inflation. Cash steadily loses purchasing power over time, which also challenges the idea that it’s risk-free. Shares, by contrast, have delivered significantly stronger returns over the past 20 years.

Source: Cutcher & Neale Accounting and Financial Services. Published May 2024. Past performance is not an indicator of future performance.

Leaving too much on the sidelines for too long can mean missing out on the growth you can achieve.

3. You need to know more before taking action

Some people feel they need deep expertise before getting started while others think they have to follow markets closely in order to make informed decisions. But striving for perfect knowledge can also lead to inaction.

While all investments carry risk and require consideration of personal circumstances, there are ways to access diversified exposure without constructing a portfolio from scratch.

For example, ETFs offer exposure to a broad range of assets or markets in a single trade. Similarly, Betashares Managed Portfolios are low-cost, diversified portfolios constructed by investing experts from ASX-traded ETFs. Both solutions can help build good investing habits into an investing strategy.

These options can offer structure and simplicity, allowing investors to stay focused on long-term goals without needing to actively manage every decision.

4. It’s better to wait for the right time

Market timing is tempting and, when investors get the timing right, the payoff can be enormous. But the reality is it’s also not easily achievable.

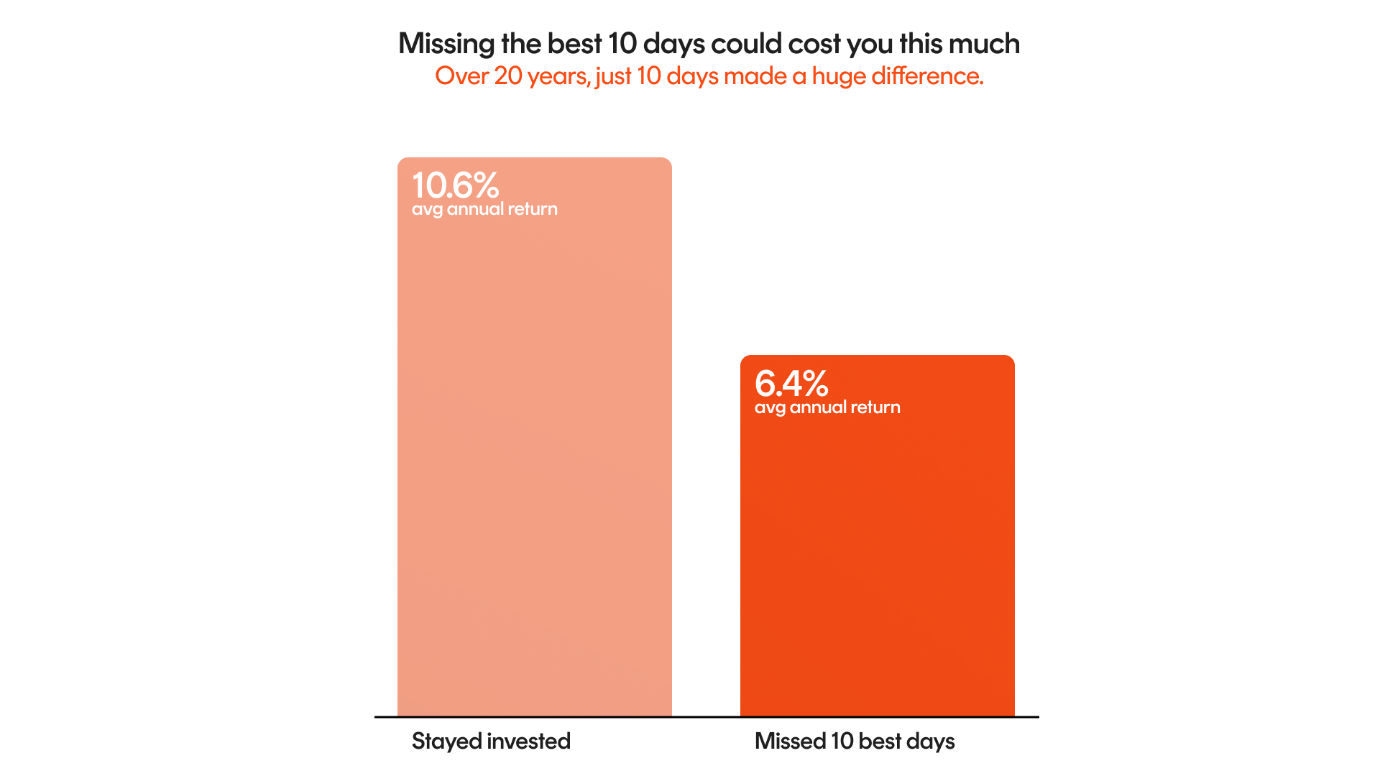

A J.P. Morgan study found that seven of the stock market’s 10 best days over the past 20 years occurred within just 15 days of the 10 worst days1. Investors who missed those 10 best days saw an average annual return of 6.4%, compared to 10.6% for those who stayed fully invested.

Source: J.P. Morgan

The takeaway? Trying to time the market can backfire – and investors who stayed the course through downturns, like the GFC or COVID sell-offs, generally fared better than those who exited and re-entered later.

That’s where dollar-cost averaging can help.

With Betashares Direct’s Auto-invest feature, you can set up recurring investments into up to five Betashares ETFs. It’s an easy way to automate your investing and stay focused on your long-term goals, without the pressure of picking the perfect time to invest.

5. Investing is something you do later in life

Some people treat investing as a second-stage priority. That is, it’s something to focus on once the mortgage is under control or life feels more settled.

But time is one of the most powerful tools in long-term investing. The longer your money stays invested, the more it tends to benefit from compounding. Put another way, your returns could generate their own returns.

Betashares’ analysis shows that a single $5,000 investment growing at 7% annually and compounded monthly could grow to over $80,000 after 40 years – even without additional contributions2. Importantly, half of that growth comes in the last ten years of the 40-year horizon. It’s a reminder that starting early can be as crucial an indicator as how much you invest, even if the compounding takes a while to kick in.

The bottom line

The way we invest has changed. Fees are lower, access is broader and tools are smarter. Yet many investors still hold back because they’ve inherited assumptions that no longer apply.

Investing today doesn’t require perfect timing, large sums or deep expertise. It requires clarity, consistency and a willingness to start, even when conditions don’t feel perfect.

The first step doesn’t have to be big. It just has to be taken.

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) is the issuer of the Betashares Funds, as well as Betashares Invest, the IDPS-like scheme available through the Betashares Direct platform. Before opening an account or making an investment decision, read the applicable Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au or by calling 1300 487 577, to consider whether the product is right for you. You should also consider the applicable disclosure document for any underlying investment available through Betashares Invest before making an investment decision. This information is general in nature and doesn’t take into account your financial objectives, situation or needs. You should consider its appropriateness taking into account such factors and seek professional financial advice. Investing involves risk.

Sources:

1. https://privatebank.jpmorgan.com/nam/en/insights/wealth-planning/the-power-of-intent

2. https://www.betashares.com.au/insights/accelerating-your-wealth-creation/

1 comment on this

Can we invest for our grandchildren who live in New Zealand.