9 minutes reading time

Following Liberation Day, the Nasdaq 100 led an exceptional global recovery. Yet over the full 2025 calendar year, European, Japanese and emerging market indices all outperformed the S&P 500 and Nasdaq 100 in both local and common currency terms.

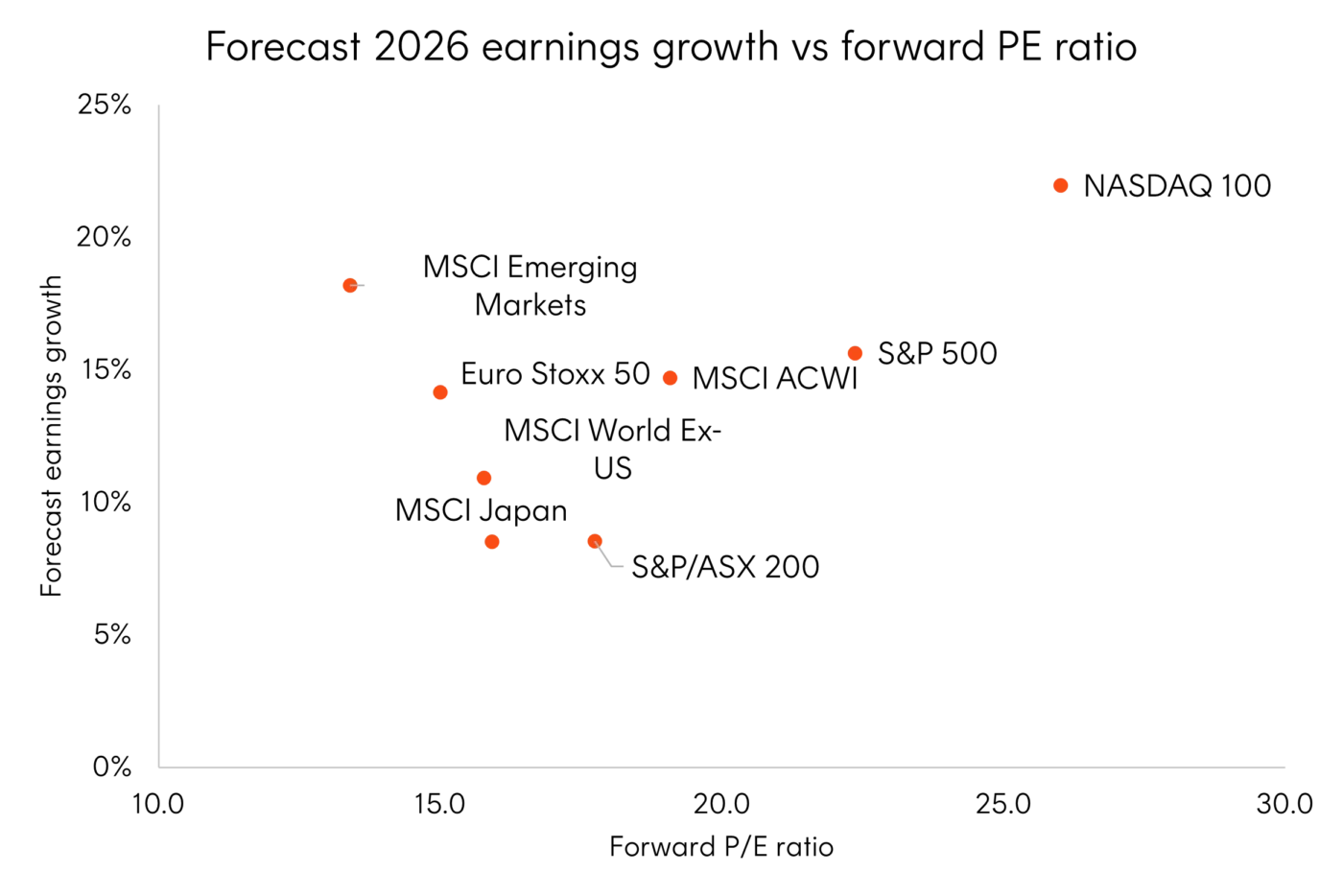

So far 2026 looks to be a supportive environment for global equities, with robust global growth and an easing bias likely under new Fed chair Kevin Warsh. The key questions for investors are: how much optimism is already in the price and whether ex-US global equities will outperform US equities, as they did in 2025.

Source: Factset, forecast 2026 earnings growth is based on analyst consensus. As at 13 January 2026.

Why US equities can continue to deliver over the long term

For the US, we forecast returns for the S&P 500 and Nasdaq 100 to be driven by strong earnings growth with valuation multiples unchanged, supported by easing monetary policy. However, for Australians investing in the US on an unhedged basis, we caution that the returns in AUD terms will likely be partly eroded due to a weakening USD.

We expect the AI capex cycle to persist in 2026, backed by evidence of productivity gains, accelerating hyperscaler cloud revenue, and ample balance sheet capacity. Large cap tech profitability should remain the key driver of index level earnings growth. We don’t believe AI is in bubble territory, noting that the most levered companies, like Oracle, already suffered historic drawdowns in late 2025. We find it unlikely that there will be a major sell off among the megacap AI players while they are consistently delivering ~20% annual earnings growth. The higher share of foreign revenue of these tech companies should also provide an earnings tailwind if the USD falls.

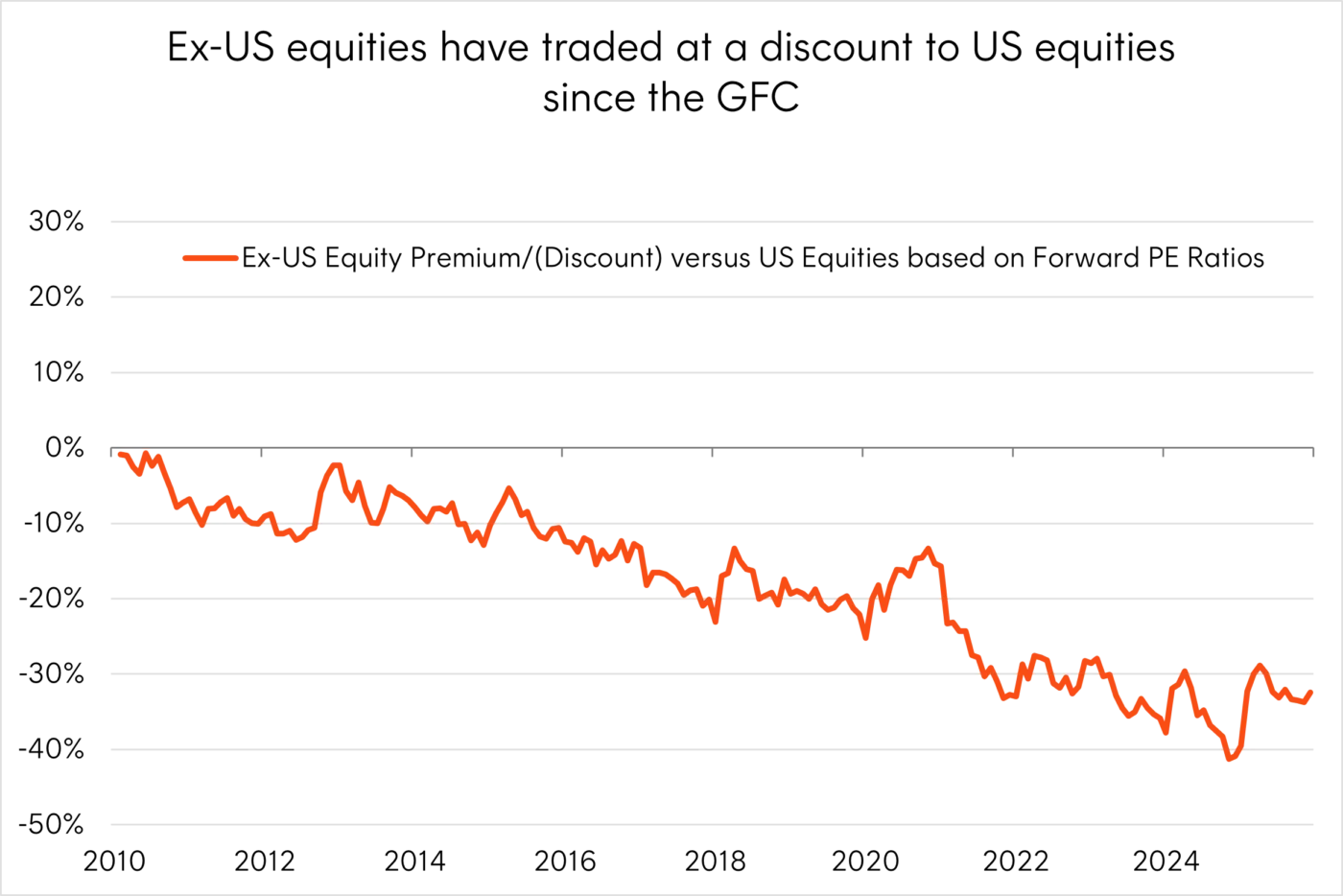

Ex-US equities closing the valuation gap

Turning to ex-US equities, since the GFC, the rest of the world has underperformed the US due to both weaker earnings growth and less multiple expansion. Ex-US developed markets (Europe and Japan) currently trade at a 30% PE valuation discount to the US, which is a 10% improvement after outperformance in 2025.

Source: Bloomberg. 1 January 2010 to 31 December 2025.

Some of the US equity premium is justified by the higher profitability and greater earnings stability of the companies that dominate the US equity market. The question for 2026 is whether this premium should be more or less than 30%.

Europe and Japan’s longer term consensus earnings growth looks more modest than the US, and these regions remain more exposed to global sentiment. However, several factors could support outperformance. A ramp up of European fiscal stimulus should start to take effect in 2026, increasing the probability of earnings upgrades. Meanwhile, as discussed earlier, Japanese growth has upside under Takaichi’s leadership. These catalysts, together with our expectation that the USD will continue to weaken, lead us to believe that ex-US developed markets will outperform US equities in 2026 in AUD terms (on an unhedged basis).

We expect 2026 to be another good year for emerging markets equities. The MSCI Emerging Market index currently offers similar earnings growth to the Nasdaq 100 at half the cost – in terms of PE multiples1. Indeed, emerging markets offer a cheaper way to play the AI trade. For example, TSMC and Korea’s SK Hynix and Samsung are important suppliers for the US data centre build-out, and Ali Baba has re-emerged as a Chinese AI champion capable of challenging the US AI leaders.

Outside of AI, India’s economy is set to rebound with structural reforms, improving infrastructure, tax cuts and lower interest rates, enhancing productivity and corporate earnings. Finally a weaker USD and easing Fed are tailwinds for emerging markets countries, lowering USD denominated debt servicing costs, encouraging foreign capital inflows, and allowing for easier monetary policy.

Investment implications

We expect a weaker USD to lead to stronger investment returns in non-US developed markets and emerging market equities in AUD terms. Currency may be a headwind for unhedged Australian investors in US markets, making diversification across regions and currencies a prudent strategy.

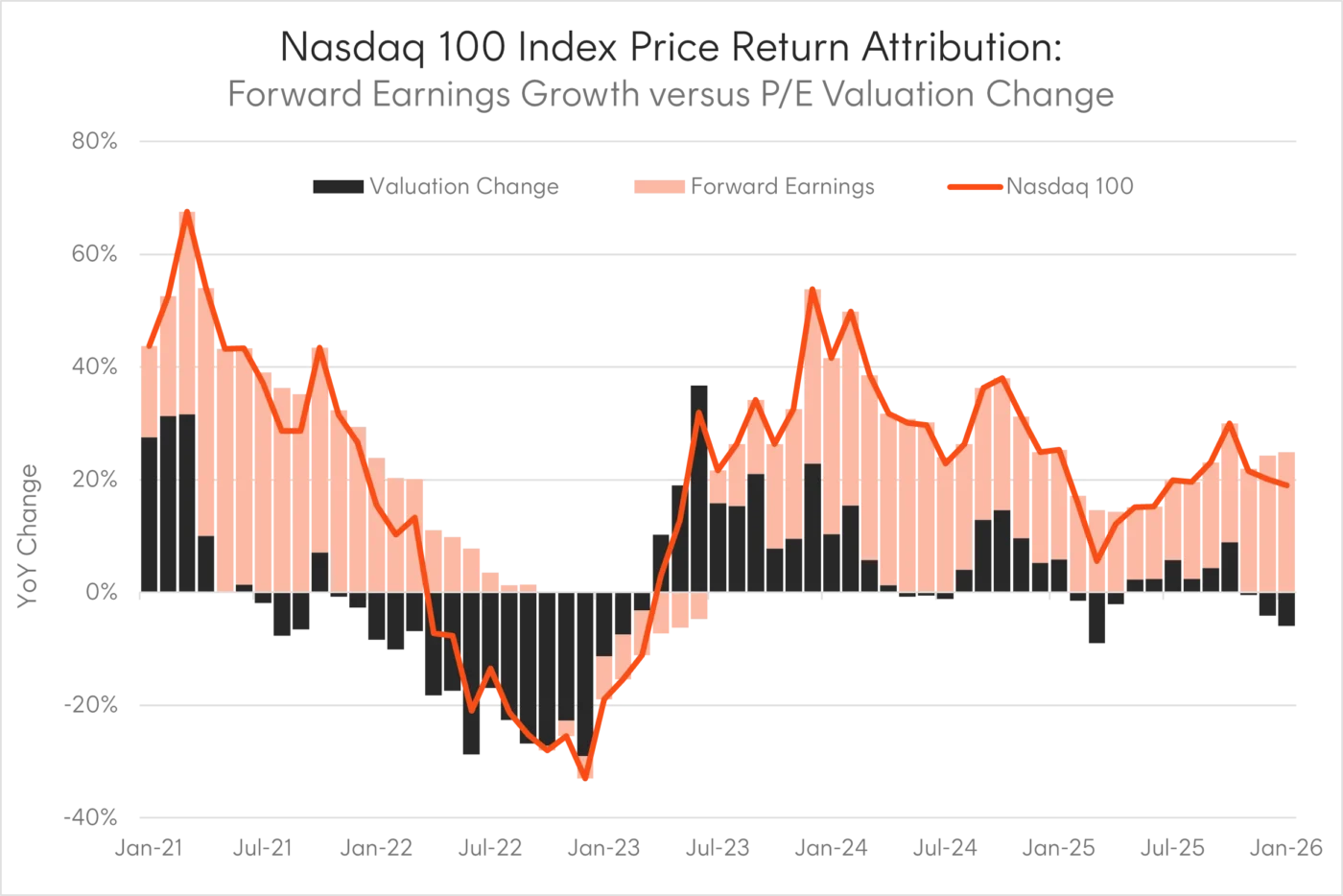

Nevertheless, the macro and earnings backdrop still justify allocation to select US equities. Earnings growth has been the dominant contributor to the Nasdaq 100’s exceptional performance over the last five years, not valuation expansion.

Source: Bloomberg. 31 January 2021 to 31 January 2026. The chart shows the rolling year-on-year change in the Nasdaq 100 index’s price, forward Price-to-Earnings and forward earnings. Past performance is not an indicator of future performance.

Leadership in US tech is broadening, with the Nasdaq 100 forecast to outstrip Mag7 earnings growth in 2026. The emergence of new leaders is part of the natural evolution of the index. A growing number of Nasdaq 100 companies are becoming integral to the AI infrastructure rollout and are harnessing AI to create end user applications, such as Advanced Micro Devices (AI chips), Palantir Technologies (data analytics) and AppLovin (gaming monetisation).

- Betashares Nasdaq 100 ETF (ASX: NDQ)

- NDQ provides Australian investors with access to the Nasdaq 100 Index. NDQ has been one of the top performing Australian domiciled global equity funds, returning almost 20% p.a. over the last ten years2.

- Betashares Nasdaq 100 Currency Hedged ETF (ASX: HNDQ)

- Given the potential for USD weakness in 2026 to impact returns, investors may wish to consider HNDQ in order to participate in the Nasdaq 100’s enviable earnings growth whilst minimising currency risk.

Ex-US developed markets in Europe and Japan should benefit from an increase in fiscal stimulus, structural reform and reducing trade uncertainty in 2026. Europe’s increasing defence and infrastructure spending and the Takaichi government’s strategic support for critical industries including AI, semiconductors, biotechnology and batteries, provide the catalyst for earnings upgrades. These potential upgrades, undemanding valuations, and our expectation of USD weakness, lead us to believe that ex-US developed markets will outperform US equities in 2026 in AUD terms (on an unhedged basis).

- Betashares Global Shares Ex US ETF (ASX: EXUS)

- EXUS offers low-cost global diversification beyond the US, providing exposure to 900+ companies from 22 developed markets, excluding the US and Australia.

- EXUS was built specifically for Australian investors, providing them access to any available foreign tax credits from dividends received, which may improve after-tax returns compared to investing in a non-Australian domiciled ETF.

Global investors have been underweight emerging markets over the past few years, but sentiment and flows appear to be at a turning point. We expect 2026 to be another good year for emerging markets equity returns, as valuations remain compelling and earnings growth strong. Indeed, emerging markets companies like TSMC, SK Hynix, Samsung and Ali Baba offer a cheaper way to play the AI trade. Beyond AI, India’s economy appears set to rebound and a weakening USD should be a tailwind for emerging market countries more broadly.

- Betashares MSCI Emerging Markets Complex ETF (ASX: BEMG)

- BEMG is the lowest cost core market capitalisation weighted emerging market ETF available on the ASX.

- BEMG holds units in a UCITS fund that uses a swap-based structure. This allows BEMG to more efficiently track the MSCI Emerging Markets Index and avoids the costs and performance impacts associated with trading in some emerging market countries.

Sources:

1. Source: Bloomberg. As at 31 December 2025. Actual results may differ materially from forecasts. ↑

2. As at 31 December 2025. Past performance is not an indicator of future performance. ↑