5 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast, click below or subscribe on Apple, Amazon or Spotify:

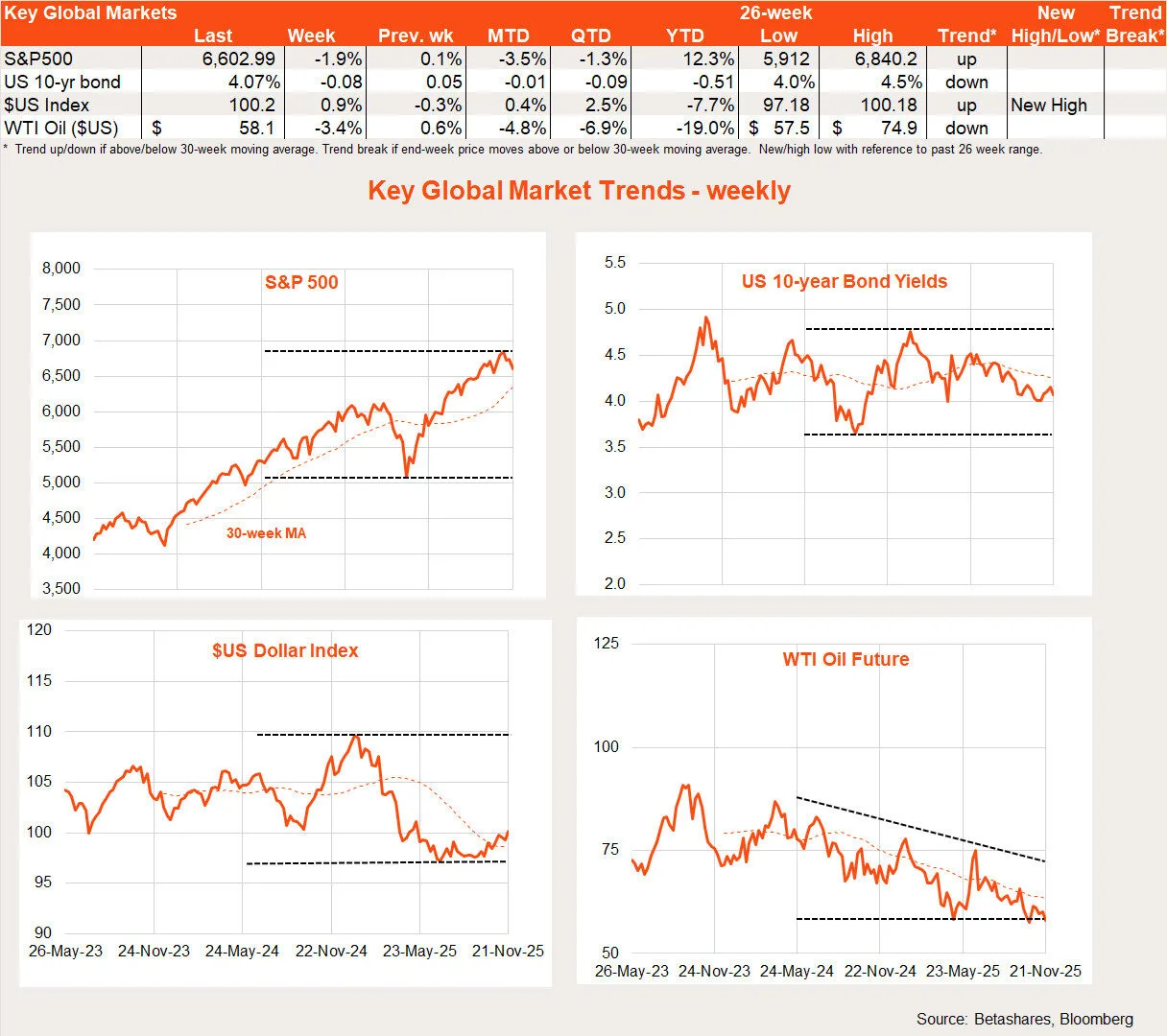

Global stocks slumped last week, reflecting lingering AI bubble concerns and pessimism around the prospect of another US rate cut next month.

Global week in review: Nvidia nerves

The major global highlight last week was the surprise intra-day decline in US equities following the hotly anticipated release of Nvidia’s earnings result. Although Nvidia again beat earnings expectations and talked up a bright future, US stocks ended the following day down 0.9% despite a 2% pop on the open.

As the old saying goes, retail investors tend to open the market while the professionals close it. So the intra-day slump seemed a vote of no confidence (or at least profit taking) among those who are supposed to know best.

The other key highlight last week was the overdue release of the September US payrolls report, which was mixed, with a better than expected employment gain of 119k yet a rise in the unemployment rate to 4.4%. Markets were unsure what this meant with regard for Fed policy.

Last but not least, Wall Street ended Friday more positively, following comments from New York Fed President John Williams – a voting Fed member – suggesting it was still possible that rates could be cut next month. Equities lifted and the market pushed up the probability of a rate cut next month, from around 40% to 70%.

Global week ahead: US inflation

With the US government back in business, the drumbeat of US economic data will start to pick up. This week we’ll get an important update on the Fed’s preferred inflation measure: the private consumption expenditure deflator (PCED) on Thursday (US time).

The good news is that – following a surprisingly benign CPI result – markets expect an equally reassuring result, with core prices (i.e. excluding food and energy) forecast to increase by only 0.2%, which would keep the annual rate steady at 2.9%. While US inflation remains higher than the Fed’s 2% target, it could be a lot worse, with the flow through of tariff effects into prices still fairly muted. Corporate America, at this stage, is still willing to ‘eat’ the tax rather than pass it onto customers.

Also due out tomorrow are retail sales, producer prices and consumer confidence. On Thursday, we get the Fed’s Beige Book report on economic conditions. All will be scrutinised for clues on the health of the US economy.

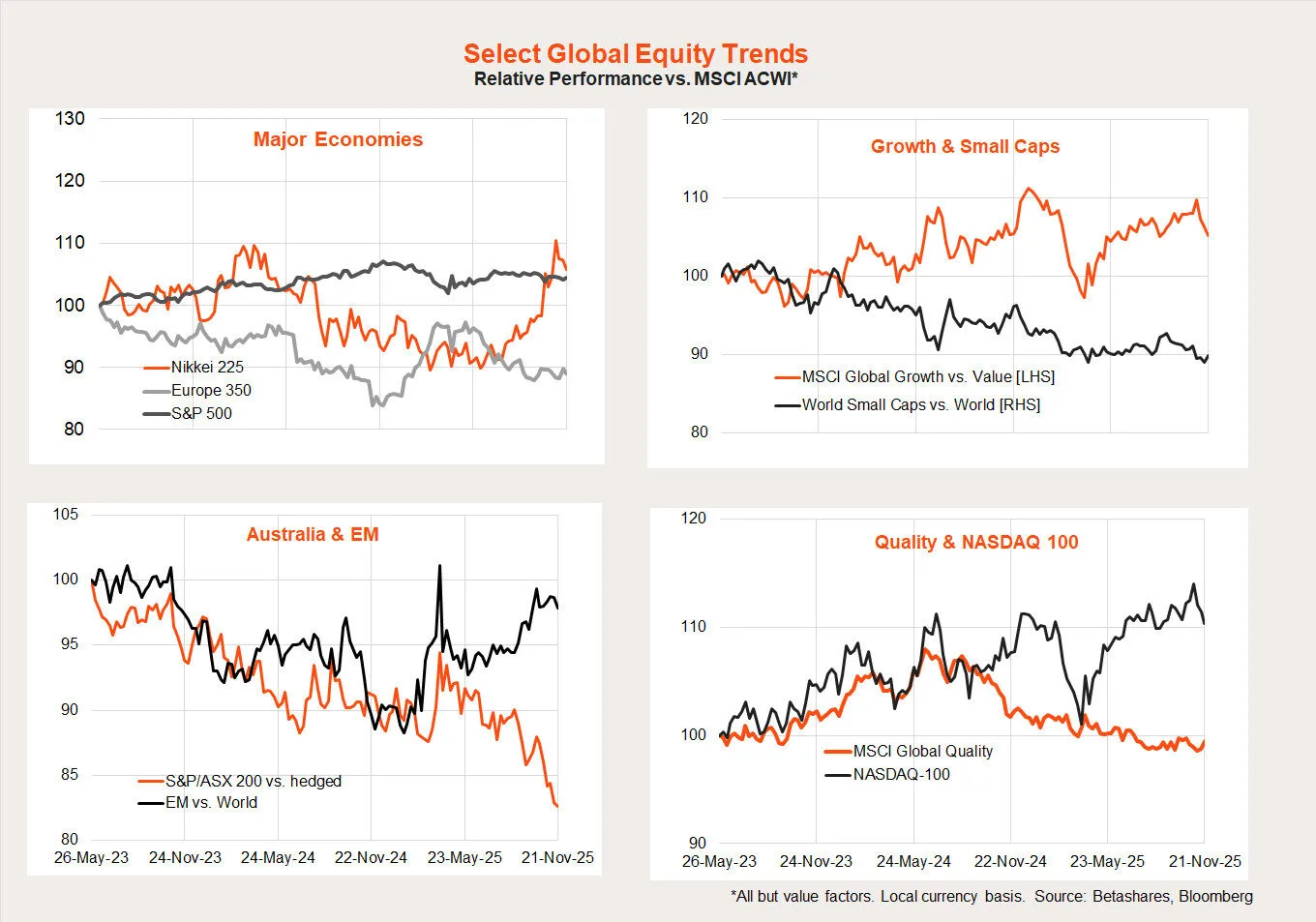

Global equity trends

It was a sea of red last week. As might be expected, tech and growth related exposures fared worst, with the NASDAQ-100 down 3.0%. Japanese stocks also corrected further after strongly outperforming in recent months.

While shifts could be underway, it’s still a bit premature to suggest the outperforming bias of US/growth/technology is shifting in favour of non-US and value. To my mind, such a shift remains directional – if equities sink further, the former will be hit hardest, although if the current market pullback is short-lived (my working assumption), the former will likely bounce back the strongest.

That said, the good relative performance of Japan and emerging markets, even before the recent market correction, suggests these could be new themes with legs and a useful source of diversification beyond US tech.

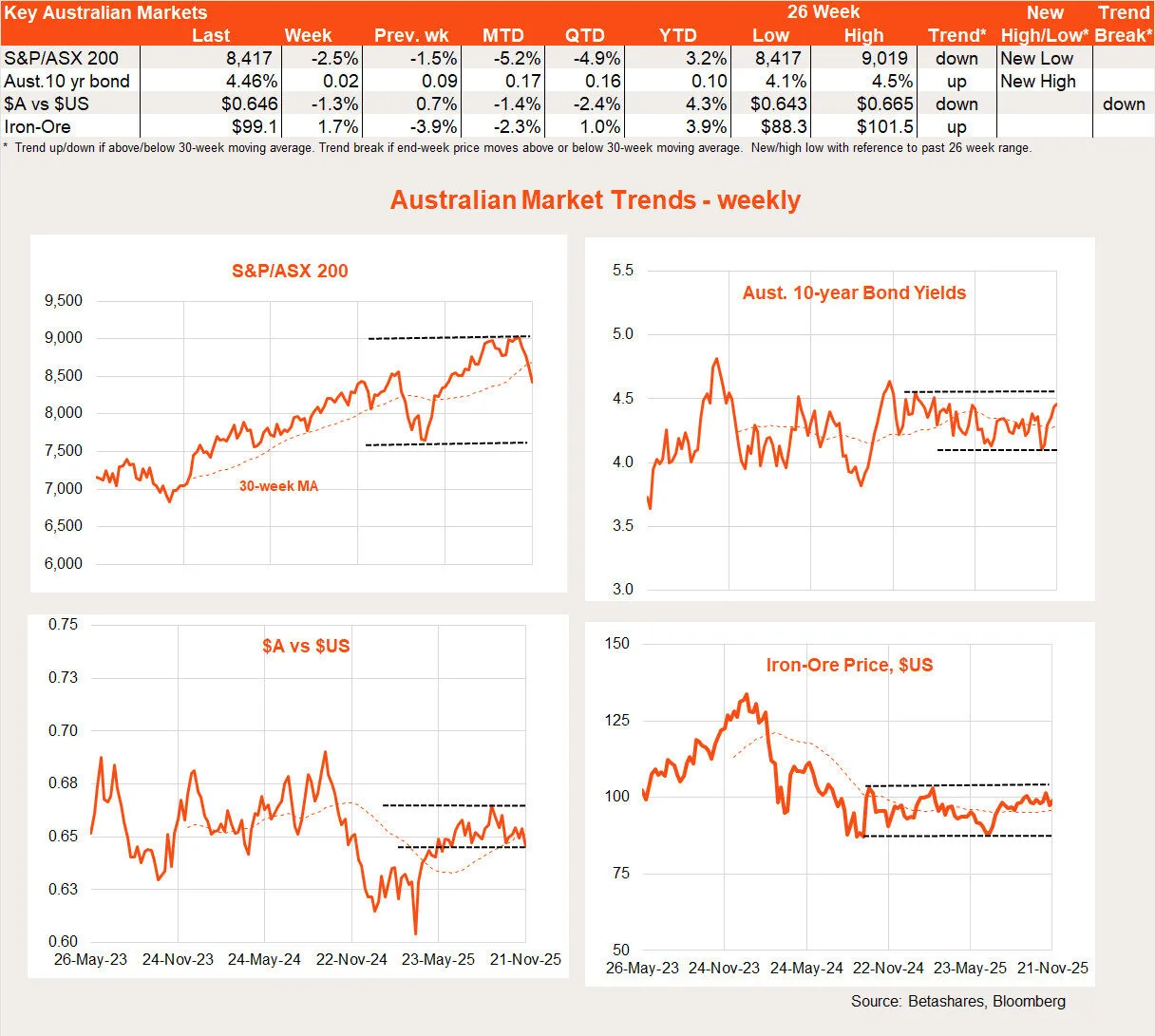

Australian week in review: RBA holds as expected

Local stocks also sunk last week in line with global markets, although are yet to reflect Wall Street’s bounce on Friday. There was only limited local news, with a fairly benign Q3 wage price index gain of 0.8%.

Apart from wages, the other local highlight was comment from Reserve Bank Assistant Governor Sarah Hunter, suggesting the labour market remains a little “tight”. It was further cold water on the prospect of a rate cut anytime soon.

Australian week ahead: All new monthly CPI!

The major local highlight this week will be publication of the first fully detailed monthly CPI report on Wednesday. Unlike monthly CPI reports to date, this publication promises more complete monthly coverage of both goods and service prices and so, in theory, should provide a higher signal to noise ratio than its predecessor.

Of critical importance in coming months will be the annualised run rate of monthly CPI increases. For the RBA to cut rates next year, we’ll need to see a sub-3% pace from the effective 4% annualised pace evident in Q3. That would imply monthly increases in the trimmed mean measure of underlying inflation of 0.2%, rather than 0.3%. In fact, if annualised inflation does not drop to below 3%, the prospect of rate hikes next year would start to become a real prospect.

Also due out this week is the start of key building blocks for the Q3 GDP report, beginning with construction work done on Wednesday and the private capital expenditure survey on Thursday. Both are likely to show positive, though fairly subdued, growth.

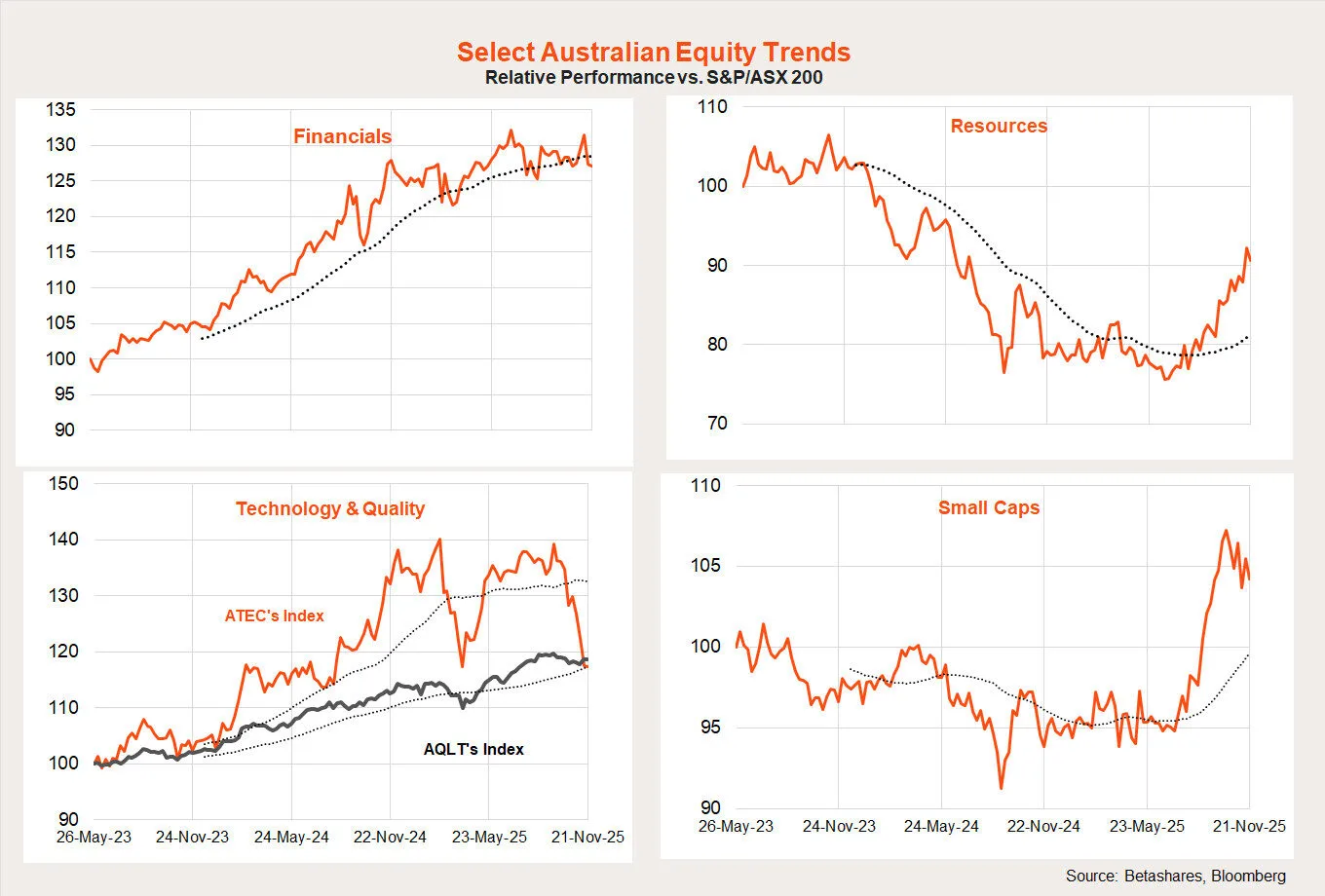

Australian equity trends

Dampened rate cut hopes have generally hurt high-beta local equity themes of late such as technology and small caps. Last week technology suffered a further 4.1% loss, while materials were down 4.0%.

In the large cap space, the outperformance trend of resources over financials remains in place.