7 minutes reading time

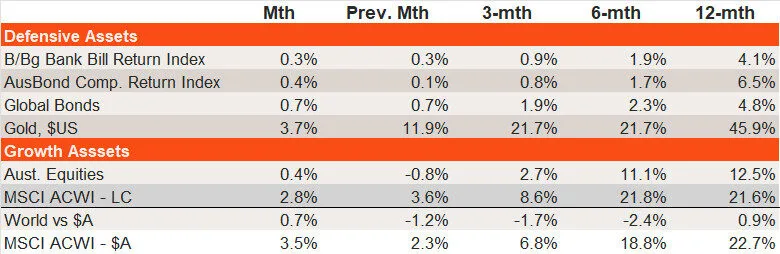

Major asset class performance

- Global equities continued to move higher in October, supported by resilient global economic growth, corporate earnings, subdued bond yields and optimism around artificial intelligence.

- Australian equities inched higher and underperformed global equities, despite a welcome upgrade to earnings expectations in the month.

- Broadly steady bond yields produced small positive gains for fixed-rate bonds.

- Gold prices rose further, albeit with a pullback late in the month.

Source: Bloomberg, Betashares. Cash: Bloomberg Australian Bank Bill Index; Australian Bonds: Bloomberg AusBond Composite Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged); Gold: Spot Gold Price in $US; Australian Equities: S&P/ASX 200 Index; Global Equities: MSCI All-Country World Index in local currency and $A currency (unhedged) terms. Past performance is not indicative of future performance.

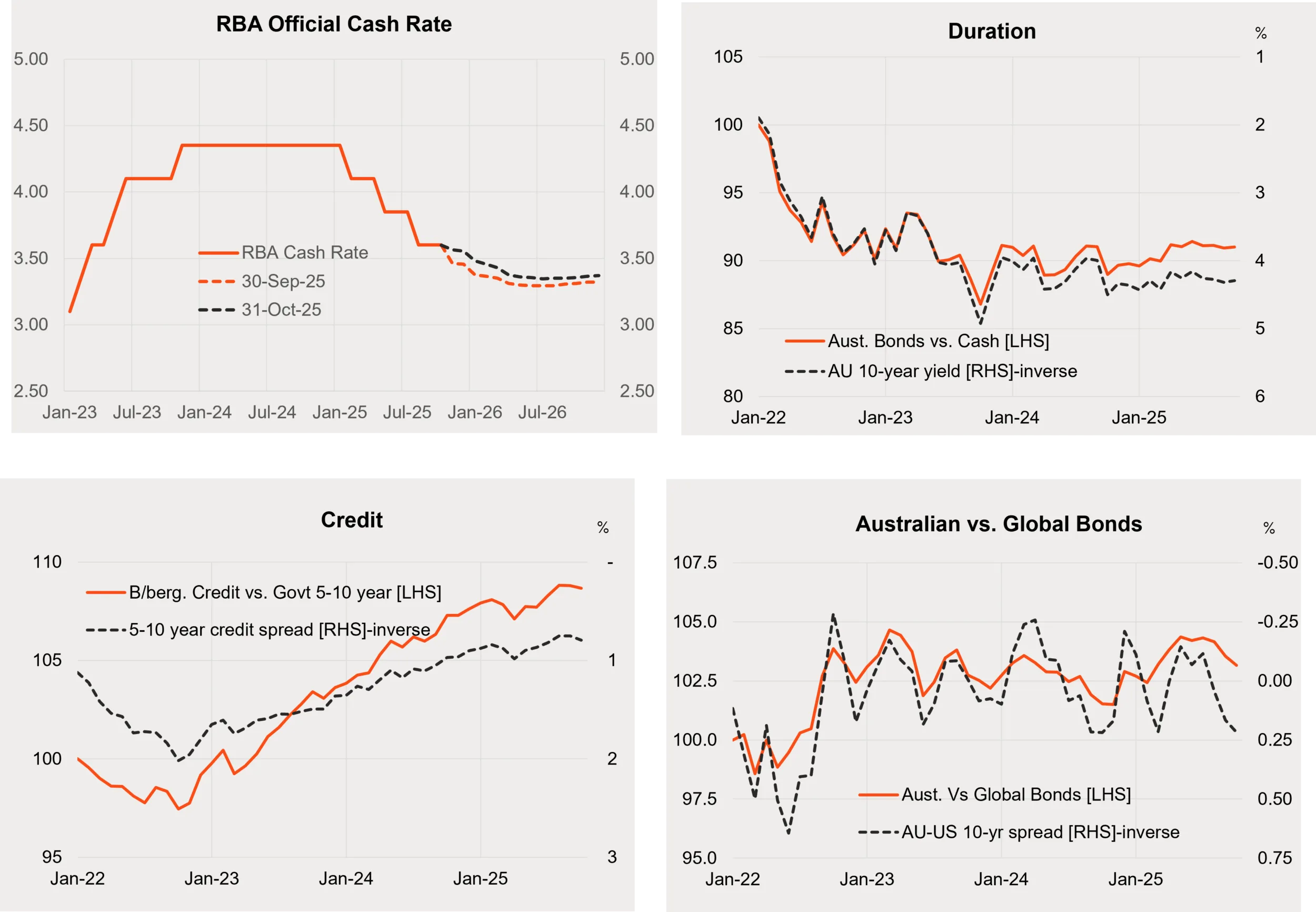

Fixed-rate bond trends

- Local rate cut expectations remains broadly unchanged over October, with mixed news over the month still leaving markets unsure whether rates would be cut in November. A higher-than-expected September quarter CPI report confirmed the inflationary pressure evident in the August monthly report, while there was also a higher-than-expected jump in the unemployment rate to 4.5%.

- Following the RBA’s decision not to cut rates in November, markets have now less than fully priced in only one rate cut by mid-2026, with steady rates thereafter.

- In the US, rate cut expectations held broadly steady, with the Fed delivering another rate cut in the month, following the rate cut in September. The market still sees a high (70%) chance of another rate cut in December, and three rate cuts overall by the end of 2026.

- Local 10-year bond yields edged down slightly to 4.30% and remain bound in the range they’ve held since early 2024. With broadly steady bond yields, local fixed-rate bonds have marginally beaten cash over the past six months.

- The prospect of at least steady official rates should support bond returns relative to cash over the coming year.

- Longer-term credit spreads edged slightly higher in the month, although have generally narrowed so far this year.

- Easing economic risks bode well for credit spreads to remain around their current, historically tight levels.

- Local bonds have marginally beaten global bonds over the past year, although relative performance remains in a choppy sideways range, and the outlook remains relatively neutral.

Source: Bloomberg, Betashares. Australian bonds: Bloomberg AusBond Composite Bond Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged).

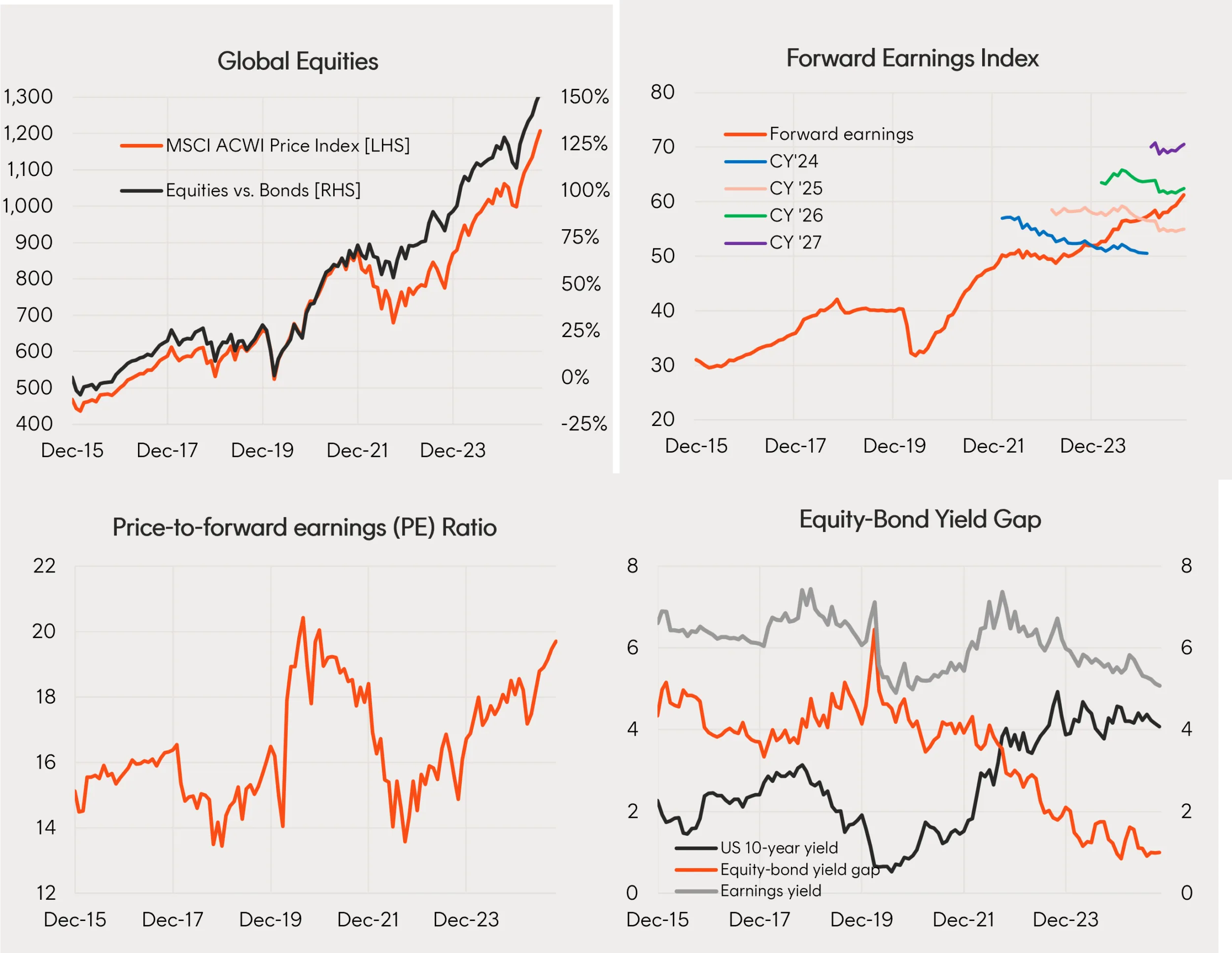

Global equity trends

- The MSCI All-World price index rose a further 2.7% in October – reaching a new end-month record high – after a solid 3.5% gain in September. The gain reflected a 1.6% rise in forward earnings and a 1.2% gain in the price-to-forward-earnings ratio to 19.7.

- Earnings expectations edged up a little further in October, with current expectations consistent with solid 15% growth in forward earnings by end-2026.

- With valuations still somewhat elevated, continued market gains are still possible, provided bond yields don’t rise much and/or the current bullish earnings outlook remains in place.

Source: Bloomberg, LSEG, Betashares. Global Equities: MSCI All-Country World Index. Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged). You cannot invest directly in an index. Past performance is not an indicator of future performance.

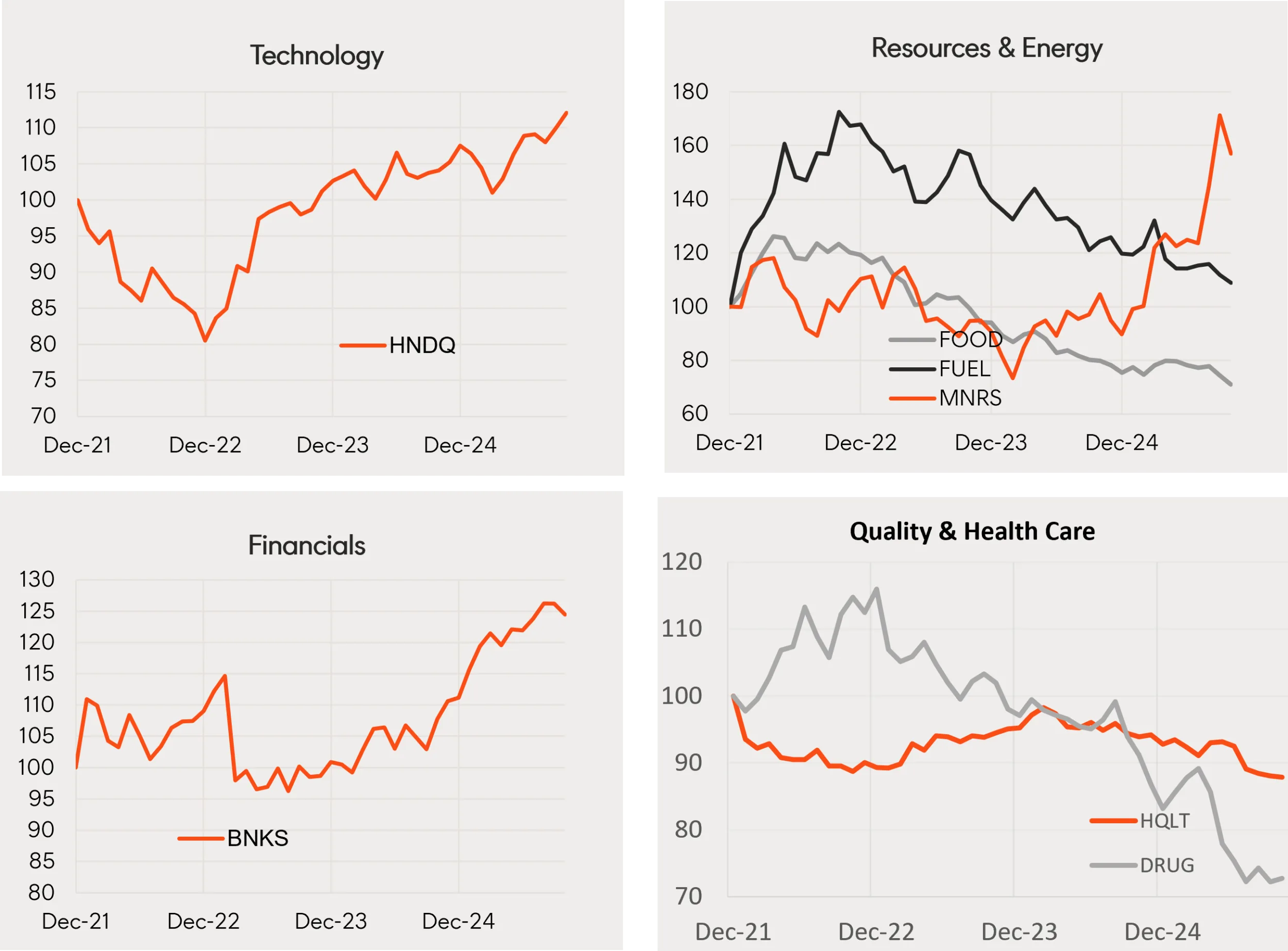

- Among select Betashares global equity ETFs, global gold miners (MNRS) corrected after recent strong gains and a pullback in the gold price late in the month. The Nasdaq-100 (HNDQ) continued to produce solid gains, with a return of 4.8%.

- All up, the standout exposures over the past 12 months have been global banks, gold miners and the Nasdaq-100.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the MSCI All-Country World Index (local currency terms) for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.

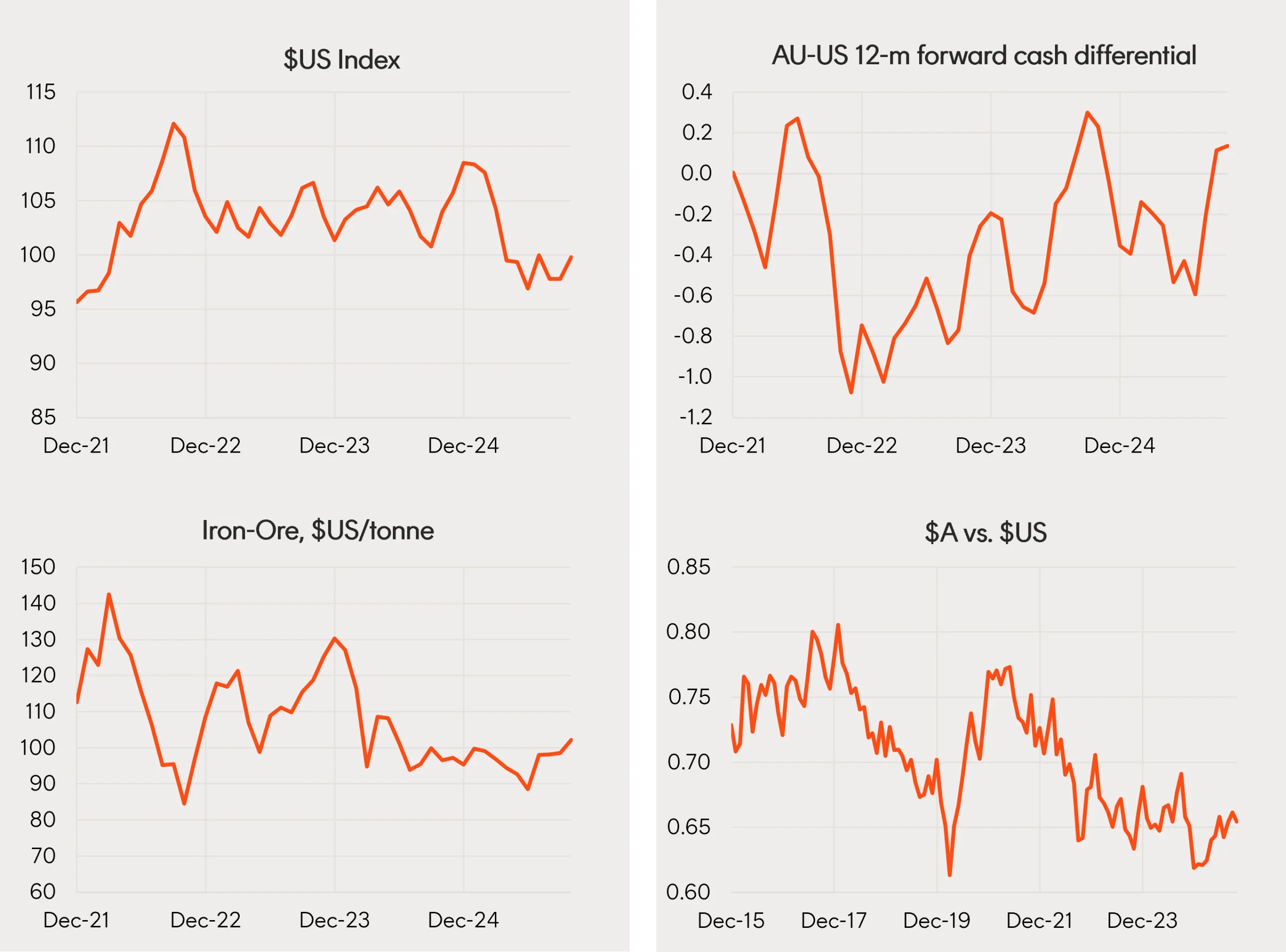

Australian dollar

- Despite a rise in iron ore prices, the Australian dollar edged back in October to US65.5 cents, largely reflecting strength in the US dollar. Australia’s 12-month forward expected cash rate differential edged up only slightly from +0.1% to +0.13%.

- The Australian dollar has generally been firm so far in 2025, largely reflecting weakness in the US dollar. Australian versus US short-term rate differentials have been choppy, narrowing earlier this year but widening more recently. Iron ore prices have been broadly steady, recovering a little of late after weakness earlier this year.

- Reflecting an easing of global risks, more US rate cuts and its still-historically expensive level, the US dollar is expected to gradually weaken over the coming year, which should support more Australian dollar strength.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

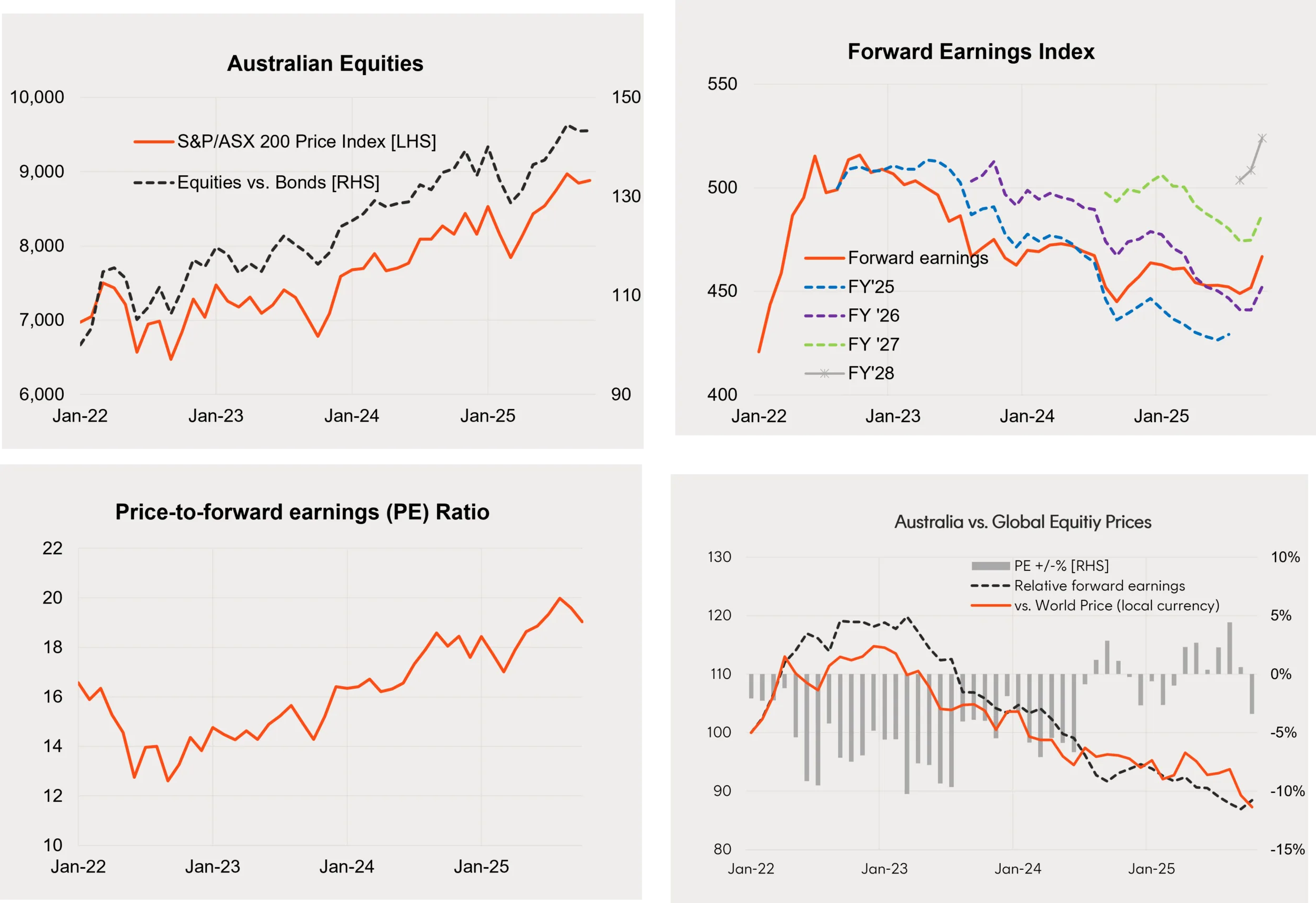

Australian shares

- The S&P/ASX 200 price index lifted only 0.4% in October, after a decline of 1.4% in September.

- Despite the modest gain in share prices, a welcome aspect of the past month has been a notable upgrade to earnings expectations. Forward earnings rose 3.3%, largely reflecting upgrades in the resource sector due to more resilient than expected commodity prices. The level of expected earnings in FY26, FY27 and FY28 were all revised up around 2.5-3.0% in the month.

- The price-to-forward-earnings ratio fell 2.9% to 19.0.

- The further fall in valuations during the month means Australian equities are back trading at a slight discount to global valuations.

- Current earnings expectations imply 8.3% growth in Australian forward earnings by the end of 2026, which is still somewhat less than that for global earnings. Accordingly, with relative valuations fair, Australian equities still seem likely to underperform global equities over the coming year due to relatively weaker growth in earnings.

- That said, of interest will be whether the local market enjoys further earnings upgrades in coming months. While the commodity outlook appears encouraging, the prospect of fewer RBA rate cuts and more constrained local economic growth is a counterweight.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

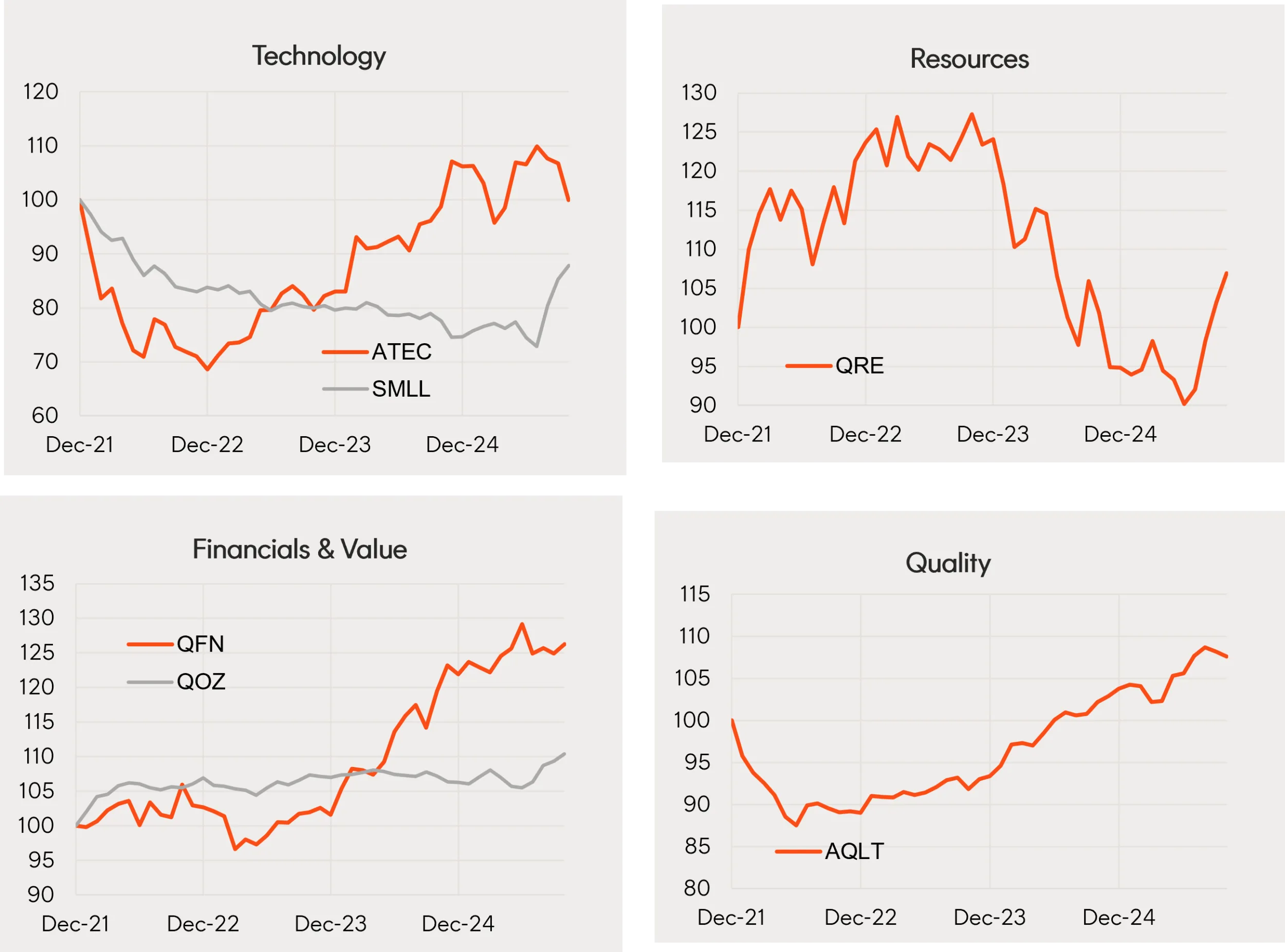

- A rotation toward resources and away from financial stocks remained evident in the large cap space over the month, while the past few months have also seen a strong rotation from large caps overall into small caps.

- Among select Betashares Australian equity ETFs, standout performers in the month were resources (QRE) and small caps (SMLL) with gains of 4% and 3.4% respectively. Financials (QFN) returned 1.5%.

- Australian quality stocks (AQLT) have remained a consistent performer so far this year, though returns edged down 0.2% in the month. Technology (ATEC) also had a notable 6% pullback in the month, with performance choppy so far this year albeit with solid gains over the past 12 months.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the S&P/ASX 200 Index for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.