6 minutes reading time

Perth high school science teacher James Pengelley has a very personal reason for why he invests for his children.

“When I was 15, my dad and I had a conversation about my money. We even took part in a couple of ASX share trading games. He talked about setting up a portfolio for me, but life got in the way and it never happened,” James recalls.

Determined not to miss that same opportunity for his own children, James has begun investing into ETFs on their behalf. But for this accomplished educator, investing for his children is as much about the educational value as it is about the financial benefit.

Lessons from family and friends

His early missed opportunity has shaped James’s financial approach as a parent, pushing him to be proactive about both building his children’s financial futures and teaching them how to stay ahead. His years teaching children and university students in both Western Australia and Hong Kong have also influenced his belief that financial literacy is a life skill every child should have.

“I think financial literacy is a life skill that kids need. My kids will have a 40-year runway, and that kind of time horizon is magic,” he says.

James is not alone. Finder’s 2025 Wealth Building Report shows 34% of Australian parents have invested on behalf of their children1, and James sees this shift first-hand. “I work with a lot of people my age, and they are talking about investing more openly now. That’s really cool to see,” he says.

James on one of his many travels. In previous lives, James worked as a teacher in Hong Kong and in Colombia. (Source: Supplied)

How James is investing for his children

James’s own investing journey hasn’t been without lessons – and those experiences have shaped how he invests for his children today.

His first approach was to portion a part of his pay cheque for his own as well as his children’s savings.

“When I reached a certain threshold, I would then put that into ETFs. That system worked well as a starting point,” he says.

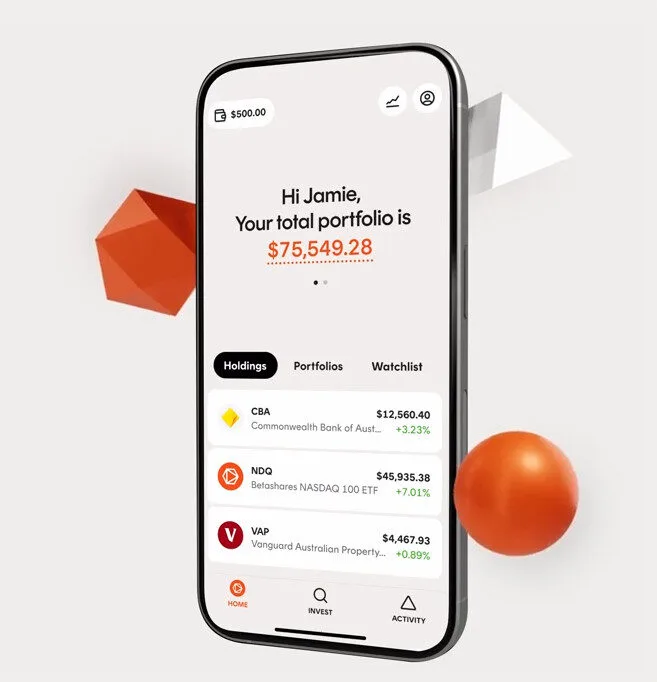

The balance has grown over time, and today his investments on behalf of his children stand at $10,000 – most of that in NDQ Nasdaq 100 ETF . He also has smaller investments in other ETFs, including ETHI Global Sustainability Leaders ETF and GNDQ Wealth Builder Nasdaq 100 Geared (30-40% LVR) Complex ETF 2. He plans to continue allocating his payday savings into these ETFs until his children are ready to receive that money.

But even if James leaves the $10,000 untouched by not contributing further amounts, the potential growth could be significant given the effects of compounding. For example, if NDQ’s since-inception return of 19.83% p.a.3 were to remain as is for the next 12 years, his nine-year old could have a portfolio worth around $87,000 by the time they are 21 years old and his seven-year old could have even more.4

However, before his children read this and become too excited, James is quick to clarify that he won’t just hand over the funds.

“If I talk to them at that age, and they say they would rather wait until their 30s, that could be a significant sum that goes toward a house. It all depends on how long the money has been there, how mature they are and how financially ready they are. I’m not going to just give them $50,000 when they’re 18,” he says.

(Source: Supplied)

Risk when it’s your own money versus your children’s money

James’s investment philosophy has evolved alongside his experience. While his first investments centred on individual stocks, a bout of volatility during Trump’s first presidency quickly taught him some hard truths about risk.

“You may think you have an idea what you’re doing, but when you realise that your portfolio is down 20% on paper, that’s when you realise how you actually feel about losing money,” he says.

Over time, James has shifted much of his portfolio from individual stocks into ETFs, a move shaped by those early lessons about risk.

What does success look like?

For this high school science teacher and father of two, success won’t be entirely material.

“On one hand, success would mean being able to give them a head start by providing some financial security for them. I don’t want to fix all their problems, but I want them to have something that will let them go into their early adult life knowing they don’t have to scrounge,” he says.

“Secondly, I want them to be able to say to their friends, ‘This is what I’m doing’, and invite them along on the journey. I think that’s a real achievement if I can teach them things that they can then teach to their friends.”

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

Disclaimer:

There are risks associated with an investment in the Funds, including market risk, country risk, international investment risk, non-traditional index methodology risk, foreign exchange risk, gearing risk, rebalancing risk, compounding risk, lender risk, currency risk and sector risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on www.betashares.com.au.

This information does not take into account any person’s objectives financial situation or needs. Investors should consider the appropriateness of the information taking into account such factors and seek financial advice.

Sources:

1. https://www.finder.com.au/news/mini-moguls-2025 ↑

2. Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve significantly higher risk than non-geared investments. An investment in GNDQ is high risk in nature. ↑

3. As at 29 August 2025 and excludes fees. NDQ’s inception date is 26 May 2015. Past performance is not indicative of future performance. ↑

4. Provided for illustrative purposes only and excludes taxes, inflation and other liabilities. Other costs ↑

2 comments on this

We are considering setting up Insurance/investment/education bonds for our 7 grandchildren to mature when they turn 28 years. Considering taxation, fees and returns, how do the 3 ETF’s compare?

For long term investing get greedy for Returns on Investments. The ASX is quite laggard by global standards with astute stocking picking or high risk bets required to get an annual compounding Return exceeding 10%. SOL and CBA are a couple of exceptions. AFI and ARG LICs do not have this level of Return, about 4% Real ROR. Oz investors are overly enchanted by receiving Fully Franked Dividends and often tolerate lower Returns to get a Tax Refund. I have invested in ETHI since May 2017 and NDQ since September 2019. Over these periods Historic Returns of 15.12% and 20.18% have been received. More importantly, CPI adjusted or Real Returns have been 11.37% and 15.91% pa. These are enviable and low risk, set-and-forget investments. ETFs deliver Returns as Distributions. These Returns can consist of several financial components and usually are slightly taxed advantaged – but not to the tune of 30% franking credits of Dividends. The superior return of these two ETF’s trounces returns from stock picking., Remember that Inflation is a Wealth Eater over three plus years timeframes – hence Real Returns matter to generate Real wealth.