Private wealth, public impact - family offices go sustainable

4 minutes reading time

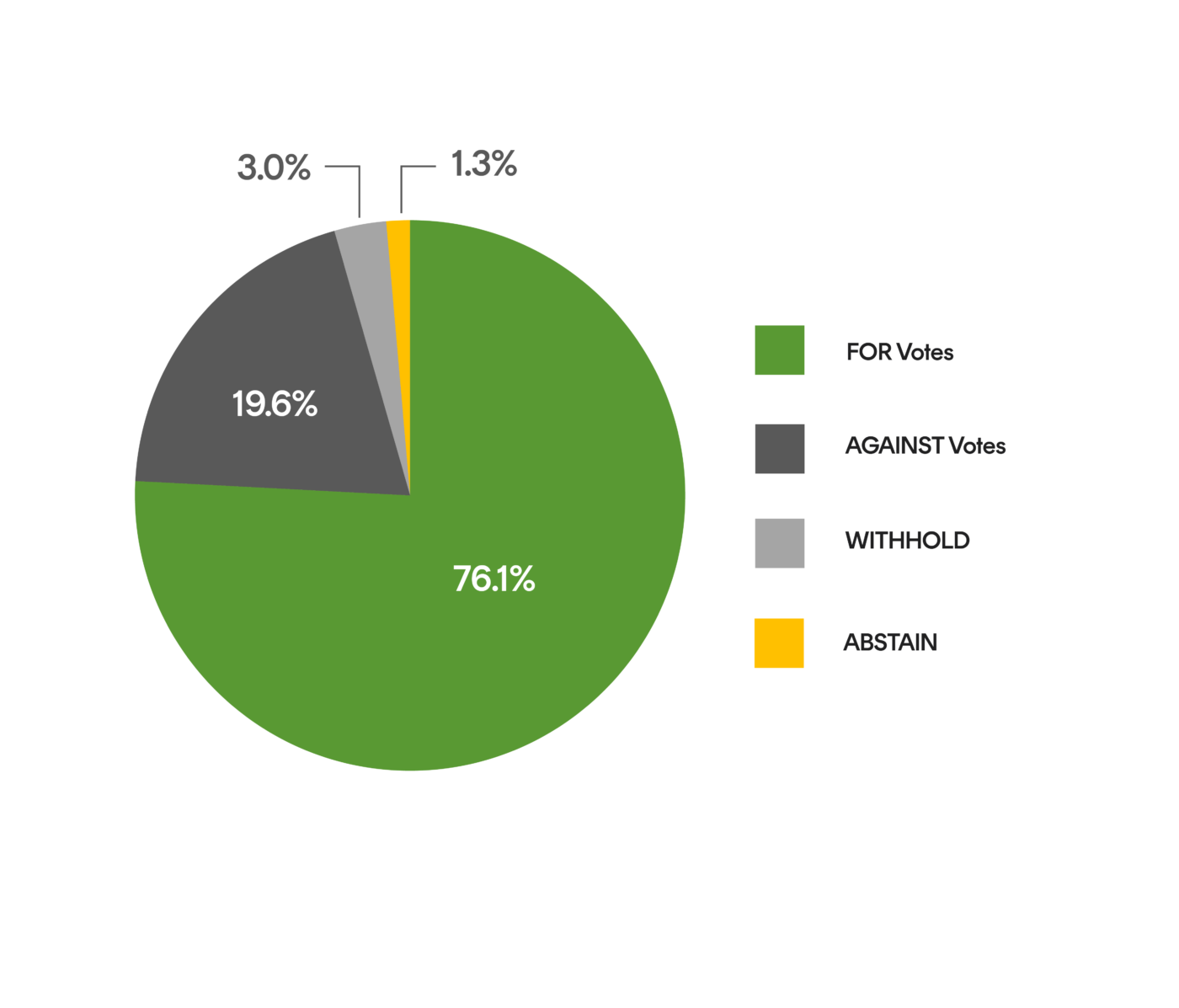

Across Betashares’ range of ethical and impact ETFs1, for the quarter ending 30 June 2025, we voted at 258 shareholder meetings on 3,296 individual proposals. We voted FOR 2,508 times, AGAINST 646 times, WITHHOLD 98 times and ABSTAIN 44 times.

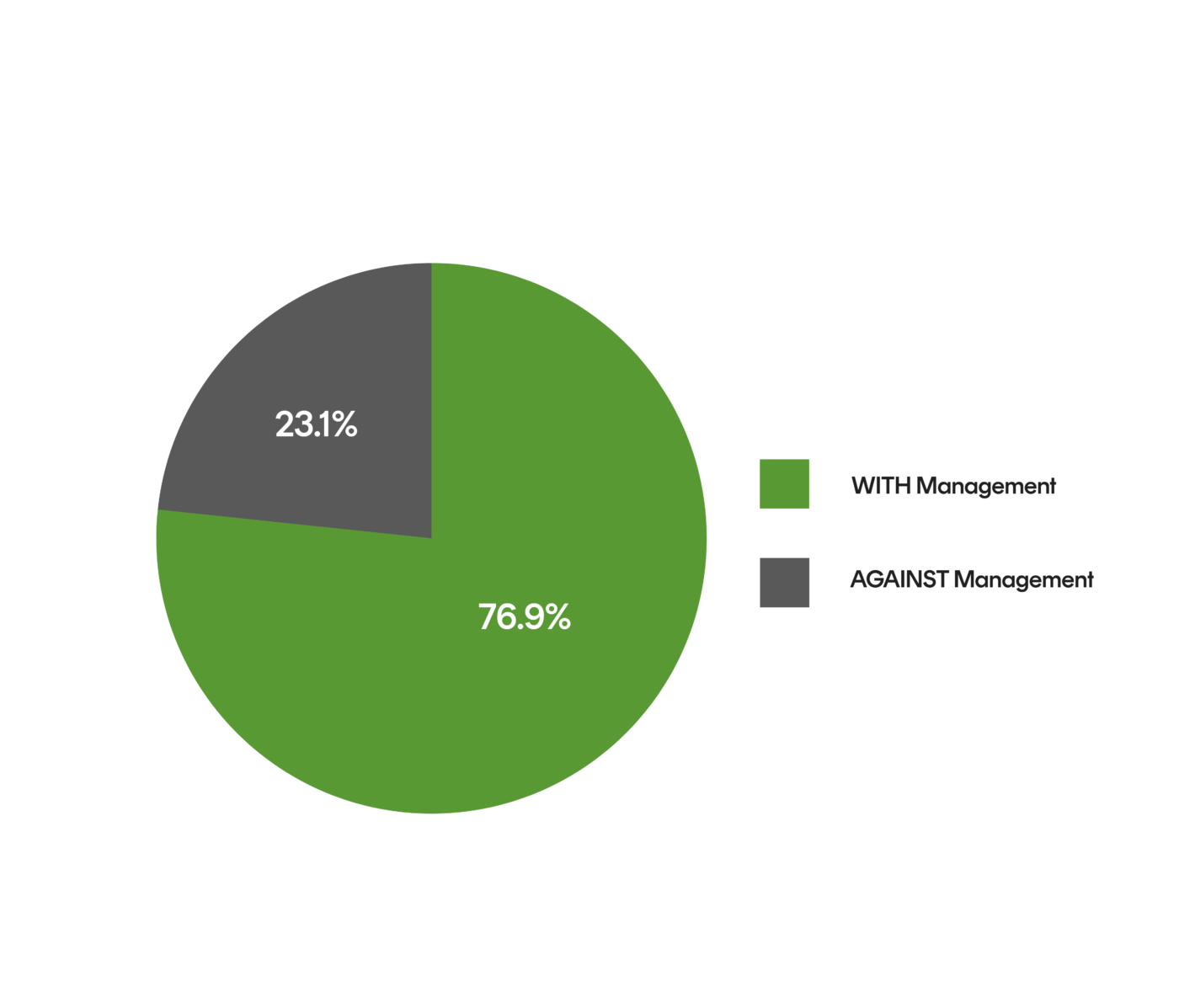

We voted WITH management 2,536 times and AGAINST management 760 times. Among the proposals, we supported a shareholder resolution at Home Depot, Inc. calling for the company to publish an assessment of its biodiversity impacts and dependencies across its full value chain. Improved disclosure on the company’s value chain would assist shareholders in evaluating how Home Depot is managing biodiversity-related risks and impacts, and in tracking progress on these issues.

Among the proposals, we supported a shareholder resolution at Home Depot, Inc. calling for the company to publish an assessment of its biodiversity impacts and dependencies across its full value chain. Improved disclosure on the company’s value chain would assist shareholders in evaluating how Home Depot is managing biodiversity-related risks and impacts, and in tracking progress on these issues.

Engagement activity

Engagement activity over the quarter focused on nature and biodiversity, labour rights and diversity, equity and inclusion.

The Responsible Investment Committee (RIC) engaged with Telus Corporation in relation to allegations of workplace intimidation and labour rights violations. These include the dismissal of union members, obstruction of collective bargaining rights and substandard working conditions at the company’s content moderation centre in Türkiye.

Telus has advised that the dismissals were for legitimate reasons and in accordance with Turkish labour law and were not related to union membership. The company further explained that a recent reclassification of the call centre sector in Türkiye underpins its current position on collective bargaining rights. In light of allegations that an industry association – of which Telus is a prominent member – may have influenced this reclassification, we requested additional details and sought clarification on the steps the company is taking to address employee concerns. The RIC plans to continue engaging with Telus to address our concerns relating to labour rights issues.2

The RIC engaged with Verizon following reports that the company had significantly scaled back its diversity, equity and inclusion (DEI) initiatives in response to recent regulatory and political developments in the US. These changes reportedly included the removal of all DEI content from employee training materials, the elimination of workforce diversity targets and the withdrawal of DEI-related performance metrics from executive remuneration frameworks.3

Given the importance of DEI in promoting fair and inclusive workplaces, the RIC wrote to Verizon seeking clarification on these developments. Specifically, we requested further information on how the company intends to uphold its stated commitment to equal opportunity and non-discrimination in the absence of formal DEI policies and structures. We also sought to understand how Verizon plans to manage associated risks, including reputational, legal and talent-related risks, that may arise from these changes.

Following public criticism of an A$497m sustainability-linked loan issued to Tassal by Westpac, Commonwealth Bank and Rabobank, the RIC initiated individual engagements with each of the banks to better understand the assessment undertaken prior to the loan’s issuance. The transaction has attracted scrutiny due to allegations of greenwashing and concerns over the robustness of due diligence processes. Tassal’s environmental record, particularly its operations in Macquarie Harbour, has raised red flags, including the loss of Aquaculture Stewardship Council certification across multiple farms and questions regarding the credibility of its sustainability performance targets.4

In our outreach, we sought details on each bank’s assessment processes and ongoing monitoring mechanisms for sustainability-linked financing. Westpac responded with an overview of its Sustainable Finance Framework but cited client confidentiality as a barrier to discussing the Tassal loan. Commonwealth Bank has provided a response and ongoing engagement is underway. Rabobank has not yet responded to our inquiry.

Sources:

1. Being Betashares Global Sustainability Leaders ETF (ASX: ETHI), Betashares Australian Sustainability Leaders ETF (ASX: FAIR) and Betashares Climate Change Innovation ETF (ASX: ERTH).

2. https://uniglobalunion.org/news/tiktok-workers-sue-telus-for-being-fired-investigation-reveals/

3. https://www.npr.org/2025/05/19/nx-s1-5402863/verizon-fcc-frontier-dei-trump

4. https://www.afr.com/companies/financial-services/westpac-and-cba-face-green-ire-over-500m-loan-to-salmon-farmers-20250409-p5lqje