Private wealth, public impact - family offices go sustainable

4 minutes reading time

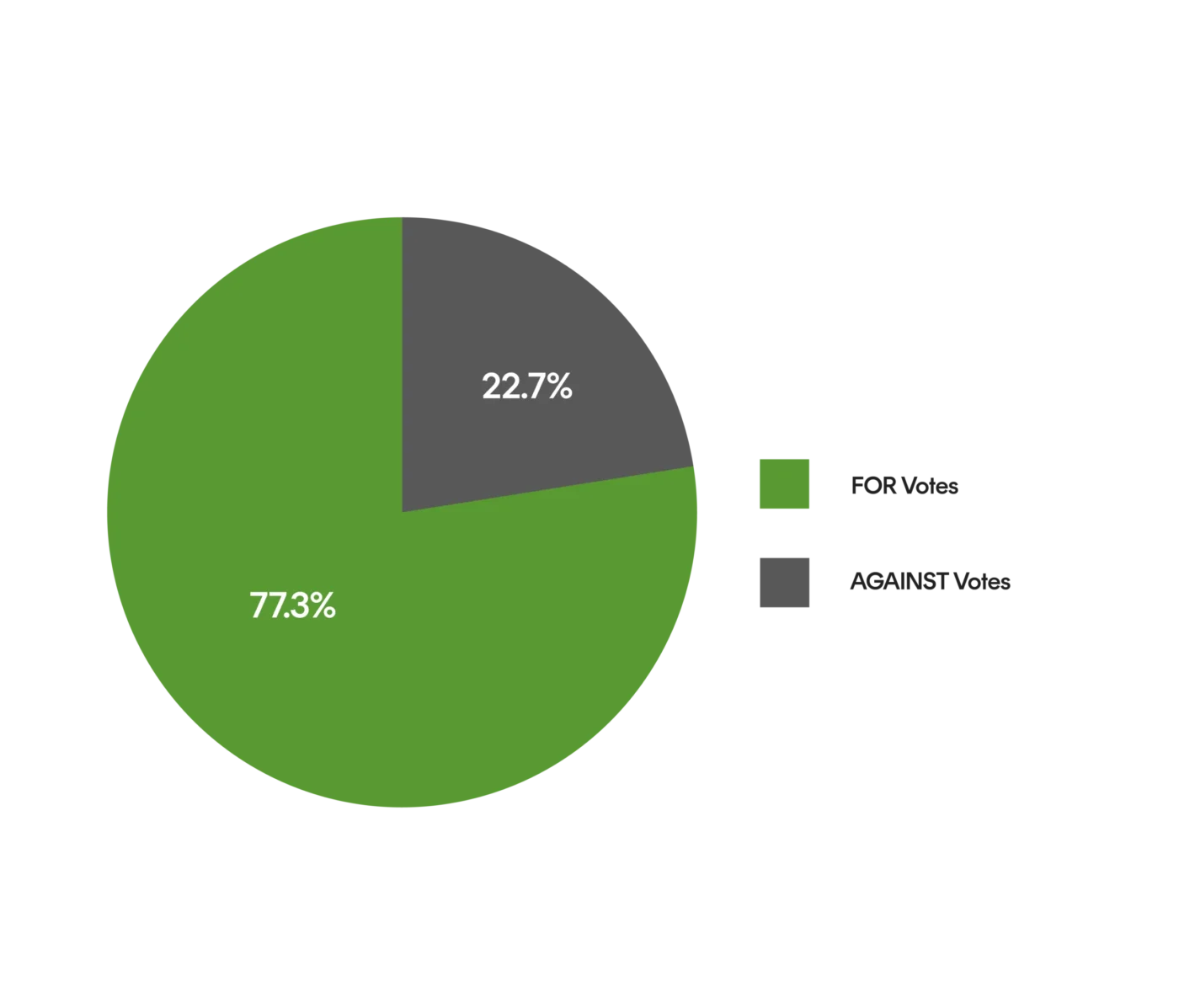

Across Betashares’ range of ethical and impact ETFs1, in the quarter ending 30 September 2025 we voted at 32 shareholder meetings on 282 individual proposals. We voted FOR 218 times and AGAINST 64 times.

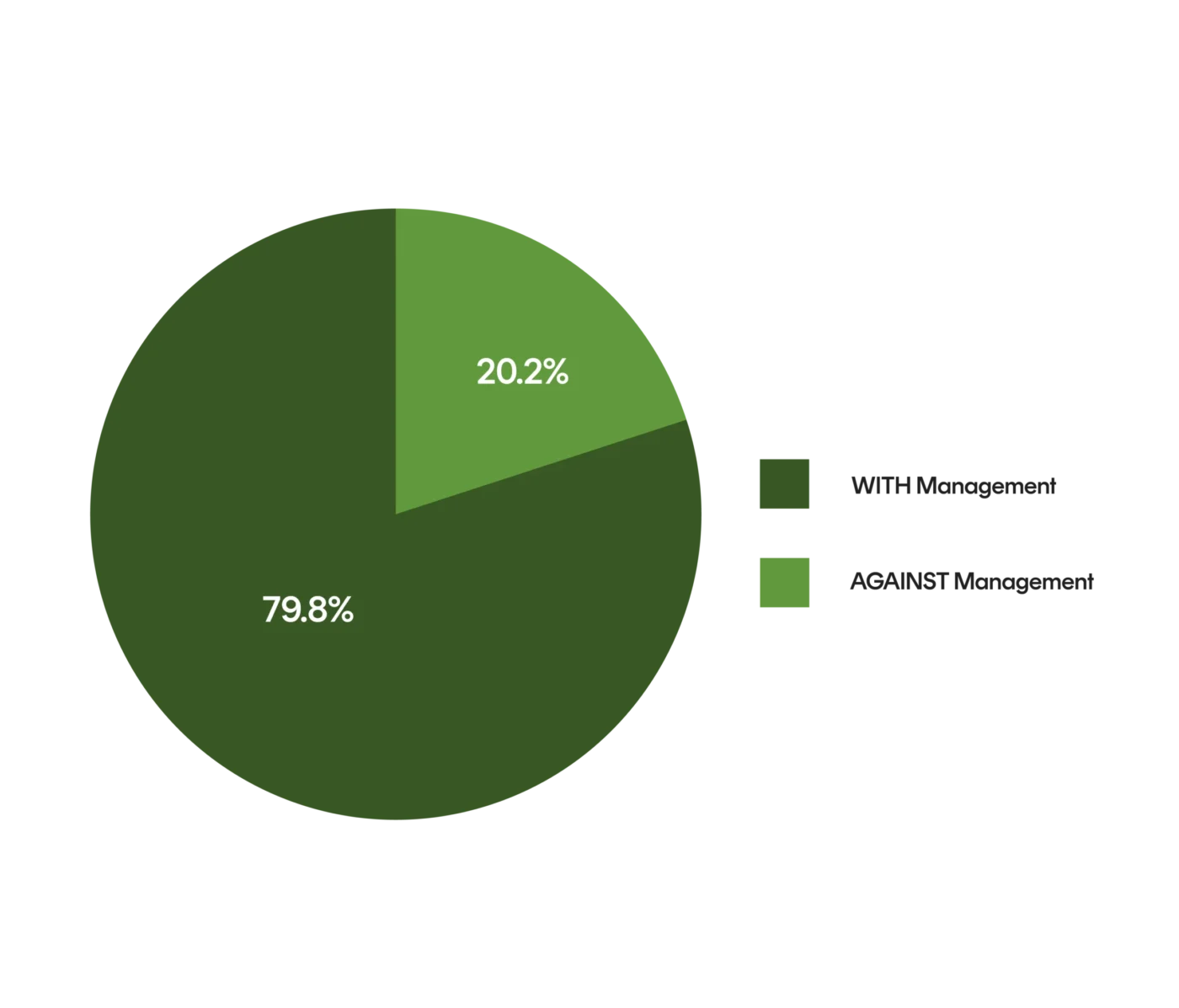

We voted WITH management 225 times and AGAINST management 57 times.

Among the proposals, we voted against a number of remuneration proposals that incentivised management for behaviours that are inconsistent with the interests of shareholders and were not aligned with global best practices related to remuneration policies.

Engagement activity

Engagement activity over the quarter focused on nature and biodiversity, diversity, equity and inclusion (DEI) policies, human rights and the treatment of vulnerable populations, and climate disclosures.

The Responsible Investment Committee (RIC) engaged with Woolworths Group following reports that the company has proposed a new development in Kincumber, New South Wales, which may adversely affect the Kincumber Wetlands. Local residents and environmental advocates have raised concerns that the proposed site includes ecologically significant wetlands that support diverse ecosystems and provide habitat for several species classified as vulnerable, endangered or critically endangered.2

The site in question is owned by the Darkinjung Local Aboriginal Land Council (DLALC). Woolworths has stated that DLALC will make the final determination regarding the potential development. The company also confirmed that, should a development be proposed, it would adhere to all standard processes of engagement, notification, public exhibition and assessment required for any rezoning or associated development application. The objective of the engagement is to understand how Woolworths’ proposed activities in Kincumber align with its stated commitment to responsible environmental stewardship and sustainable land use.

The RIC engaged with Roche Holding following reports that the company had withdrawn its diversity targets in response to recent US Executive Orders relating to DEI.3 The engagement aimed to understand the nature and implications of these changes, including their impact on Roche’s DEI policies and employee engagement practices.

Roche advised that it is reviewing and adjusting its global and US DEI programs to ensure compliance with the relevant Executive Orders. The company reaffirmed its ongoing commitment to DEI but did not provide specific details regarding amendments to its policies. Roche indicated that further information may be disclosed in its FY2025 Sustainability Report, expected in early 2026, which the RIC will review as part of its continued monitoring.

The RIC engaged with the International Finance Corporation (IFC) following reports that several private hospital operators financed by the IFC were allegedly detaining patients unable to pay medical bills and denying treatment to those unable to afford upfront fees.4 The purpose of the engagement was to understand how the IFC is responding to these allegations and to gain insight into the mechanisms it employs to monitor and manage the social impacts of its healthcare investments.

In response, the IFC provided information outlining its investment approach to private healthcare and shared a public statement addressing the allegations. In its statement, the IFC acknowledged recent patient safety incidents at client hospitals and recognised the need to strengthen oversight of its healthcare portfolio. The organisation is enhancing its assessment and supervision processes through the introduction of new quality and ethical evaluation tools, conducting reviews of existing health investments to identify potential risks, and implementing corrective safeguards where required. For future investments, the IFC emphasised that adherence to ethical standards remains a critical criterion, noting that it will not engage with clients who fail to meet these principles.

The RIC engaged with Fisher & Paykel Healthcare (FPH) to discuss the company’s sustainability approach, climate disclosures and social practices. FPH continues to align with NZ Climate Standards and TCFD, with plans to strengthen resilience and adaptation. The company is expanding supplier assessments beyond emissions to broader environmental risks and improving DEI initiatives, though some US programs were paused following Executive Orders. Modern slavery risks are managed through EcoVadis ratings and internal audits. The RIC plans to continue to engage with FPH on climate disclosures and its approach to DEI within its business.

Sources:

1. Being Betashares Global Sustainability Leaders ETF (ASX: ETHI), Betashares Australian Sustainability Leaders ETF (ASX: FAIR) and Betashares Climate Change Innovation ETF (ASX: ERTH).

2. https://coastcommunitynews.com.au/central-coast/news/2025/05/opposition-to-proposed-woolies-development-ramps-up/?srsltid=AfmBOoqr_0bNuayrUr6bjbP14qZcv8YH0ID3SRF-VTOmv9vSXWN140zR

3. https://www.swissinfo.ch/eng/roche-scraps-global-dei-leadership-targets-on-trump-pressure/89032102

4. https://www.brettonwoodsproject.org/2025/04/new-report-documents-abuses-at-ifc-funded-hospitals-further-exposing-consequences-of-the-billions-to-trillions-approach/https://www.brettonwoodsproject.org/2025/04/new-report-documents-abuses-at-ifc-funded-hospitals-further-exposing-consequences-of-the-billions-to-trillions-approach/