5 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast, click below or subscribe on Apple, Amazon or Spotify:

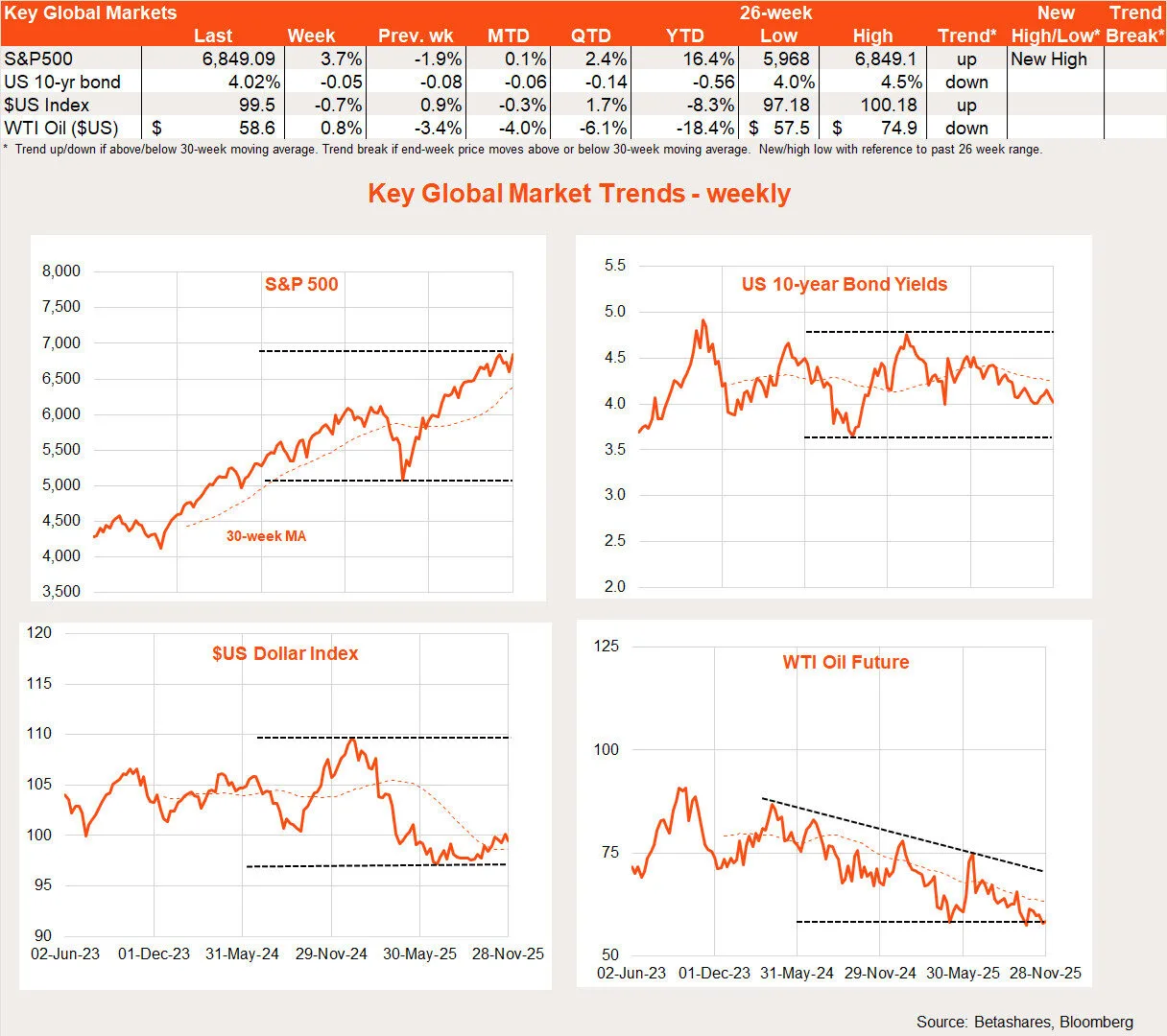

Global stocks rebounded last week, buoyed by the growing prospect of a US rate cut this month.

Global week in review: Rate cut hopes

There was little in the way of major US economic data last week, but what was released tended to be on the soft side. The Conference Board measure of consumer confidence suggested households were quite despondent, with growing concerns over the economic outlook and job availability. If confidence drops much further, it would be clearly moving into previous recessionary levels.

Retail spending was not much better, rising a mere 0.2% in September. All up, the data suggests that outside of the booming AI infrastructure build, other parts of the US economy are pretty soggy – likely not helped by erratic policymaking out of Washington.

All that said, Wall Street saw reason to rally, with another key Fed speaker – Governor Christopher Waller – supporting a rate cut this month. Waller’s comments early in the week followed on from New York Fed President Williams’ equally dovish comments the previous Friday and helped underpin equities through the week. Markets are pricing a rate cut this month with near-90% certainty.

Global week ahead: US inflation

There’s a smattering of key US data this week, including the ISM manufacturing and service sector surveys, job openings and the private consumption expenditure deflator (PCED).

The data will provide important updates on both the health of economic activity and any lingering inflation impetus from the tariffs. At this stage, markets still see the inflation outlook as fairly benign, with a 0.2% gain in core PCED prices expected on Friday. One risk this week could be a surprise slump in job openings given all the anecdotal talk of a weakening labour market.

Of course, should activity data turn out to be weak, markets could take it as ‘bad news is good news’ to the extent that it strengthens the case for a rate cut at next week’s Fed meeting.

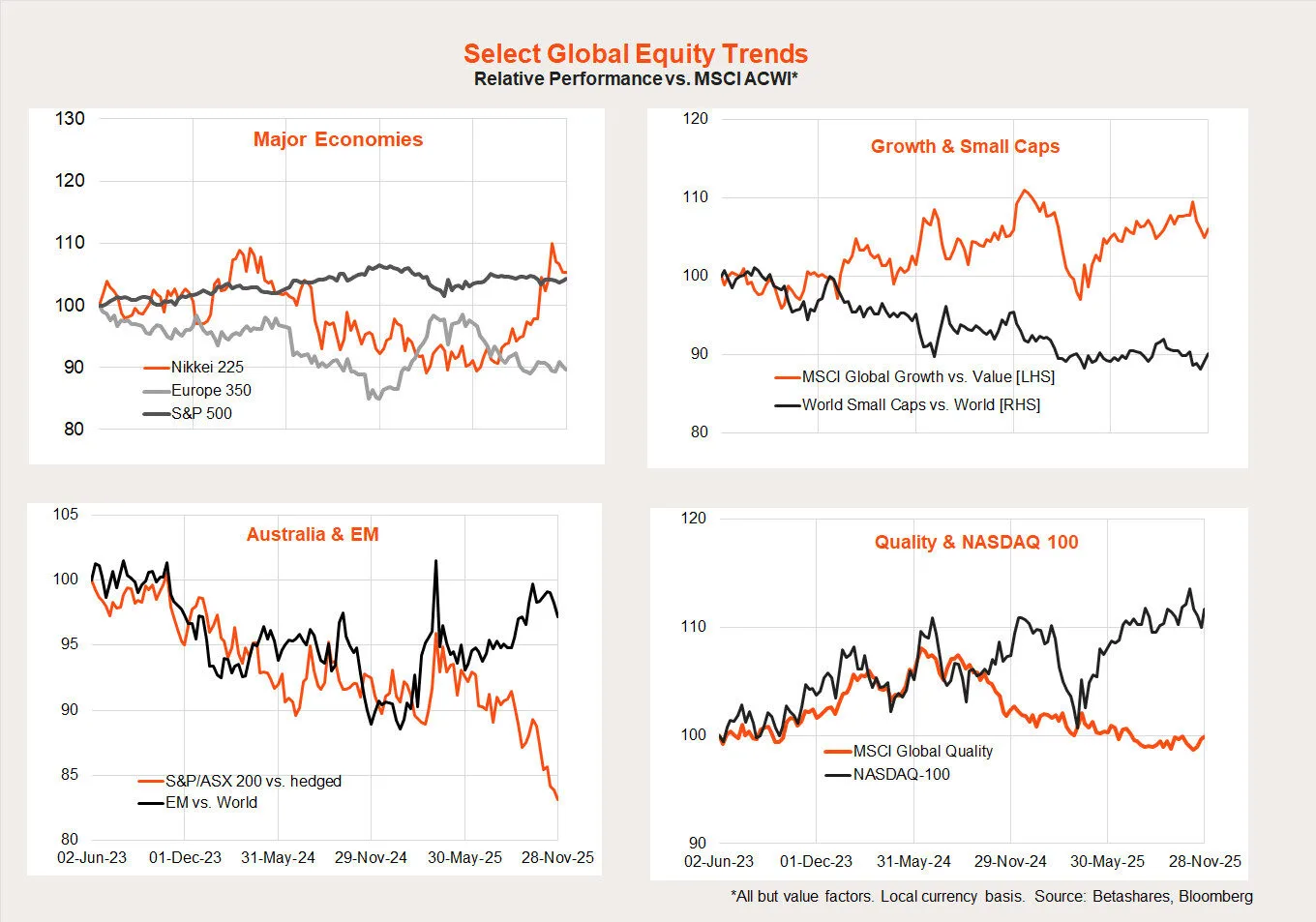

Global equity trends

As might be expected, it was the US/growth/technology segment that led global equity markets higher last week. The NASDAQ-100 lifted a lazy 4.9% after a drop of 3.0% the previous week.

As I noted last week, it’s still a bit premature to suggest the outperforming bias of US/growth/technology is shifting in favour of non-US and value. To my mind, such a shift remains directional. If equities sink further, US/growth/technology will be hit hardest, but if the recent market pullback is short-lived (my working assumption), they will likely bounce back the strongest.

That said, the good relative performance of Japan and emerging markets, even before the recent market correction, suggests these could be new themes with legs and a useful source of diversification beyond US tech.

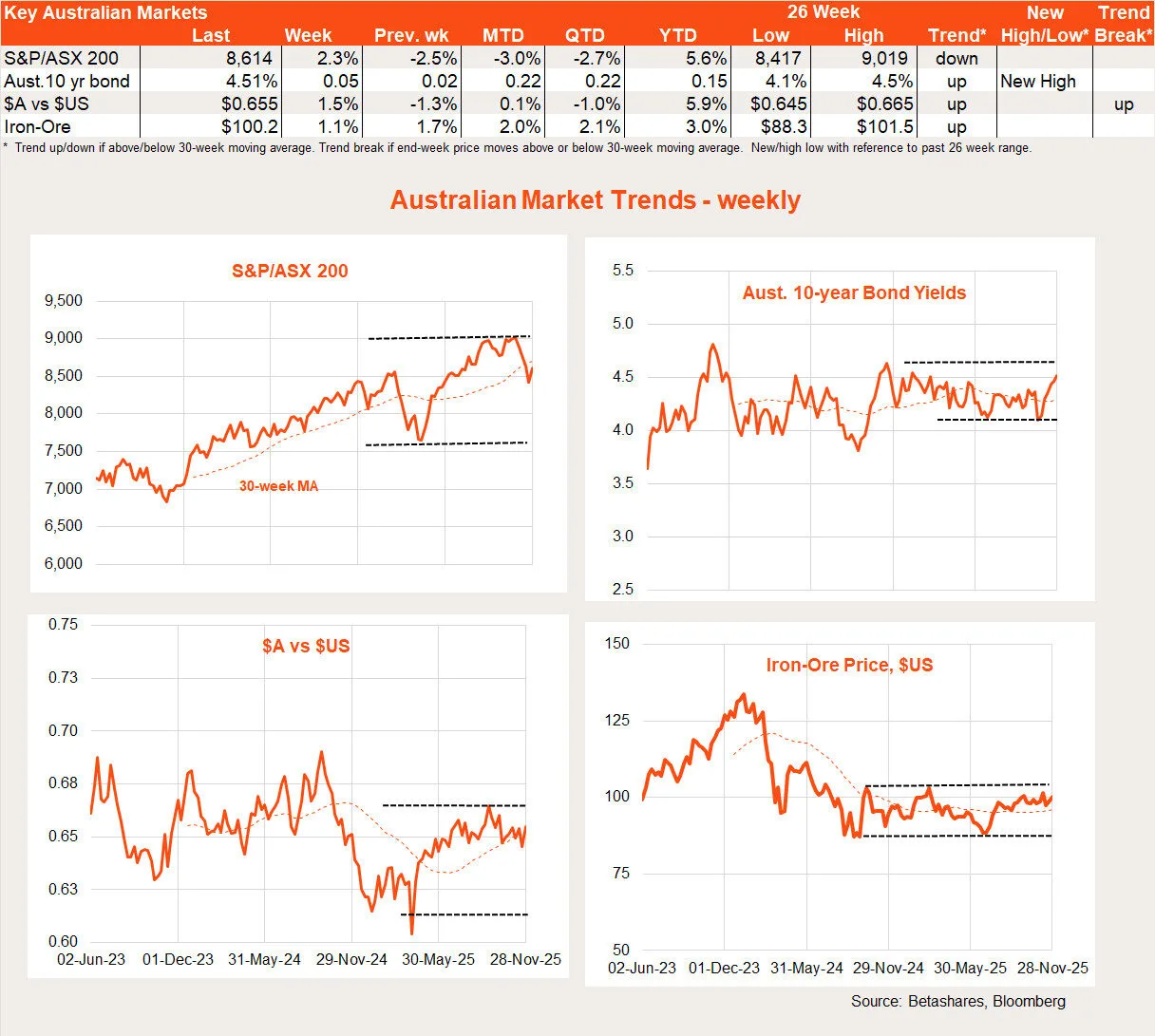

Australian week in review: Firm October CPI

Local stocks rode the global equity rebound last week, despite a firm October inflation report which further lessened markets’ hopes of a rate cut next year.

The major local highlight last week was the first of the fully detailed monthly CPI reports. The key takeaway was that the seasonally adjusted trimmed mean measure of underlying inflation lifted 0.3% in October, implying an annualised rate of inflation still above the RBA’s 2-3% inflation target.

For there to be any hope of rate cuts next year, the annualised pace of underlying monthly inflation gains will need to slow to below 3% – and, if it does not, we face the prospect of higher rates. Indeed, markets are now pricing a 30-40% chance of one rate hike by end-2026.

Other data last week were also firm. Aside from a quirky drop in mining investment, construction work done in Q3 was solid, with good gains in both residential (+4.2%) and non-residential (+3.7%) construction. Capital spending was also solid last quarter, rising 6.4%, with the business investment outlook for FY26 upgraded. After dropping back in Q2, even public infrastructure investment rebounded last quarter, rising 3.9%.

All up, business investment and construction appear to be strengthening, broadening the recovery in private activity which has so far been consumer-led. Investment and construction activity is being underpinned by the residential housing upswing, green energy projects and Australia’s own mini AI-related data centre boom.

At least mining investment remains fairly flat and public infrastructure spending appears to be plateauing. Either way, the strengthening outlook for investment will likely add to the RBA’s concerns over limited spare economic capacity.

Australian week ahead: Q3 GDP

The major local highlight this week will be Wednesday’s release of the Q3 GDP report, which is shaping up to be quite solid.

Although trade, inventory and profit data yet to be released could change the story, the data released so far suggests broad-based strength across consumer spending, public demand, housing construction and business investment. The market currently expects quarterly economic growth of 0.7%, after a gain of 0.6% in Q2. If borne out, it would lift annual economic growth from 1.8% to 2.2%.

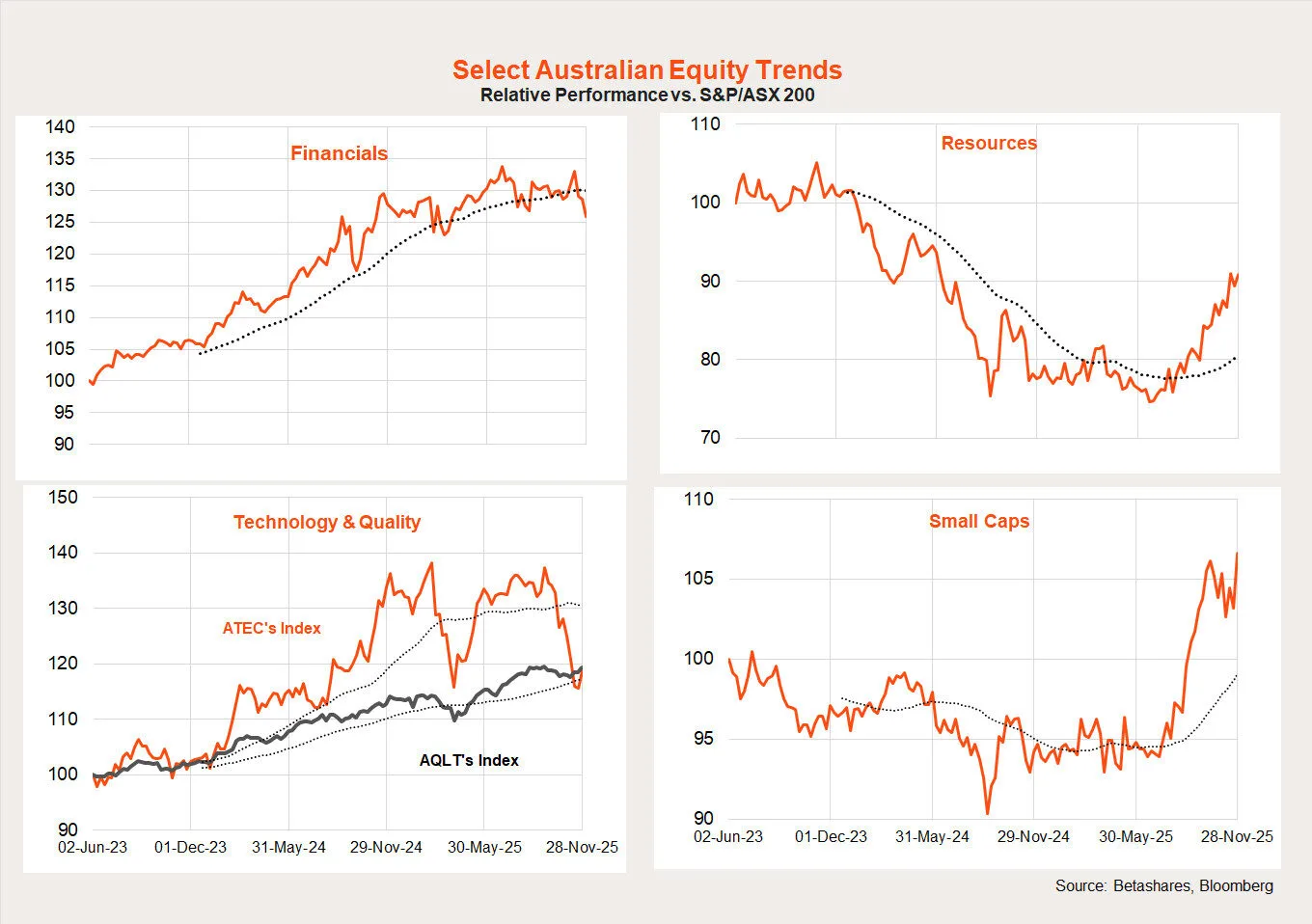

Australian equity trends

Dampened rate cut hopes have generally hurt high-beta local equity themes of late such as technology and small caps. Last week, however, technology and small caps both snapped around back 6.0%.

Materials also continued to perform well, rising 5.0%. This continued the outperformance trend of resources over financials.