6 minutes reading time

If you’d prefer to listen to this week’s edition in podcast form, please click the below player:

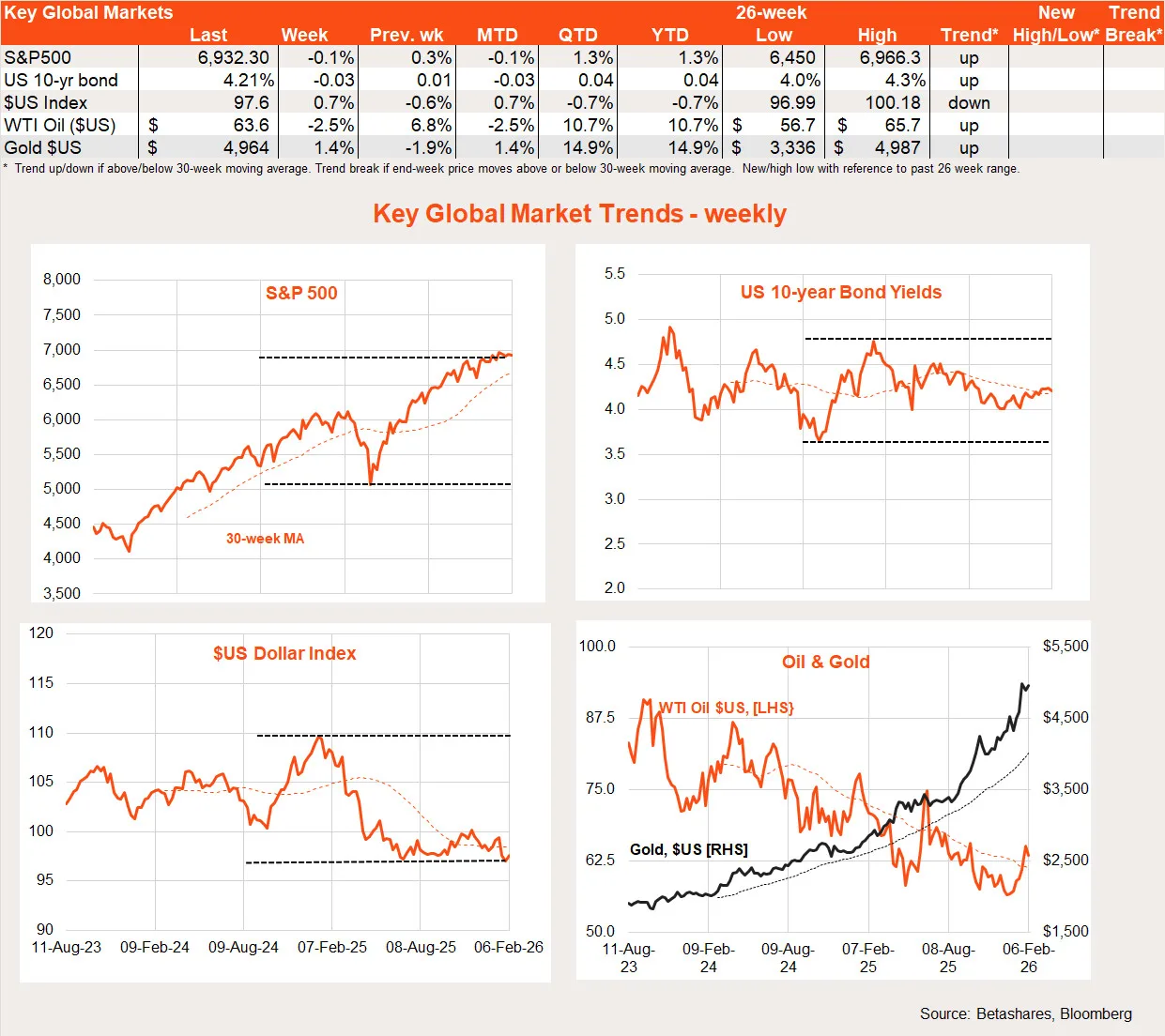

US stocks slipped last week, reflecting US-Iran tensions and AI-related concerns.

Global week in review: Iran tensions and the software meltdown

Global stocks continued to nervously grind higher last week. The corporate earnings and economic growth outlook still remain encouraging, underpinned by a lift in a key US manufacturing index last week. Countering this however are simmering US-Iran tensions and the ‘creative destruction‘ taking place in the US technology sector.

With regards to Iran, all of the US’ talk of supporting protesters appear to have disappeared following another brutal crackdown. Instead, the US is now focused on striking another nuclear deal with the threat of further military strikes as its bargaining chip. Talks progressed last week and the world is awaiting the outcome. History suggests however any US strike would be a one-day wonder for markets – although given we don’t know when and if another strike will come, it leaves investors nervous.

Then we have new question marks around the AI boom, which has been a tailwind for large-cap US technology stocks since late 2022. Along with concerns over valuations, debt funding and the ultimate Mag-7 return from their massive investments, the latest concern is ‘SaaSpocalypse‘. The new fear is that many of the world’s leading software as a service (SaaS) companies will have their business models destroyed by easier and cheaper coding offered by AI services.

After all, if coding is so easy, much cheaper software services could soon become available and/or many businesses might find they can develop their own inhouse solutions. But while that may be true, it’s also possible that existing SaaS players could equally avail themselves of these cheaper coding opportunities – thereby cutting costs and retaining their existing customers. Switching costs from systems already embedded into business operations may also not be easy. The clear losers, unfortunately, appears to be run-of-the-mill human coders. We will see!

Outside of the US, early polling suggests Japan’s Liberal Democratic Party enjoyed a big win in Sunday’s elections. If the LDP secures a ruling majority, it will likely fuel further optimism about economic reforms and fiscal stimulus – helping support the ongoing outperformance in Japanese equities.

Global week ahead: US payrolls & inflation

A short-lived US government shutdown delayed last week’s release of the January payrolls report. It is now scheduled for this Thursday, with a job gain of 70k expected, keeping the unemployment rate steady at 4.4%. Markets are currently quite nervous about the softening in the US labour market, so a strong result would be reassuring whereas a weak report could lower bond yields and raise talk of a near-term Fed rate cut.

US retail sales and the NFIB small business survey will also provide important updates on the health (or otherwise) of the US economy.

Also important this week will be the US consumer price index (CPI) report for January. Markets anticipate another fairly benign monthly gain of 0.3% for core CPI, which would see annual growth ease from 2.6% to 2.5%.

Note: The Fed’s preferred underlying inflation measure – the private consumption expenditure deflator (PCED) excluding food and energy – was running at an annual pace of 2.8% in November. Stripping out tariff effects, one could argue US inflation is not too far from the Fed’s 2% target – although one risk in coming months is if more US companies finally start to pass on the tariff costs they have been shouldering so far. Several groups, including Goldman Sachs, say that 90-95% of the annualised US$250 billion increase in tariff revenues so far has been paid by US businesses and consumers (foreign suppliers have not cut their prices). Businesses have been sharing around 60% of this domestic burden to date.

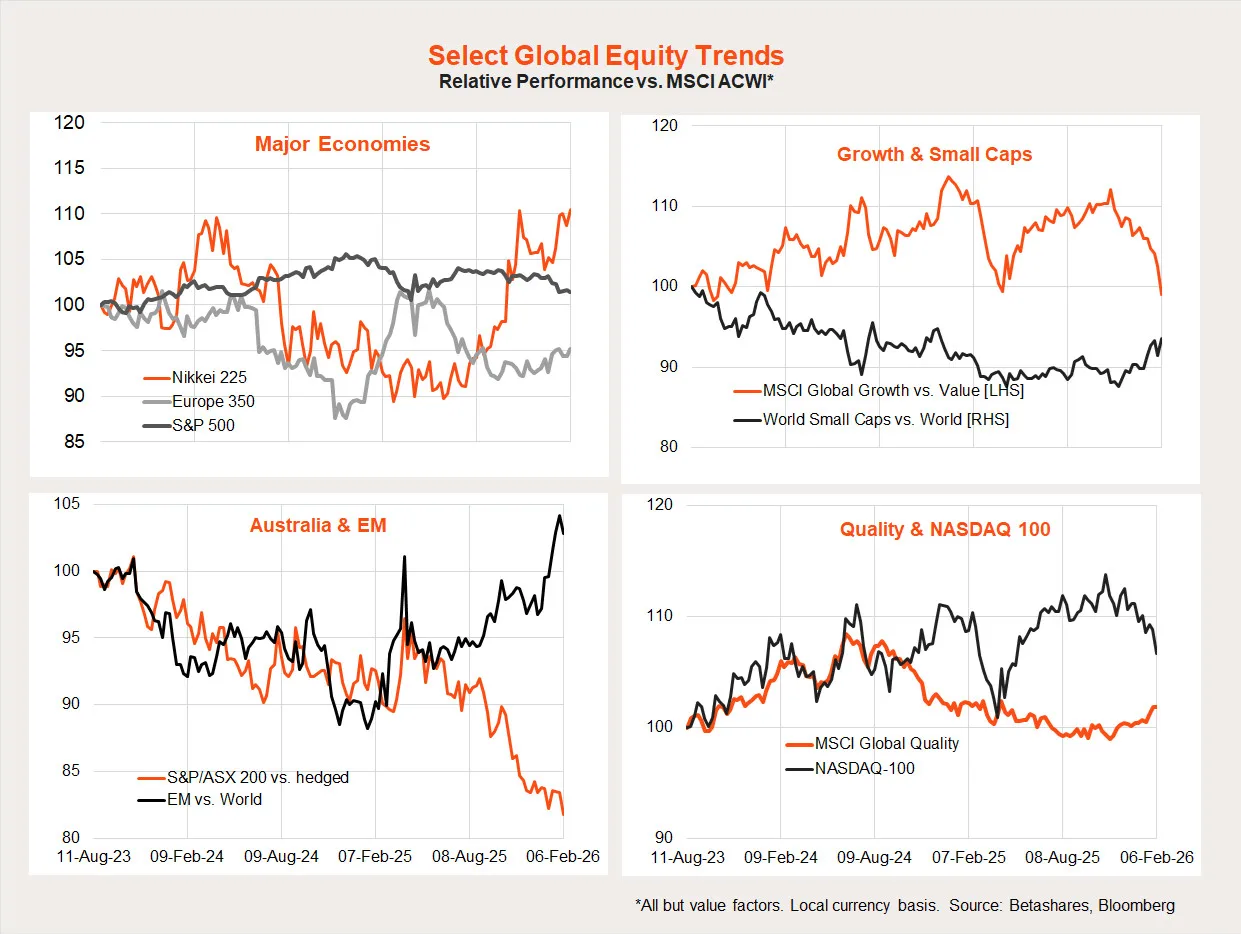

Global equity trends: the great rotation continues

The MSCI All-Country World Equity Index actually edged up 0.1% last week, supported by strength in Japan, while the S&P 500 and NASDAQ-100 declined 0.1% and 1.9% respectively. Value stocks also handily beat growth stocks, and technology underperformed. All up, the ‘great rotation’ remains alive and well.

Indeed, since the end of October 2025, we’ve seen underperformance of US/growth/technology, replaced by strength in Japan, emerging markets and small caps. Sadly, Australia’s trend of underperformance (in currency hedged terms) continues despite renewed optimism in the resources sector.

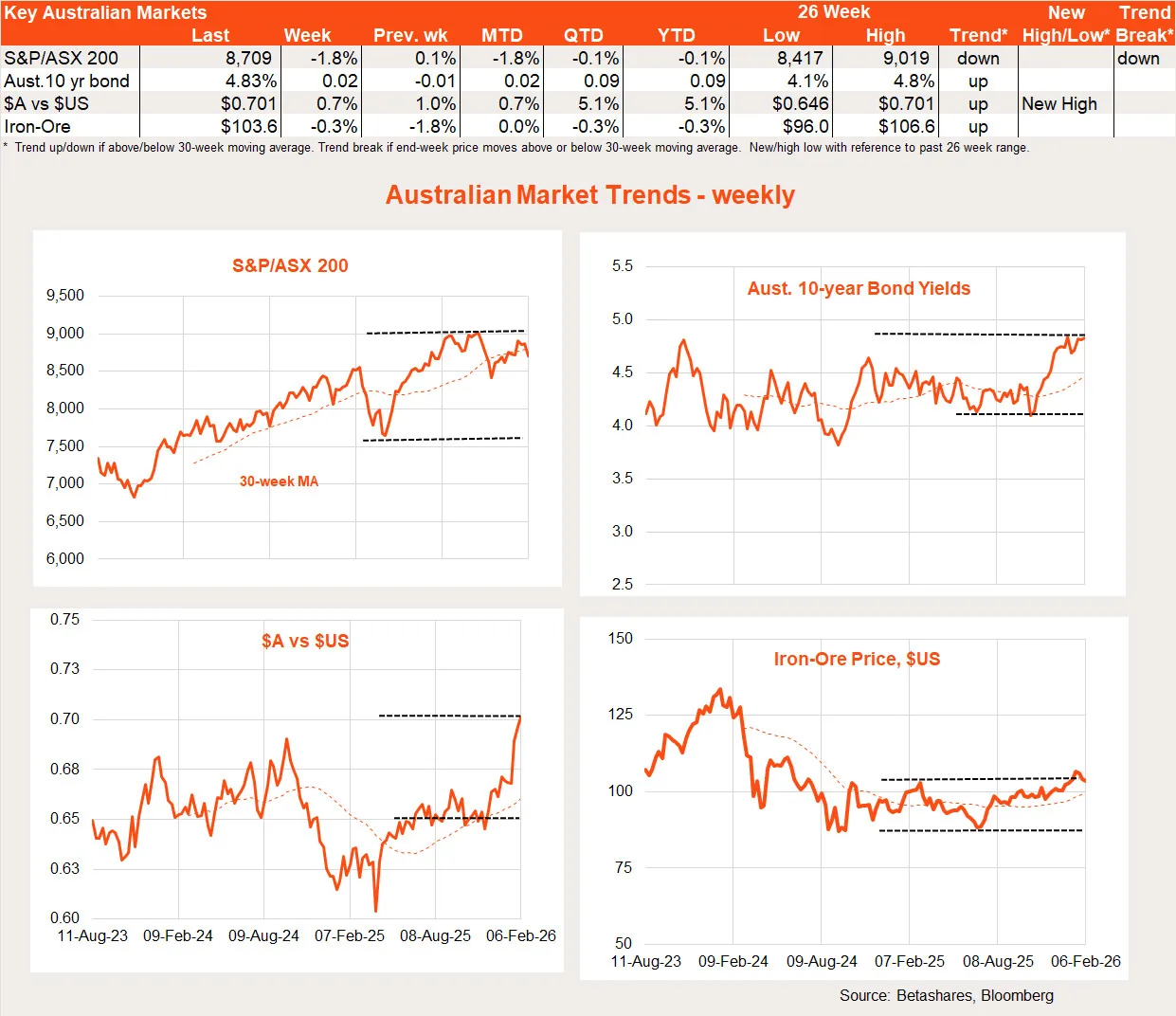

Australian week in review: hawkish RBA

Australian shares fell last week, not helped by the RBA’s rate hike and the risk of more to come.

As I expected following the hot Q4 CPI report, last week’s major highlight was the RBA’s decision to lift interest rates – which the market had as a 70% chance. The reason for the RBA’s decision was pretty clear: it feels some of the lift in inflation in H2 2025 reflected the broad-based rebound in demand pressing on limited spare capacity, so higher rates were needed to reign in that demand and ease pricing pressures.

Is there more to come? The RBA’s own forecasts assume uncomfortably high underlying inflation in H1 2026, even with the market’s expectation of one further rate hike. This suggests the RBA’s own base case is likely that it will raise rates at least once more – likely in May – if the Q1 2026 CPI in late April has another hot reading for trimmed mean inflation (say a gain of 0.8% or more).

I’m hopeful that more of the recent lift in underlying inflation reflects a one-off restoration of crimped profit margins in new home building and consumer products – not to mention airline/hotel profiteering during the Ashes cricket test series. If so, there’s a good chance the Q1 CPI could surprise on the downside – but it’s far from a done deal!

Australian week ahead: RBA finger on the trigger

We’ll get important updates on the state of the consumer with the February Westpac consumer sentiment survey on Wednesday and the December ABS Household Spending Indicator today.

While sentiment is likely to have weakened further, estimated household spending has been quite firm in the months leading up to December 2025 (although this may partly reflect an earlier start to sales activity). Strong consumer spending is not what the RBA wants to see at present.

Also of interest will be Q4 housing finance commitments, given the strong upturn we saw through the course of 2025. Again, strength in housing finance – especially investor lending – is not something the RBA would welcome.

With regards to the RBA itself, two key senior officials also speak this week.

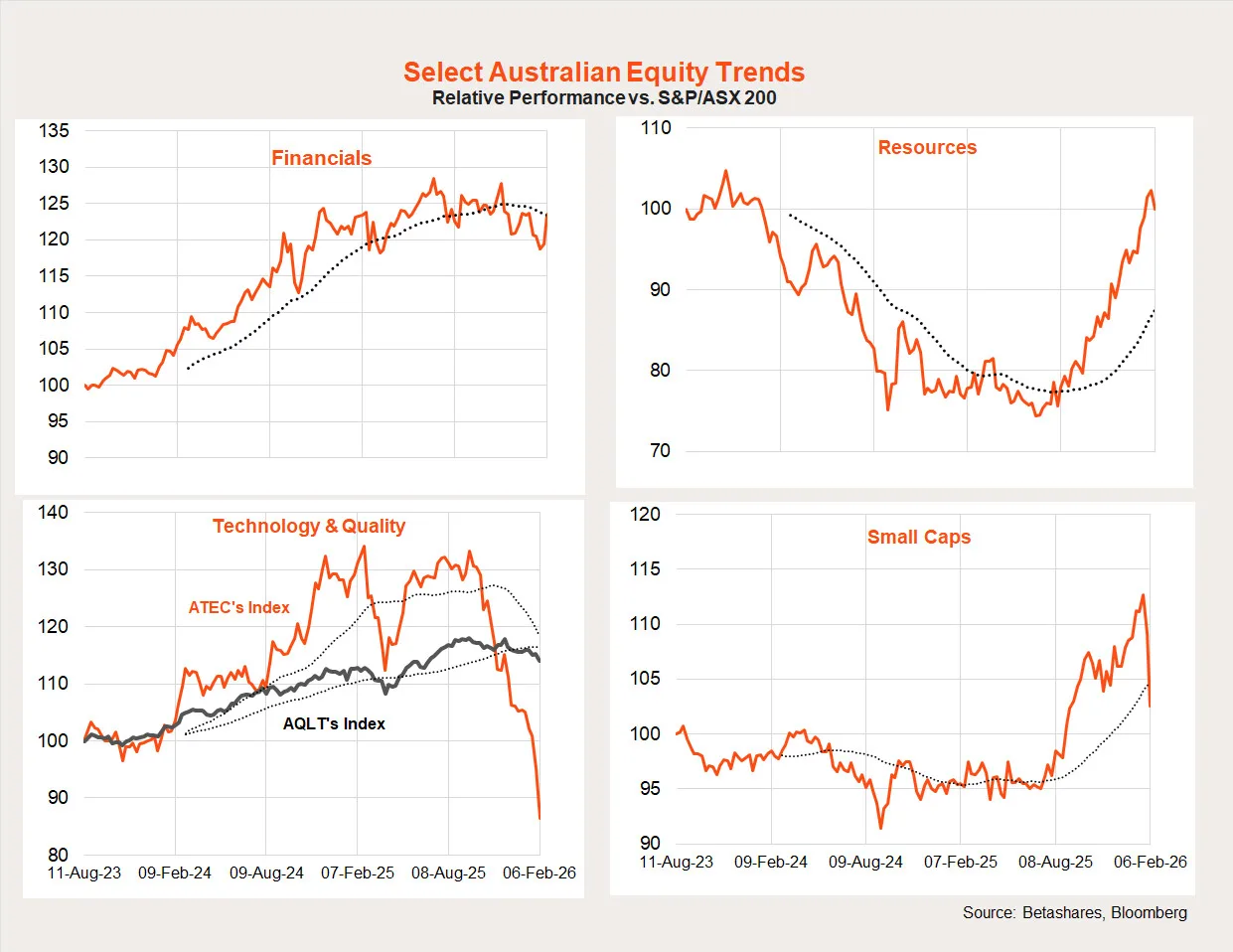

Australian equity trends

There were not many places to hide on the Australian equity market last week, with the technology sector again hit hard – although financials actually rose 1.5% while consumer staples were flat.

That said, a rotation from financials to resources remains broadly in place, although the recent outperformance of small caps unwound somewhat last week.