5 minutes reading time

For many Australians, completing your tax return is a bit like assembling IKEA furniture – often frustrating, with a vague instruction manual (or in this case, tax law) and plenty of moving parts to keep track of.

While we can’t do your taxes for you, we may have a tool to make things easier when it’s time to lodge your return, be it this year or in the future.

The challenges of the current system

Traditionally, tax reporting is not the core responsibility of your investing platform. For instance, share registries (like MUFG Corporate Markets) primarily issue distribution and holding statements, but these are not the same as full tax summaries.

Ultimately, investors are responsible for ensuring their investment records are complete and accurate come tax time. And while technology has made this easier, collating and managing all these documents can still be a hassle. What’s more, the Australian Taxation Office (ATO) requires investors to keep a record of any investment decisions made over the last five years.

So given this process can be so cumbersome, we’re here to provide you with a solution.

The single document that could help make tax time easier

Betashares Direct includes personalised tax and performance reporting, along with a range of intuitive tools to simplify tax time for you.

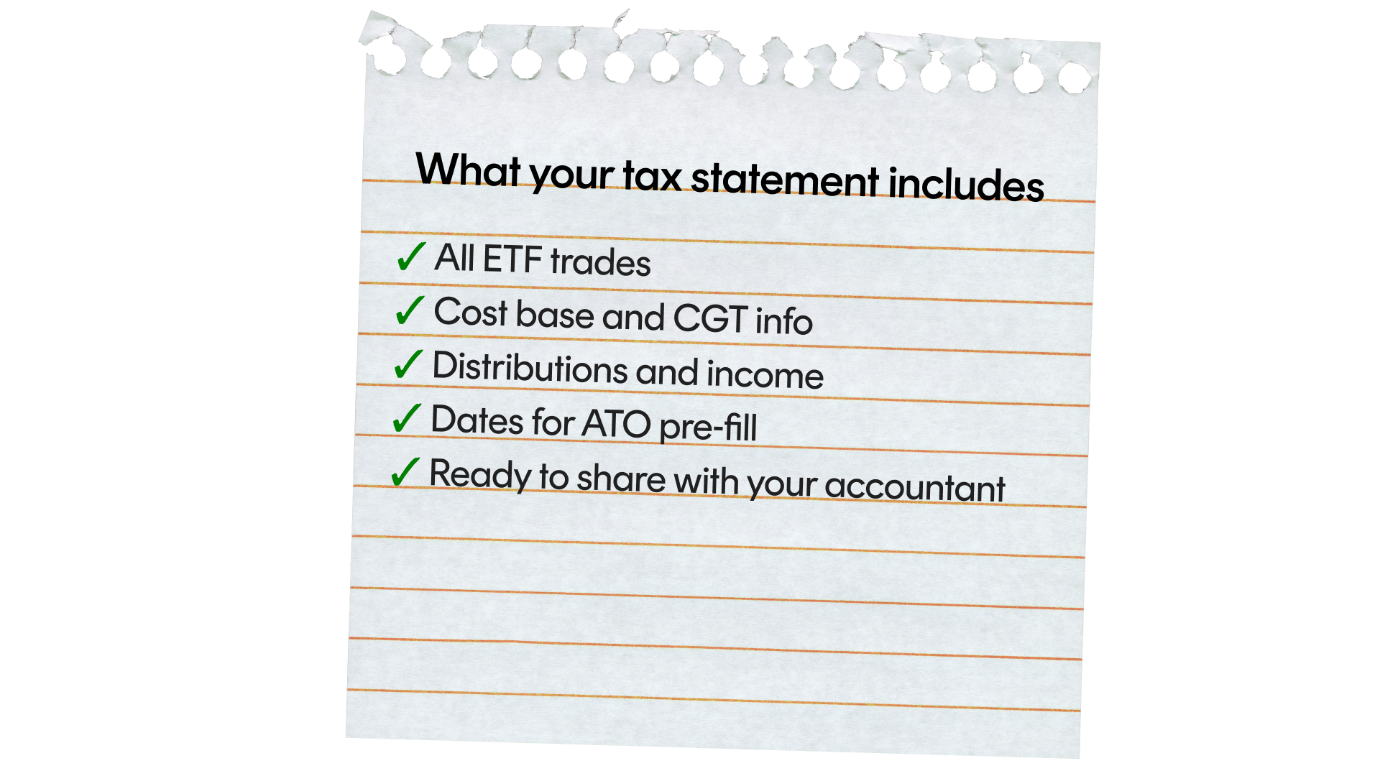

Each account comes with a single annual tax statement that consolidates all investments held through Betashares Direct. It includes everything, from individual shares and ETFs to any investments held in our managed portfolios.

The statement, accessible through Betashares Direct, provides a summary of gains and losses from holdings sold over the last financial year, income received from distributions and dividends and a consolidated report of all the tax attributes associated with your holdings on Betashares Direct.

Best of all, it’s included at no extra cost. It is pre-filled and automatically uploaded to MyGov. Whether managed directly or via a tax agent, the statement is designed to take the hassle out of tax time.

Please note that Betashares Direct only provides you with information on the investment decisions you make within the Direct platform, you will need to keep separate records of investments held outside of your Betashares Invest account.

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

Other documents Direct provides

Betashares Direct investors also get a separate Capital Gains Tax (CGT) report. This report is released alongside your annual tax statement.

If you are a new Direct investor but have investments elsewhere, the platform can take on the tax cost information when you sign up. This way, you have just one record on one platform.

The CGT report provides information on gains and losses from ETFs sold during the past financial year. Even if you have not sold any ETFs during the year, the CGT report will include information about adjustments that Betashares Direct made against the tax costs of your ETF holdings.

If you do sell any of your investments, the correct tax costs will be made available. This gives both investors and the ATO peace of mind.

Having said this, while this report is sent to the ATO, the data will not be prefilled.

To learn more about capital gains and losses, as well as when they may apply to you, click here.

What about distributions?

Distributions are a key part of many investors’ portfolios. For some investors, it’s even the cornerstone of their investment strategy. But what about reporting distributions come tax season?

Distributions you’re entitled to generally need to be reported in your tax return. This applies whether you reinvested those distributions (e.g. through a distribution reinvestment plan) or whether you received the payouts in cash. This may also apply to any distributions you are entitled to but don’t receive until after the end of the financial year (30 June).

Since distributions are required to be broken down by tax components (e.g. interest, dividend or other income), the process can be confusing. Further, each ETF issuer presents this information in slightly different formats. But with Betashares Direct, the platform reviews all these statements and consolidates all tax components for you, saving time and effort.

Further information

It’s important to note that Betashares is not a tax adviser and this information should not be construed as tax advice. You should obtain professional, independent tax advice specific to your personal circumstances before making any investment decision or completing your tax return.

Please also note this information assumes you had an Australian residential address at the time of your first investment, as Betashares Direct is currently only available to Australian tax residents.

But aside from these conditions, a little preparation – and the help of your Betashares Direct tax statement – can make tax time a lot less complicated (and a lot less sweary) than assembling IKEA furniture. If you are seeking further information, please read the Betashares Direct Tax Guide.