5 minutes reading time

Kuang Sheng has spent the last 14 years building a life in Australia, including a career, a home and broad financial security. But his next financial goal is focused on his parents.

Now 35 and mortgage-free, he’s investing with Betashares Direct to help close the 8,000km gap between them.

“I am the only child of my parents, so I feel I bear a lot of responsibility to take care of them,” Kuang says. “I want to buy a home for my parents so that they can enjoy their retirement in Australia.”

For Kuang, who now works in education, financial independence and family have always been intertwined. Now that he’s achieved financial independence, he’s focused on reuniting his family.

Kuang enjoying the sights of Sydney. (Source: Supplied)

Frugal from the very beginning

Kuang, who was born in 1990 in central China, tells me a frugal lifestyle was instilled in him from an early age.

“My grandfather was a senior engineer. He wasn’t poor, but he always turned the light off when leaving a room. As long as I can remember, he never leaves his apartment fully lit.”

His parents are, by his account, equally frugal.

“Even though my parents are both professionals, they always cook at home. They don’t live or appreciate an extravagant lifestyle,” he says.

Kuang doesn’t seek out luxury either. Apart from his new iPhone 17 – bought the day before our conversation – his last major splurge was a designer suit and tie nine years ago.

“I just live within my means and use the rest of my cash to invest. I try to use low or no leverage,” he says.

Kuang’s ready to take your call! (Source: Supplied)

Kuang’s investing journey

Kuang moved to Australia in 2011 to further his education. Even back then, he was interested in investing. But his journey didn’t start with ETFs.

“When I was a business school student, I did some speculative trading in stocks. I’ve always had an impulse to try investing,” Kuang says. He adds that he only spent a few thousand dollars and lost some of it while trying his hand at technical analysis and even leveraged derivatives (through CFDs). He wasn’t alone in taking losses.

“Both brokers I traded with [at the time] have since shut down. The lesson here is that risk goes both ways – for investors and for brokers,” he says.

Following that experiment, Kuang focused on paying off his home. After achieving that milestone in 2020, he shifted focus to growing savings into lasting wealth.

“Then I started to think, what’s the best way to achieve some return on my cash? Is there a better way?”

After eyeing a range of different assets and watching finfluencers like Dave Ramsey and Graham Stephan, Kuang settled on ETFs.

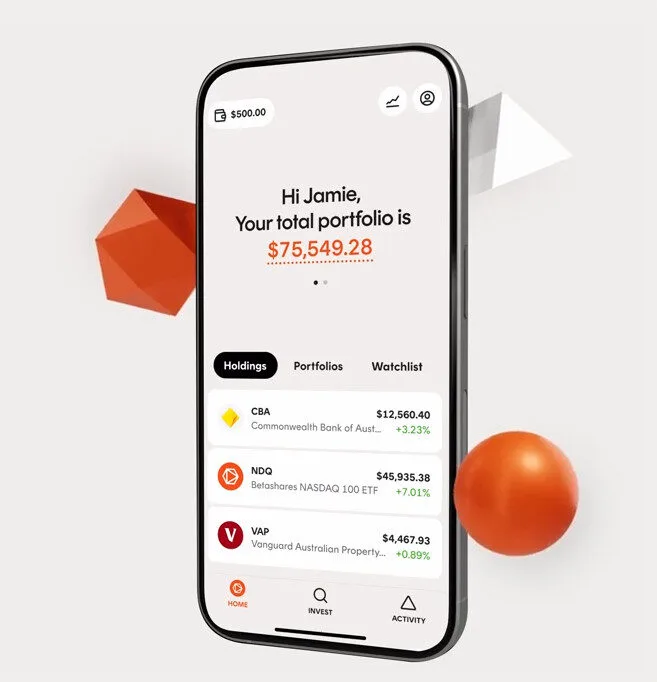

Following three years of investing solely in ETFs, Kuang has accrued a seven-figure balance on Betashares Direct. His portfolio features a range of broad-market ETFs, including BGBL Global Shares ETF and NDQ Nasdaq 100 ETF .

“I invest in BGBL because it tracks an index that covers many markets broadly – not just NASDAQ and NYSE. It does it with low fees and no tax drag too. That international coverage also gives me a hedge against the Australian dollar weakening, which matters when my income and assets are all here in Australia,” Kuang says.

“It’s also similar but not identical to VGS, so I can use it for tax loss harvesting strategies between the two,” he adds. He also still holds some individual stocks related to his profession but says they are minor holdings.

His advice for other investors

Kuang has two pieces of advice around investing. Top of mind for him is the long-held idea that staying liquid is vital – advice he once took to heart.

“Because of the depreciative and inflationary nature of cash, I think the only time it’s beneficial to hold a large pile of cash is when everything bursts and the economy is in recession. If you expect that to happen, then maybe that’s a decent strategy. But if not, invest with the trend,” Kuang says.

His other advice is to back Australia.

“The stock market in Australia has seen stable 7% growth over many decades. This means that even if you use a conservative approach – like they do in superannuation – you will still get a higher return than most savings accounts,” he says.

For Kuang, these principles aren’t just about building wealth; they’re about building a future. As his portfolio continues to grow through patient and diversified investing, he’s getting closer to his ultimate goal: helping his parents enjoy their retirement in the country he now calls home.

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.