6 minutes reading time

- Global shares

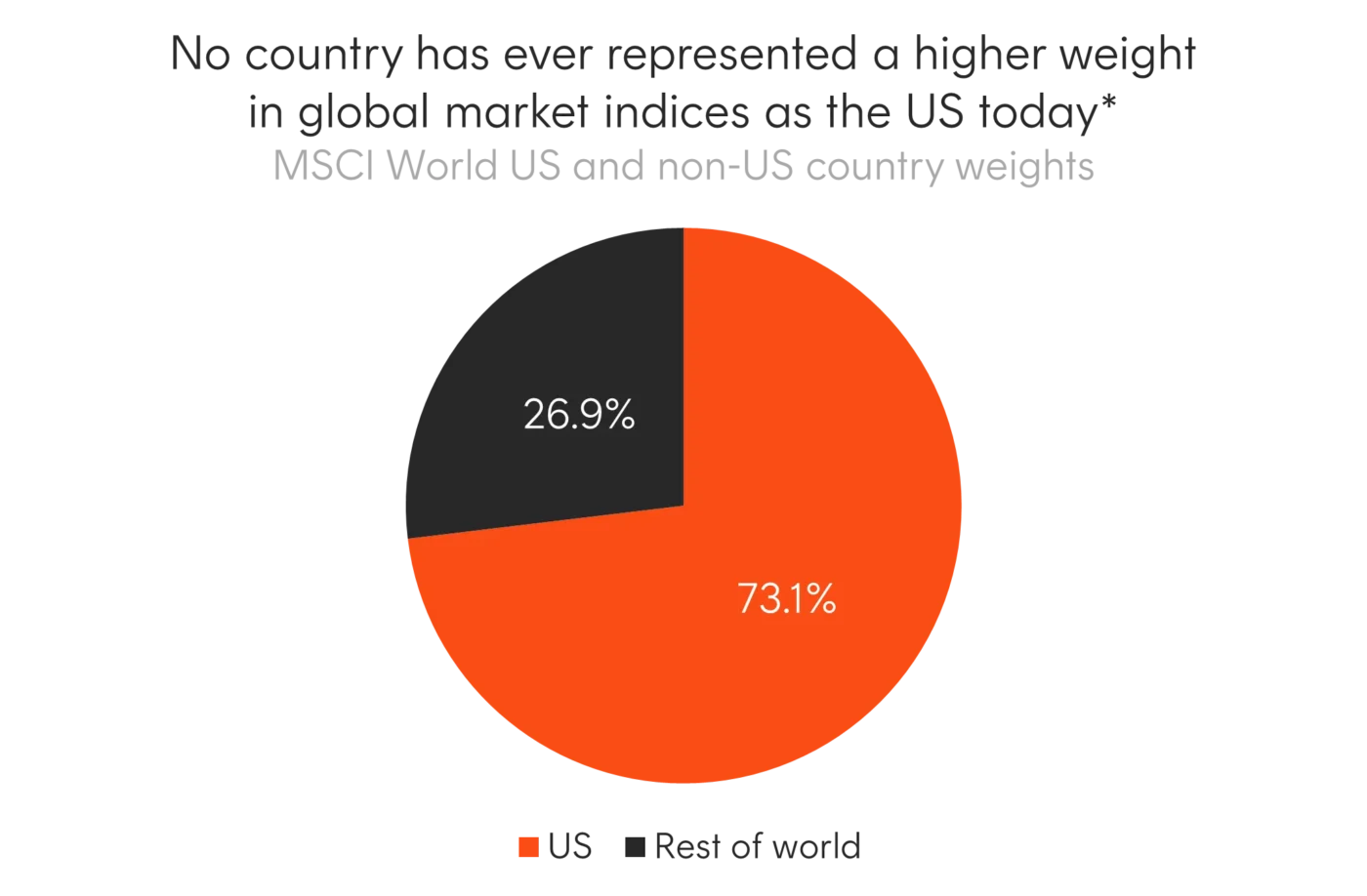

Something unprecedented has been happening in markets. US companies now represent over 70% of the MSCI World Index1. Only one other country (Japan during its 1980s asset price bubble) has ever had more influence on the global stock market’s performance when it represented 45% at its peak2. The US itself has never had a weight this large in the index3.

While the US’ strong outperformance has benefitted many investors over the past decade, it also creates concentration – exposing portfolio risk and return drivers to a narrow range of companies, macroeconomic conditions, policy environments and sector imbalances.

Source: Bloomberg. Regional weights in MSCI World Index as at 31 October 2025. * Elroy Dimson, Paul Marsh, and Mike Staunton, Triumph of the Optimists, Princeton University Press, 2002, and subsequent research, Bloomberg. 1900 to 2025.

For investors concerned about what this concentration means for their portfolio, Betashares has launched EXUS Global Shares Ex US ETF . EXUS is a thoughtfully constructed ETF designed specifically for Australian investors, offering greater control over concentrated US exposures and broader strategic asset allocation.

An ETF built for the Australian allocator

EXUS aims to track the performance of the Solactive GBS Developed Markets ex Australia and United States Large & Mid Cap AUD Index (before fees and expenses), and was created specifically with the Australian investor in mind.

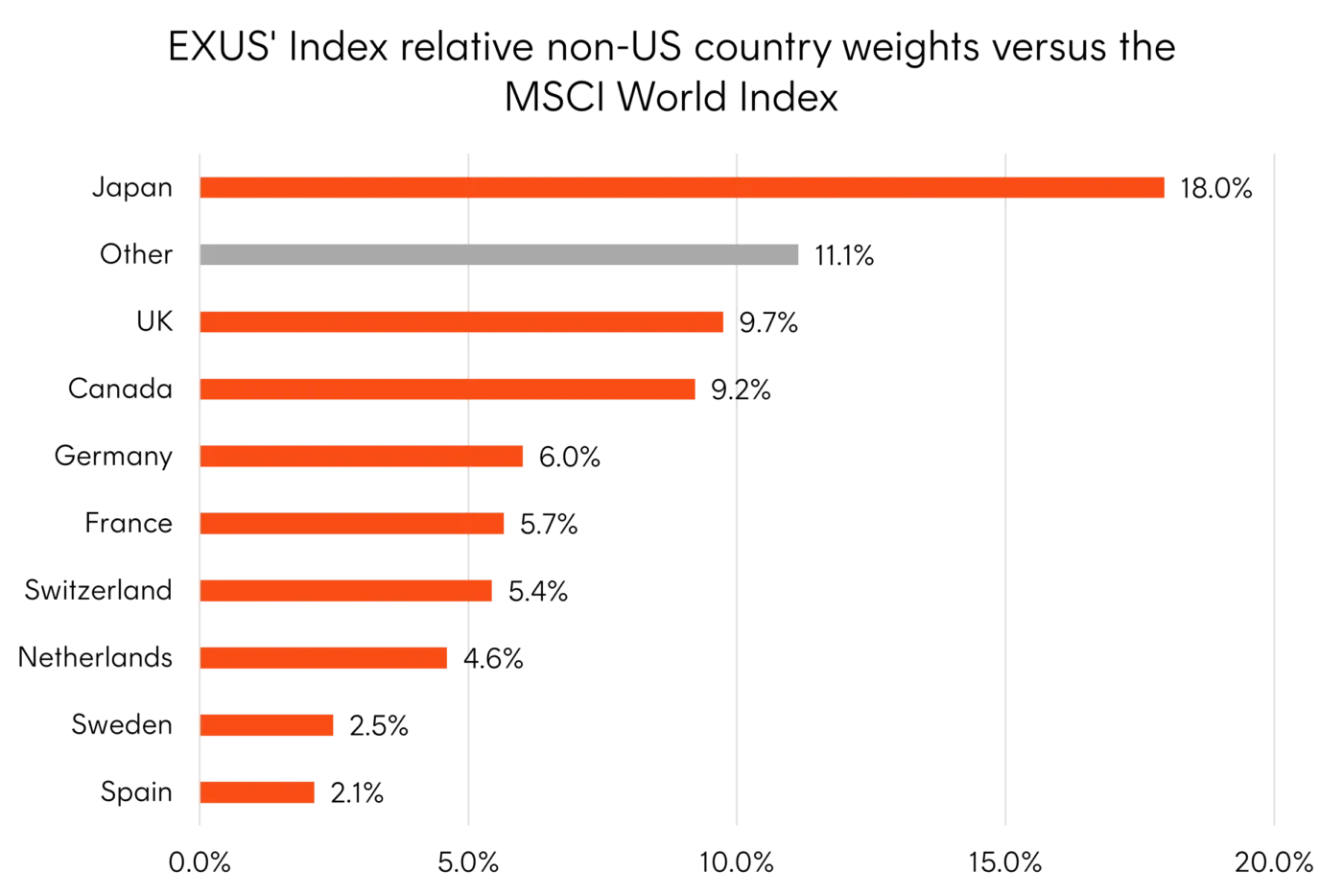

The index provides exposure to the world’s largest developed market companies, excluding both Australia and the US.

The exclusion of Australian shares, alongside US stocks, is unique for a broad global ex-US ETF in the Australian market4 with the aim of reducing holdings overlap for Australian investors. By comparison, in the FTSE All-World ex US index, Australia is the 8th largest country allocation while CBA and BHP are the 16th and 27th largest individual holdings respectively5.

Source: Solactive, Bloomberg. As at 31 October 2025. EXUS’ Index is the Solactive GBS Developed Markets ex Australia and United States Large & Mid Cap AUD Index constituents are subject to change.

The Index also invests only in companies incorporated in developed markets6, excluding emerging markets from its allocation. Doing so gives the investor more control over how much emerging market exposure they want in their portfolio. By comparison, emerging markets currently make up 27% of the FTSE All-World ex US index7.

An efficient fund structure for the Australian market

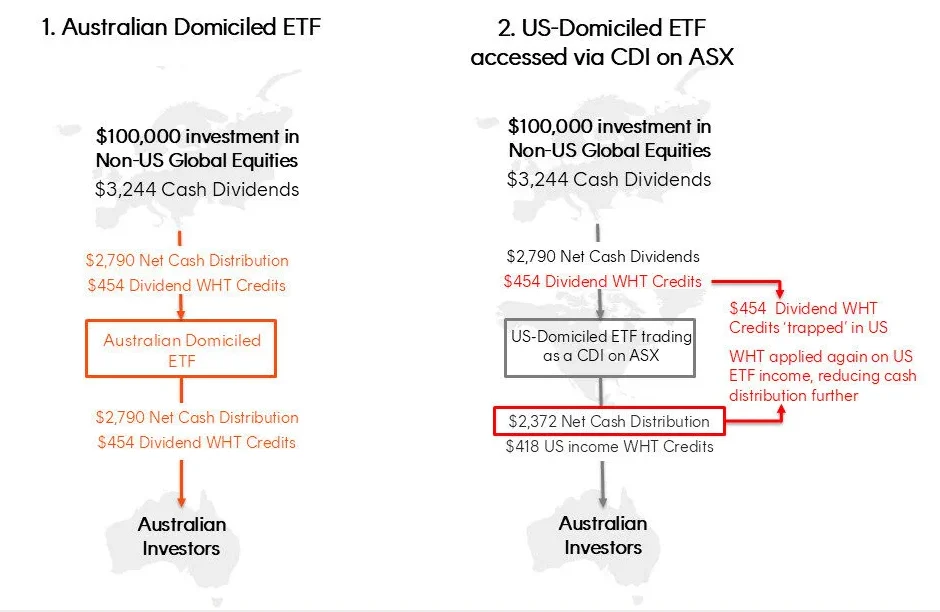

EXUS is an Australian domiciled ETF that invests directly in underlying companies. As is typical for a fund of this nature, EXUS uses a sampling strategy – holding representative companies rather than every single holding – to track the index efficiently.

EXUS is domiciled in Australia, which means investors are entitled to claim withholding tax (WHT) credits on any dividends these foreign companies pay8. This is important as other ASX-listed ETFs which are domiciled offshore do not receive the same benefit.

Example of the dividend and tax entitlements through different structures

The value of the lost tax credits depends on the individual investor’s tax rate. However, by comparison, the quantum for an ETF of this nature can be greater than a typical low-cost index tracking ETF’s management fees9. Not all Australian investors will be able to claim the foreign income tax offset.

Investment implications and portfolio construction

EXUS is designed to complement, not replace, an investor’s US equity holdings and provide more diversification across other developed markets.

Alongside Betashares’ other core global equity building block ETFs, investors can achieve greater strategic asset allocation control, improve portfolio diversification and create the foundations of a robust core portfolio. These other global equity building block ETFs include:

- Betashares Global Shares ETF (ASX: BGBL)

- Low-cost exposure to approximately 1,300 companies from more than 20 developed market countries.

- Betashares MSCI Emerging Markets Complex ETF (ASX: BEMG)

- One of Australia’s most cost-effective emerging markets ETFs structured to minimise deviations of the fund’s returns from the index and enhance exposure to markets that are costly and complex to access directly.

For more information on EXUS, please visit the fund page here.

There are risks associated with investment in the Fund, including market risk, international investment risk, medium sized companies risk and currency risk. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

The Fund is not sponsored, promoted, sold or supported in any other way by Solactive AG nor does Solactive AG offer any express or implied guarantees or assurance either with regard to the results of using the Index at any time or in any other respect. The Index is calculated and published by Solactive AG. Neither publication of the Index by Solactive AG nor the licensing of the Index for the purposes of use in connection with the Fund constitutes a recommendation by Solactive AG to invest capital in the Fund nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in the Fund.

Sources:

1. Source: Bloomberg. As at 31 October 2025. ↑

2. Source: https://www.reuters.com/markets/asia/japans-crazy-1980s-bubble-dim-memory-nikkei-hits-record-high-2024-02-22/ ↑

3. Source: Elroy Dimson, Paul Marsh, and Mike Staunton, Triumph of the Optimists, Princeton University Press, 2002, and subsequent research, Bloomberg. 1900 to 2025. ↑

4. As of 31 October 2025. ↑

5. Source: Bloomberg. As at 27 October 2025. Country and single security allocations are subject to change. ↑

6. Eligible companies are assigned to their respective country, based on their country of primary listing/country of incorporation. If a company is incorporated and listed in different countries, Solactive will consider the company’s country of domicile and country of risk to determine the appropriate country classification. ↑

7. Source: Bloomberg. As at 30 September 2025. Emerging markets allocations are subject to change. ↑

8. Where an Australian domiciled ETF invests directly in companies listed in a foreign country with which Australian has a double taxation agreement. Not tax advice. ↑

9. Based on Betashares’ analysis of the distributions and associated WHT credits between between July 2024 and June 2025 for an ASX listed ETF, which is a CHESS Depository Interest in a US domiciled ETF, with similar underlying holdings to EXUS. Calculations assume the same distribution yield applies to both the Australian ETF and US domiciled ETF. ↑