5 minutes reading time

Global markets

Global stocks were generally edging higher last week before Israel’s attack on Iran caused an understandable sell-off on Friday.

Israel-Iran conflict appears contained

My early thoughts on the Israel-Iran tit-for-tat remain the same. Markets won’t much care if they keep exchanging missiles, provided it does not spark a wider Middle East conflict (which I suspect most Arab countries don’t want to be drawn into) or threaten global oil supply (such as Iran threatening to block the Strait of Hormuz).

While equity markets might just yawn, the conflict offers a further boost to gold and some support to beleaguered oil prices.

It’s also noteworthy that the US dollar has so far not played its traditional “safe haven” role in the face of renewed Middle East tensions. This highlights the likely weakening trend for the long-mighty greenback.

Threadbare trade deal and good inflation

Prior to Israel’s attack on Iran, markets were greeted with some encouraging news last week. After weeks of hopeful speculation, Trump declared “our deal with China is done”, even though it only appeared to relate to China continuing to sell America rare earths in exchange for access to more US technology.

China’s agreement to supply rare earths will apparently be subject to a six-month review. Meanwhile, American tariffs on Chinese imports will hold at 55%, while China’s tariff on the US will be 10%.

Call that a “deal”? I think Trump is bored with the whole process and just wants to move on to tax cuts and illegal immigration.

In other encouraging – albeit likely dated – news, US consumer prices remained remarkably benign in May. Core prices rose only 0.1%, keeping the annual rate steady at 2.8%. Front-loading of imports ahead of the planned tariffs, along with some softness in consumer spending, likely accounts for the benign result. Of course, worse may be to come – but so far at least the feared tariff-induced surge in inflation has yet to materialise.

Softening jobless claims and immigration TACO

It’s early days on the activity front, but US weekly jobless claims have also moved higher in recent weeks. Claims can be volatile and subject to seasonality, but this could be an early sign of labour market softness that markets are now watching closely.

If this gains momentum, Trump may become even more willing to cut quick deals and the Fed more inclined to talk up the prospect of rate cuts.

Also noteworthy last week was Trump’s quick apparent backdown regarding illegal immigrants. He noted he was prepared to make exceptions in the case of farmer and leisure workers – due to their importance for farmers and small business alike.

This should have been obvious to anyone who has looked at the numbers. After all, illegal immigrants are thought to account for around 10% of the workforce. They are critical in areas such as farming, home building, hospitality and childcare. A severe cut back in these workers, along with tariffs, would be a negative supply shock to the economy. It would place upward pressures on wages and prices as well as downward pressure on economic activity.

Week Ahead: Fed meeting

The key global highlight this week will be the mid-week Fed meeting. While the Fed is expected to keep rates firmly on hold, markets will be interested in its updated economic and interest rate ‘dot plot’ forecasts.

Given the absence of material tariff effects on the economy so far, and the fluidity of where tariffs may settle, I don’t anticipate significant changes to the Fed outlook. The “dot plot” is likely to still show two rate cuts pencilled in for this year, and two more in 2026.

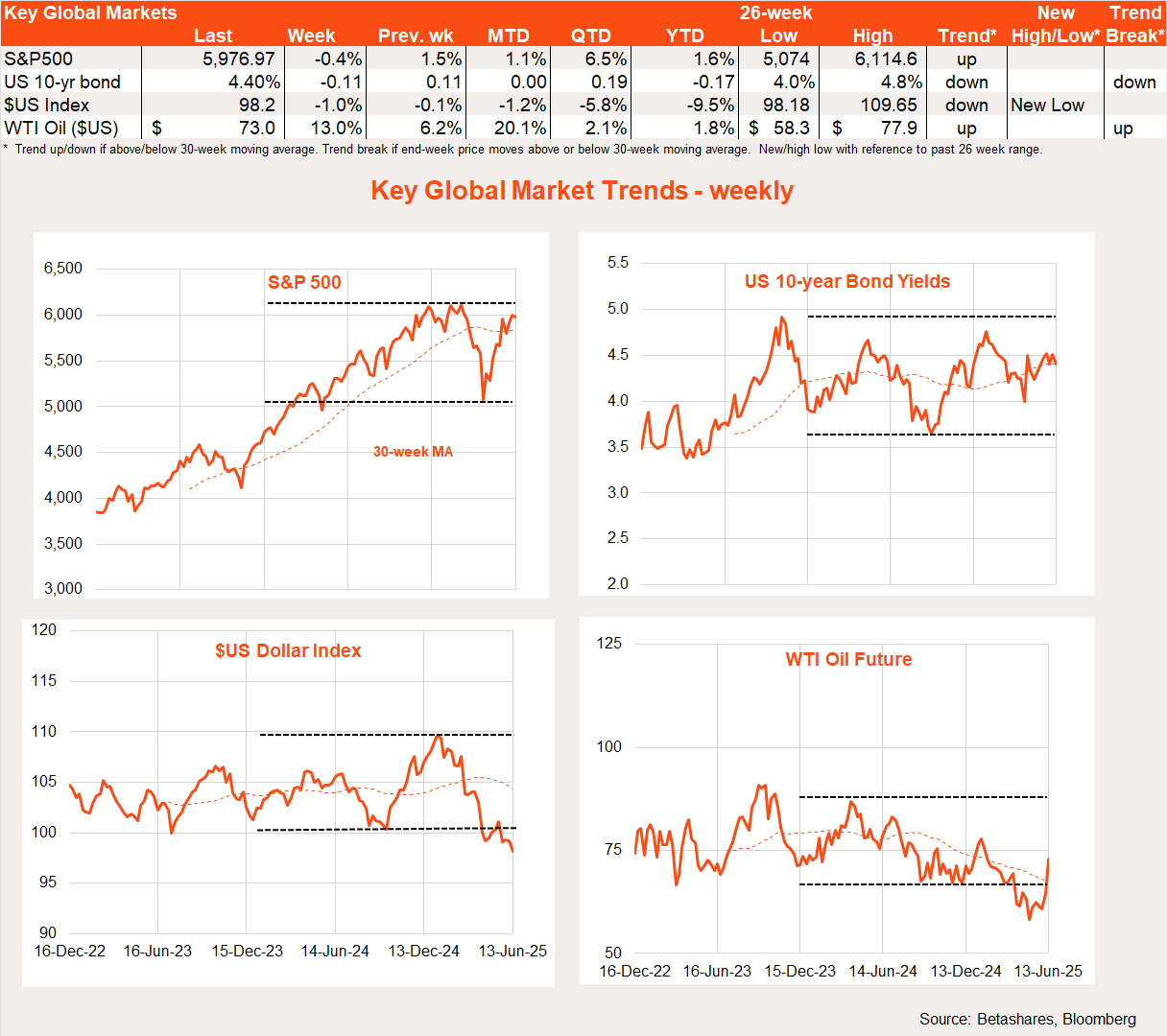

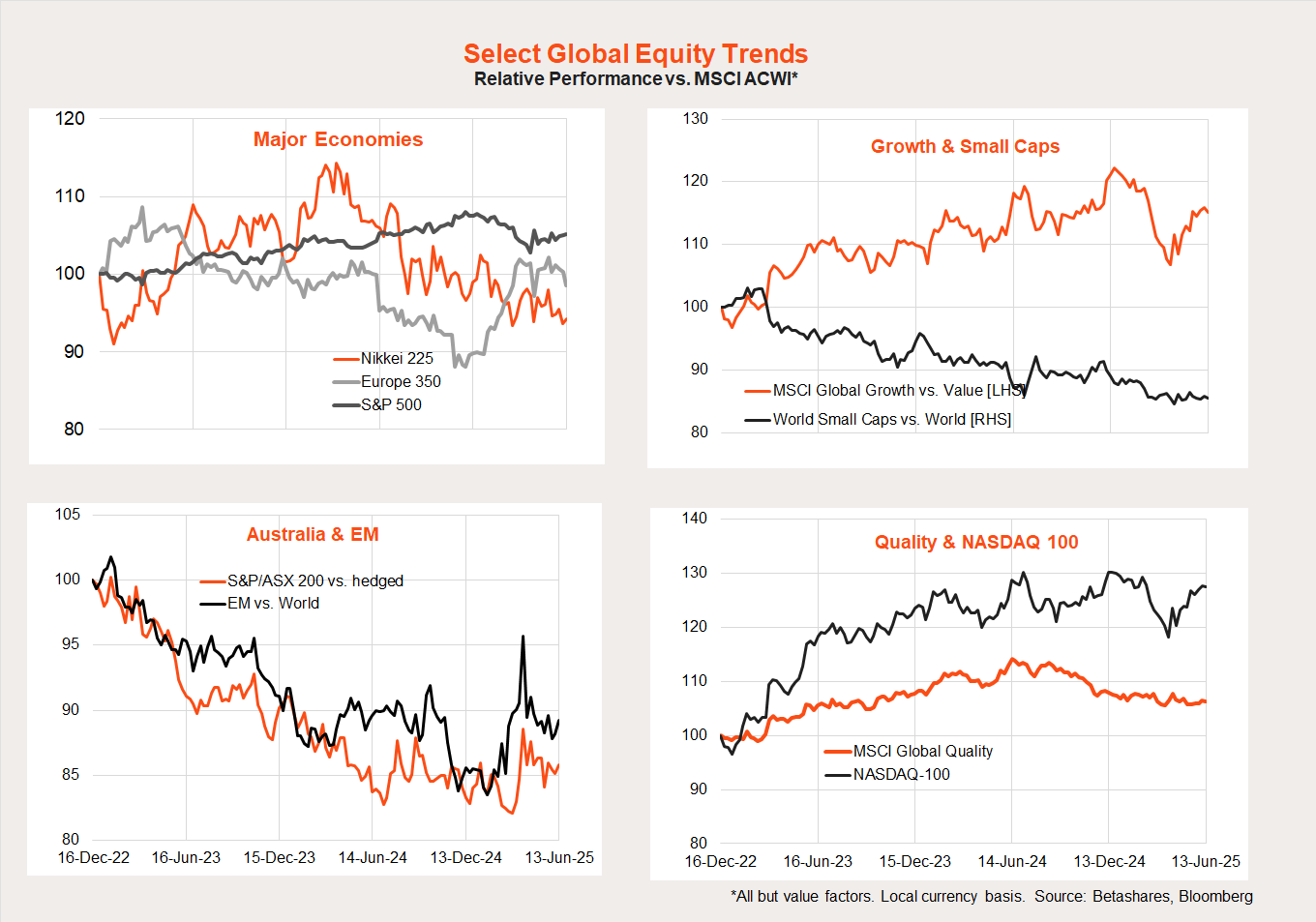

Global market trends

The main trend in recent weeks has been the rebound in the relative performance of the US and growth/tech-related exposures since markets bottomed in early April.

If stocks resume their downtrend, I expect growth and US equity markets to be hit hardest. If, however, the equity uptrend has returned, reports of the death of US tech exceptionalism could be premature once again.

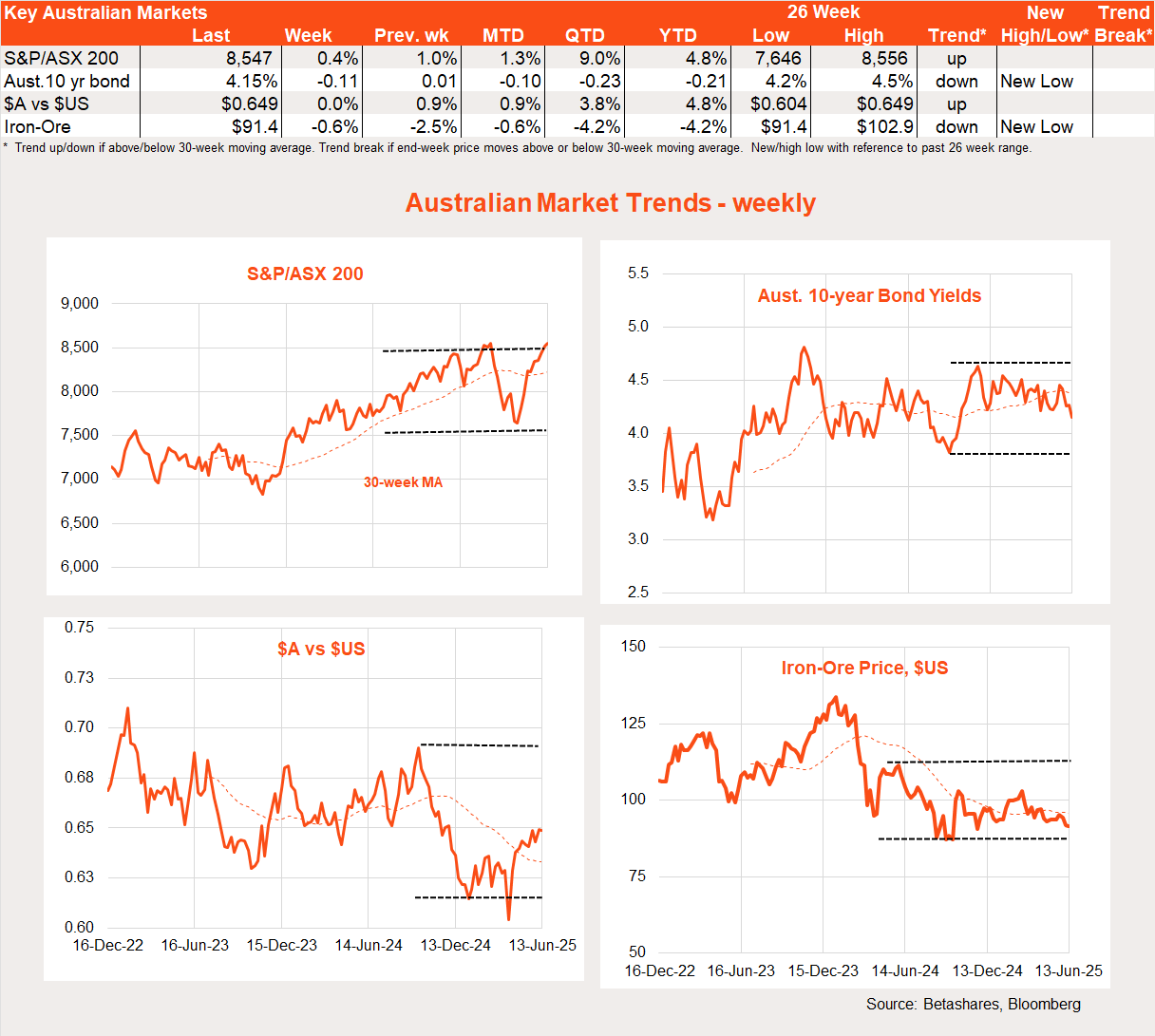

Australian markets

Local stocks have so far been spared from Friday’s global equity selloff. However, the market is seeing some early pain this morning. Energy stocks, however, may benefit from the lift in oil prices.

Local highlights last week included business and consumer confidence, which continued to show a convergence in sentiment. Consumers remain downbeat but their confidence is gradually improving in the face of rate cuts and easing inflation, while once-buoyant business sentiment has been gradually easing to more historically normal levels.

The key local highlight this week will be Thursday’s May labour market report. It is expected to show still-firm employment growth of around 20k and a steady 4.1% unemployment rate.

All up, despite the recent weak Q1 GDP report, continued firm employment growth argues against a July RBA rate cut. Having said this, I still favour an August move after a hopefully benign Q2 CPI report.

Have a great week!