7 minutes reading time

Benjamin Graham’s The Intelligent Investor is one of the most influential texts in financial markets. Yet while Graham is widely regarded as the “father of value investing”, his emphasis on a business’ quality over price alone laid the groundwork for an entirely different investment approach.

When The Intelligent Investor was first published in 1949, the principle of quality was revolutionary. Graham argued that the fundamental strength of a business was as important as its price. And although markets have changed significantly in the past 75 years, the principle remains more relevant than ever.

Identifying quality means looking at how efficiently a company generates returns, how prudently it manages risk and how consistently it performs over time. Once investors understand these signals, they can use them as a practical framework for recognising resilient businesses and building portfolios equipped to navigate different market conditions.

Does quality investing work?

Like all investing styles, quality investing performs differently depending on the market conditions at the time. Research shows that quality companies tend to outperform through a market cycle but particularly during late-cycle and recessionary periods. In contrast, quality investments typically underperform when low interest rates and accommodative economic policy are dominant macroeconomic features. In these times, cyclical stocks often lead market rebounds.

Consider the following chart, which compares the iSTOXX MUTB Global Ex-Australia Quality Leaders 150 Index against the MSCI World ex-Australia Index. Over the past ten years, the quality index has outperformed by 0.7% p.a. (after fees).

Source: Bloomberg. All values rebased to 100. As at 31 October 2025. QLTY’s index is the iSTOXX MUTB Global Ex-Australia Quality Leaders 150 Index. Management fees, as of writing, are 0.35% p.a. Past performance is not an indicator of future performance. You cannot invest directly in an index.

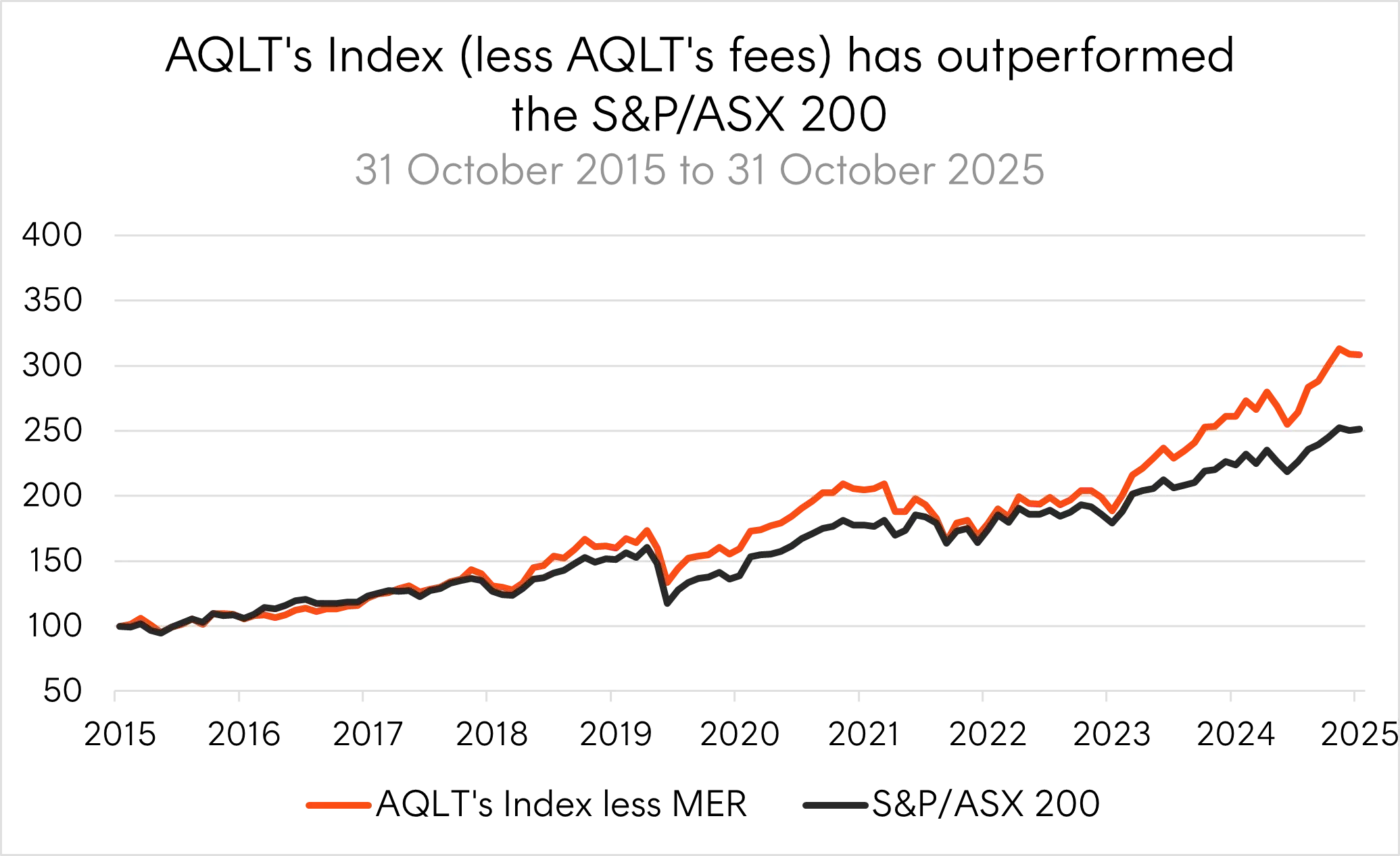

The pattern also holds up locally. The Solactive Australia Quality Select Index has outperformed the S&P/ASX 200 by 2.2% p.a. (after fees) over the past ten years.

Source: Bloomberg. All values rebased to 100. As at 31 October 2025. AQLT’s index is the Solactive Australia Quality Select Index. Management fees, as of writing, are 0.35% p.a. Past performance is not an indicator of future performance. You cannot invest directly in an index.

Belief in a quality investing style is embedded in the logic that companies with a high return on equity, low levels of debt (and leverage) and stable earnings are, by their very nature, traditionally more resilient in a downturn and provide strong returns over most of the cycle. Their strong balance sheets and consistent cash generation can provide a buffer when market conditions deteriorate.

This pattern reflects the structural advantages that often matter most during different economic conditions. Companies with high returns on equity, low debt levels and stable earnings are built for long term resilience rather than rapid expansion. During late-cycle periods and recessions, when credit tightens and conditions deteriorate, these characteristics become critical. Quality companies can maintain profitability and experience shallower drawdowns than their peers. However, during early recovery phases following recessions, cyclical stocks tend to outperform, especially when economic policy is accommodative and credit becomes more plentiful.

But how do investors identify these characteristics in practice?

High return on equity

Generating returns on invested capital is the fundamental goal of investing. To identify companies that have demonstrated this ability consistently, investors can use the return on equity metric.

Return on equity (ROE) represents how much profit a company makes for every dollar invested by shareholders, and the return those investors may expect. Having a high return on equity means a company is capable of effectively using shareholder equity to generate profits, and has the potential to fund expansion without incurring excessive debt and possesses an efficient business model.

It’s also important for investors to note that there is no single universal benchmark for all industries. For instance, a good number in the utilities sector (7%-10%) may differ significantly from one in the industrials sector (12%-18%)1. Investors should make sure they analyse the asset they are looking at investing in and compare its ROE to its direct competitors.

Low leverage

While return on equity reveals how efficiently a company generates profit, examining how much debt fuels that profitability provides equally important insight into business quality.

One way to examine this is to look at the level of leverage a company has on its balance sheet. Leverage involves borrowing capital and investing those funds in the hope that future returns will be greater than the cost of servicing the debt they have borrowed. Generally, the higher the leverage, the more financial risk a company assumes. Leverage can be calculated in a range of ways, the most common one being the debt-to-equity ratio (which measures short term plus long-term debt divided by total equity).

Just like the return on equity measure, leverage levels will often vary by industry. For instance, traditional banks naturally carry higher leverage as part of their business model, whereas technology or healthcare companies often operate with minimal debt.

A company with low leverage has one less thing to worry about during periods of economic stress. Companies carrying minimal debt face lower refinancing risks and reduced sensitivity to credit conditions, which can help maintain operational stability regardless of the interest rate environment.

Relative earnings stability

Profitability and financial strength provide important signals, but consistency is what distinguishes truly quality companies from temporarily strong performers.

Earnings stability measures how consistently earnings have been generated over time. It can be measured by looking at how much a company’s return on equity (ROE) has varied from its average level over the past five years. A five-year time horizon gives an investor long enough to see the real picture but not so long that old data becomes irrelevant. The more that yearly ROE figures deviate from the average, the less stable the company’s earnings are considered to be.

Companies with stable earnings have shown consistency over a period of time and have historically been more resilient during contractions or recessions because their earnings are less volatile. This characteristic has led to such companies being referred to as ‘defensive’ investments, in contrast to cyclical investments whose performance is more dependent on the economy.

Investors should note that quality companies will often trade at premium valuations – the quality factor definition does not consider valuations. During periods of rapidly rising rates (such as in 2022), these valuations may come under pressure even as the underlying business fundamentals remain sound. As always, it’s not just what you’re buying but what price you buy an asset at as well.

Three ETFs that focus on quality companies

Screening hundreds of companies across these three metrics and monitoring them continuously requires significant time and resources. Quality-focused ETFs address this by systematically implementing the framework for investors.

Betashares has its own quality-focused range of ETFs that specifically seek out the highest quality companies from Australian and global markets based on the metrics discussed above.

For an exposure to high quality Australian companies, investors can consider Betashares Australian Quality ETF (ASX: AQLT). AQLT holds the largest companies, by market capitalisation, listed on the ASX but reweights them by quality metrics, namely high return on equity, earnings stability, and low levels of leverage, rather than market capitalisation. This translates to higher exposure to names like Telstra and Macquarie and lower exposure to BHP and CBA, alongside high-quality names from the mid and small caps, including Pro Medicus, Hub 24 and Breville.

For a global quality exposure, investors can consider Betashares Global Quality Leaders ETF (ASX: QLTY) or its currency hedged cousin, Betashares Global Quality Leaders Currency Hedged ETF (ASX: HQLT). Both aim to track an index (before fees and expenses) that comprises 150 of the highest quality global companies. HQLT’s currency hedging may appeal to investors seeking to reduce exchange rate volatility in their international equity exposure.

Source:

1. https://fullratio.com/roe-by-industry, as at October 2025 ↑