Earn attractive income from high-quality private credit

This page is intended only for wholesale investors (being a ‘wholesale client’ as defined under the Corporations Act 2001 (Cth)). By continuing, you acknowledge and confirm that you are a wholesale investor. If you are unsure, please read on how you can invest in private assets or speak to a financial adviser before proceeding.

Earn attractive income from high-quality private credit

This page is intended only for wholesale investors (being a ‘wholesale client’ as defined under the Corporations Act 2001 (Cth)). By continuing, you acknowledge and confirm that you are a wholesale investor. If you are unsure, please read on how you can invest in private assets or speak to a financial adviser before proceeding.

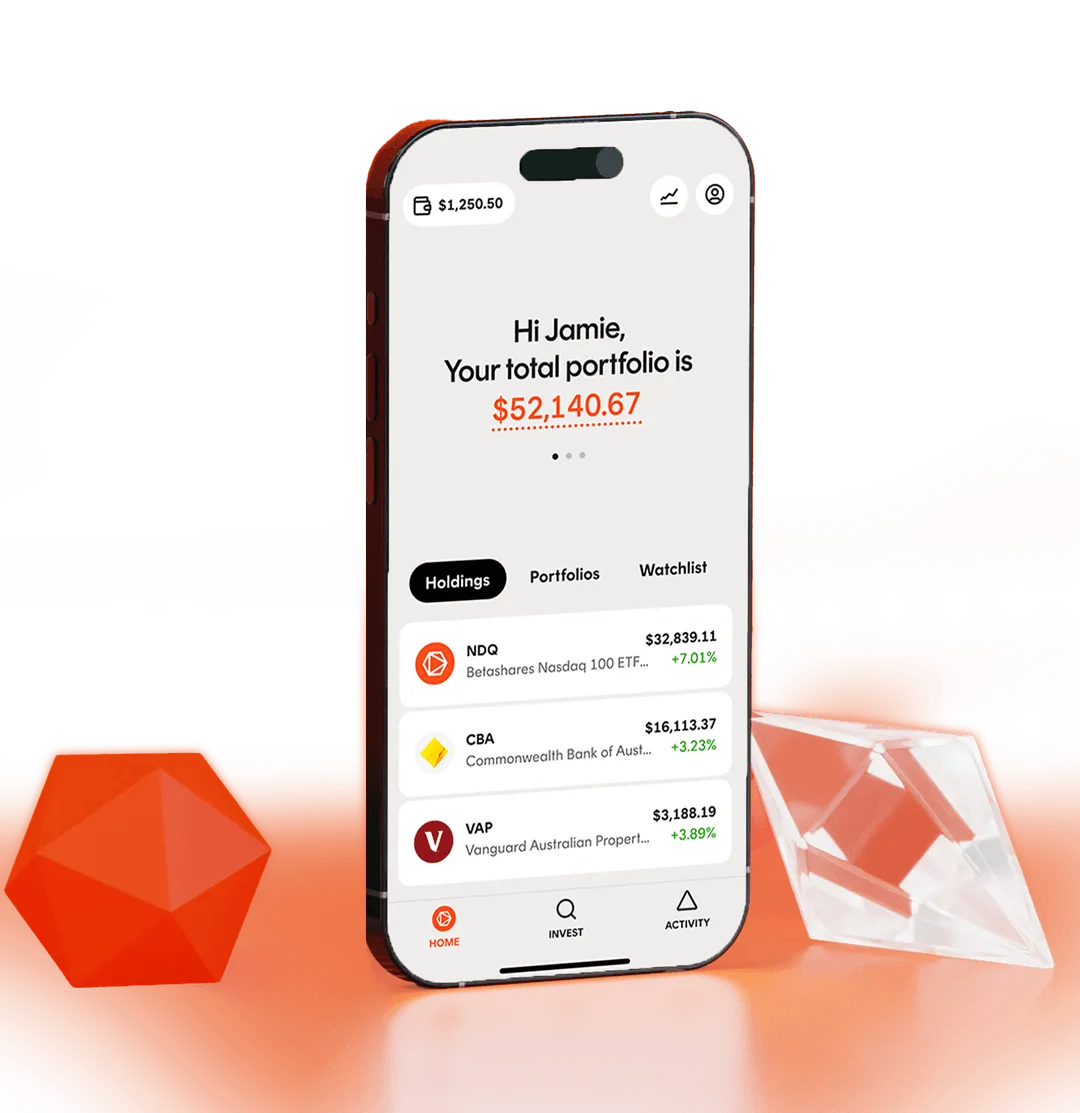

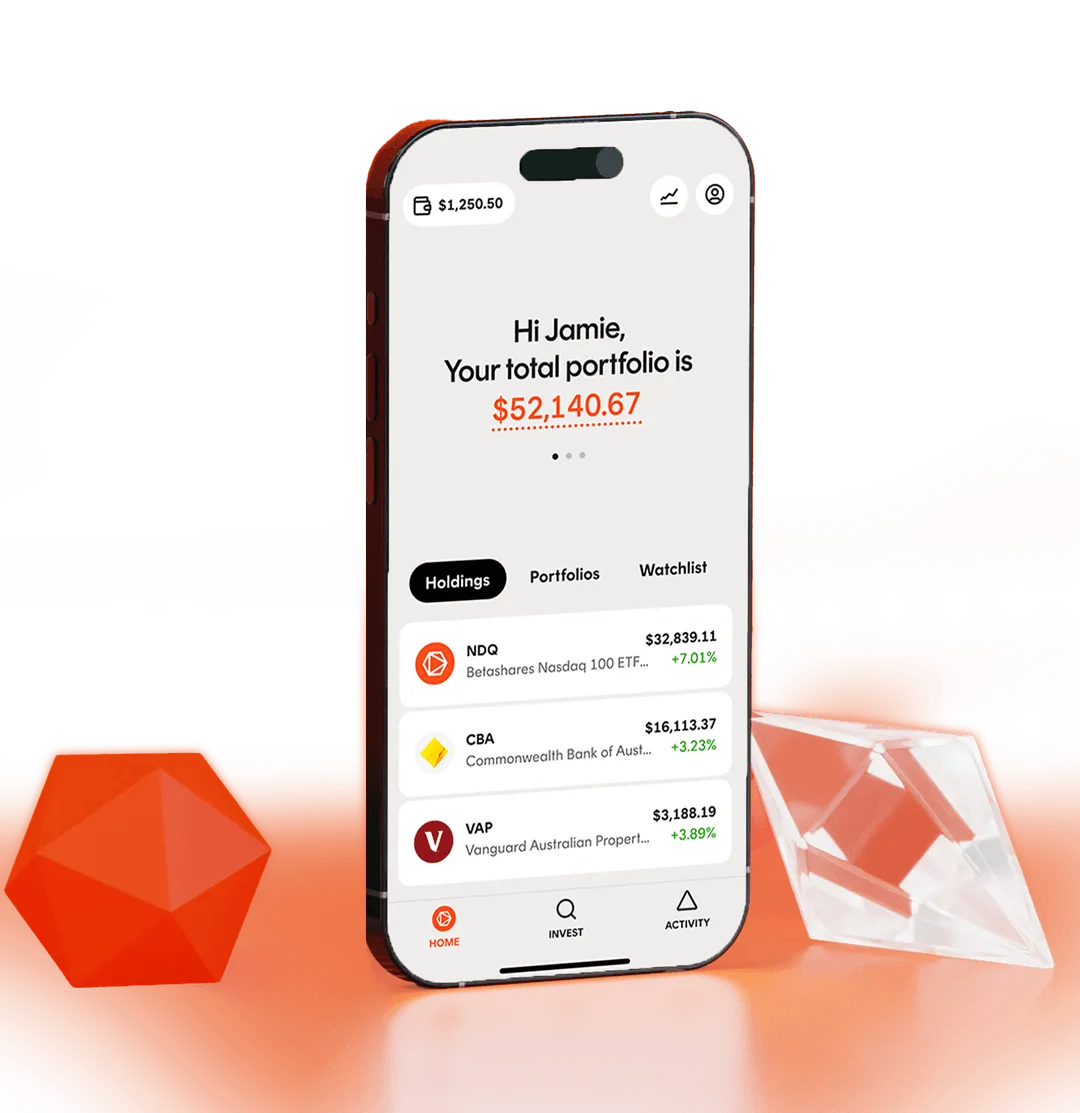

Historically, access to high-quality private investments has been restricted primarily to large institutions and ultra-high-net-worth individuals. Our first Betashares Private Capital fund offers the opportunity to earn attractive income from high-quality private credit. The Betashares Private Capital – Cliffwater Private Credit Fund is available for investment via Betashares Direct.

The Fund has a projected 12-month distribution yield of 8-9% p.a.*

Our first Betashares Private Capital Fund offers the opportunity to earn attractive income from high-quality private credit.

The Fund provides exposure to a diversified portfolio of over 3,800 senior secured loans to predominantly US middle-market businesses by investing in a fund managed by leading global private credit manager, Cliffwater LLC.

* The projected 12-month distribution yield (current as at 27 August 2025) is an estimate only, subject to assumptions, risks and uncertainties. Actual results may differ materially. The projection is based on the underlying fund’s 12-month historical interest rate margin above the benchmark Secured Overnight Financing Rate (SOFR) added to projected SOFR rates, net of Fund fees and costs and estimated FX hedging impact, and assumes no loan portfolio changes, no defaults, and a consistent distribution policy. More info set out below.

There are risks associated with an investment in the Fund, including liquidity risk, interest rate risk, leverage risk and credit risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Suitability:

The Fund is available to wholesale investors, and other investors with a financial adviser using an investment platform, who are seeking income and capital preservation from an allocation to private credit, and who have a medium risk and return profile for that portion of their investment portfolio. It is suited to investors comfortable with the risks associated with private credit, including exposure to an asset class that is inherently illiquid and limited ability for investors to withdraw their investment. A minimum investment timeframe of 5 years or more is suggested.

Why consider this fund?

How can I invest in private assets?

There are two ways to invest in Betashares Private Capital investment opportunities:

1. If you have an adviser, speak to your adviser about investing through an investment or superannuation platform.

2. If you don’t have an adviser, and you qualify as a wholesale investor, you will shortly be able to access Betashares Private Capital investments on Betashares Direct.

Generally, to qualify as a wholesale client under the Corporations Act 2001 (Cth), you must meet one of the following criteria:

You hold a certificate from a qualified accountant (dated within the last 6 months) confirming net assets of at least $2.5 million or gross income of at least A$250,000 per annum over the past two financial years.

You are investing A$500,000 or more into a single investment opportunity.

You are a ‘professional investor’ (which may include financial advisers, family offices and licensed brokers).

About Betashares Private Capital

Betashares Private Capital provides access to investment opportunities beyond traditional public markets.

Historically, the world of private investing has been open only to institutions and ultra-high-net-worth individuals. Betashares Private Capital changes that – offering simple, cost-effective access to professionally managed private investments, through partnerships with leading global managers.

Frequently Asked Questions

Private credit generally involves lending to companies through direct, negotiated loans that are not traded on public markets. Unlike listed bonds, these loans are typically illiquid and held to maturity. They tend to offer higher yields in exchange for reduced liquidity, and require specialist expertise to originate and manage. Private credit is most commonly used to finance middle-market companies that may not be able to access traditional bond markets.

Private market investments carry a number of risks, including:

- Liquidity risk: Private asset investments typically provide limited liquidity – they are not traded on stock exchanges and may restrict the amount or frequency of redemptions.

- Credit or default risk: For debt-based private investments (such as private credit), there is a risk that borrowers may default on their obligations, leading to potential capital losses.

- Valuation risk: Because private assets are not publicly traded, they are generally subject to periodic or model-based valuations.

It’s important to understand these risks and consider if private assets are appropriate for your investment profile.

For individual (non-advised) investors, Betashares Private Capital funds will be available via Betashares Direct to investors who qualify as wholesale clients. Investors who have a financial adviser can invest in Betashares Private Capital funds through selected investment or superannuation platforms (once available).

‘Quarterly liquidity means redemptions (withdrawals) will generally be processed once every calendar quarter, typically on a pre-determined redemption date. Requests to redeem may be submitted during the quarter relevant redemption period (prior to the any applicable redemption request deadline), but will not be processed until the redemption date. Redemptions may be subject to conditions, such as available liquidity or notice periods. It’s important to review the applicable disclosure document for full details on the redemption terms.

Now available on Betashares Direct

Betashares Private Capital – Cliffwater Private Credit Fund

Now available on Betashares Direct

Betashares Private Capital – Cliffwater Private Credit Fund

Important information and assumptions

Projected 12-month distribution yield is based on:

1. the historical interest rate margin on the underlying fund’s loan portfolio (Interest Rate Margin), being the difference between the 12-month historical distribution yield of the underlying fund and the 12-month return for the US floating rate benchmark applicable to the underlying fund’s loan portfolio (the Secured Overnight Financing Rate (SOFR) Total Return Index published by the Federal Reserve Bank of New York); and

2. adding the Interest Rate Margin to the projected SOFR reference rate (based on current futures market pricing) applicable to the underlying fund’s loan portfolio over the projection period.

The projection is net of Betashares fund’s management fee and costs and the FX hedging impact based on forward exchange rates.

The projected yield assumes: (1) the composition of the underlying fund’s loan portfolio and the Interest Rate Margin remain the same over the projection period; (2) there are no defaults in respect of the underlying fund’s loan portfolio; and (3) the historical distribution policy/profile for the underlying fund is maintained over the projection period.