Written By

Richard Montgomery

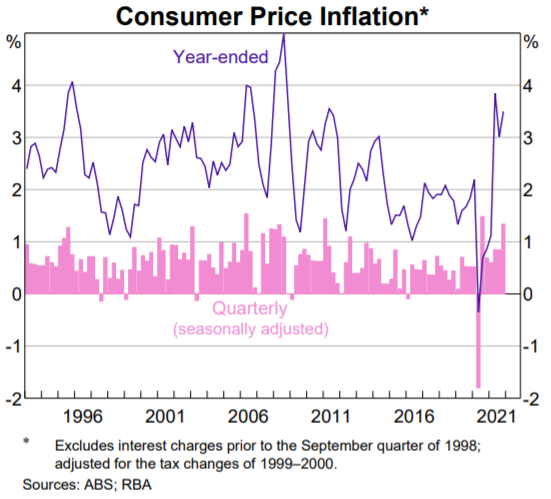

In recent years, many successful investment strategies have been based around the assumption of continued low and stable inflation. With the global economy recovering strongly from the COVID-19 pandemic, inflation risk has increased.

In this article, we look at how rising inflation could affect the economy and investment markets.

Summary

What is inflation?

Why does inflation matter?

Rising inflation can mean rising interest rates

How does inflation affect investors?

How are share investors affected?

Are all stocks affected the same?

Growth vs. value stocks

Fixed income investors

Learn more…

An inflationary environment can present challenges for investors. It is important to make sure your portfolio is well diversified, and provides exposure to investments that have the potential to provide some defence against rising inflation.

Written by

Richard Montgomery

Manager – Investment Communication

Read more from Richard.