6 minutes reading time

A note from David: There is no podcast this week. This is also the last edition of Bassanese Bites for the year. I’ll be back on board post the holiday break on Monday January 19. I wish all my readers a safe and happy new year.

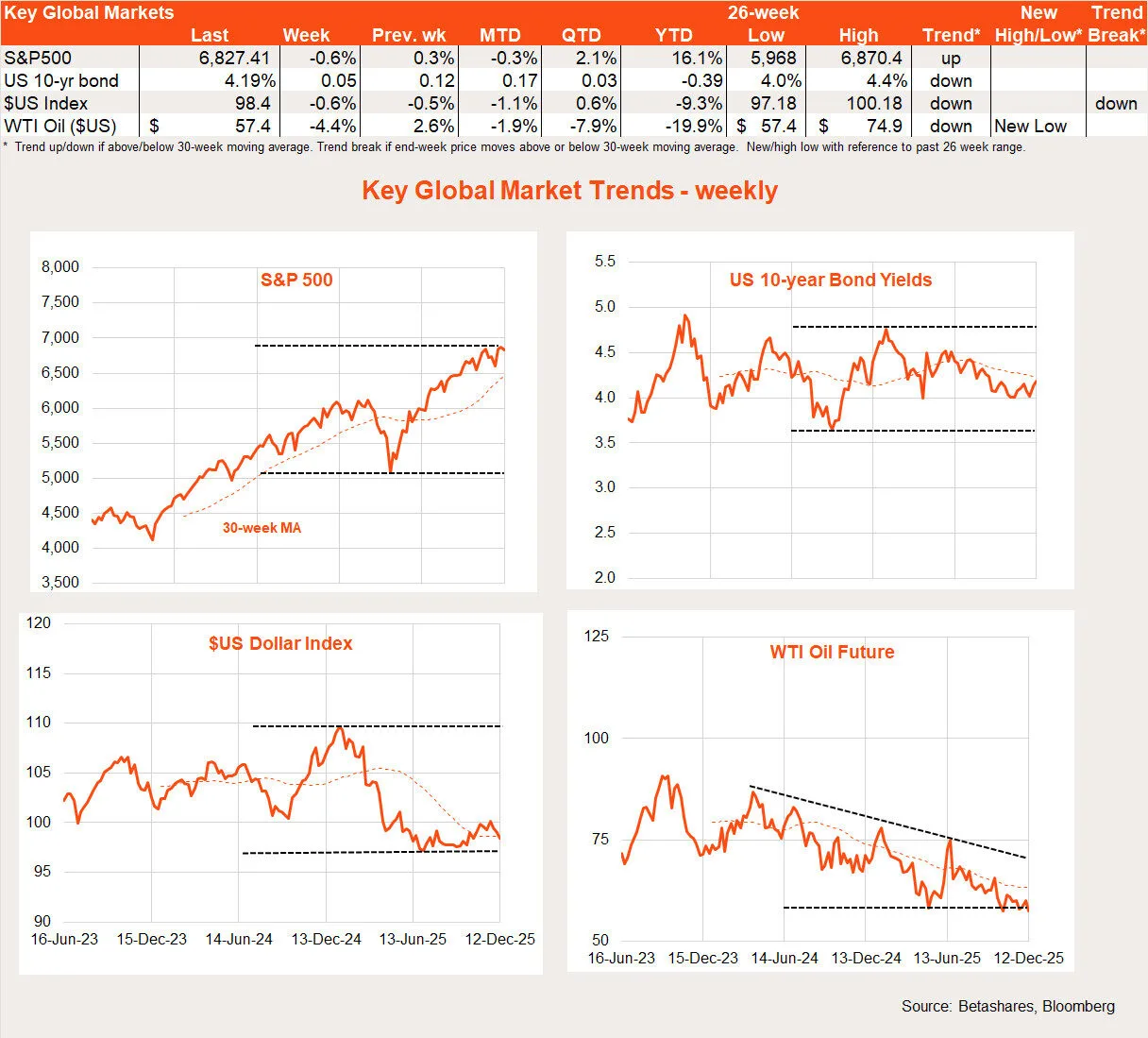

Global stocks edged lower last week as concerns re-emerged over a potential AI bubble and despite a rate cut in the US.

Global week in review: Fed vs. AI

There was little in the way of major US economic data again last week, with the major highlight being the Fed’s widely anticipated 0.25% rate cut – the third in a row. It was a contentious decision, with Trump-appointed Governor Stephen Miran arguing for a 0.5% cut, while two other Fed members (reasonably in my view) voted for no cut at all.

Contrary to market fears, the Fed’s commentary also remained open to the idea of further rate cuts, with the ‘dot plot’ of rate expectations still suggesting one more cut next year. The Fed also lowered it’s end-2026 core inflation forecast from 2.6% to 2.5%, with Chair Jerome Powell suggesting most of the upward pressure on prices has stemmed from tariffs.

Much of this good news, however, already seemed well priced by the market. What did re-emerge as a concern was the AI boom, with questions coalescing around three key issues: growing use of debt, greater competition in the chip space and the perennial one of whether there will be an adequate return on the billions being spent on AI capacity.

Indeed, markets view Oracle as potentially the “canary in the coal mine“, with a disappointing earnings result last week causing its share price to drop even as it doubled down on plans to invest in data centre capacity. Nvidia also remained under pressure, with Alphabet and other players developing capacities to build their own chips.

Global week ahead: US payrolls and the BOJ

With the US government having re-opened for several weeks, the data flow is stepping up once again. This week brings retail sales and the combined October and November payrolls reports on Tuesday (US time), the November CPI on Thursday and the October private consumption expenditure deflator measure (PCE) on Friday.

Markets anticipate reasonable monthly employment gains of 50-80K persisted in the past few months, although there are downside risks. Inflation is expected to remain fairly contained, with monthly gains in the core CPI and PCE of 0.3% and 0.2% respectively.

Also of note this week is the Bank of Japan policy meeting, with recent official signals suggesting a 0.25% rate hike is on the cards. This would take the official rate from 0.5% to 0.75%. Potential market volatility should be limited by the well telegraphed nature of the move, although there’s still uncertainty over how hawkish the accompanying policy statement will be.

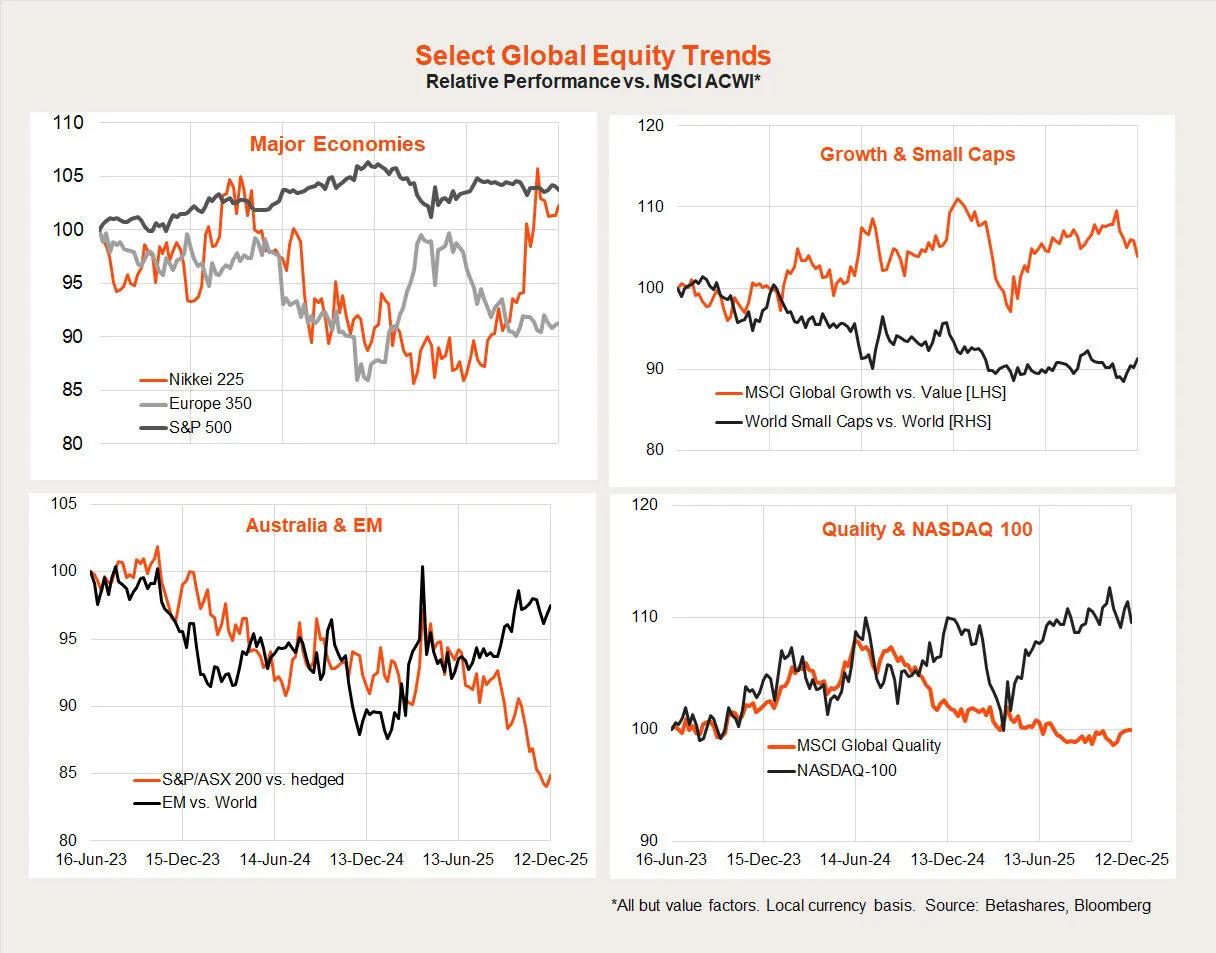

Global equity trends

AI jitters saw the NASDAQ-100 drop a chunky 1.9% last week, with emerging markets, Japan and even Australian shares faring better. That said, it’s still premature to suggest the outperforming bias of US/growth/technology is shifting in favour of non-US and value.

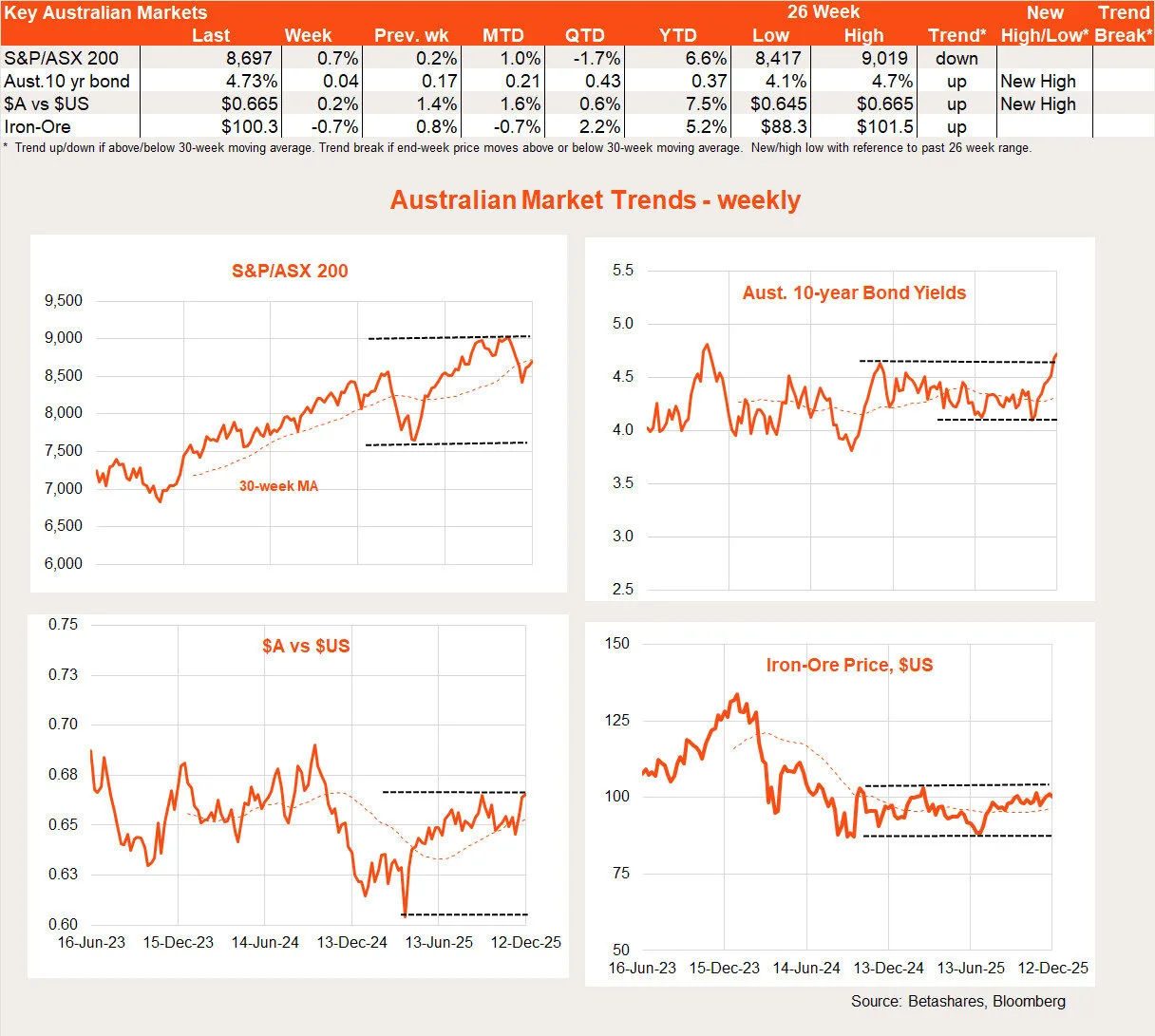

Australian week in review: Hawkish hold

The main local news last week was the hawkish commentary from the Reserve Bank following its widely expected decision to leave rates on hold at its final meeting of the year. The Fed and RBA seem increasingly to be on divergent paths, breathing new life into the Australian dollar but contributing to local bond market underperformance.

The key takeaway from RBA Governor Bullock’s press conference last week was that the upcoming February meeting could be considered ‘live’. In somewhat earlier timing than the market had anticipated, Bullock indicated the RBA could be forced to lift interest rates at that meeting if the Q4 CPI – due in late January – showed persistent inflationary pressures.

So how bad is bad? Note trimmed mean inflation rose 1% in Q3 (4% annualised), and the RBA is forecasting a 0.8% gain for Q4 (up from the 0.6% gain forecast in August before the Q3 CPI was released). That in itself would imply annualised underlying inflation remains above the RBA’s 2-3% target band, although it would mark a step down from the Q3 result and be in line with the RBA’s November forecasts.

At face value, a 0.8% Q4 gain in trimmed mean inflation should not be bad enough for the RBA to hike rates. Or would it? Clearly, a gain of more than 0.8% would seal the deal while a gain of 0.7% or less should see the RBA remain on hold.

The decision may also turn on the composition of the CPI result – will the more demand-driven housing, market services and consumer durable sources of inflation be prominent in the Q4 result again or could more one-off factors be at fault?

My base case is the trimmed mean gain will be 0.8% or less, and that should be enough for the RBA to hold the line on rates. That said, I also concede the RBA could hike with a 0.8% gain, or that the gain could be more than 0.8%.

Either way, it will be an exciting start to the new year!

Of course, the case for rate hikes would also weaken if the labour market turned down more clearly. Last week also saw employment drop 21k in November, although the unemployment rate held steady at 4.3%.

At this stage, however, I’d attribute the employment drop to monthly volatility or seasonal quirks. With hiring intentions still holding up, I can’t see the labour market weakening quickly enough for the RBA to shift its current laser focus on the near-term inflation outlook anytime soon.

Australian week ahead: consumer sentiment

Tomorrow’s Westpac-Melbourne Institute measure of consumer sentiment is the only economic data of note this week. After a surprise pop higher in November, a drop back in December seems likely especially given the hawkish RBA headlines of late.

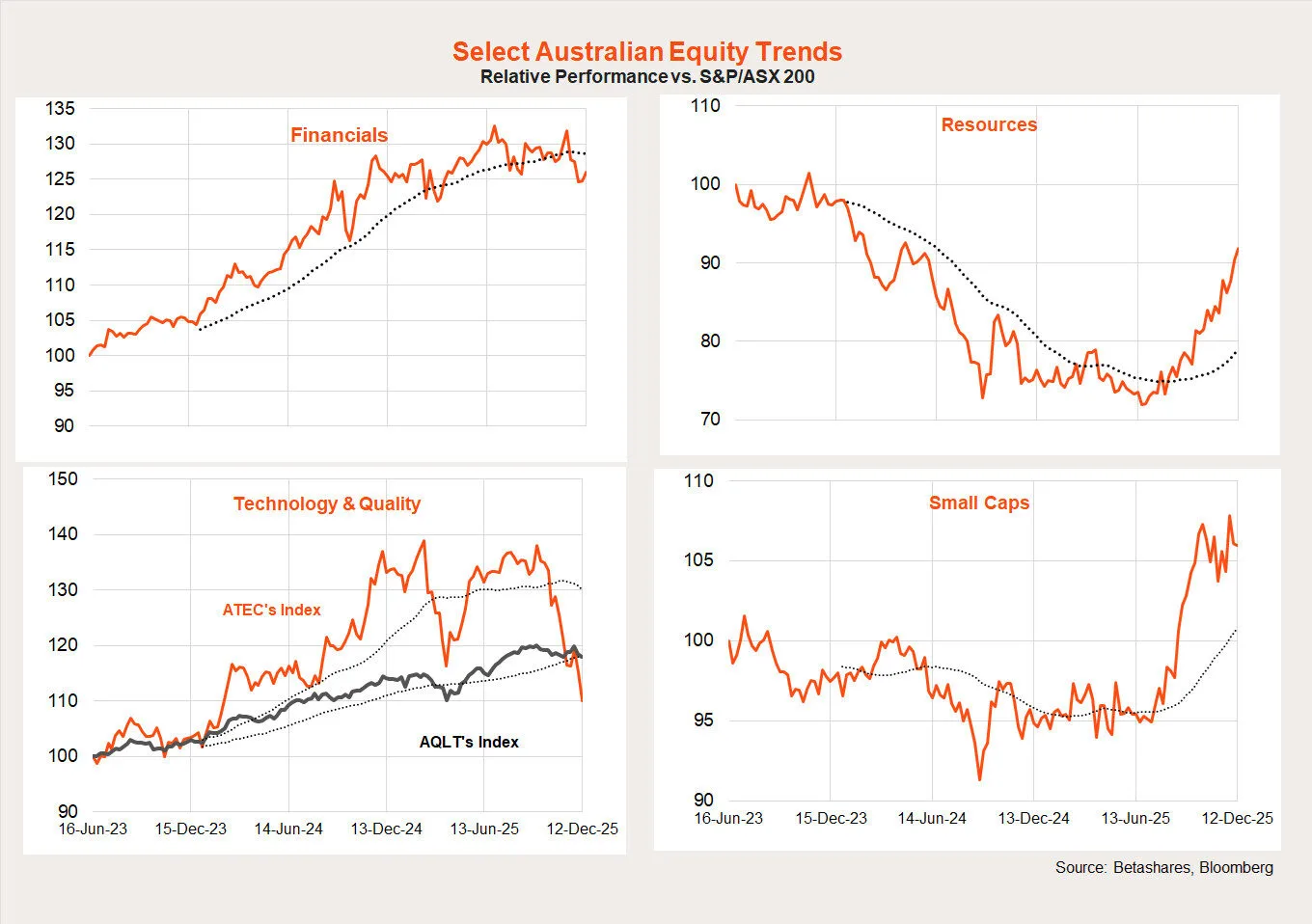

Australian equity trends

Materials were again the standout performer last week, with a gain of 2.8%, although financials also did okay with a 1.7% gain. As would be expected, growth/technology stocks fared the worst. Technology was down 4.7%.

All up, resources are now clearly in the ascendancy while quality stocks are also holding up reasonably well.