6 minutes reading time

Infrastructure investments have long been valued by institutional investors for their unique combination of stable cash flows, inflation protection, and portfolio diversification benefits.

TOLL FTSE Global Infrastructure Shares Currency Hedged ETF now provides Australian investors with efficient, low-cost access to these characteristics through a diversified portfolio of core infrastructure businesses across developed markets.

Infrastructure’s return drivers and characteristics

Infrastructure assets possess distinctive characteristics that differentiate them from traditional equity, fixed income, and private asset investments, making them a valuable component of diversified portfolios. Chief amongst these are potential for:

- Predictable cash flows and defensive qualities

- Inflation protection

- Uncorrelated returns

Recurring cash flows and defensive qualities

Infrastructure companies operate essential services which tend to have inelastic demand, like electricity, water, transportation, and communication services, all of which remain necessary regardless of economic conditions.

These businesses often benefit from regulated or monopolistic market positions with high barriers to entry, generating long-term contracted revenue streams. This combination has historically delivered lower volatility than broad equity markets while maintaining attractive return potential, often providing valuable downside protection during periods of market stress.

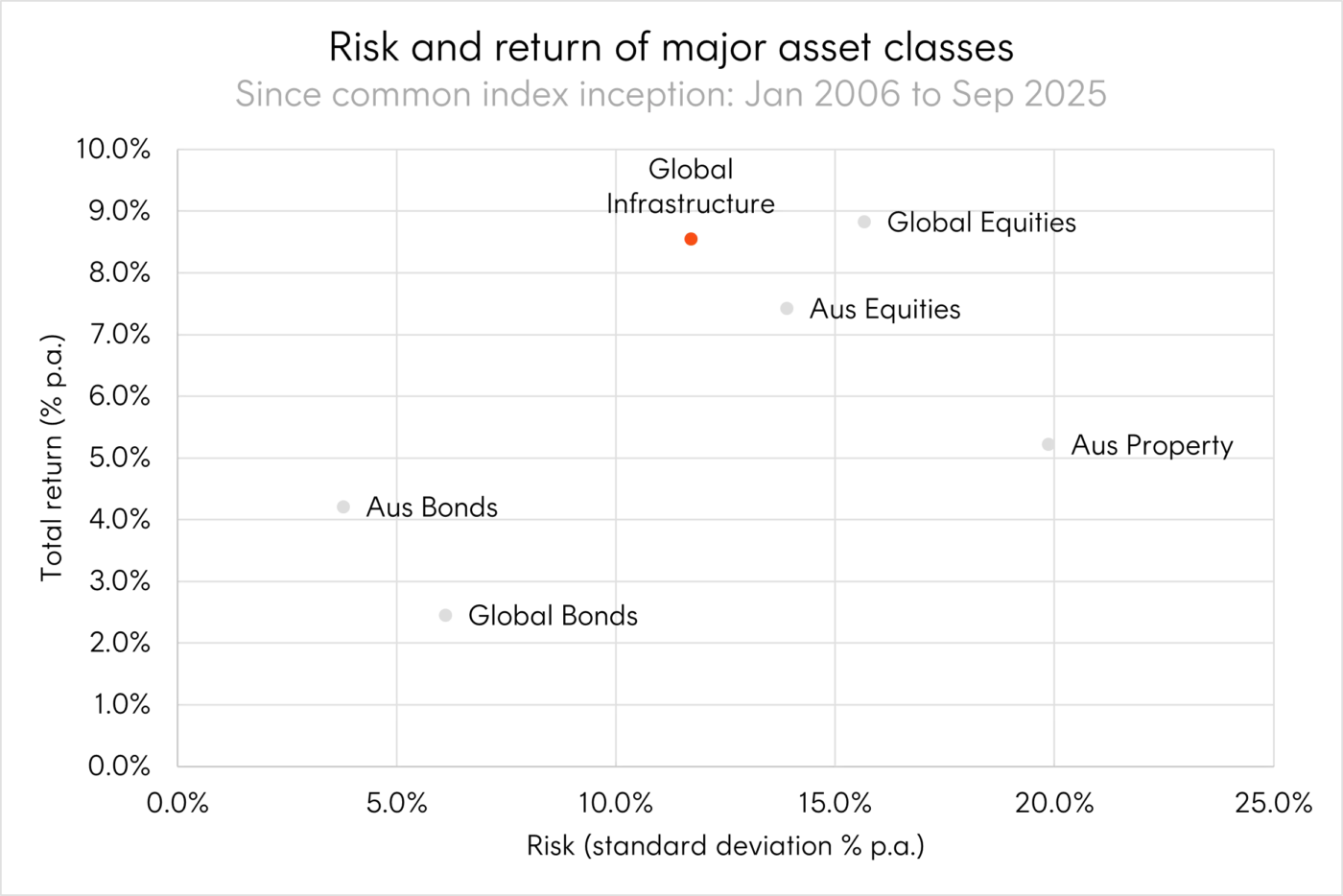

Source: Bloomberg. Past performance is not an indicator of future performance of any index or ETF. January 2006 to September 2025 using monthly data. Indices used: Global Infrastructure refers to the FTSE Developed Core Infrastructure 50/50 Hedged to AUD. Global Equities refers to the MSCI World Index. Aus Equities refers to the S&P/ASX 200. Aus Property refers to the S&P/ASX 300 A-REIT Index. Aus Bonds referrers to the Bloomberg Ausbond Composite 0+ yr Index. Global Bonds refers to the Bloomberg GlobalAgg Index. Indices do not take into account any ETF fees and costs. You cannot invest directly in an index.

Inflation protection

Infrastructure’s natural inflation hedging capability stems from multiple sources. Utility companies tend to benefit from regulatory rate reviews that account for inflation, while transportation assets often include contractual pricing agreements linked to consumer price indices. The essential nature of these services typically provides strong pricing power to pass through cost increases, while the real asset backing offers a degree of protection. This combination has historically enabled infrastructure to maintain meaningful real returns across various inflationary environments.

Portfolio diversification

Infrastructure investments have also historically exhibited low correlation to global equities providing potential diversification benefits. Because returns are driven by contracted revenues rather than economic growth cycles, infrastructure has historically tended to produce enhanced risk-adjusted returns when added to conventional portfolios.

Portfolio implications

Infrastructure occupies a unique position between traditional equities and fixed income in the risk-return spectrum. While infrastructure companies are listed securities, their return drivers – long-term contracted cash flows and regulatory frameworks – differ fundamentally from cyclical equity markets.

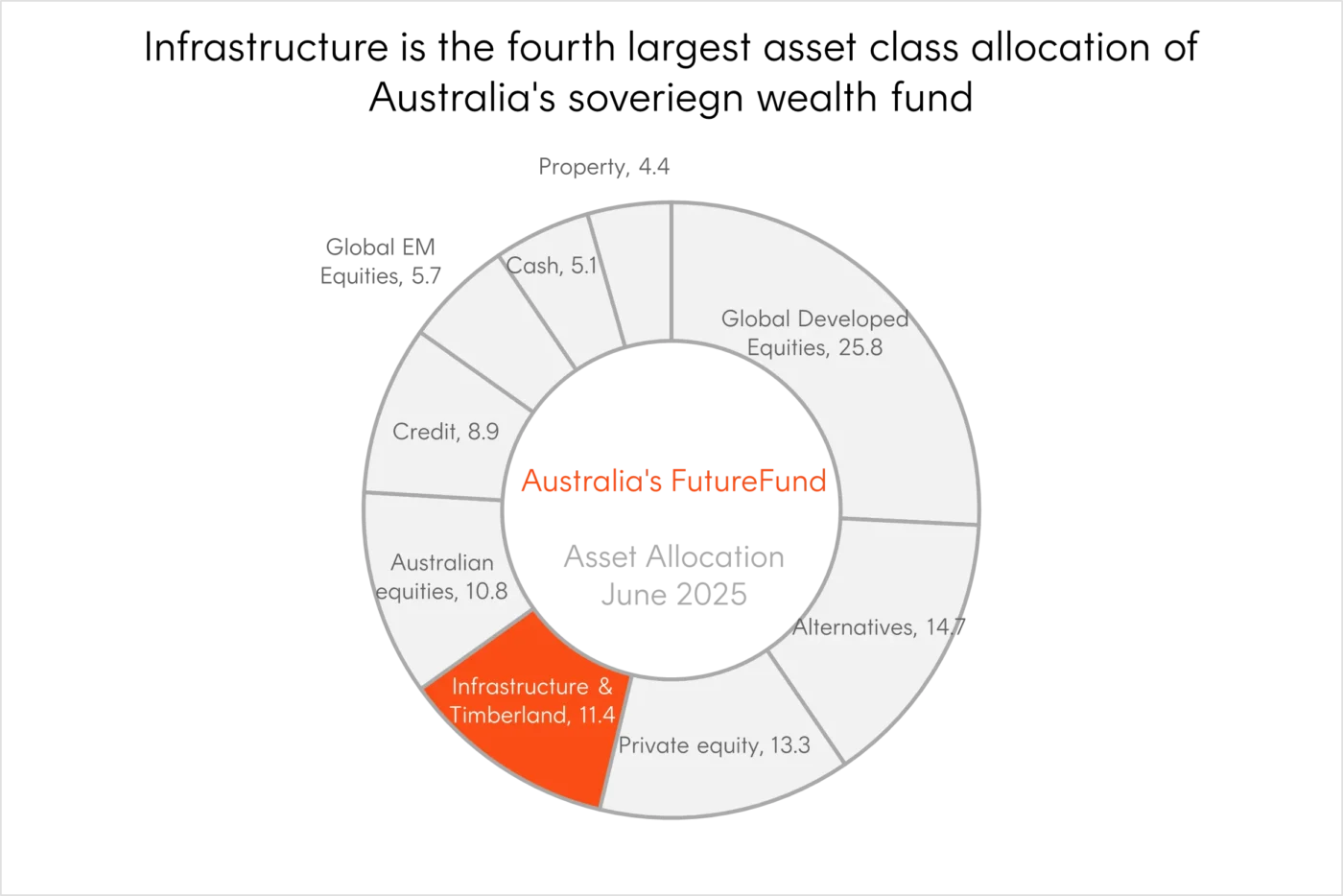

Given infrastructure’s investment characteristics, it often functions effectively as a smaller strategic allocation. Both Australian industry superannuation funds and Australia’s Future Fund allocate approximately 11%1 to the asset class. These allocations demonstrate infrastructure’s role as part of a strategic holding, with the asset class particularly suitable for investors with medium to long-term horizons seeking both capital growth and regular income.

Source: FutureFund, Australia’s Sovereign Wealth Fund Portfolio Update June 2025. The information provided is not a recommendation or offer to make any investment or to adopt any particular investment strategy.

Betashares FTSE Global Infrastructure Shares Currency Hedged ETF (ASX: TOLL) provides a simple way for asset allocators, advisers, and investors to gain access to global infrastructure via the familiar ETF structure.

Betashares FTSE Global Infrastructure Shares Currency Hedged ETF (ASX: TOLL)

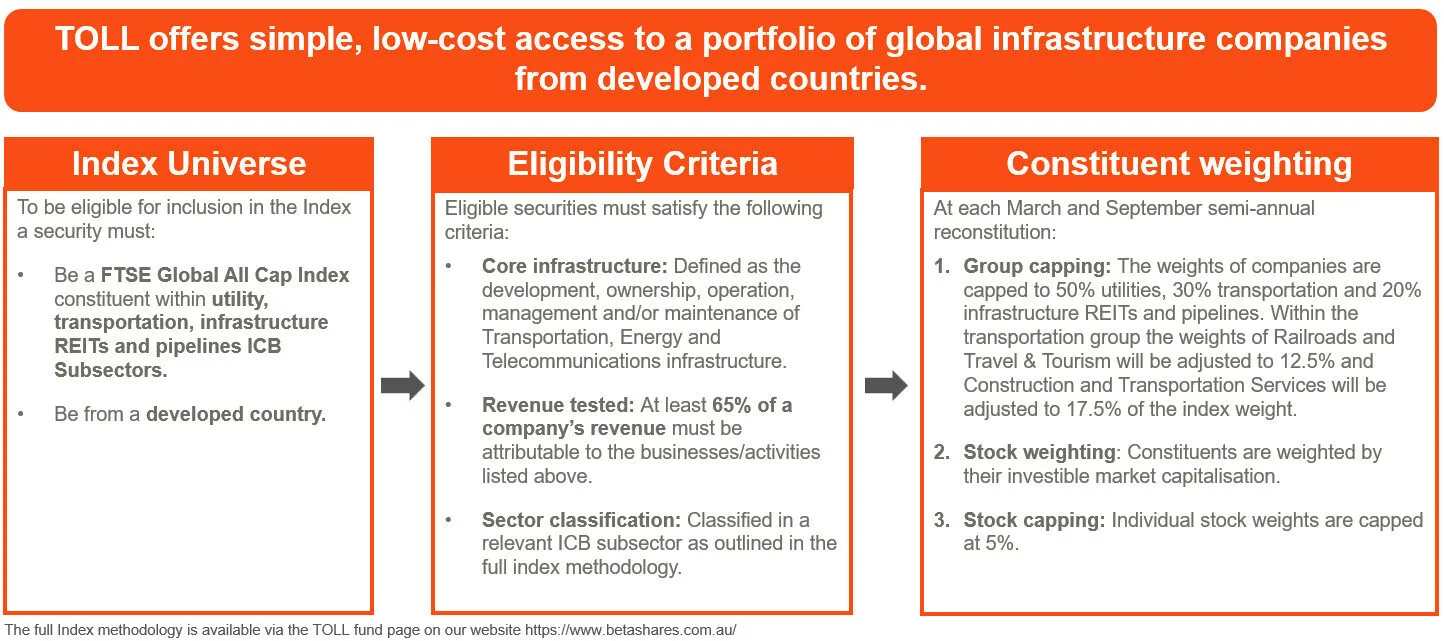

TOLL’s Index, the FTSE Developed Core Infrastructure 50/50 Hedged to AUD, includes only companies deriving at least 65% of their revenue from core infrastructure activities (as defined in the diagram below), ensuring the portfolio focuses on true infrastructure operators rather than companies with peripheral exposure.

The index maintains equal 50% allocations to utilities (electricity, gas, and water) and transportation and other infrastructure services (transportation assets, energy infrastructure like pipelines, and communication, travel and tourism infrastructure). This balanced approach prevents over-concentration while providing comprehensive exposure to approximately 135 securities.

For the full index methodology please visit TOLL’s fund page here.

Finally, the Fund seeks to minimise the impact of currency fluctuations by hedging into Australian dollars, ensuring investor’s returns are driven by global infrastructure, not the impact of exchange rates.

TOLL provides an efficient, cost-effective solution combining core infrastructure focus, balanced sector exposure, and competitive fees.

For more information on TOLL, visit the fund page here.

Sources:

1. APRA Quarterly Superannuation Statistics and FutureFund Australia’s Sovereign Wealth Fund Portfolio Update June 2025. ↑