7 minutes reading time

One of the enduring myths about Australia is the role of property as the best way to create wealth. Like much of the Western world, property ownership is ingrained in Australia’s psyche as the pathway to a secure financial future.

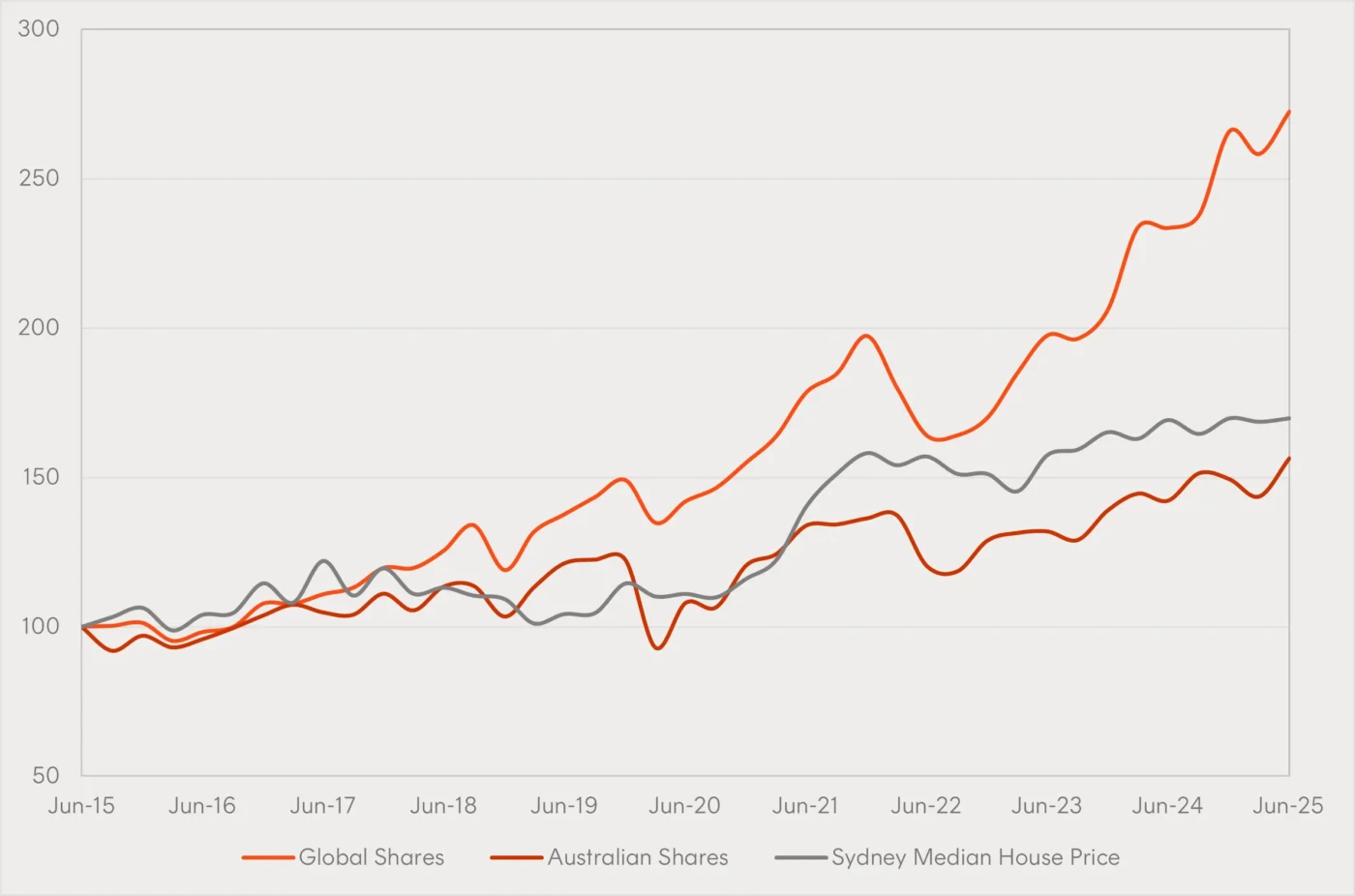

Over the last 10 years, the median Sydney house price has increased by 70%, in Brisbane and Adelaide prices have more than doubled. However, like many myths, reality is not always as it seems.

When compared to certain asset classes, the performance of residential property looks quite pedestrian. In comparison, the price appreciation of a broad global equity index over the same period is a staggering 172%, and that is before considering dividends.

Capital Growth of Sydney Housing, Global shares and Australian shares

Jun 2015 – June 2025 (Indexed to a starting value of 100)

Sources: Bloomberg and ABS, as at 30 September 2025. The Sydney Median House Price represents the median price for an established house transfer (unstratified) and does not take into account potential rental income, stamp duty or other costs of transfer. Global Shares are represented by the MSCI World Index; Australian Shares are represented by the S&P/ASX200 Index. Index performance is the price return index for the relevant index in AUD terms, and does not take into account dividends. The Wealth Builder ETFs do not aim to track an index.. You cannot invest directly in an index. Index performance does not take into account any ETF fees and costs. Past performance is not indicative of future performance of any index or ETF.

Where is all this property wealth coming from?

It’s not so much price appreciation itself that has created so many property millionaires, but rather something called ‘leverage’ or ‘gearing’. The use of gearing can magnify both gains and losses, but as long as the asset purchased increases in value by more than the cost of borrowing then gearing can help that individual to get ahead.

For Australians who own property, the leverage provided by their mortgage has allowed their equity in a house to increase at much faster rate than the value of the property itself. This outcome, in combination with other tax and policy settings1, seems to have stacked the deck in favour of home ownership over other forms of wealth creation.

Can a geared investment strategy also build wealth through the share market?

While record prices have pushed property ownership beyond the reach of many Australians, the same strategy of gearing can be considered in the context of share ownership.

In 2024, Betashares launched the Wealth Builder ETF range. These innovative ETFs provide the potential to build long-term wealth through diversified exposure to Australian and global shares using a ‘moderate’ level of gearing. They offer a compelling alternative to other forms of investment gearing that is simple to access , very cost effective and takes advantage of diversification and the markets’ compounding power over time.

- The gearing is internally managed within the ETFs, meaning all loan obligations are met by the fund. No loan applications, no credit checks and no possibility of margin calls for investors.

- Institutional interest rates on the loan are considerably lower than those typically available to individual investors seeking to borrow on their account or obtain a mortgage to acquire property, meaning the threshold to achieve positive returns is lower.2

- Whilst gearing does magnify gains and losses and may not be a suitable strategy for all investors, a ‘moderate’ gearing range (30-40% for these ETFs), together with a diversified portfolio, could be suitable for many investors with a long investment timeframe who are seeking to accelerate their growth potential and who are comfortable with the higher levels of volatility associated with gearing.

Our Wealth Builder ETF range has been well supported by investors seeking a moderately geared exposure to Australian and global sharemarkets. For example, GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF has over $130 million in assets under management.

Pleasingly, to date, the Wealth Builder ETFs have performed as we had expected in a range of market conditions, including periods of volatility, which we unpacked in this insights piece featuring GHHF (noting that past performance is not indicative of future performance).

And with many Australians choosing to allocate a greater share of their portfolio offshore with a focus on capital growth and wealth creation, we have had considerable investor interest in a new Wealth Builder ETF that provides exposure to broadly diversified global shares.

Expanding the Wealth Builder range

We are proud to announce the launch of GGBL Wealth Builder Global Shares Geared (30-40% LVR) Complex ETF . Like the other Wealth Builder ETFs, it allows investors to access the well-established benefits of gearing, which is professionally managed within a moderate range. GGBL builds on the success of BGBL Global Shares ETF – an ungeared fund that provides a market capitalisation weighted exposure to approximately 1,300 global companies (ex-Australia), which is now approaching nearly $3 billion in assets under management. GGBL combines investors’ money with borrowed funds and invests the proceeds in BGBL.

The introduction of GGBL expands the Wealth Builder range to four, offering Australian investors robust building blocks to construct their portfolios as they choose.

|

Exposure |

Australian shares |

Global shares |

Australian and global shares |

Nasdaq 100 |

|

ETF Name and ASX Code |

G200 Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF | GGBL Wealth Builder Global Shares Geared (30-40% LVR) Complex ETF | GHHF Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF | GNDQ Wealth Builder Nasdaq 100 Geared (30-40% LVR) Complex ETF |

|

Underlying portfolio |

200 largest ASX-listed companies |

Diversified portfolio of global equities (ex-Australia) |

Diversified basket of Australian and global developed and emerging markets equities |

100 of the largest non-financial companies listed on the Nasdaq |

|

Management fee and costs% |

0.35% p.a. of Gross Asset Value |

0.35% p.a. of Gross Asset Value |

0.35% p.a. of Gross Asset Value |

0.50% p.a. of Gross Asset Value |

*Other costs apply. Please refer to the PDS.

Betashares Wealth Builder ETFs have a wide range of potential use cases, from accumulators with limited capital trying to reach their financial goals sooner, to asset rich investors seeking to optimise outcomes across investment vehicles.

Does gearing into property or shares offer the better investment?

It’s important to note that investing doesn’t just come down to which asset class offers the best expected returns. You need to consider the risks associated with each asset, and your personal situation such as your goals, financial situation, risk appetite, and age.

But regardless of the asset class, for gearing to work as intended you need an investment with the potential to generate long-term capital growth and income in excess of the costs of borrowing, including interest cost. A diversified portfolio of shares offers such potential, and the Wealth Builder ETFs provide a cost effective way to apply the power of moderate leverage to the Australian and global share markets for investors seeking to build long term wealth. Best of all, you can buy the Wealth Builder ETFs on the ASX in a single trade, without the need to save for a five or six figure house deposit.

The gearing ratio of each Wealth Builder ETF (being the total amount borrowed expressed as a percentage of the total assets of the Fund) will generally vary between 30% and 40% on a given day. This means that each Fund’s geared exposure is anticipated to vary between ~143% and ~167% of the Fund’s Net Asset Value on a given day. Each Fund’s portfolio exposure is actively monitored and adjusted to stay within this range.

Each Fund’s returns will not necessarily be in this range over periods longer than a day, primarily due to the effects of rebalancing to maintain the Fund’s daily target geared exposure range and the compounding of investment returns over time, and the impact of fees and costs.

This effect on returns over time can be expected to be more pronounced the more volatile the relevant sharemarket or portfolio and the longer an investor’s holding period.

Due to the effects of rebalancing and compounding of investment returns over time, investors should not expect each Fund’s Net Asset Value to be at a particular level for a given value of the relevant sharemarket or portfolio at any point in time.

Investors should monitor their investment regularly to ensure it continues to meet their investment objectives.

Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve significantly higher risk than non-geared investments. An investment in each Fund is very high risk in nature.

There are risks associated with an investment in each Fund, including market risk, underlying ETF risk, gearing risk, rebalancing and compounding risk and lender risk, as well as (for GHHF, GGBL and GNDQ) currency risk.

Sources:

1. For example, allowing negative gearing, certain exceptions from capital gains tax and age pension means tests. ↑

2. That threshold is the point at which the geared returns generated on the underlying investment are higher than the costs of investing, including interest on the borrowed funds ↑