What is ESG investing?

5 minutes reading time

This article was first published on 14 March 2018. It has been updated and republished due to investor demand.

Although “ethical” investing is clearly on the rise, some investors may be dismayed to find what they thought was an ethically orientated investment fund may still be exposed to industries that many values-based investors would be looking to avoid, such as fossil fuel generation, armaments, gambling, tobacco, junk food and alcohol. In this post I look deeper into ethical investing and delve into Betashares’ Ethical ETFs, which offer peace of mind through the adoption of some of the most stringent ethical screens in the country.

Ethical investing is on the rise

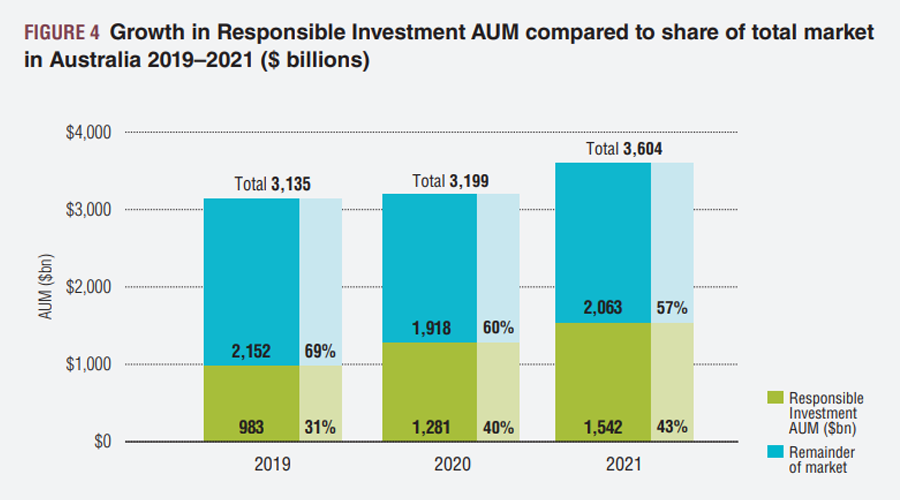

Australian investment in responsible and ethical investment portfolios has grown at a rapid pace in recent years. According to data from the RIAA, Australia’s responsible investment market reached $1.54 trillion in funds under management in 2021, representing a market share of 43% of the entire local funds’ management industry. Responsible investment funds continue to grow in use, with RIAA data showing that these funds have seen their funds under management increase by over $550 billion since 2019.

Source: Responsible Investment Benchmark Report Australia 2022, Responsible Investment Association Australasia (RIAA)

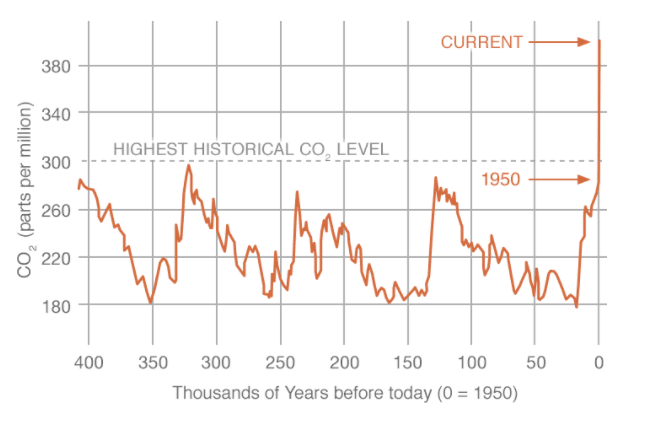

Investor preference is a key driver behind the increase in responsible investments. Given the environmental and social pressures facing our planet, many more investors are seeking out investment funds that only invest in companies consistent with their values. As seen in the chart below, for example, global CO2 levels are now very high by historic standards.

Global Atmospheric Carbon dioxide (CO2) Concentrations

Source: NASA

But responsible investing is increasingly not just a matter of conscience – it can make good financial sense in its own right. Not only is consumer spending shifting toward companies that are considered greener and more socially responsible, technological innovation in the energy sector is also favouring companies less reliant on producing or using fossil fuels.

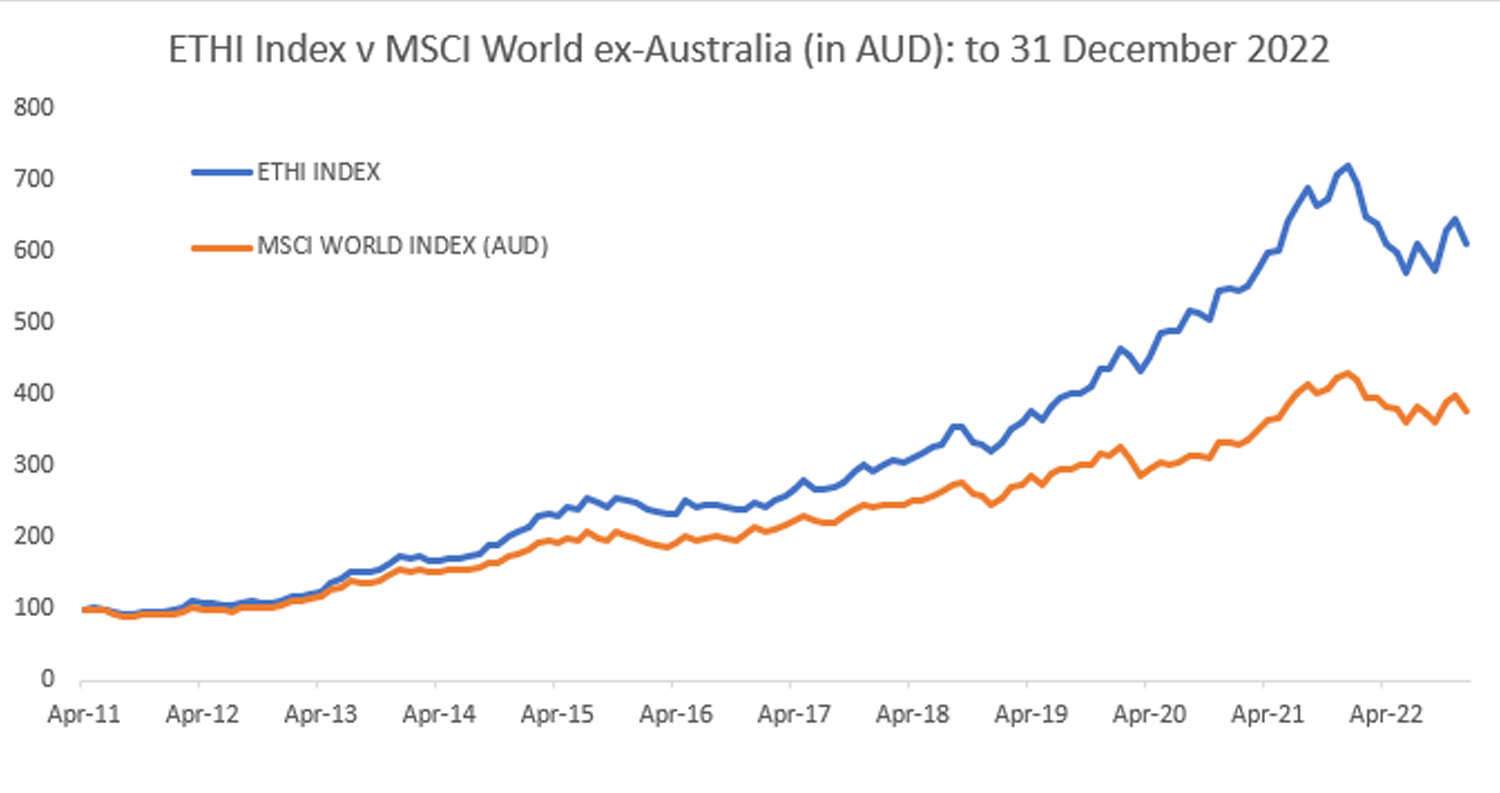

Indeed, by way of example, the Index of global companies that ETHI Global Sustainability Leaders ETF aims to track has, since its inception, outperformed the MSCI World Equity Benchmark.

Source: Bloomberg. The Index which ETHI aims to track is the Nasdaq Future Global Sustainability Leaders Index. Past performance is not indicative of future performance of index or ETF. Investing involves risk.

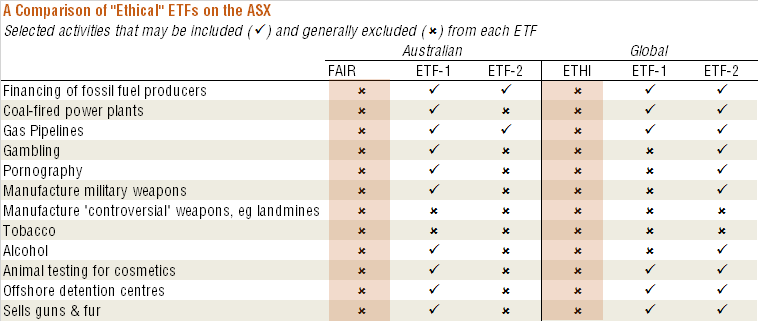

One challenge for socially minded investors is that there is no generally agreed definition of what constitutes an “ethical” or “responsible” investment fund. Indeed, as noted above, it may surprise some investors to know that some funds that label themselves as ethical may actually include exposure to fossil fuel producers, while others can include companies engaged in a range of other activities such as gambling or tobacco.

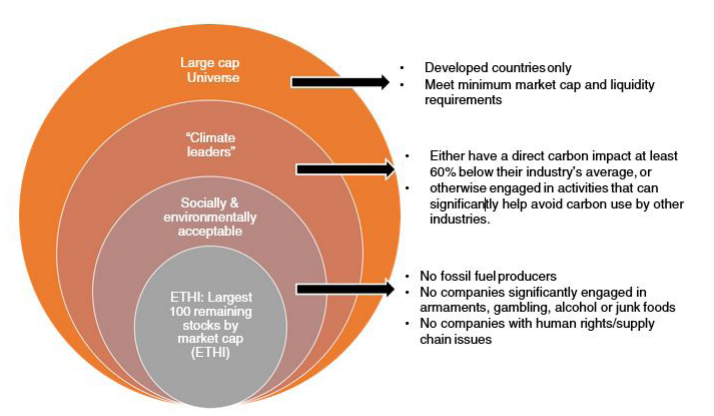

To provide investors with a “true to label” investment experience, Betashares decided at the outset that its suite of ethical funds – ETHI Global Sustainability Leaders ETF and FAIR Australian Sustainability Leaders ETF – would be subject to some of the most comprehensive ethical and social governance (ESG) screening methodologies in the industry.

To qualify for either ETHI or FAIR, not only do companies need to meet certain qualifying criteria to be considered leaders in “sustainable” or “climate friendly” activities, they also then can’t be materially associated with a fairly wide range of activities that could be deemed inconsistent with responsible or ethical investing. These activities include, among others, the production or financing of fossil fuels, gambling, junk food, tobacco, pornography, armaments, alcohol and animal cruelty. In the case of our Australian ethical fund, FAIR, an added gender diversity screen insists that companies must also have at least one female board member.

The diagram below outlines the screening methodology underpinning of our global ethical fund (ASX Code: ETHI).

The upshot of this broad screening methodology is that Betashares’ suite of ethical ETFs is arguably the most “true-to-label” available on the ASX.

We have researched the holdings of other so-named “ethical” ETFs available on the ASX to the best of our abilities, to check just how ‘true to label’ some of these funds are. As seen in the table below, both FAIR and ETHI exclude companies engaged in a broad range of the usual sensitive activities one might expect, whereas the various criteria used by other Australian and Global “ethical” ETFs means that, depending on the fund, they can and often do include companies engaged in areas such as alcohol, the financing of fossil-fuel producers, coal-fired power plants, the operation of detention centres, animal testing on cosmetics or the operation of gas pipelines.

If in doubt, investors are encouraged to look “under the hood” at what companies their ethical fund actually holds and/or review the fund’s screening methodology within its product disclosure statement.