7 minutes reading time

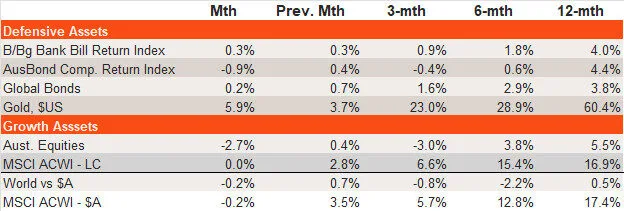

Major asset class performance

- Global equities ended November broadly unchanged, with an early month sell-off due to AI bubble concerns eventually unwound on renewed US rate cut hopes.

- Australian equities were weaker, reflecting a relatively larger decline in valuations as firm inflation data pushed up bond yields and reduced the chances of a local rate cut next year.

- Global bond yields were broadly steady, contributing to a small gain in returns. Higher local bond yields produced a negative return on Australian bonds.

- Gold prices rose further, supported by the prospect of another US rate cut.

Source: Bloomberg, Betashares. Cash: Bloomberg Australian Bank Bill Index; Australian Bonds: Bloomberg AusBond Composite Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged); Gold: Spot Gold Price in $US; Australian Equities: S&P/ASX 200 Index; Global Equities: MSCI All-Country World Index in local currency and $A currency (unhedged) terms. Past performance is not indicative of future performance.

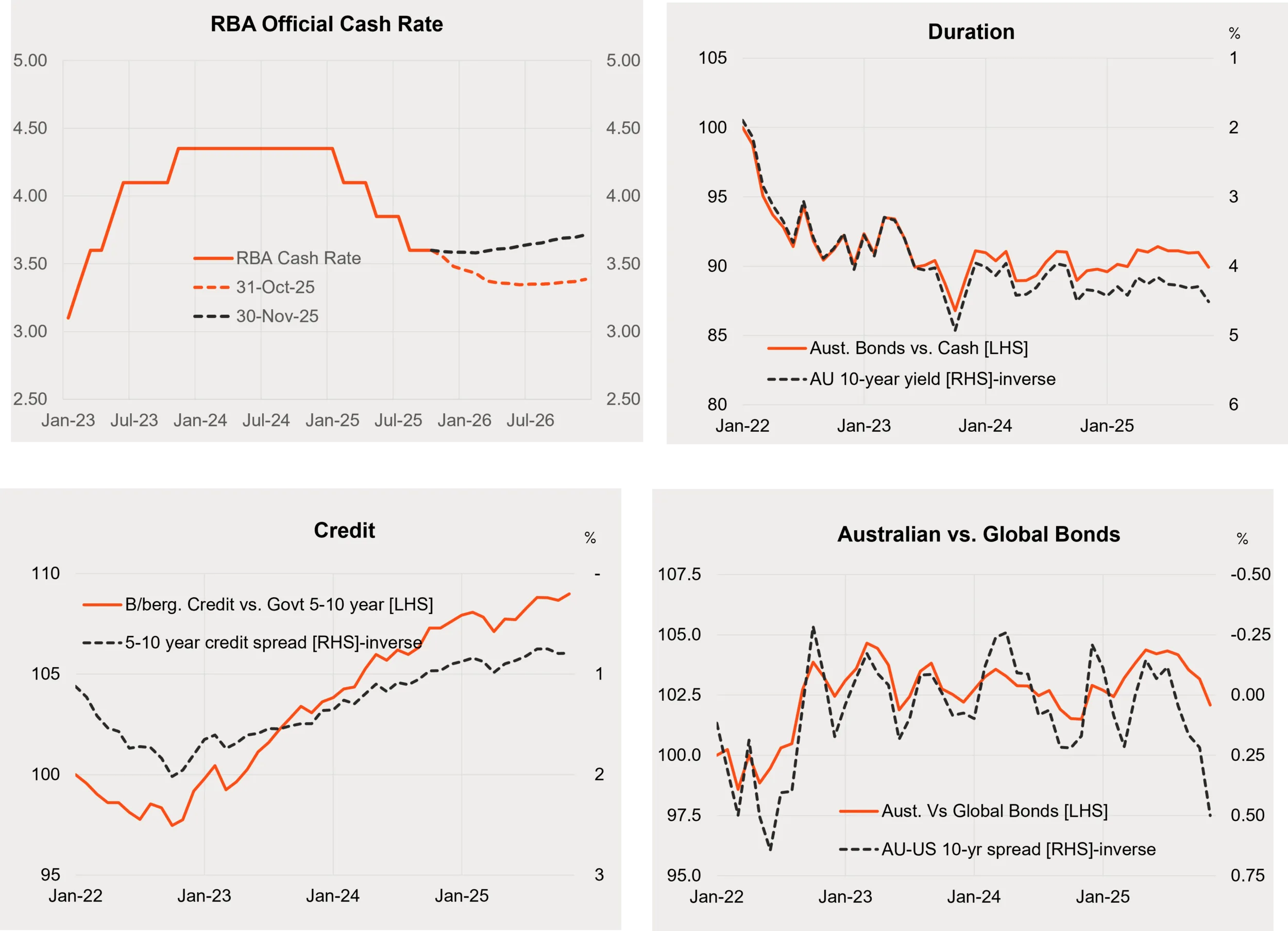

Fixed-rate bond trends

- Local rate cut expectations shifted notably over November, with a modest chance of one rate cut next year replaced with a modest chance of a rate hike. A key development was the October CPI report, which revealed the annualised rate of underlying (trimmed mean) inflation was still running above 3%. A firm labour market report, with the unemployment rate dropping from 4.5% to 4.3%, was another contributing factor.

- In the US, by contrast, rate cut expectations increased a little further, with the market ending the month with a high chance of a December rate cut following dovish comments from several key Fed officials. Despite still sticky underlying inflation of just under 3%, Fed officials expressed greater concern over downside risks to the labour market.

- Local 10-year bond yields rose by 0.22% to 4.51%, although remain in the range they’ve held since early 2024. Higher bond yields saw fixed-rate bonds underperform cash in November, largely unwinding the modest outperformance evident earlier this year.

- Longer-term credit spreads held steady in the month, although have generally narrowed so far this year.

- A widening in Australian versus global bond yields in November saw local bonds underperform, although relative performance has been in a choppy sideways range for two years.

Source: Bloomberg, Betashares. Australian bonds: Bloomberg AusBond Composite Bond Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged).

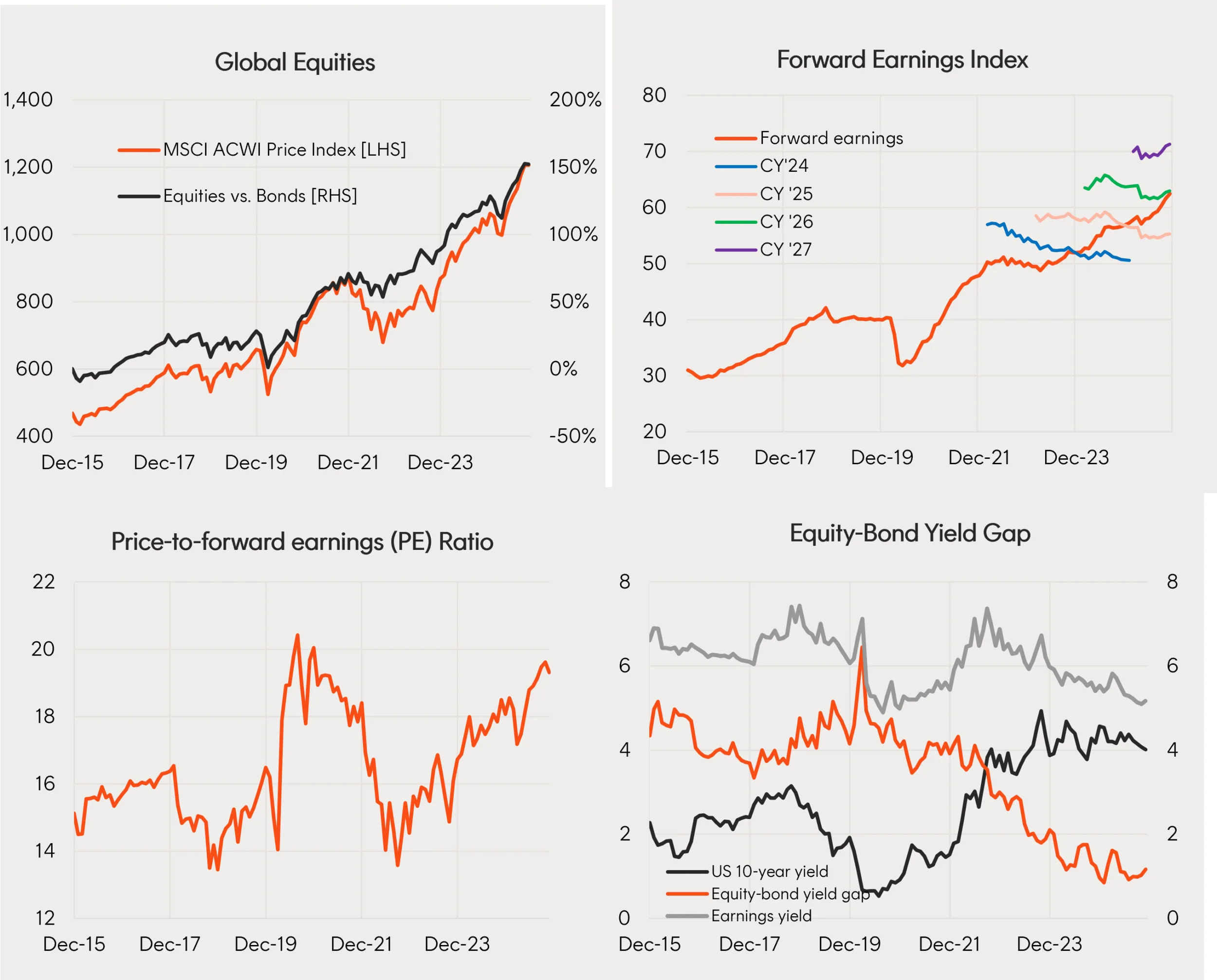

Global equity trends

- The MSCI All-World price index was flat in November after a solid 2.8% gain in October. The flat outcome reflected a 1.5% rise in forward earnings being offset by a 1.5% decline in the price-to-forward-earnings ratio to 19.3.

- Despite the decline in valuations, earnings expectations continued to edge up in November, with current expectations consistent with solid 14% growth in forward earnings by end-2026.

- With valuations still somewhat elevated, continued market gains are still possible, provided bond yields don’t rise much and/or the current bullish earnings outlook remains in place.

Source: Bloomberg, LSEG, Betashares. Global Equities: MSCI All-Country World Index. Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged). You cannot invest directly in an index. Past performance is not an indicator of future performance.

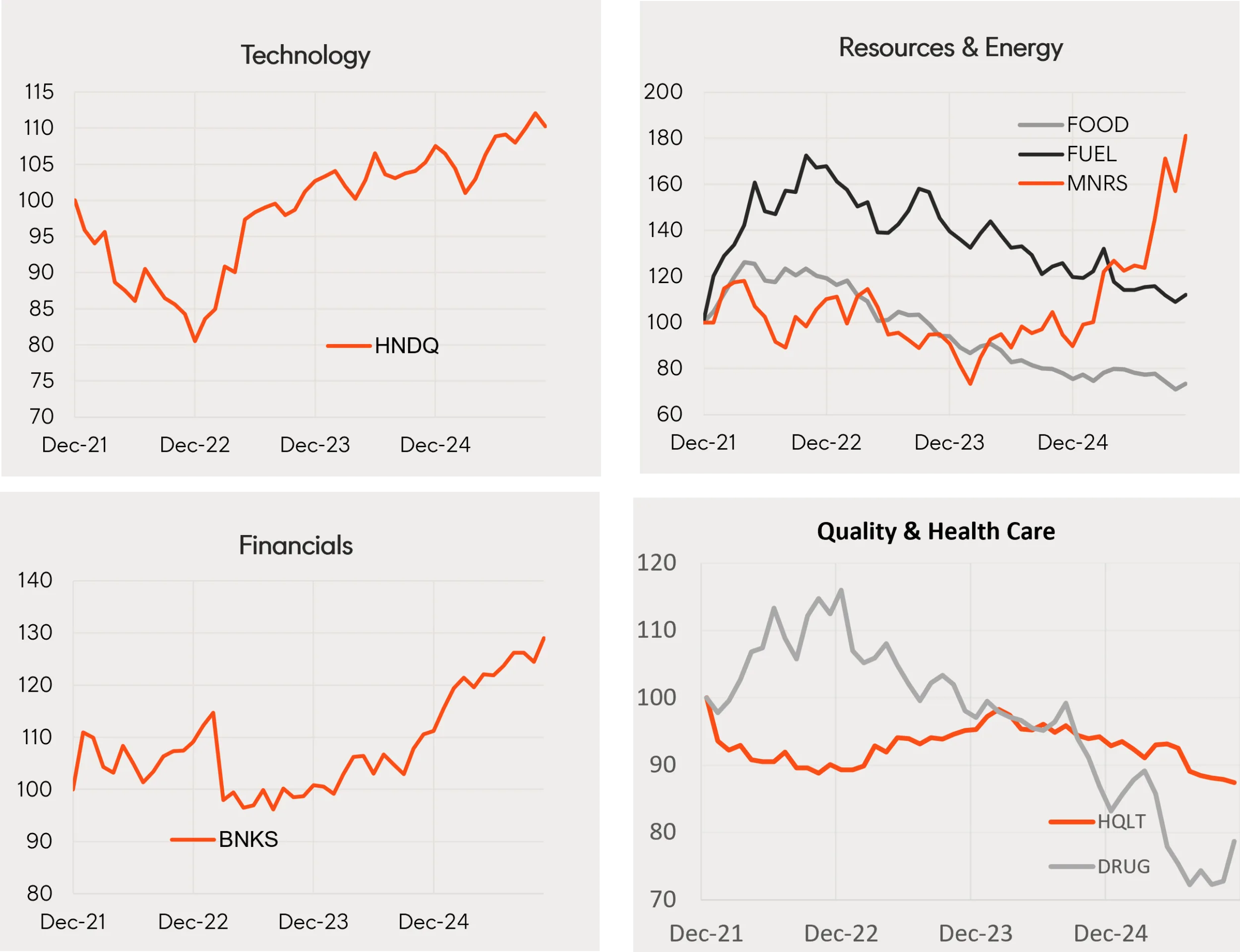

- Among select Betashares global equity ETFs, global gold miners (MNRS) stormed back (after correcting in October) with a 15.4% gain. Perhaps reflecting its defensive qualities, global health care (DRUG) also did well with a 8.2% gain. The Nasdaq-100 (HNDQ) pulled back by 1.6%.

- All up, however, the standout exposures over the past 12 months remain global banks, gold miners and the Nasdaq-100.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the MSCI All-Country World Index (local currency terms) for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Australian dollar

- Despite the widening in short-term interest rate differentials against the US from +0.13% to +0.51%, the Australian dollar remained fairly steady over November, ending the month at 65.5 US cents.

- In turn, this reflected a relatively steady US dollar index, which edged down 0.3% across major currencies. Iron ore prices slipped 0.5% to $US101.6/tonne.

- The Australian dollar strengthened earlier this year, in line with US dollar weakness, although both have tended to consolidate within tight ranges since mid-year.

- Reflecting an easing of global risks, more US rate cuts and its historically expensive level, the US dollar is still expected to gradually weaken over the coming year, which should support more Australian dollar strength.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Australian shares

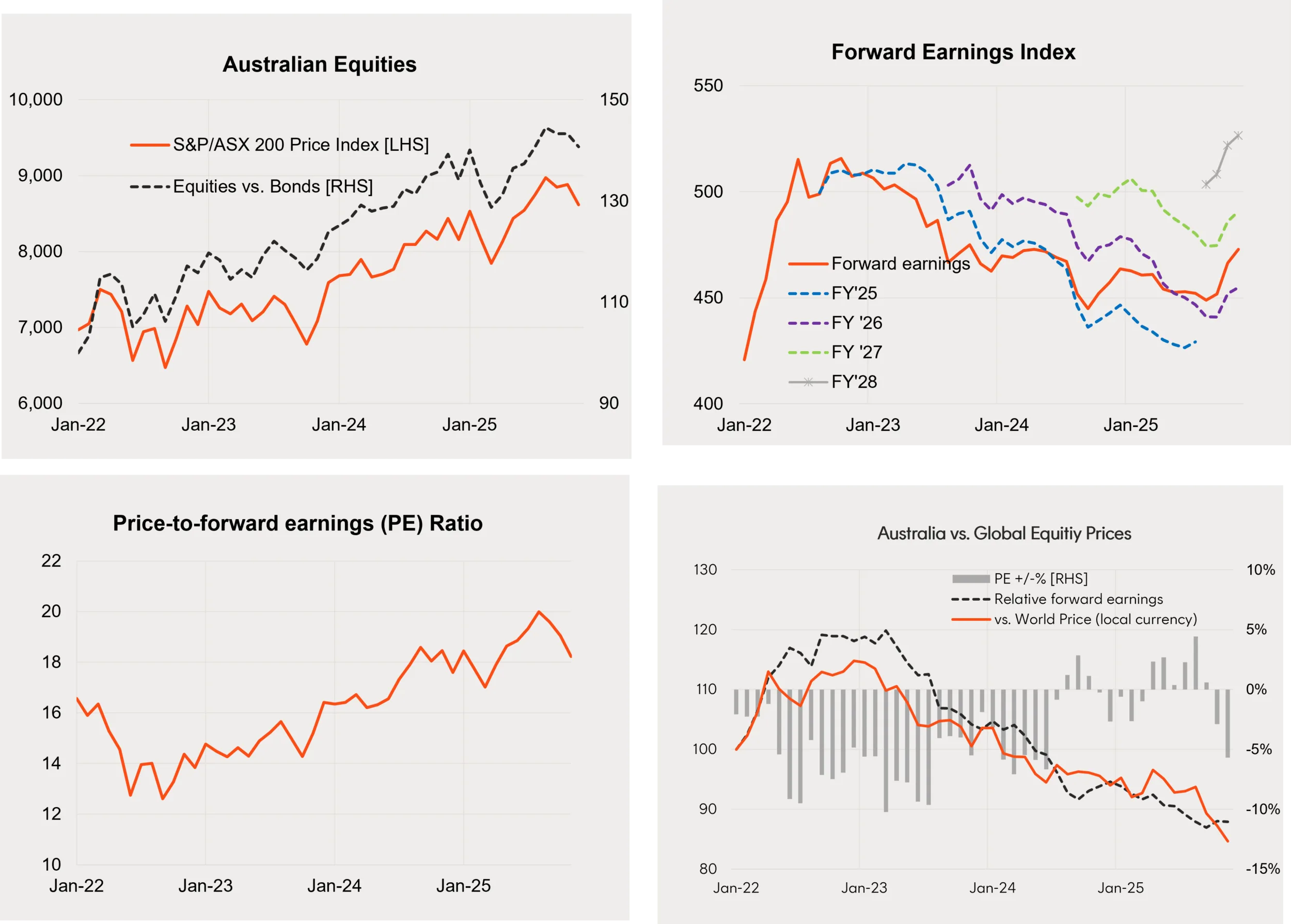

- The S&P/ASX 200 price index declined 3.0% in November, after a modest 0.4% gain in October.

- The price decline came despite a 1.4% gain in forward earnings, which in turn has reflected upgrades to the earnings outlook for the current and future financial years, due to more resilient then expected commodity prices. Current earnings expectations imply 7.8% growth in Australian forward earnings by the end of 2026, which is about half that expected for global earnings.

- With earnings holding up, the equity decline reflected a 4.4% decline in the price-to-forward-earnings ratio to 18.2, which in turn likely reflected a rise in local bond yields and diminished rate cut expectations as outlined above. As a result, Australian equities ended the month trading at a modestly cheap 5.7% discount to global equities.

- Despite the weaker earnings outlook, the now cheaper relative valuation for Australian equities has improved their year-ahead relative return outlook to a more neutral setting.

- That said, while the return outlook appears more encouraging, the possibility of no further RBA rate cuts – and potential rate hikes – is a plausible counterweight.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

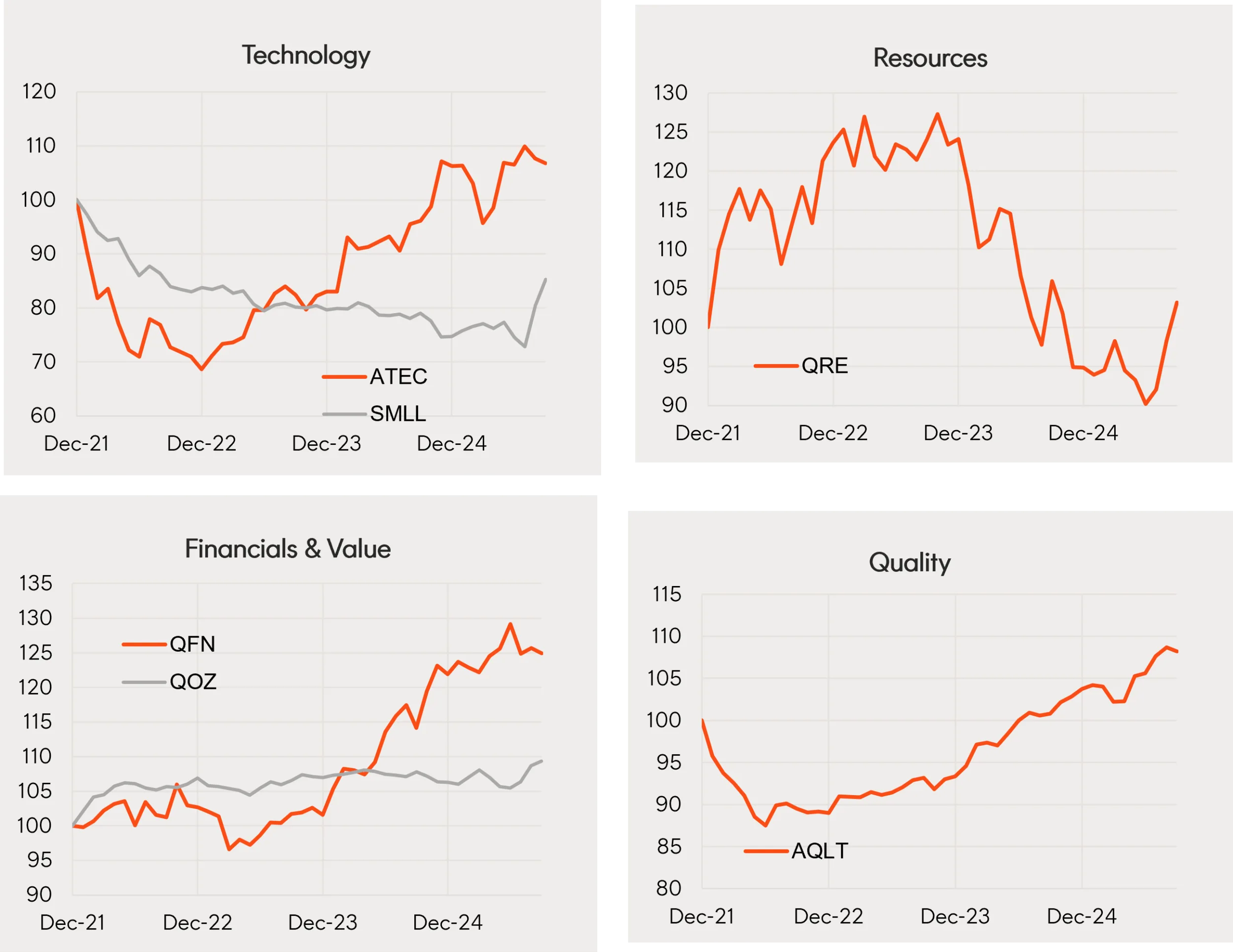

- Diminished local rate cut expectations and global AI jitters again hurt the high-beta technology sector (ATEC) in November while small caps (SMLL) held up well.

- More broadly, the rotation toward resources (QOZ) and away from financial stocks remained evident. Quality (AQLT) continues to perform relatively well.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the S&P/ASX 200 Index for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.