6 minutes reading time

If you’d prefer to listen to this week’s edition in podcast form, please click the below player:

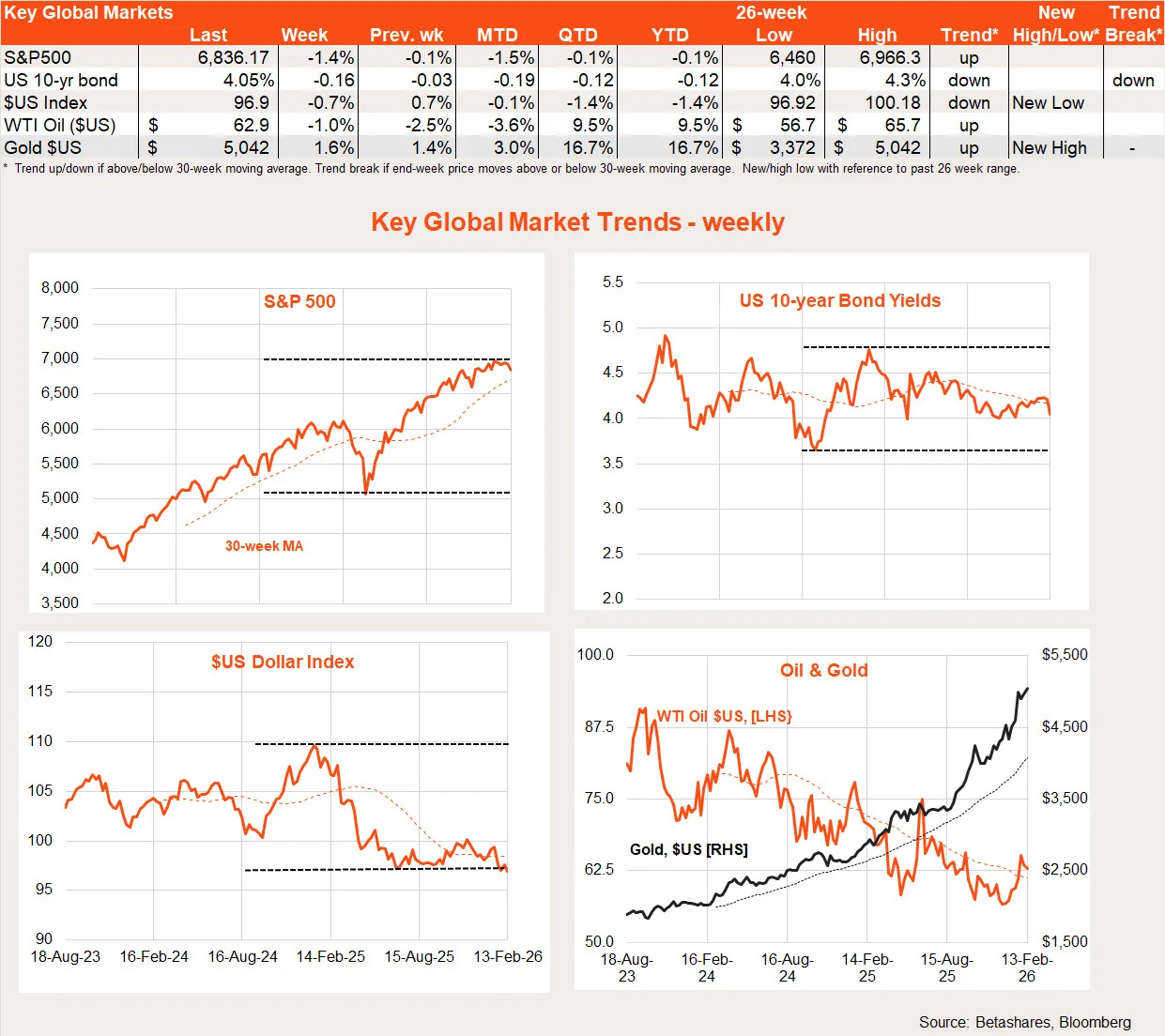

US stocks slipped further last week, reflecting broadening AI disruption concerns.

Global week in review: mixed US data & AI disruption

US economy muddling along

Global equity markets continued to trade nervously last week – dropping on bad news and not rallying much on good news.

US economic data was mixed. December retail sales were softer than expected, with the flat result raising some downside growth concerns. That said, at least part of the weakness likely reflected shifting seasonal patterns, driven by the growing popularity of November sales – spending that month rose a healthy 0.6%.

Offsetting the weakness in retail sales was a better-than-expected 130k gain in January employment, with the unemployment rate dropping from 4.4% to 4.3%. Weekly jobless claims also remained reassuringly low.

Capping off the week was a slightly lower-than-expected 0.2% gain in headline consumer prices, although core CPI inflation was in line with expectations at 0.3%. Core annual CPI inflation edged down to 2.5% from 2.6%, and is likely closer to the Fed’s 2% target once tariff effects are stripped out. Benign inflation and generally slowing employment remain green lights for further Fed rate cuts despite GDP growth remaining buoyant.

AI disruption spreads

But perhaps the biggest Wall Street story last week was growing signs of rolling AI-related disruption across more sectors. What was a concern only for software companies has since spread to financial services, trucking and commercial property. The arrival of AI tools to aid tax planning and freight management sent shudders through the first two sectors while growing concerns over white-collar unemployment hurt the commercial property sector. The sector has already come under pressure from the work-from-home trend.

One dawning reality for Wall Street is that many of the potential losers from AI disruption are well established large listed companies, while some of the AI usurpers are either unlisted or – so far at least – still too small to move markets.

For instance, listed ‘penny stock’ Algorhythm (NASDAQ: RIME) is an AI upstart aiming to make freight management more efficient – and thus reduce demand for trucking services. RIME rose 270% last week but still has a market capitalisation of just US$20 million! Altruist, which sent shudders through the listed wealth management sector last week with its AI tax planning tool, is an unlisted tech upstart but, as at April 2025, was already reportedly valued at nearly US$2 billion.

While the near-term impact of AI disruption is mixed in equity markets, the potential productivity payoff is unambiguously positive over the longer term. AI disruption, to the extent it lowers inflation and potentially disrupts economic activity temporarily, is also clearly good news for fixed rate bonds!

Global week ahead: US GDP and PCE

Most of the major US economic news is released this Friday, including Q4 GDP and the December private consumption expenditure deflector (PCED).

After a strong annualised gain of 4.4% in Q3, US GDP is expected to have grown at an annualised rate of 2.8% in Q4 according to market consensus, although the Atlanta GDPNow current estimate is 3.7%.

The core PCED – the Fed’s preferred measure of underlying inflation – is expected to have risen 0.3% in December, which would result in an uptick in annual core inflation to 3.0% from 2.8%. Somewhat unusually, the PCED measure of US consumer price inflation is currently running above the CPI measure. This reflects the relative strength in energy prices and weakness in housing prices over the past year, with the PCED having a higher weight to the former and a lower weight to the latter than the CPI.

Elsewhere, New Zealand’s central bank is expected to leave rates on hold on Wednesday. The RBNZ is facing the mixed forces of both high inflation and unemployment – although the latter is expected to help lower the former over the coming year.

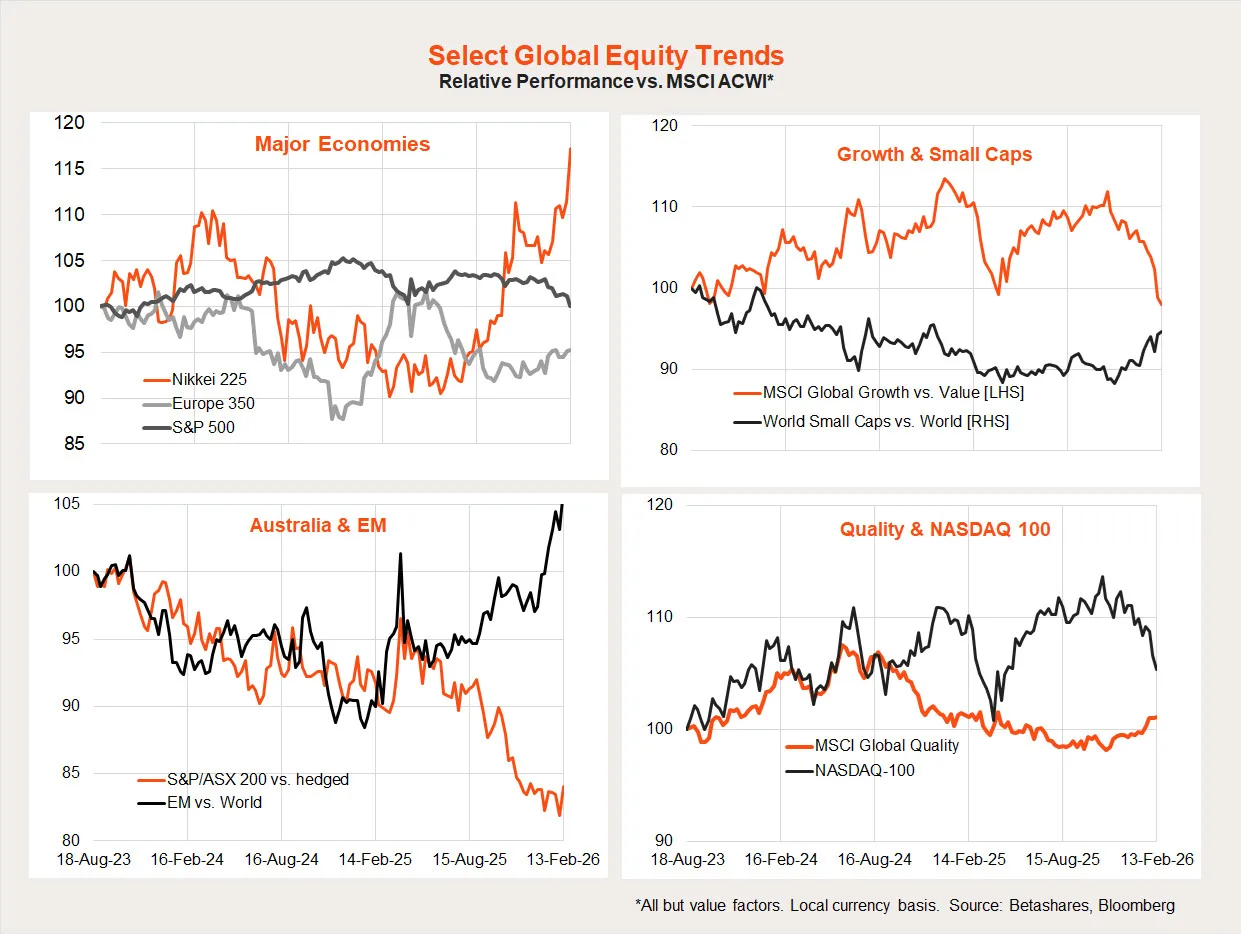

Global equity trends: the great rotation continues

The ‘great rotation’ remains alive and well. The MSCI All-Country World Equity Index edged down 0.2% last week, outperforming the S&P 500 and NASDAQ-100 which were both down 1.3%. Following the Japanese election (mentioned last week), the Nikkei-225 soared 5.0% while emerging market equities enjoyed a 2.7% gain.

Since the end of October 2025, we’ve seen underperformance of US/growth/technology, replaced by strength in Japan, emerging markets and small caps. Australia enjoyed a relative performance bounce last week, though the longer-run trend remains downward.

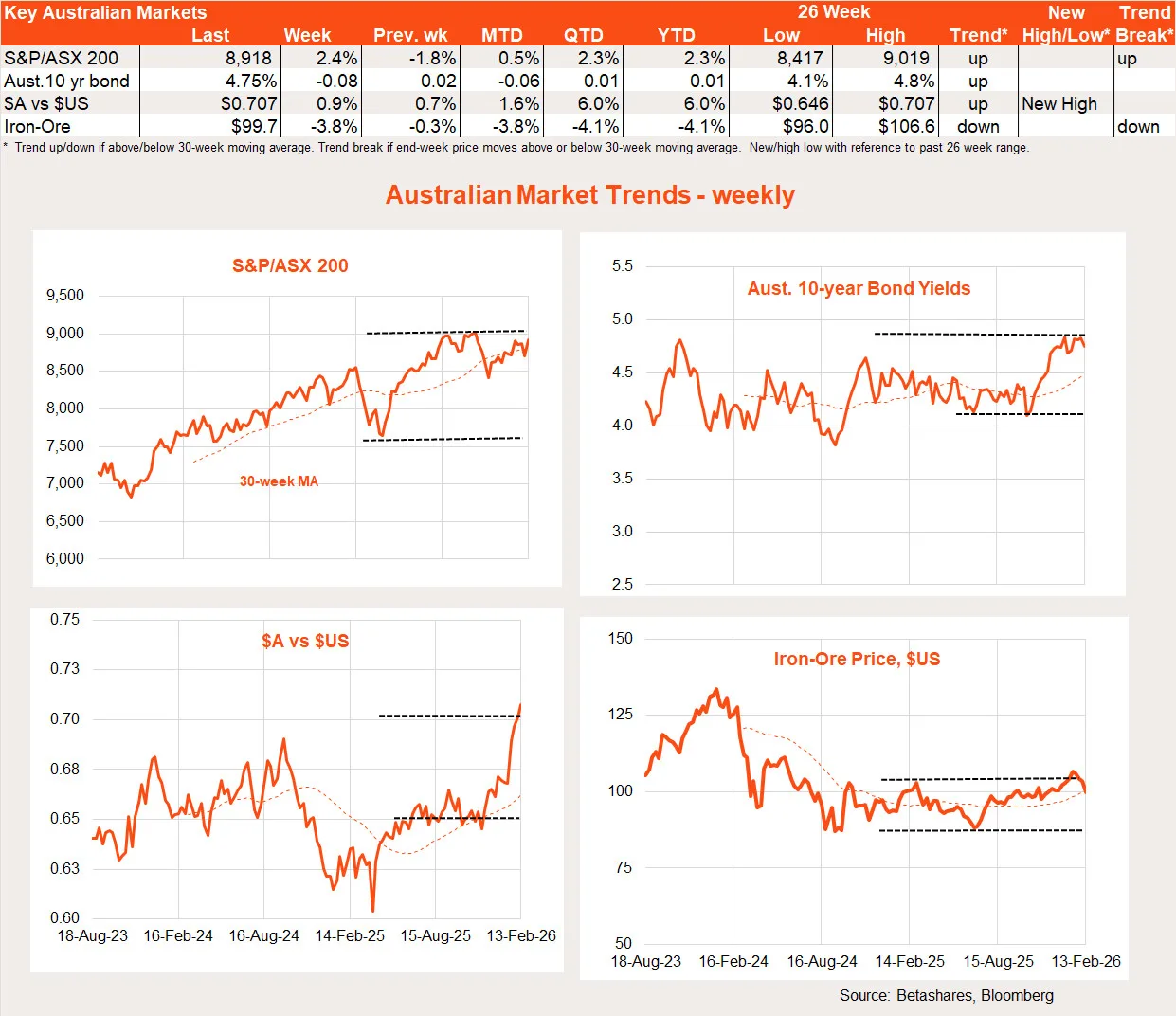

Australian week in review: a solid bounce

As noted above, Australian shares enjoyed a solid bounce last week, with the S&P/ASX 200 returning 2.4% after a 1.8% decline in the previous week (reflecting the RBA rate hike). Materials, utilities and financials enjoyed especially strong gains.

The main news last week was an easing in both business and consumer sentiment following the RBA’s rate hike. The Westpac measure of consumer sentiment declined 2.6% in February, with the recovery in sentiment over previous months now appearing to stall at below-average levels. The NAB measure of business conditions edged back from +9 to +7 in January, returning to long-run levels.

Dwelling finance was strong in Q4, obviously pre-dating the RBA’s February 2026 rate hike, with lending up 9.5%, driven by gains of 10.6% for home buyers and 7.9% for investors. The Federal Government’s first home buyer incentives clearly helped boost demand, with evidence of housing exuberance during the quarter likely contributing to the RBA’s decision to raise rates earlier this month.

Australian week ahead: RBA minutes and employment

Tuesday will shine even more light on the RBA’s decision to raise rates this month with the release of the meeting minutes. Markets will be attentive to any hints of further rate cuts, even if they are now attaching an 80% chance to a rate hike by the May 2026 meeting.

On Thursday, we get the January labour market report. A healthy 20k gain in employment and a modest rebound in the unemployment rate from 4.1% to 4.2% is expected. Note that employment has been choppy of late – likely not helped by shifting seasonal patterns – with surprise strength in December and surprise weakness in November.

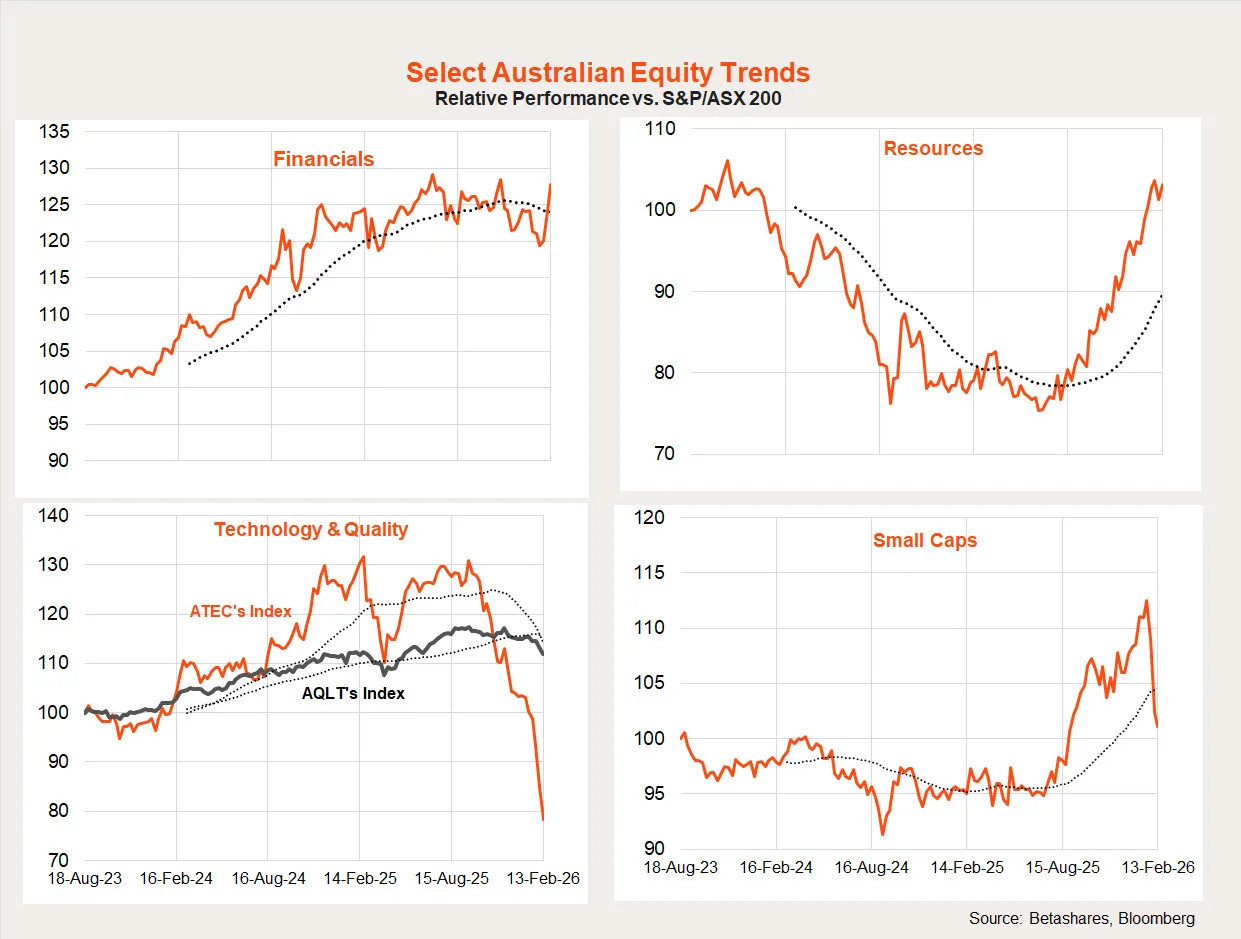

Australian equity trends

After an RBA-induced drop in the previous week, many leading sectors enjoyed decent rebounds last week. More broadly, recent trends remain in place, with a rotation from financials and technology to resources. The recent outperformance of small caps continued to unwind further last week.