5 minutes reading time

Ask five investors on the street what their financial ambitions are and there’s a good chance at least one will say their main goal is to earn extra income.

Investing for passive income has broad appeal – and it’s not just older generations driving the trend.

According to ASX data, 34% of ‘wealth accumulators’ identify building a sustainable income stream as their primary investment goal. For ‘next generation’ investors (Gen Z and Gen Y), it’s 36%.1 And with costs climbing, finding ways to outpace inflation is front of mind for many people.

We spoke to two Australian investors at very different life stages about how they’re using ETFs to build passive income.

Meet Kaleb: The 24-year-old on a single-minded mission

Not every 24-year-old has worked out what they want to do by the time they turn 40. But Kaleb is one of them.

Kaleb hard at work. (Source: Supplied)

For now, he’s working six nights a week on the Gold Coast light rail extension project as a track slab designer.

“I’ve been in full hustle mode for quite a while,” Kaleb says. “It’s pretty brutal but it pays dividends – and my bills.”

But don’t be fooled by his youth. Kaleb is a property owner and has a financial adviser, with the aim of earning enough passive income from investing that he can achieve financial independence by the age of 40.

“Within the next 10 years, the magic number would be to have at least $1.2 million invested in Betashares ETFs, which I estimate will earn me $40,000 to $50,000 in income a year,” Kaleb says.

“Obviously markets can be a bit volatile here and there but, combined with all the other things I’m doing, I think it’s achievable,” Kaleb adds.

To work towards his goal, Kaleb is investing a significant portion of his money into DHHF Diversified All Growth ETF .

His other holdings include popular ETFs like Betashares Nasdaq 100 ETF (ASX: NDQ), Betashares Asia Technology Tigers ETF (ASX: ASIA) and Betashares Global Cybersecurity ETF (ASX: HACK). He’s also invested in Betashares S&P 500 Equal Weight ETF (ASX: QUS) and Betashares Gold Bullion Currency Hedged ETF (ASX: QAU).

Finally, he made his initial investment in ARMR Global Defence ETF about six months ago – a move shaped by personal research and influenced by global tensions.

“I’d like to think about 80% of my strategy is growth-focused,” Kaleb says. “I’m in it for the long run.”

When asked for advice he’d give other young investors, Kaleb offers three simple tips.

- Start early. He began investing in ETFs and shares at the age of 21, a head start he says has made a real difference.

- Automate where you can. “If you don’t want to think about it, you don’t have to,” he says. “There’s so many things in Betashares Direct you can automate.”

- And don’t get spooked. Kaleb says investors shouldn’t be deterred by short-term noise, such as market volatility.

Meet Ian: The retired investor who wants to make his retirement a comfortable one

At the other end of the life experience spectrum is 69-year-old Ian, who’s looking to make the most of his newfound retirement.

Ian enjoying the good life. (Source: Supplied)

After decades working in the Pacific’s fisheries industry, Ian has settled into a quieter life on the New South Wales mid-north coast. Today, he owns a portfolio of ETFs, a handful of individual shares and an investment property.

But it wasn’t always this way.

“Previously, I had a fairly ad hoc approach of buying individual stocks and shares. But when I saw what Betashares was offering, I thought this is a good opportunity to take it a bit more seriously and try to get a secondary income out of it,” Ian says.

Like many, Ian started investing later in life. His asset allocation strategy has been more of a gradual evolution than a formal plan – but he says building a solid, diversified portfolio is what matters most now.

“I realise I could have been doing this a lot earlier and not messing around with the sharemarket as much,” Ian says.

“It should have been more a focused study on diversification and making sure the asset allocation was right.”

In terms of his ETFs, Ian uses Betashares Direct’s Auto-invest feature to invest $150 a fortnight into the following:

- Betashares Asia Technology Tigers ETF (ASX: ASIA)

- Betashares Australian Resources Sector ETF (ASX: QRE)

- Betashares Australian Top 20 Equities Yield Maximiser Complex ETF (ASX: YMAX)

- Betashares Energy Transition Metals ETF (ASX: XMET)

He also invests in two Betashares Managed Portfolios: High Growth and Geared Advantage.

“I like the spread that portfolios give you. It gives me some exposure to global markets, a little bit of fixed income and, of course, Australian shares,” Ian says.

His advice to other income-focused investors is to keep it simple.

“I always work on the basis that, if it sounds too good to be true, it is. Pick companies that are making a profit rather than speculative names – companies have to make a profit to pay a dividend.”

Now that he’s retired, Ian’s focus is on enjoying the lifestyle he’s worked hard to build.

“I want to continue to be able to travel, grow my wine collection and be able to afford to buy something I want when I see it.”

For the record, he’s also always wanted a Mercedes-Benz sportscar. And with retirement underway, he just might finally get behind the wheel.

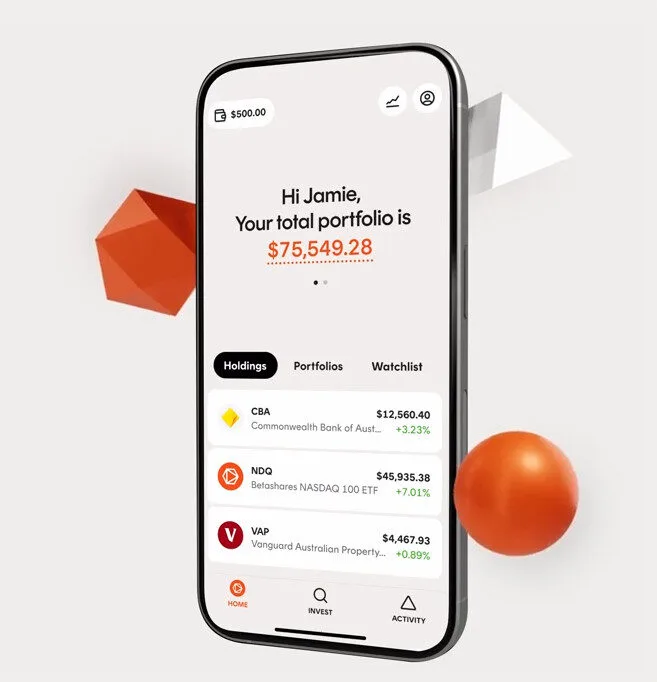

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

Sources:

1. https://www.asx.com.au/content/dam/asx/blog/asx-australian-investor-study-2023.pdf ↑

6 comments on this

ian,

try YM1JCB and hvstjob

what does the financial adviser do for the young man.. Mine has taken my funds from a retail super uni super and placed them in a wrap account with expand super and wants me to an an investment account and place 500k there I am nervous who can I talk to

Thanks Bookworm!

At Meagan, I had something similar happen to me, a financial adviser got me to take my super out of Uni Super and put it in a wrap account. Worse thing ever, it’s for him to make money, get it out and put it back into Uni Super.

at meagan you should of got a second opinion before you moved your funds put it back in the uni super i sounds like a scam to me your advisor only has his /her best interest at heart not yours

Great work on your blog post! The information you provided was practical and applicable to real-life situations. I appreciated the actionable steps you outlined. click here to uncover more practical insights.