Dollar cost averaging is a simple investing strategy that assists in mitigating market timing risk and can help you gradually accumulate wealth. Like all investing strategies, dollar cost averaging does not guarantee profit, but over time, can help in reducing the effect of market fluctuations.

Summary

- Similar to a regular savings plan, dollar cost averaging involves investing the same amount of money at set intervals over a long period – whether market prices are up or down

- Dollar cost averaging can be useful in helping investors to focus on their long-term investment goals by avoiding trying to time the markets

- If you’re a member of a superannuation fund you’re already practising dollar cost averaging indirectly via the regular concessional contributions being made by your employer

What is dollar-cost averaging?

Dollar cost averaging involves investing the same amount of money at regular intervals, for example monthly or quarterly – without regard to market movements. Investing a fixed dollar amount means that when prices are higher, your money buys fewer shares/ETF units, and when prices are lower, your money buys more.

The theory behind this strategy is that you reduce market timing risk – instead of investing your entire allocated amount in one lump sum, you can spread your investment out over a period of time. Depending on market movements, spreading out your entry points potentially can achieve a lower average cost base.

Realistically, almost all Australians practise dollar cost averaging via their superannuation. For most of us, a percentage of our salary automatically gets sent to our superannuation account of choice, and is then invested into ETFs, managed funds, direct stocks etc. This is a prime example of dollar cost averaging – consistent, regular amounts being invested regardless of how markets are performing.

Example

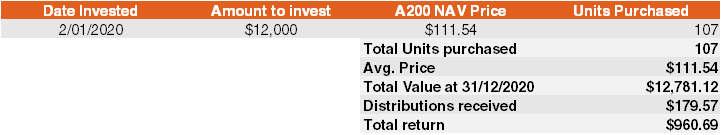

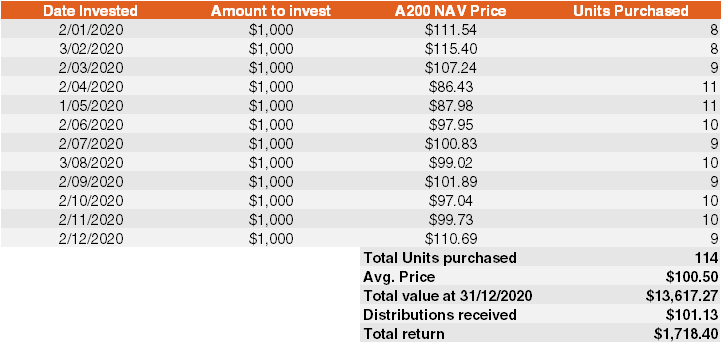

Let’s look at a simple example.*

Take a low cost, index tracking fund, like the A200 Australia 200 ETF . Let’s assume it is the beginning of 2020 and at the end of 2019, you made a New Year’s resolution to start investing some money into the stock market.

You check your bank account, and you have $12,000 to invest. Looking back over 2019, you notice the Australian market was up just over 23% and has been trending higher and higher for the last few years. You are worried that as markets approach all-time highs, you might be getting in at the top.

Rather than trying to pick ‘the best time to invest’, let us assume you deployed a dollar cost averaging strategy starting from the first investible day of the year and made the same, equal investment, each month after that.

When is dollar cost averaging most effective?

Learn more…

To continue learning about ETFs, portfolio construction and investment strategies, visit the Education Centre.

Formerly Managing Editor at Livewire Markets. Passionate about investments, markets, and economics.

Read more from Patrick.