David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

3 minutes reading time

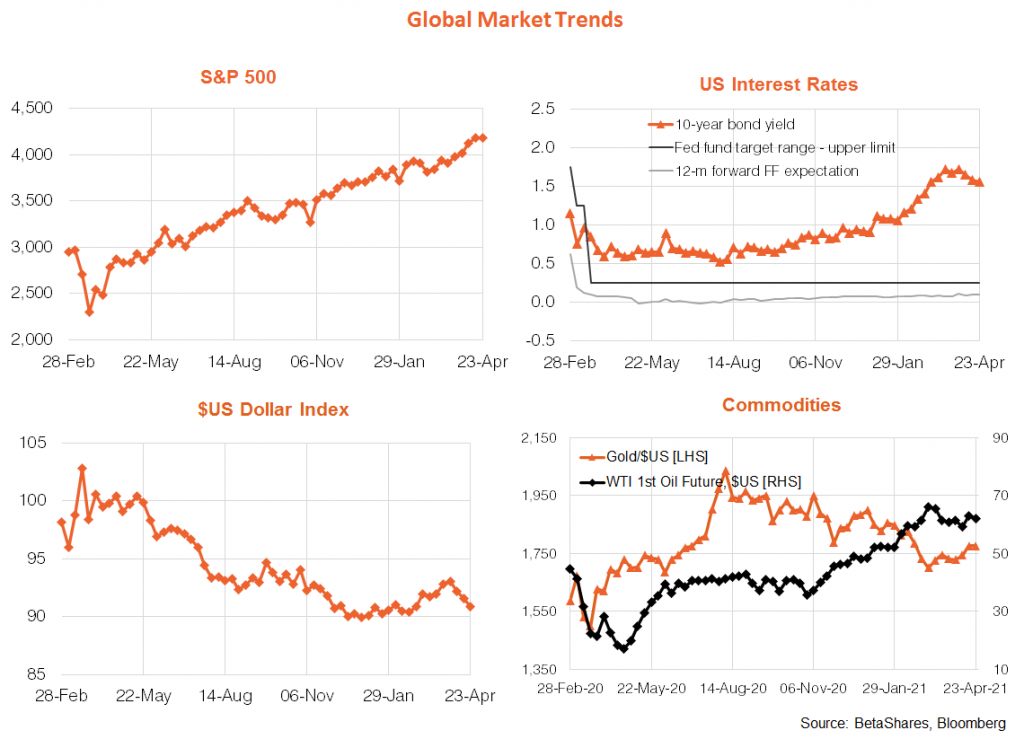

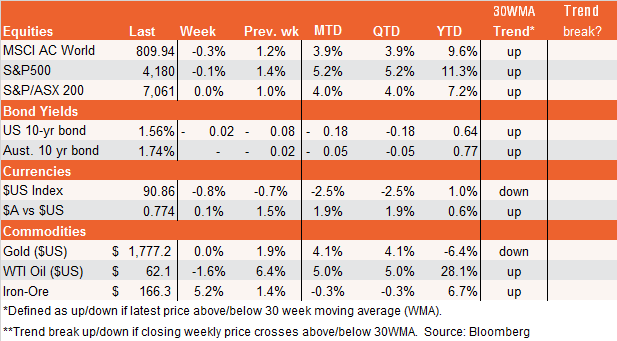

Global markets

Concern over rising COVID cases in hotspots such as Japan, Brazil and India set global equities back last week as did talk of a proposed hike in the U.S. capital gains tax for high-income earners. The end result was a small weekly pullback in stocks after four weekly gains, despite another encouraging drop in U.S. weekly jobless claims and market-beating corporate earnings reports. The more cautious market tone also kept bond yields in check, while the $US eased.

A key focus this week will remain the U.S. earnings reporting season, with tech heavy weights such as Microsoft, Alphabet, Apple and Facebook all set to present updates. While some post-COVID slowing in performance may be evident among these tech names, overall results are likely to remain solid. The first estimate of U.S. Q1 GDP is also released, with a cracking 6.5% annualised result expected (after 4.3% in Q4). The Fed also meets but is likely to reiterate it still sees no need to tighten for a while due to slack remaining in the economy.

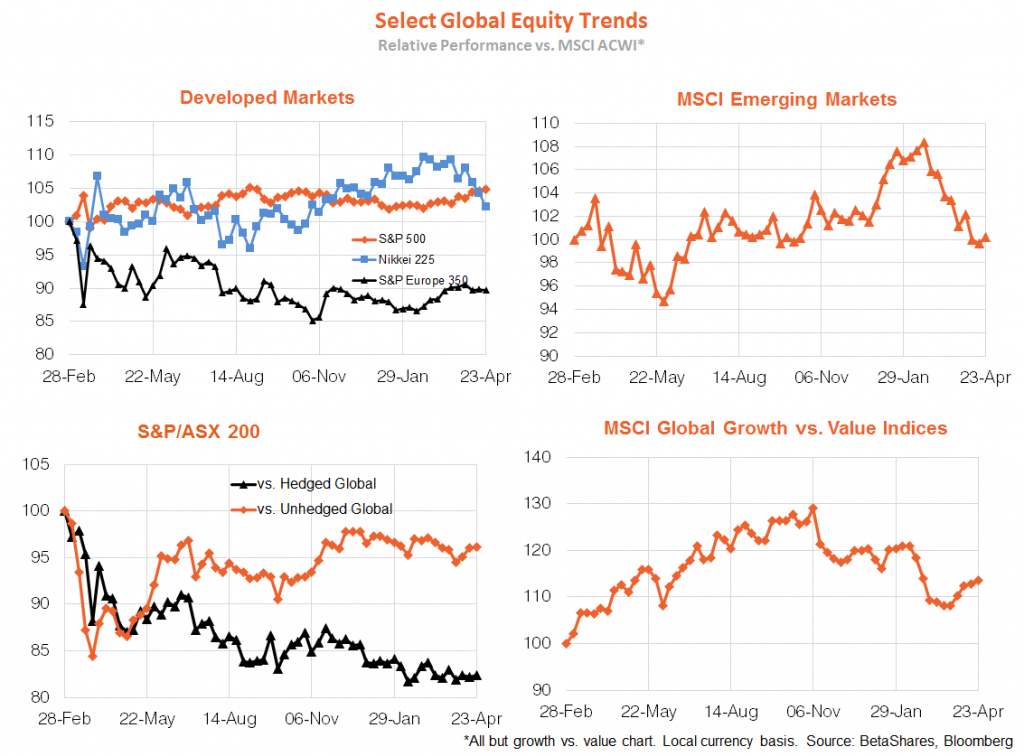

Global equity trends

Rising COVID cases have seen Japanese and European post-COVID outperformance come off the boil somewhat, with the U.S market strengthening. The recent trend of emerging markets underperformance (likely reflecting rising EM COVID cases and policy tightening in China) appears to have stabilised in recent weeks. The stabilisation in bond yields has allowed growth to hold its own versus value in recent weeks, while Australian relative performance continues to meander.

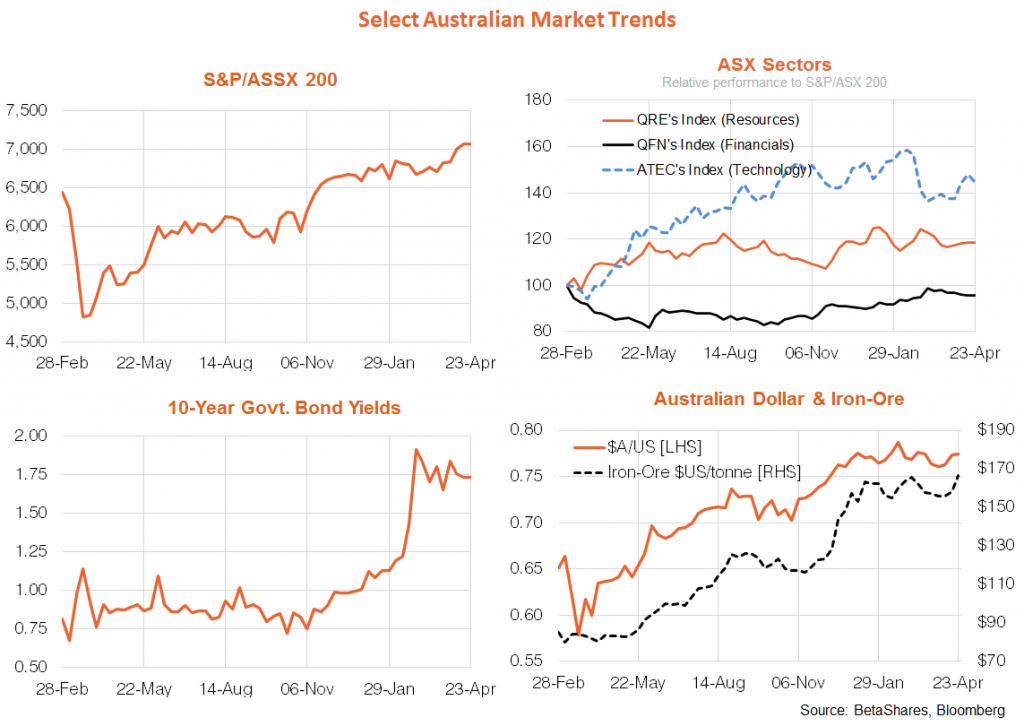

Australian market

As expected, minutes from the latest RBA policy meeting still have the Bank bending over backwards to provide support, with no hint of tightening any time soon. The Board again noted the strength in house prices – which had broadened to the more expensive capital-city market – and indicated it would continue to monitor this trend “carefully.”

March retail sales, meanwhile, were stronger than expected, rising 1.4%. Another notable development last week was a rebound in iron-ore prices, which along with a weaker $US helped support the $A and mining stocks. Despite some new steel curbs in parts of China, recovering global steel demand, China’s hunger for better quality/lower polluting iron-ore and lingering Brazilian supply disruptions continue to underpin benchmark prices.

In terms of key trends, lower bond yields and upbeat data have allowed equities to break out of their recent range. Resources and technology have lifted relative to financials in recent weeks.

The local economic highlight this week will be the consumer price index on Wednesday. This is likely to continue to show benign inflation, with the annual growth in underlying prices expected to be around 1.4%. Nothing to see here.

Of course, the other major focus this week will be the duration of Perth’s ‘mini-lockdown’ and the extent to which other states are affected and/or close their borders again. My own trip to Perth visiting clients – due to start tomorrow – appears very shaky this morning!

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.