Ether managed to hit another all-time high, but it was short-lived and the price dropped, hitting a low of $3,959 before recovering. Over the last 7 days ETH returned -5.21%, slightly outperforming bitcoin’s -8.48%.

Bitcoin’s market cap is down to $1.11T, market dominance fell to 42.11%, and the value of the entire crypto market dropped to $2.63T.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $58,775 | $66,281 | $55,705 | -8.48% |

| ETH (in US$) | $4,341 | $4,891 | $3,959 | -5.21% |

Source: CoinMarketCap. As at 21 November 2021. Past performance is not indicative of future performance. Performance is shown in U.S. dollars and does not take into account any USD/AUD currency movements.

News we are keeping an eye on

In an interview with Bloomberg television, Commonwealth Bank of Australia (CBA) CEO, Matt Comyn, said that the biggest concern around crypto for banks is being shut out completely. In the interview Mr Comyn said: “We see risks in participating, but we see bigger risks in not participating.” In regard to the asset itself, he said: “It’s important to say we don’t have a view on the asset class itself – we see it as a very volatile and speculative asset, but we also don’t think that the sector and the technology is going away anytime soon.”1 CBA announced the purchase of a small stake in the cryptocurrency exchange Gemini Trust Co., which they hope will be a long-time partnership2.

The Head of Payments Policy at the RBA, Tony Richards, said in a recent speech that the demand for crypto accompanied by price rises in the speculative asset class could start to reverse. Factors could include: households paying more attention to regulators and being less influenced by fads and a fear of missing out, high use of energy in proof-of-work consensus mechanisms which could attract greater attention from governments and policymakers, and possibly a greater focus on the (near) anonymity that cryptocurrencies offer and their potential use in facilitating financial crime and the black economy3.

Mr Richards also stated: “If there were to be global policy action to deal with some particular concerns about the use of cryptocurrencies, plus the arrival of new stablecoins and CBDCs (central bank digital currencies) that could safely meet the needs of a wide range of users, existing cryptocurrencies might then have only niche use cases, at best.”

Crypto equities

Shares in the largest North American bitcoin miner and a top 3 holding in CRYP Crypto Innovators ETF , Marathon Digital, dropped about 33% after the SEC issued a subpoena related to a partnership for a Montana data facility. The firm’s CEO, Peter Thiel, declined to comment further on the probe. Marathon is looking to raise up to $650 million by issuing debt to upgrade mining equipment and potentially fund acquisitions, according to Thiel4.

Large scale Bitcoin miners have been extremely profitable, and according to Thiel, the breakeven rate for the firm is a bitcoin price of roughly $6,500 after factoring in energy and hosting costs, which could explain the increase of almost 5X in the share price this year.

Bitcoin miners secure the Bitcoin network by competing to confirm transactions, and are a critical component of the maintenance and development of the blockchain ledger. For doing so, bitcoin miners are currently rewarded with 6.25 bitcoin per block added to the blockchain, approximately every 10 minutes. This is how new bitcoin enters into circulation.

On-chain metrics

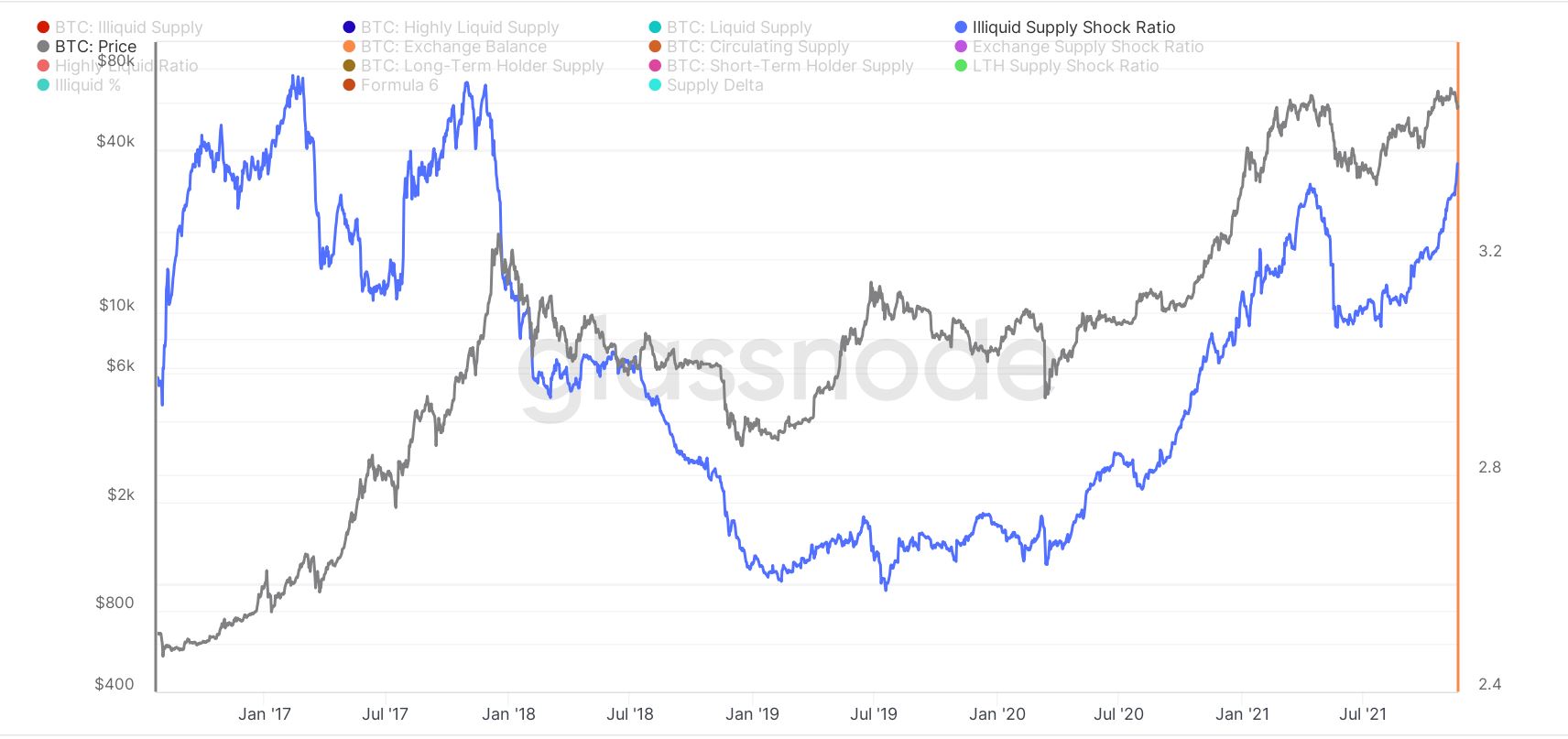

This week we take a look at the Illiquid Supply Shock (ISS) Ratio, the ratio between Illiquid Supply, and the sum of Liquid and Highly Liquid Supply. This metric could be considered a leading indicator, and gives an insight into entities whose holdings of bitcoin are considered ‘illiquid’, and whether they are currently buying or selling. An entity’s holdings are considered illiquid if the entity spends 25% or less of the coins that it takes in.

Citing data from on-chain analytics company Glassnode, we look at the ISS Ratio. Even with the bitcoin price recently setting an all-time high, coupled with a sell-off taking the price back down below $60K, the ISS Ratio has continued to trend higher, meaning buying from these entities has continued. In the past, mass selling of bitcoin from these entities has coincided with bull-market tops, as you can see in the chart in 2017 and earlier this year in April/May, and selling from these ‘illiquid’ entities gives reason for caution.

Illiquid Supply Shock Ratio

Source: Glassnode.

Altcoin news

A new entrant to the Top 15 with a return of over 56% in the last 7 days is the Crypto.com (CRO) token. Driving the price higher was an historic naming rights deal announced last week. Reportedly, it is the single largest naming rights deal in the history of an American venue at $700m over the next 20 years. The iconic Staples Centre in Los Angeles, which hosts LA-based NBA teams, cultural and entertainment industry events, will now be known as the Crypto.com arena. The sponsorship is one of many Crypto.com sponsorships, which include F1, UFC, Aston Martin, and the Philadelphia 76s5.

The token itself can be used in Crypto.com’s ecosystem. According to coinmarketcap, the CRO blockchain is mainly focused on providing utility to the users of Crypto.com’s payment, trading and financial services solutions. CRO owners can stake their coins on the Crypto.com Chain to act as a validator and earn fees for processing transactions on the network. Additionally, CRO coins can be used to settle transaction fees6.

| Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.bloomberg.com/news/articles/2021-11-18/biggest-risk-of-crypto-is-missing-out-warns-top-aussie-banker?sref=6EQWk76O

2. https://www.smh.com.au/business/companies/cba-takes-stake-in-major-crypto-exchange-gemini-20211119-p59abv.html

3. https://www.rba.gov.au/speeches/2021/sp-so-2021-11-18.html

4. https://www.bloomberg.com/news/articles/2021-11-17/bitcoin-needs-to-drop-80-before-marathon-loses-money-on-mining?sref=6EQWk76O

5. https://www.nytimes.com/2021/11/18/technology/crypto-staples-center-la.htmlhttps://coinmarketcap.com/currencies/crypto-com-coin/

6. https://coinmarketcap.com/currencies/crypto-com-coin/

Off the Chain will be published every Tuesday, and provide highlights of key developments in bitcoin and the rest of the crypto market along with analysis, insights and the latest news in the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.