What is a geared fund (GGUS)?

GGUS is ‘internally geared’, meaning all gearing obligations are met by the Fund. GGUS combines funds received from investors with borrowed funds and invests the proceeds in a broadly diversified share portfolio consisting of the largest 500 shares listed in the U.S. by market capitalisation (as measured by the S&P 500 Index). The Fund’s gearing ratio (being the total amount borrowed expressed as a percentage of the total assets of the Fund) is managed between 50-65%.

Why invest in GGUS?

If you want:

- Geared exposure to the returns of the S&P 500 (LVR expected to range between 50-65%, 2x – 2.86x).

- No margin calls for investors.

- Diversification into U.S. equities relative to the S&P/ASX 200.

- Ability to gain exposure to the U.S. share market via the Australian Securities Exchange (ASX).

- A fund with a transparent, real time pricing guide.

- Currency hedged

Let’s go through each of these in turn.

1. Geared exposure

If you are an investor who is comfortable with equity market volatility and want more bang for your buck (between 2 to 2.86 times more bang to be precise), then this fund may appeal to you. If the S&P 500 goes up 1% on a day, we expect GGUS to go up between 2% to 2.86%. Likewise, if the S&P 500 goes down -1% GGUS will go down -2% to -2.86%

Why does GGUS move 2%-2.86% on a day if the S&P 500 moves 1%? 2x to 2.86x is the range within which the ‘gearing multiple’ can fluctuate. This is a function of the LVR (loan to value ratio, which is 50%-65%) explained in the Product Disclosure Statement (PDS).

We do not dynamically adjust the gearing multiple to take advantage of an expected market rise or lower it to cushion an expected market fall. The gearing multiple fluctuates in response to U.S. sharemarket movement and currency (even though the fund is currency hedged.) We reset the gearing multiple back towards the middle of the gearing multiple range only when one of the boundaries is reached. Hang on to your hat! It will be a bumpier ride.

2. Geared, but no margin calls?

Right. Debt is met from inside the fund, not via a margin account, so there are no potential margin calls to be paid directly by the investor.

3. Diversification

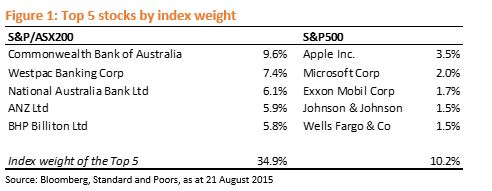

The U.S. economy doesn’t look much like the Australian economy. Let’s compare the S&P 500 against S&P/ASX 200. These are similar in the sense that they are the dominant local indices and are both market capitalisation weighted. As the names suggests, the S&P 500 is generally made up of 500 securities, the S&P/ASX 200 generally has 200, the most obvious difference. The S&P 500 has less stock level concentration than the S&P/ASX200. This brings us to the top five stocks in each index. In Australia at present the top five stocks are made up of our big four banks and BHP, which combined make up almost 35% of the index. In the US the top 5 are Apple, Microsoft, Exxon, Johnson & Johnson and Wells Fargo which make up around 10% combined. Figure 1 shows the top 5 stocks by index weight. As you can see, the Australian market is more concentrated than the US.

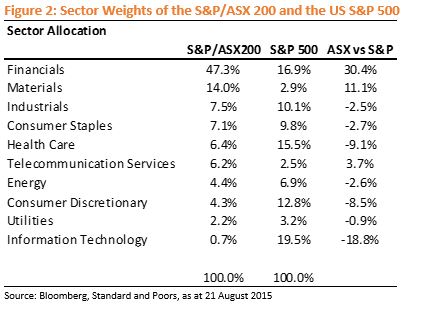

I mentioned that the US economy doesn’t look much like the Australian economy. Figure 2 shows the sector weights of both indices and the third column, ASX vs S&P, shows the difference in the sector weights. At time of writing the Australian market had 30.4% more in the Financials sector (thanks to the big four banks), was 11.1% heavier in the Materials sector (BHP) and at 0.7% of the index had 18.8% less in Information Technology compared to the S&P 500. Australia doesn’t have much IT – no disrespect to the Australian Computershare and Carsales.com, but they’re no Apple or Microsoft.

4. Ability to invest in the U.S. market on the ASX

The Geared U.S. Equity fund can be bought via the ASX, ticker GGUS. This means that GGUS can be traded on the ASX just like any other share during market hours.

5. Transparent, real time pricing guide

Like all of BetaShares Funds, market makers make bids and offers at a margin around fair value. Individuals can trade within this price range around fair value at pretty much any time the market is open. When the U.S. market is not open, market makers have an expectation of what fair pricing should be from the futures market, as it gives the best indication of where the stocks are expected to open. Whilst the fund does not trade futures, they provide price guidance so a fair pricing indication can be accessed whenever the Australian market is open.

6. Currency hedged

US dollar exposure of the fund is hedged back to Australian Dollars, so there is minimal currency exposure. This works so that whenever units are created in GGUS, the fund deposits money in an Australian dollar at call account. BetaShares needs to do two things to provide geared exposure to the US market that is currency hedged. Firstly, BetaShares has set up a U.S. dollar debt facility which allows GGUS to take out U.S. dollar debt. So when units are created in the Fund, GGUS takes out a ‘geared multiple’ of the Australian dollar deposit in U.S. dollar debt. Secondly, BetaShares uses the proceeds of the debt to buy exposure to a portfolio of shares consisting of the largest 500 shares listed on the U.S. market. The U.S. dollar denominated debt offsets the U.S. dollar stock exposure, so at the outset there is no net USD exposure. BetaShares actively monitors the hedging and gearing levels as stock and currency fluctuate. We trade stock and currency to maintain the ratios within the ranges given in the PDS.

GGUS Geared U.S. Equity Fund – Currency Hedged (hedge fund)

This article mentions the following funds

Written by

Betashares ETFs

2 comments on this

Are you able to explain to me if the S&P 500 is currently at record highs, why the GGUS is still trading 17% below its $40.74 price in December 2021?

Hi Wayne,

Thanks for your comment.

It is important to note that the gearing ratio for GGUS will generally vary between 50% and 65% on a given day. This means that the Fund’s geared exposure is anticipated to vary between 200% and 286% of the Fund’s Net Asset Value on a given day. The Fund’s portfolio exposure is actively monitored and adjusted to stay within this range.

The Fund’s returns will not necessarily be in this range over periods longer than a day, due to the effects of rebalancing to maintain the Fund’s daily target geared exposure range and compounding of investment returns over time. The Fund’s returns over periods longer than one day may differ in amount and possibly direction from the daily target geared return range. This effect on returns over time can be expected to be more pronounced the more volatile the broad US sharemarket and the longer an investor’s holding period. As such, due to the effects of rebalancing and compounding of investment returns over time, investors should not expect the Fund’s Net Asset Value to be at a particular level for a given value of the broad US sharemarket at any point in time.

I hope this helps!

Cheers,

Dina