The crypto market bounced higher over the last week, with Ethereum leading the way. Bitcoin hit its highest level in more than a month with hopes that the shakeout of the past few weeks is nearing an end.

The stronger Ethereum move was in part attributed to news of final testing steps towards the migration or ‘the Merge’ where ETH will move from proof-of-work to proof-of-stake, which is projected to take place in September. Given the precipitous decline of the last few months, a relief rally is unsurprising.

At the time of writing, bitcoin is trading at US$22,630. Ethereum was up 17.68% vs bitcoin’s 5.72% for the week.

Bitcoin’s market cap increased to US$432.6B, with the total crypto market back above US$1 trillion, at $1.04T. Bitcoin’s market dominance fell slightly to 41.51%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $22,630 | $24,196 | $20,778 | 5.72% |

| ETH (in US$) | $1,601 | $1,641 | $1,329 | 17.68% |

Source: CoinMarketCap. As at 24 July 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

News we’re watching

SEC’s work on crypto regulation

Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), outlined what to expect from the securities watchdog on crypto regulation in an interview with Yahoo Finance. “More broadly, the public right now would benefit from investor protection around these various service providers – the exchanges, the lending platforms, and the broker-dealers. We at the SEC are working in each of those three fields… and talking to industry participants about how to come into compliance or modify some of that compliance.” He said that areas being looked at are the tokens, the stablecoins, and the non-stablecoins.

“The public benefits by knowing full and fair disclosure and that somebody is not lying to them … basic protection,” the SEC boss emphasised.1

BNP Paribas to introduce crypto custody services

French international banking group BNP Paribas reported that it will develop a custodial service offering for bitcoin and other digital assets through two new partnerships. BNP Paribas is the second-largest banking group in Europe after HSBC, and one of the biggest across the globe. It has over 190,000 employees and around $612 billion in assets under management.

The bank will partner with Metaco, a Swiss-based crypto custody provider, in order to facilitate the infrastructure needed to integrate the custodial offering with its existing infrastructure. BNP will also partner with blockchain platform Fireblocks to offer hot wallet and tokenisation services, and in the development of a connectivity layer. The offering will also enable users to transfer, hold and issue related digital assets, such as tokenised bonds. BNP will be able to offer cryptocurrency custody services to its 60 million customer base.2

Tesla sells Bitcoin holdings

Tesla sold some of its bitcoin holdings netting the company $936 million in cash, according to its Q2 2022 earnings report released last week. Only 25% of its original holdings purchased last year remains.3 Tesla initially purchased $1.5 billion worth of bitcoin in February 2021, fueling a rally for the cryptocurrency into April, but also led the sell-off in the asset after ceasing to accept bitcoin for car payments the following month due to environmental concerns surrounding bitcoin mining.

Tesla CEO, Elon Musk, stated on the earnings call: “We are certainly open to increasing our bitcoin holdings in the future, so this should not be taken as some verdict on bitcoin, it’s just that we were concerned about overall liquidity for the company, given Covid shutdowns in China.”4

On-chain metrics

Bitcoin (BTC): Realised Price

Realised Price is the average cost basis for all coins on the network. The realised price is interesting to look at as it can act as both major support and resistance levels. As the BTC price goes up, and new investors begin to buy Bitcoin, the average purchase price increases. The opposite happens as the price of BTC begins to fall, losses are realised and BTC is rebought at lower levels, lowering the realised price. Historically, market price trading below realised price has tended to represent cyclical bottoms for bear markets.

Looking at data from on-chain analytics company Glassnode, the price of BTC has traded below the realised price for over a month, but is now back above. Following the mass selling between May and July, new buyers have come to market putting investors in a much healthier position and as a result, a genuine bottom formation could arguably be underway.

Source: Glassnode. Past performance is not indicative of future performance.

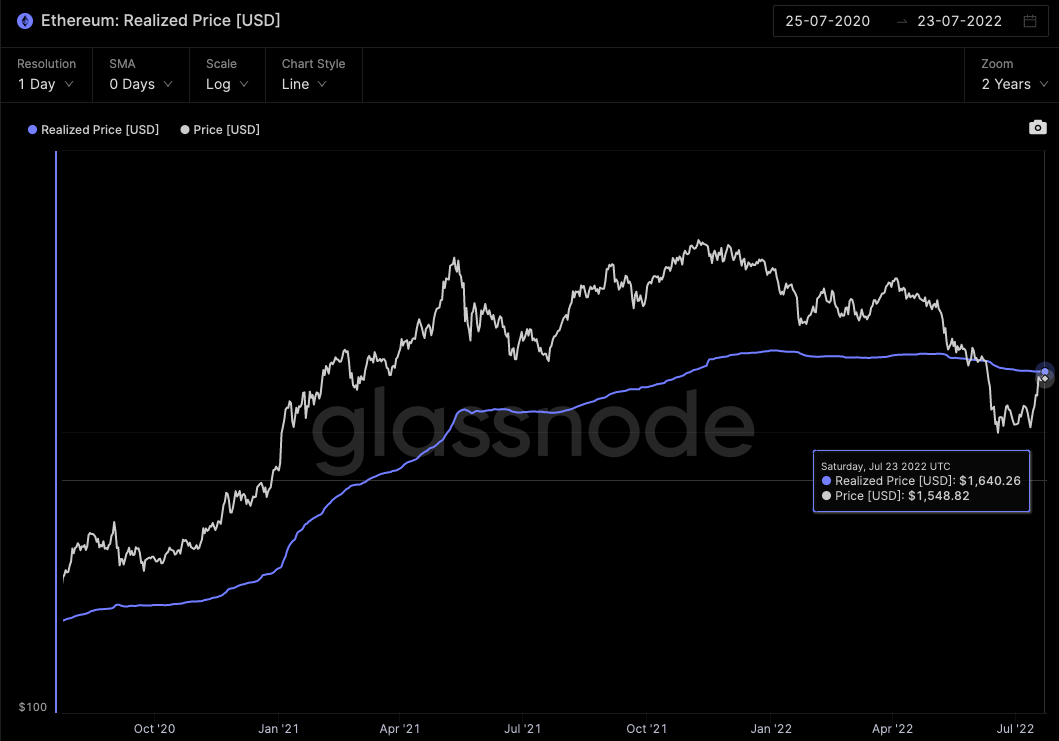

Ethereum (ETH): Realised Price

Looking at the realised price data for Ethereum, ETH is almost trading back to its realised price after the significant price increase over the last week. ETH may face resistance at current levels, but if the market price can push through this resistance, then a new level of support may possibly form.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Co-founder of Ripple, Jed McCaleb, has nearly emptied his XRP wallet. McCaleb co-founded Ripple but left the company in 2014 to start altcoin Stellar. As co-founder, McCaleb held approximately 9 billion XRP which was locked-up, and which he was allowed to sell or transfer only under specific conditions. Over the last eight years, the co-founder has been selling his stash, but was limited by these restrictions.5 Ripple has also been plagued by a lawsuit with the SEC since December 2020, as the SEC is alleging XRP itself is a security and claims all sales of XRP are illegal.

Ripple is a money transfer network designed to serve the needs of the financial services industry. XRP is the native cryptocurrency of the Ripple network, and has consistently placed in the top 10 cryptocurrencies by market capitalisation since 2017. A win or settlement in the SEC case in conjunction with less selling pressure from the ex co-founder could arguably be bullish for the popular cryptocurrency.

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://dailyhodl.com/2022/07/18/sec-chair-gary-gensler-points-to-whats-coming-for-crypto-regulation-in-next-several-months/

2. https://www.coindesk.com/business/2022/07/19/french-banking-giant-bnp-paribas-enters-crypto-custody-space-sources/

3. https://www.cnbc.com/2022/07/20/tesla-converted-75percent-of-bitcoin-purchases-to-fiat-currency-in-q2-2022.html

4. https://blockworks.co/elon-musk-teslas-bitcoin-sale-not-a-verdict-on-the-asset/?utm_source=Sailthru&utm_medium=email&utm_campaign=Daily%20NL%20Thursday%206.21.22&utm_term=Daily%20Newsletter

5. https://news.bitcoin.com/jed-mccalebs-tacostand-xrp-wallet-is-near-empty-after-the-ripple-co-founder-transferred-9-billion-xrp-over-the-years/

Off the Chain will be published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.