David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

6 minutes reading time

Week in review

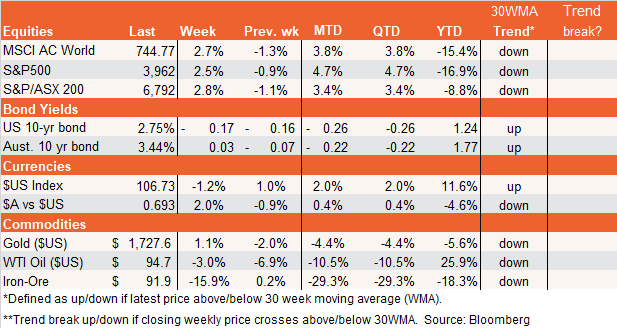

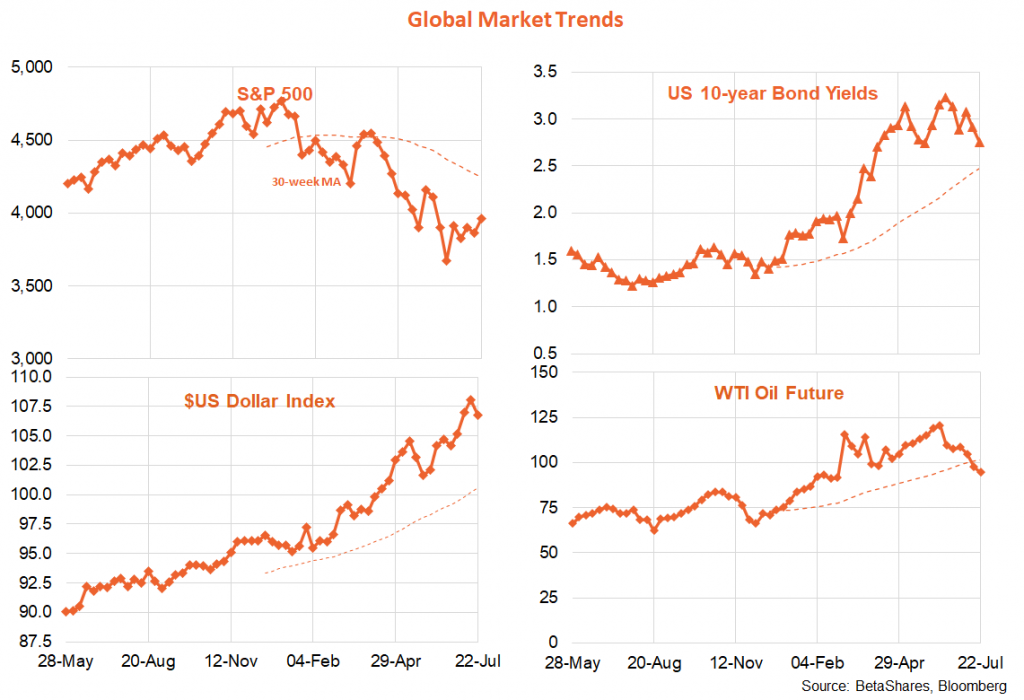

It was a topsy-turvy week for global equities, with investors still unsure whether to laugh or cry in the face of mixed earnings reports and weakening economic data. In terms of major global markets, equities are still trying to stage a recovery, taking heart from falling commodity prices and bond yields even as this means growth is also weakening. The $US consolidated last week, partly reflecting the larger than expected 0.5% rate hike from the European Central Bank.

All up, what’s clear is that there are increasing signs that the US economy is on the verge of tipping into recession unless the Fed relents sometime soon. Key service and manufacturing data took a leg down last week, a range of housing indicators dropped sharply and weekly jobless claims continued to move higher. At the same time, however, the good news is that weaker demand appears to be easing supply bottlenecks and some price pressures.

We’re essentially in a race against time. Will US inflation slow quickly enough for the Fed to pivot and save the economy from recession? Or will it linger, thereby compelling the Fed to keep hiking – or at least refrain from cutting quickly – lest it allow persistently high inflation to embed itself into inflation expectations and wage/price setting behaviour (thereby repeating the mistakes of the 1970s).

My base case view since mid-June is that the US economy will lose the race and the Fed won’t flinch – meaning we’ll get recession and disinflation. Indeed, given America’s still very tight housing and labour markets and the still tight global oil market, it seems we need a decent slowdown in demand (and hence likely recession) to ensure inflation comes back down in a timely fashion.

Australia is facing similar challenges, although it remains the case that officially reported wage growth remains quite a bit tamer than in the US. That said, comments from RBA Governor Lowe and Deputy Governor Bullock last week suggest the RBA seems intent on containing inflation expectations also – especially given now high core and headline inflation and the lowest unemployment rate in a generation. The RBA seems on track to hike rates to what it considers the minimum likely ‘neutral’ rate of 2.5%, and likely now has a base case to get to at least 3% to err on the side of restraint.

The big debate in Australia now is not so much whether the RBA should at least get back to neutral (most think that reasonable) but rather exactly where neutral might be. Some of the RBA’s biggest critics implicitly assume neutral is now a lot lower than 2.5%, and blindly just heading to that rate will unnecessarily crush economic growth (especially given still benign official wage estimates). My view? We’re clearly unlikely at neutral now – so the RBA has more work ahead, but the higher rates go, the more important it is to pause and assess the impact of what’s already been done before further aggressive hikes.

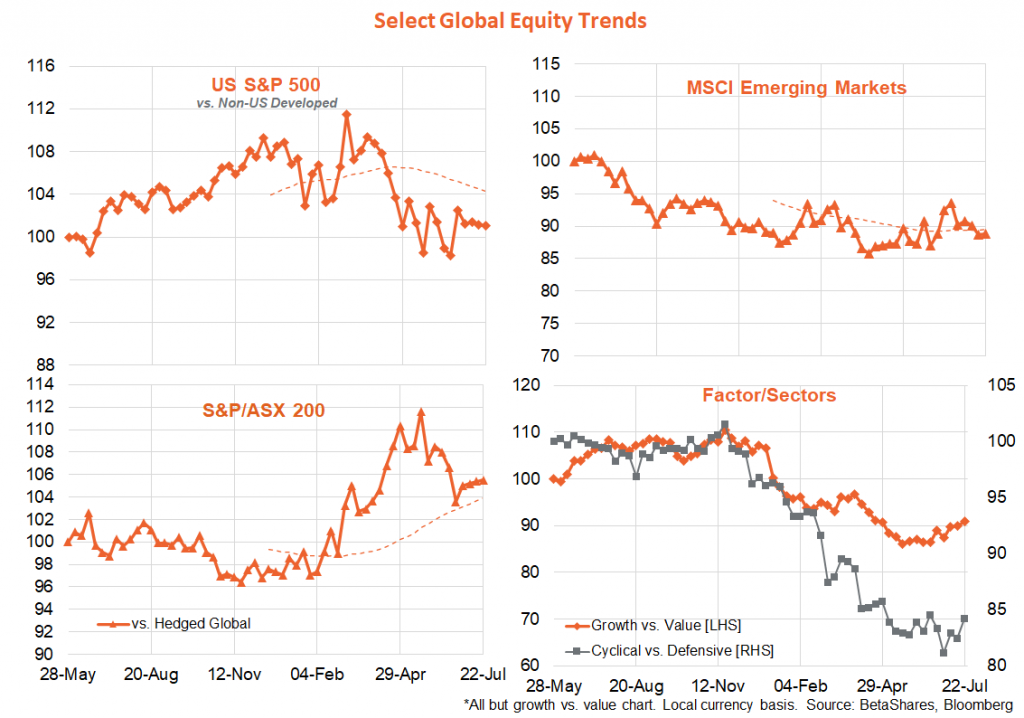

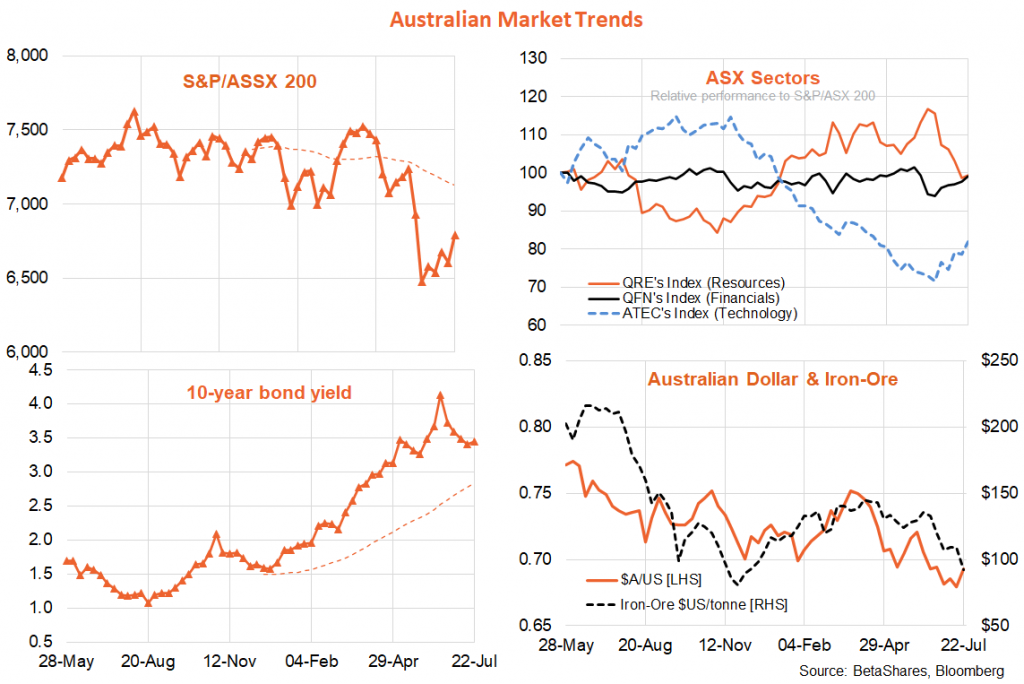

Within equity markets, the underperformance of growth versus values continues to bottom out as bond yields move lower, while even cyclicals have attempted a comeback over defensive sectors in recent weeks.

In Australia, iron-ore prices dropped further last week, which should help constrain any further rebound in the $A. In line with lower bond yields, the growth/technology sector has improved its relative performance compared to resources.

The week ahead

It is a big week! The major event will of course be Wednesday’s US Federal Reserve announcement, with a further 0.75% rate hike now widely anticipated. Interest will again be in Fed chair Powell’s press conference – will he remain very hawkish or hint at a potential pause sometime soon? I suspect the Fed will try very hard not to give markets too much cheer with regard to policy at this stage, even while again expressing hope that a recession can be avoided.

In this regard, Thursday’s preliminary estimate of Q2 GDP will be interesting as there is a risk of a negative outcome, which would at least tip the US into a technical recession with two successive quarters of negative economic growth. Note consensus forecasts suggest a modest positive outcome of 0.4%, even while the Atlanta Fed’s latest GDP Now forecast suggests negative 1.6% growth.

Also key will be Friday’s June US private consumption deflator. While lower oil prices should contain growth in headline prices, core prices (i.e. excluding food and energy) are expected to lift 0.5% (after 0.3% in May) keeping annual core inflation at an uncomfortably high 4.7%. Similarly, the Q2 US employment cost index is expected to show still firm quarterly wage growth of around 1.2%. Also on Friday, the University of Michigan releases its latest estimate of 5-year ahead US household inflation expectations – which have moderated lately after a worrying lurch higher some months ago.

It’s also a bumper week for US Q2 earnings reports – with tech heavies such as Amazon, Alphabet, Microsoft and Meta all reporting. As evident on Friday with Snap’s poor result, focus will be on the extent to which online advertising revenue is slowing in line with the economy. According to FactSet, of the 21% of S&P 500 companies that have reported so far, 68% have beaten estimates, which is below the five-year average of 77%. The average earnings beat is 3.6%, which is also below the five-year average of 8.8%. That said, there was a small upgrade to overall expected Q2 earnings last week, due to some better than expected outcomes in the energy and health care sectors.

Not to be outdone, Australia’s Q2 consumer price index report is also released on Wednesday, with a further acceleration in both headline (from 5.1% to 6.3%) and trimmed mean (3.7% to 4.7%) annual inflation expected due to gains in petrol, food and housing construction costs. Much higher outcomes will increase talk of a potential 0.75% rate hike by the RBA next week, which can not be ruled out given the Bank’s focus on being seen to be ‘ahead of curve’ to contain inflation expectations.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.