Since the time of writing (17 July) to this morning, the total crypto market cap has surpassed US$1T, driven primarily from significant price appreciation of many altcoins. Ethereum now has a 7-day price increase of 35%.

Bitcoin has continued to trade rangebound, unable to break the US$22,500 mark, but it broke a milestone last week as more than 1 billion unique wallets have now transacted with bitcoin. Ethereum had a strong week after a tentative date in September was announced for the network’s merge. Another crypto lender has filed for bankruptcy and the New York Yankees are set to pay employees in bitcoin.

At the time of writing, bitcoin is at US$21,401.

Ethereum returned 13.97% vs bitcoin’s 0.22% for the week.

Bitcoin’s market cap grew to US$408.6B, while the total crypto market sits at US$973.1B. Bitcoin’s market dominance decreased to 42%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $21,401 | $21,600 | $18,999 | 0.22% |

| ETH (in US$) | $1,357 | $1,378 | $1,019 | 13.97% |

Source: CoinMarketCap. As at 17 July 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

News we’re watching

Celsius declares bankruptcy

Another one bites the dust.

Celsius, a crypto lender that saw peak assets close to US$25B, has filed for chapter 11 bankruptcy. This comes approximately one month after the platform halted customer deposits, withdrawals and interest payments on deposited crypto, and two weeks after it fired 150 staff members. Celsius grew to be a significant player in the digital assets space, offering an 18% yield to depositors of certain crypto currencies.

According to the filing, the company’s total assets fell 80% from their October 2021 peak to just US$4.3B, while owing US$4.7B to its customers (and having US$5.5B in total liabilities). Vermont’s Department of Financial Regulation (DFR) has joined in on a multi-state investigation of the crypto lender, saying: “Celsius deployed customer assets in a variety of risky and illiquid investments, trading, and lending activities… Celsius compounded these risks by using customer assets as collateral for additional borrowing to pursue leveraged investment strategies.”1

Depositors to Celsius may technically be classified as “unsecured creditors”, according to Celsius’s terms of use, meaning they sit on the lower end of 100,000+ creditors to be repaid.

New York Yankees partner with Bitcoin Payroll Platform

The iconic New York Yankees have signed a multi-year deal with the digital assets financial services firm New York Digital Investment Group (NYDIG).

According to the official press release, Yankees employees are set to receive part of their post-tax salary in the form of bitcoin. The NYDIG conducted a survey of the Yankees’ workforce, finding 25% of workers are interested in receiving a portion of their salaries in bitcoin. For employees under 30 years the proportion is 36%. With no transaction fees involved, the platform, however, does not let its users transfer their coins to external wallets nor receive the asset from external sources.

“For employees of the Yankees and beyond, the opportunity to allocate a small slice of their pay to a Bitcoin Savings Plan can be one of the most efficient ways to save bitcoin, and the dollar-cost averaging can smooth out the bumps along the way”, said NYDIG’s Chief Marketing Officer.2

The Yankees are not the first major deal that NYDIG has closed. The digital assets firm has also inked deals with the likes of Deloitte, Idaho Central Credit Union and the NBA’s Houston Rockets.

Ethereum merge likely in September

Ethereum Foundation’s Tim Beiko announced last week that the long-awaited Ethereum merge is likely to happen in September. The merge is a term used to describe the transition from a Proof-of-Work (PoW) validation to Proof-of-Stake (PoS). The merge will reduce Ethereum’s carbon footprint by about 99.9%, at the same time increasing the scalability of the network.

According to CoinBase: “Today’s PoW mechanism, whereby miners compete to secure the network by solving complex computational puzzles, is the consensus algorithm that secures the bitcoin blockchain, but it has been criticised for its high energy costs. PoS – versions of which have already been adopted by chains like Solana and Tezos – replaces miners with validators. Validators can stake 32 ETH with the Ethereum network for the chance to get randomly selected to add blocks (bundles of transactions) to the chain.”

The merge is an attempt to solve the “Blockchain Trilemma”, a term coined by the Ethereum team that highlights the trade-offs between scalability, security and decentralisation. Many crypto currencies have one or two of these features down, but lack all three. For example, Ethereum currently lacks scalability as it is only capable of handling 30 transactions per second, compared to Visa’s 24,000. This is one reason why Ethereum’s gas fees can reach exorbitant levels and is a primary roadblock more broadly to crypto’s attempt to replace centralised finance. It’s estimated that Ethereum’s network will be capable of handling up to 100,000 transactions per second after the merge is complete, a 30,000-fold increase from current levels.3

On-chain metrics

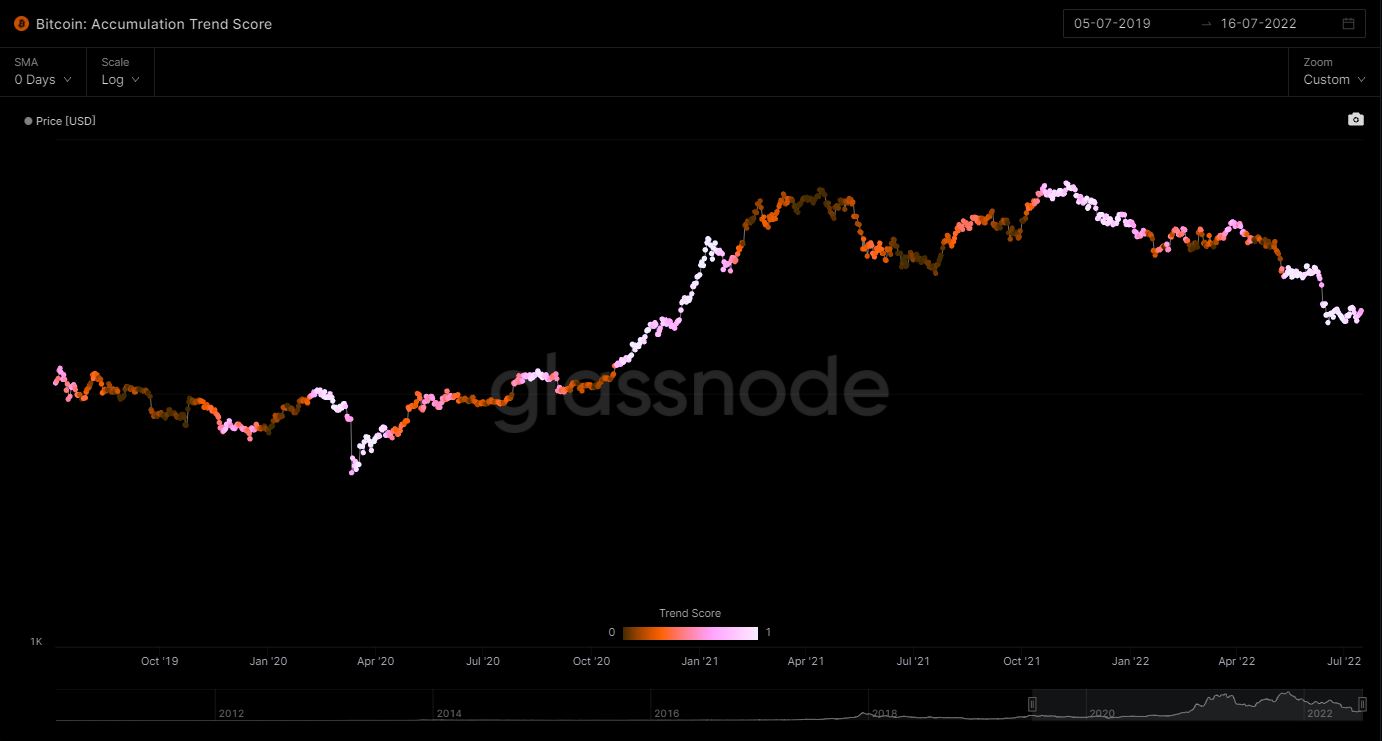

Bitcoin (BTC): Accumulation Trend Score

The Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings. The Accumulation Trend Score represents both the size of an entity’s balance (its participation score), and the amount of new coins it has acquired/sold over the last month (its balance change score). An Accumulation Trend Score of closer to 1 indicates that on aggregate, larger entities (or a big part of the network) are accumulating, and a value closer to 0 indicates they are distributing or not accumulating. This provides insight into the balance size of market participants, and their accumulation behaviour over the last month.

At each of the last two price drops of bitcoin, around ~US$30K and ~US$20K, wallets with larger balances have been accumulating bitcoin more than they have been distributing, in aggregate.

Source: Glassnode. Past performance is not indicative of future performance.

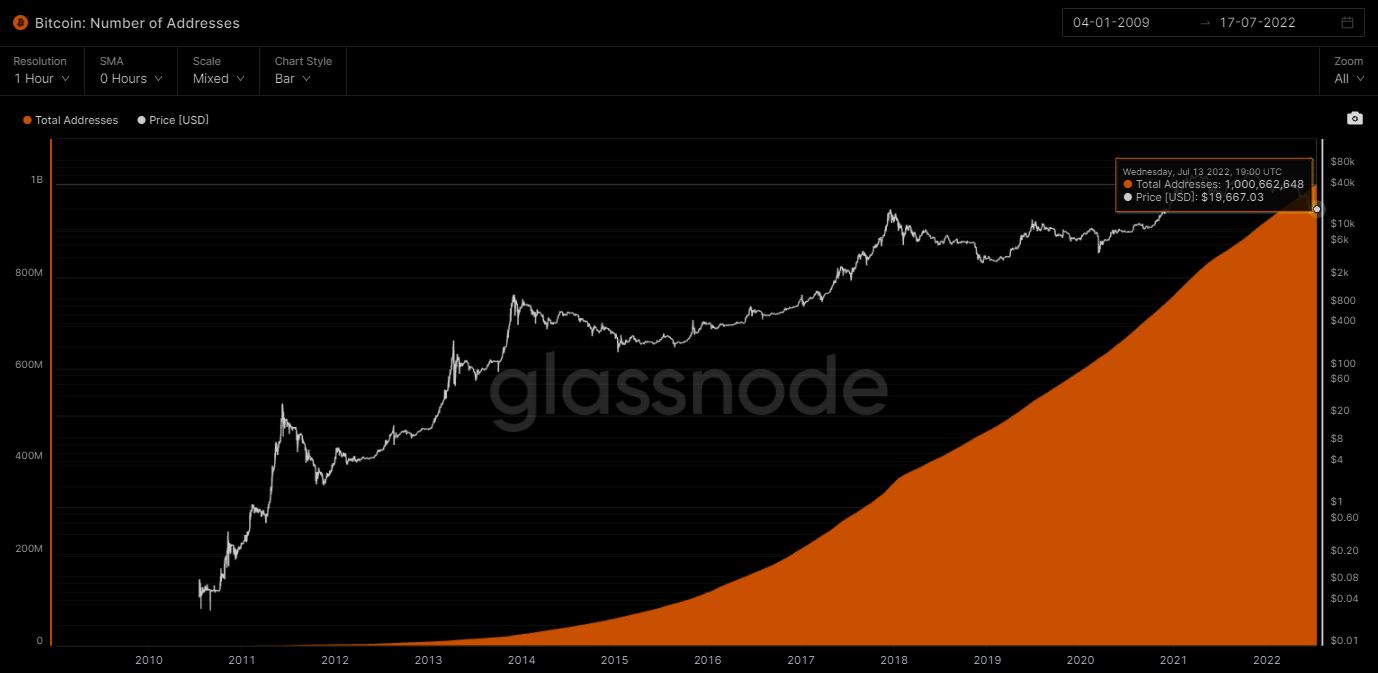

Bitcoin (BTC): Number of Addresses

Bitcoin’s number of addresses is defined as the total number of unique addresses that ever appeared in a transaction of the native coin in the network.

The metric passed a significant milestone last week, with more than 1 billion unique addresses used in a bitcoin transaction.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Last week, Walt Disney announced that Polygon (MATIC) will be one of six companies invited to join the 2022 Disney Accelerator. Polygon is a scalable blockchain network that allows developers and enterprises to build Web3 experiences. Polygon has seen significant media attention of late, announcing partnerships with Meta (previously Facebook), Reddit, Nothing and Stripe.

Disney’s program is aimed at accelerating the growth of innovative companies, and the class of 2022 can expect to receive guidance from Disney’s senior leadership team, as well as a dedicated executive mentor. Bonnie Rosen, General Manager of the Disney Accelerator program, commented: “For nearly a century, Disney has been at the forefront of leveraging technology to build the entertainment experiences of the future… we look forward to furthering our commitment to innovation and continuing to bring magical experiences to Disney audiences and guests for the next 100 years.”

Ryan Wyatt, CEO at Polygon Studios, tweeted: “The hits keep on comin’! Polygon has been invited to Disney’s prestigious Accelerator program. We were the only blockchain selected. It speaks volumes to the work being done here, and where we’re going as a company.” MATIC’s price increased 25% on the day of the announcement.4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.smh.com.au/business/markets/crypto-lender-celsius-files-for-bankruptcy-after-cash-crunch-20220714-p5b1pq.html

2. https://www.investing.com/news/cryptocurrency-news/new-york-yankees-to-pay-workers-in-bitcoin-btc-in-partnership-with-nydig-2847779

3. https://www.coindesk.com/tech/2022/07/15/ethereums-merge-projected-for-september-according-to-soft-timeline/

4. https://thewaltdisneycompany.com/2022-disney-accelerator-participants-announced/

Off the Chain will be published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Benjamin Cahill