3 minutes reading time

Rare dip for ETF assets, despite strong flows

-

The Australian ETF industry recorded a rare dip in terms of assets, as positive inflows were not enough to offset global sharemarket declines during February

-

February saw ETF industry assets fall less than one per cent (-0.81%) month-on-month, for a total monthly market cap decline of $2.1B. The industry now sits at $255.3B – just shy of the all time high set last month

-

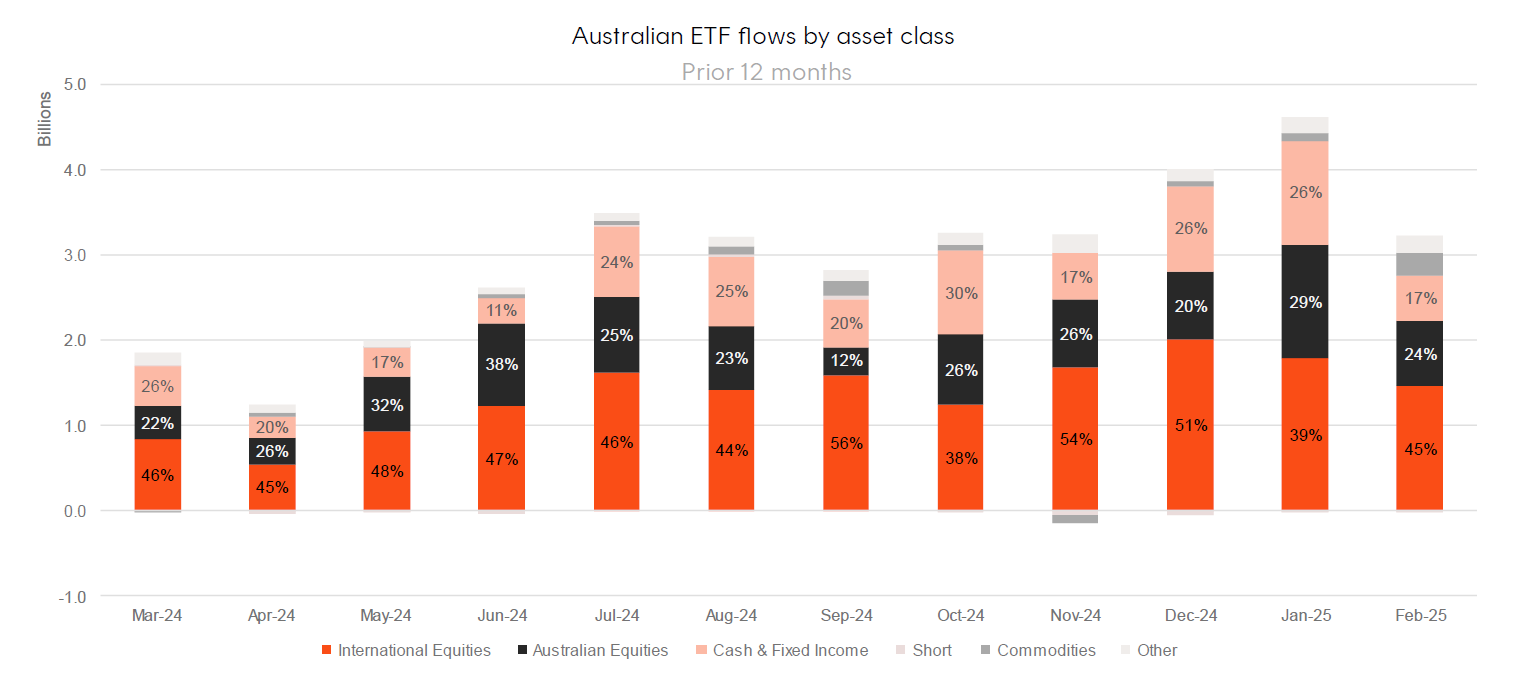

Notwithstanding market volatility, industry flows remained positive – with $3.2B of net flows for the month. February marks the fifth consecutive month where the industry recorded flows above the $3B mark

-

ASX trading value was 8% higher month on month, sitting at $13B for February

-

Over the last 12 months the Australian ETF industry has grown by 34.8%, or $66.0B

-

Product launches returned with 11 new funds launched in February, including a new Bitcoin exposure and the first Ethereum ETF on the ASX

-

A Chinese equities related exposure topped the performance charts last month, followed by a short Australian equities fund (ASX: BBOZ) and a leveraged US Treasury Bond Fund (ASX: GGFD)

-

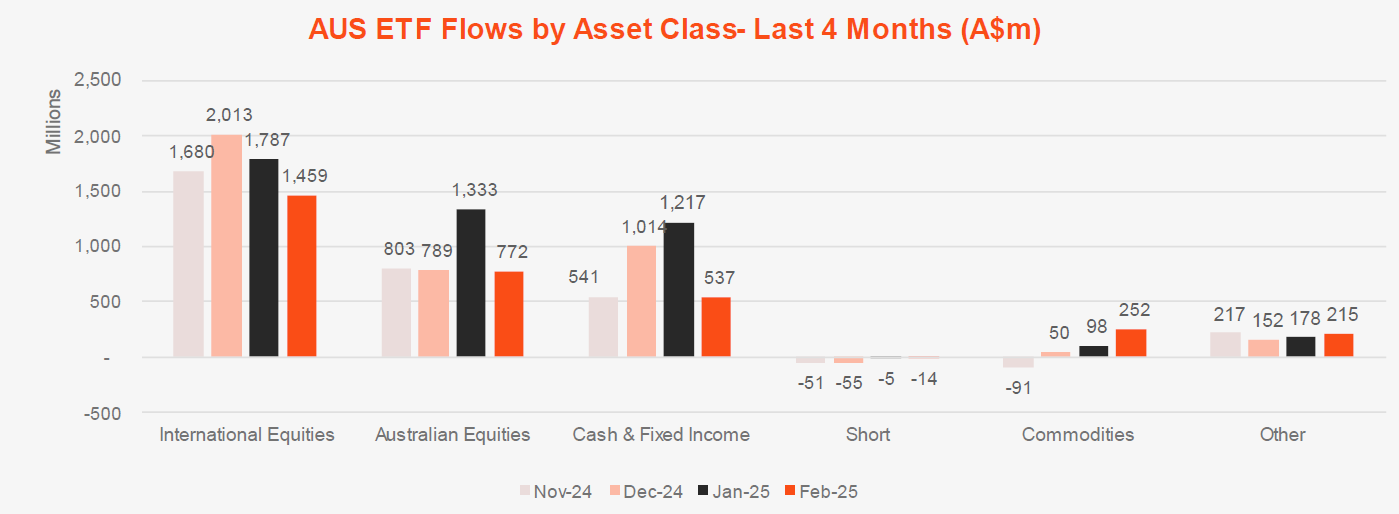

International Equities products ($1.5B) maintained their strong lead over Australian Equities ($722 million) and Fixed Income ($500 million).

Market Size and Growth: February 2025

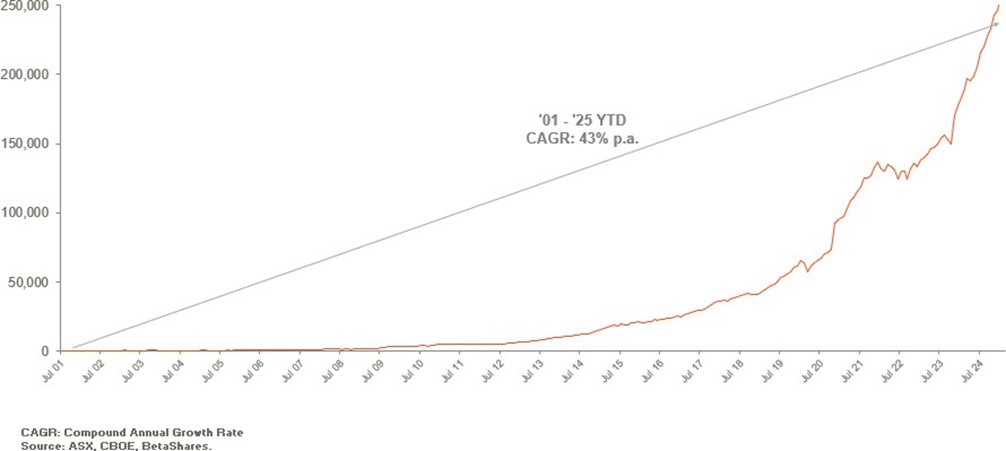

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $255.3B

- ASX CHESS Market Cap: $217.69B1

- Market Cap change for February: -0.81%, -$2.08B

- Market cap growth for last 12 months: 34.8%, or $66.0B

New Money

- Net inflows for month: $3.2B

Products

- 407 Exchange Traded Products trading on the ASX & CBOE

- Product launches returned with 11 new funds launched in February, including a new Bitcoin exposure and the first Ethereum ETF on the ASX

Trading Value

- ASX trading value was 8% higher month on month, sitting at $13B for February

Performance

- A Chinese equities related exposure topped the performance charts last month, followed by a short Australian equities fund ( BBOZ Australian Equities Strong Bear Complex ETF ) and a leveraged US Treasury Bond Fund ( GGFD Geared Long US Treasury Bond Currency Hedged Complex ETF )

Industry Net Flows

Top Category Inflows (by $) – Month

| Broad Category | Inflow Value |

|---|---|

| International Equities | $1,459,267,772 |

| Australian Equities | $772,181,854 |

| Fixed Income | $500,432,601 |

| Commodities | $252,030,073 |

| Multi-Asset | $94,798,519 |

Top Sub-Category Inflows (by $) – Month

| Sub-Category | Inflow Value |

|---|---|

| International Equities – Developed World | $835,283,318 |

| Australian Equities – Broad | $645,505,671 |

| Australian Bonds | $436,810,574 |

| International Equities – US | $398,870,717 |

| Gold | $239,788,738 |

Top Sub-Category Outflows (by $) – Month

| Sub-Category | Inflow Value |

| Fixed Income – E&R – Ethical | -$103,182,317 |

| Australian Equities – Sector | -$44,939,167 |

| Australian Equities – Short | -$20,278,149 |

| Australian Equities – E&R – Impact | -$138,298 |

Performance

Top Performing Products – Month

| Ticker | Product Name | Performance (%) |

| IZZ | iShares FTSE China Large-Cap ETF | 11.87% |

| BBOZ | Betashares Australian Equity Strong Bear Fund (managed fund) | 11.60% |

| GGFD | Betashares Geared Long U.S. Treasury Bond Fund – Currency Hedged (Hedge Fund) | 7.32% |

| GAME | Betashares Video Games and Esports ETF | 6.43% |

| DTEC | Global X Defence Tech ETF | 6.35% |

2 comments on this

what is your Cu ETF?

Hi John, thank you for your interest and question!

While we do not yet offer an ETF that provides a pure copper exposure, the Betashares Energy Transition Metals ETF (XMET) does have a 33% exposure to copper producers. Beyond copper, XMET more invests in companies involved in energy transition metal production such as Lithium and silver, as well as companies involved in the recycling and processing of raw materials. For more information on the fund, please visit the XMET fund page

https://www.betashares.com.au/fund/energy-transition-metals-etf/

Please familiarise yourself with the PDS and TMD of each security before making an investment decision. The above information is general in nature only and does not consider your personal situation or investment objectives and therefore may not be appropriate for you.

Betashares Customer Support.