David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

3 minutes reading time

Global Markets

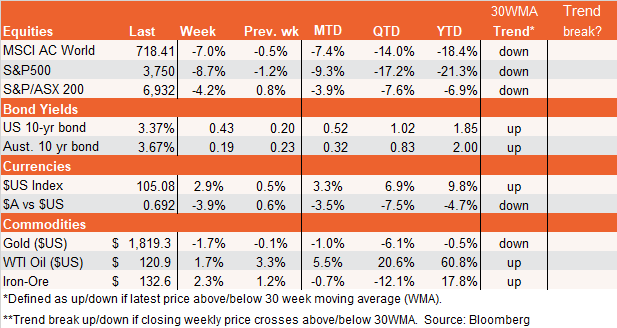

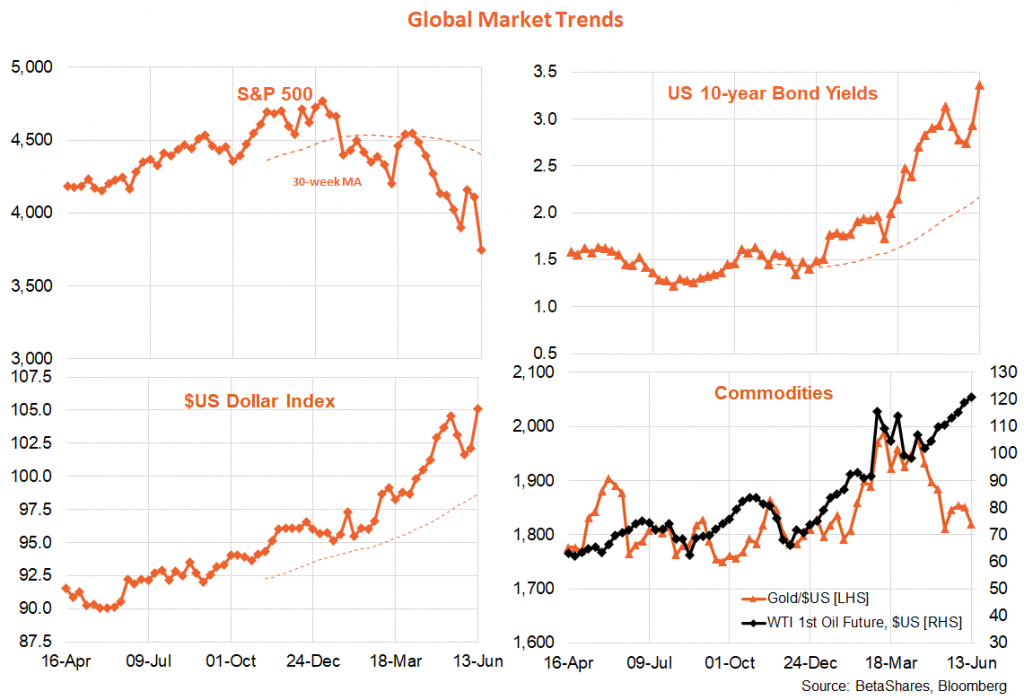

Friday’s hotter than expected U.S. consumer price index report was the major event last week and has clearly rattled markets. Headline CPI inflation rose by 1% versus market expectations for a 0.7% gain, while core inflation was only a bit higher than expected (at 0.6% versus market expectation for a 0.5% gain). The bottom line: U.S. inflation remains stubbornly high and markets now anticipate the Fed will need to do more, even at the risk of a recession.

The highlight this week is the Federal Reserve meeting. This will include updated economic forecasts and a new “dot plot” for the expected path of the Fed funds rate.

Following overnight media reports, it now seems likely the Fed will raise rates by a whopping 0.75% at this week’s meeting – just to assure markets that it is not falling (further) behind the inflation curve. Markets now anticipate the Fed could hike rates to 4% by mid-2023!

Other keys events this week will be US retail sales and housing starts.

While most bad news seems increasingly priced into bond markets (I think the US will be in recession well before the Fed gets rates anywhere near 4%), the same can’t be said for equity markets. If the US does tumble into a hard landing, (I suspect the Fed increasingly sees this as unavoidable) equity valuations and earnings expectations would likely tumble a lot further.

The key problems in the US now are cost-push inflation pressures from the Russia-Ukraine war and climate change induced poor harvests. These are combining with demand-pull inflation due to America’s low unemployment rate and pent up demand for services. US goods inflation is slowly cresting, but service sector inflation is picking up the slack. With the labour market tight and inflation expectations rising, the Fed is concerned with getting inflation down fast enough that it does not feed into a 1970s style wage-price spiral.

The only near-term positive for equity markets is that they’ve fallen so far so fast over the past week – and perhaps a 0.75% Fed rate hike might perversely boost sentiment that the Fed is serious about getting on top of inflation and getting closer to the end of the rate hike cycle, even if it risks nearer-term economic pain.

Australian Market

Australia won’t be spared from Wall Street’s sell down, especially if expectations of a global slowdown build. Indeed, the Fed is now effectively gunning for commodity markets – it wants to create enough demand destruction to at least get food and energy prices lower.

Key highlights this week will be the NAB and Westpac surveys of business and consumer sentiment today and tomorrow respectively, followed by Thursday’s labour market report. A drop in both business and consumer sentiment seems likely given the RBA’s recent aggressive rate hike and ongoing global financial market volatility. That said, employment growth is likely to remain firm with the unemployment rate expected to dip a bit lower.

Have a Great Week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.