Key considerations before investing

Summary

Before making an investment in ETFs, there are several things to understand including an ETF’s structure, whether the ETF is currency hedged, the ideal time to buy & sell on the ASX and more. These nine tips may help beginner ETF investors get started.

1. Understand an ETF’s basic structure and liquidity before you start to trade

ETFs work a little differently to standard shares you might be more familiar with, or already trading in. ETFs are simple to use products and easily accessible to more investors of all experience levels, plus they offer liquidity and transparency.

ETFs are also more cost-effective, and if you’ve got a self-managed super fund (SMSF), ETFs can be purchased within your SMSF.

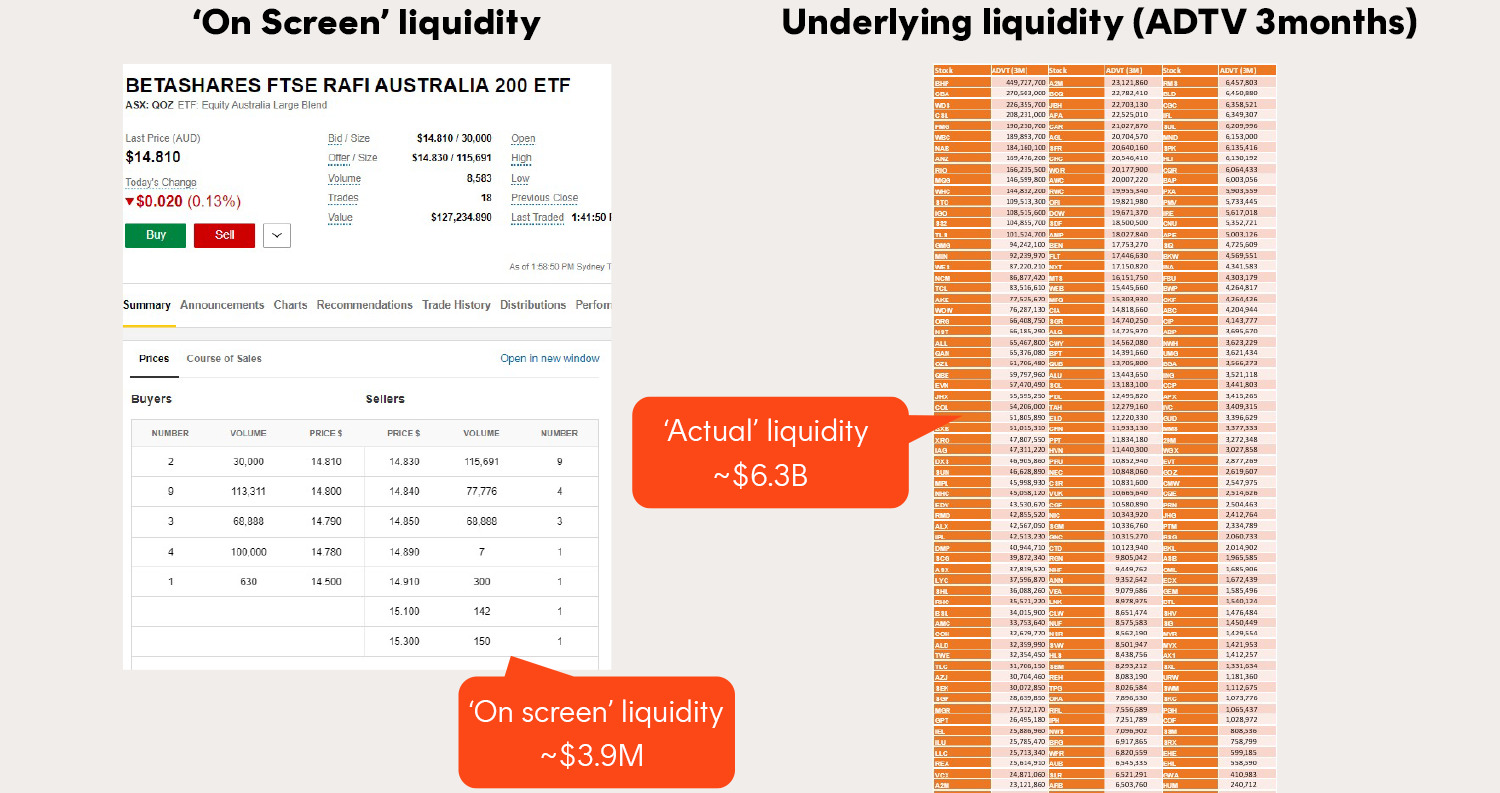

Let’s talk about the liquidity of ETFs briefly. One of the most critical differences you should be aware of is that, unlike shares, the size of the ETF in terms of assets under management, the daily volume traded and the volume of units quoted ‘on screen’ is not indicative of liquidity.

This is because an ETF is an open-ended investment fund.

An ETF’s open-ended structure means units of an ETF can be created or redeemed by market makers, as opposed to company shares which, by definition, can only have a fixed amount of stock outstanding on any given day.

As such, the supply on offer for an ETF can be adjusted to cater to the demand of the market. Therefore, the ETF fund size, daily volume traded and ‘on screen’ liquidity are not meaningful when assessing the liquidity of an ETF. An ETF’s liquidity is mainly determined by the liquidity of the underlying holdings of the fund.

Here is an example of this in operation, in which the daily liquidity is reflected by the daily average volume of the underlying holdings for QOZ FTSE RAFI Australia 200 ETF rather than its ‘on screen’ volume.

Source: Bloomberg, Commsec – 28 Dec 2022.

In terms of how to actually buy and sell ETFs, unlike traditional managed funds, you do not require an application form to purchase an ETF, instead, once you have a brokerage account, you simply buy and sell units as you would any share on the ASX.

2. Know what the NAV is, and then use the Indicative Net Asset Value (iNAV) to help determine the price to trade

There are a couple of tools available to investors to help them determine the right price to buy or sell an ETF. The most basic of these is the NAV or “net asset value”.

All ETF providers are required by law to list the net value of the ETFs underlying holdings – or NAV – on their website, and while fees and other costs mean you won’t get to trade in the market at exactly that price, you can use that as a guide to ascertain the ‘fair value’ of the product at the beginning of the trading day.

From there you can make use of the iNAV. To help determine a fair price to buy or sell an ETF you are able to refer to its indicative net asset value or “iNAV” (if available) – this is as opposed to a traditional share in which you compare your preferred ‘buy’ price with the price being offered on the screen.

The iNAV is the estimated intra-day ‘fair value’ of the ETF (which is the price per unit of the basket of underlying securities held by that particular ETF less any liabilities such as management fees) which updates frequently during the day in real time.

iNAVs bring intra-day pricing transparency to ETFs in contrast to unlisted managed funds, for which net asset values are determined just daily (or sometimes less frequently) once the trading day ends.

iNAVs for Betashares Funds can either be found on our website on the respective product page or via an ASX code which is specified on our website for certain funds.

3. Is the ETF currency hedged or unhedged?

Something you’ll need to consider with ETFs which track international shares is whether your investment is “hedged” or “unhedged” when it comes to the foreign currency.

The impact of currency is a genuine potential risk for ETF investment – you might well invest prudently and see the stocks in your ETF all go up, which would result in a profit for you, were it not the case that the currency involved in the ETF goes the other way, leading to a reduction on the available profit or even, in an extreme scenario, a loss!

All ETFs which invest in international shares will be currency Hedged or Unhedged, and it’s important to decide how you wish to invest.

For example, if you are solely wanting to take a view on the value of the underlying international shares, without having to worry about the direction of the foreign currency and the Australian dollar, you are likely going to want to invest in a “hedged” ETF.

If, on the other hand, you would like to include the relative performance of the foreign currency to the Australian dollar as part of your investment you may be happy to invest in an unhedged way. Please note that, if you invest in an unhedged product, should the value of the foreign currency appreciate against the AUD, this will be a net benefit to the performance.

Conversely, should the Australian dollar appreciate against the foreign currency, the performance of the unhedged product will be worse than the underlying performance of the shares themselves.

So, if you are investing in international ETFs, make sure you also keep a close eye on the currency behaviour and how you wish to take a view on that.

4. What’s a short exposure?

There are certain exchange traded products that provide a short exposure to the sharemarket.

Where traditional index-tracking funds move inline with a benchmark, a short exchange traded product is designed to go up when the benchmark falls, and vice versa. This allows investors to simply take a short position via such a product.

As with all short positions, this might seem like a risk-filled investment, but there’s one significant benefit to it; if you’re predicting a fall in the sharemarket, a short exposure is a way to hedge the risk across your portfolio and potentially generate profits from a falling market.

Betashares currently offers three short funds – two covering the Australian market:

And one covering the US market:

5. Understanding bid & offer spreads

All exchange traded and unlisted investment funds are subject to bid and offer spreads (known as buy/sell spreads for unlisted funds).

In the case of ETFs, a bid/offer spread is the difference between the NAV of the Fund and the price at which the ETF can be bought or sold on the ASX.

A ‘spread’ is a Market Maker’s compensation for the time and financial risk they bear by making markets and enhancing liquidity i.e. acting as a buyer and seller of ETF units on the exchange and creating and redeeming units based on investor demand.

Spreads for each fund vary as they are largely dependent on liquidity of the underlying securities. In general, the more liquid the security, the tighter the spread. Market Makers also seek to maintain tight spreads to ensure they do not give their competition the potential to ‘arbitrage profits’.

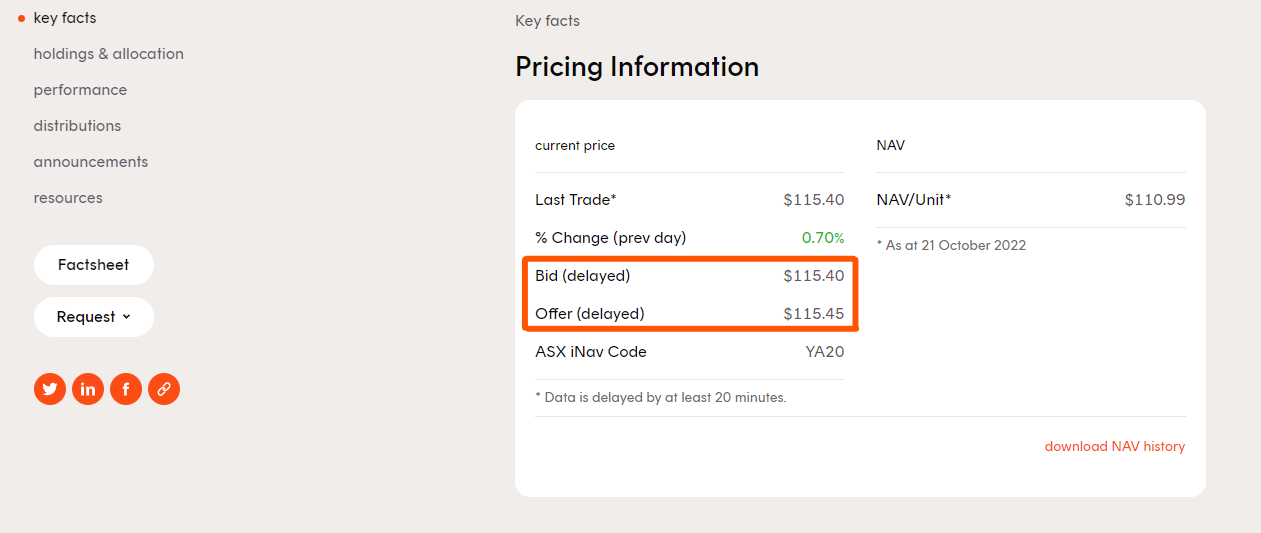

Bid/offer spreads for all Betashares Funds can be found on the Betashares website, on the respective product page, as seen in the screenshot below:

6. Know the difference between ‘market orders’ and ‘limit orders’

When placing an order through your broker, whether it be for a share or an ETF, you have the option of placing your trade as a ‘market order’, in which you are agreeing to bid on whichever price the market is willing to pay, or a ‘limit order’ in which you determine the price you are willing to bid.

The risk with the market order is that if there are many orders placed at the same time, relative to the demand on offer (i.e. a previous investor has placed a large order which momentarily depletes the volume offered at the current market price), your trade runs the risk of being filled with the next best market offer and this may be worse than the best price possible.

A volatile market may also cause the iNAV of the ETF to fluctuate and spreads to widen, which also may lead to bids being filled at undesirable prices.

To avoid this risk, you may wish to place a ‘limit order’. Although you may run the risk of your order not being filled immediately, you still avoid the risk of getting worse than your desired price for the ETF.

7. Time when you buy/sell an ETF

Investors may also wish to avoid trading near the market open and close. This is because Market Markers can experience higher risk at these times, which may result in wider than normal spreads.

At the market open, Market Makers look to determine the accurate pricing of the ETF’s underlying securities, taking into account the fact that only some, but not all, of the securities, have commenced trading and therefore have current prices available.

The higher risk is experienced by Market Makers when markets open and near market closing time, as prices of securities tend to fluctuate more at these times.

This volatility occurs around the market close as the ‘matching period’ approaches (all trades that take place on the close transact at a price determined by the market, regardless of what price an investor bids or offers). Market Makers bear a higher risk in pricing at this point, which can lead to wider than normal spreads.

On this basis, investors should be mindful of trading around market open and close periods.

To repeat what we said in Tip #1, something that many observe with ETFs is that the volume of trading, i.e. buying and selling during the day, may be low, which may lead some people to believe that ETFs have relatively low liquidity.

This is not the case at all.

ETFs have an open-ended structure, meaning that the liquidity of ETFs is beyond the amount of on-screen volume that investors see on the trading screen. As a rule of thumb, the liquidity of ETFs is at least as great as the liquidity of all the underlying assets that comprise an ETF.

8. ETFs can help deal with market volatility

Volatility in the markets is something that is increasingly commonplace, and ETFs are a useful weapon to help manage this risk.

One of the major advantages of ETFs is the fact that they typically trade very closely to NAV, as described above. By contrast, a listed investment company – or LIC – provides no formal mechanism to ensure that the bid-offer prices are close to the NAV and this means that when there’s a great deal of selling going on – a “panic” – there is a real chance that the traded price for the LIC will fall well below the LIC’s NAV, imposing costs on anyone who wanted to sell out as quickly as possible.

9. What happens to my assets in the event of a product issuer’s bankruptcy?

The ETF structure is generally very investor-friendly, and includes protection mechanisms for the investor. Put simply, in the unlikely event that a product issuer goes bankrupt, the product issuer’s creditors aren’t going to be able to access the ETF’s assets.

ETFs have the same legal structure as a traditional managed fund, and this means that the assets that form the underlying ETF are held on trust for the benefit of investors, and do not form part of the assets of the product issuer.

Normally, to ensure additional separation, assets will normally be held by an independent third party known as a ‘custodian’, which has been appointed by the ETF issuer, but is not part of the same organisation.

Written by

Benjamin Smith

Video and Content Executive

Ben brings a unique blend of financial acumen and creative storytelling to his role. With a solid background as a portfolio analyst, Ben possesses a deep understanding of the financial markets, investment strategies, and how ETFs work.

Read more from Benjamin.