David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

3 minutes reading time

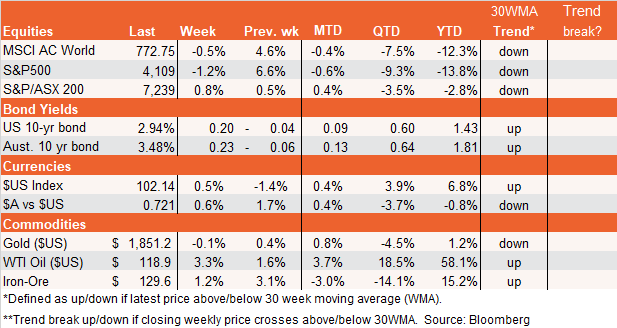

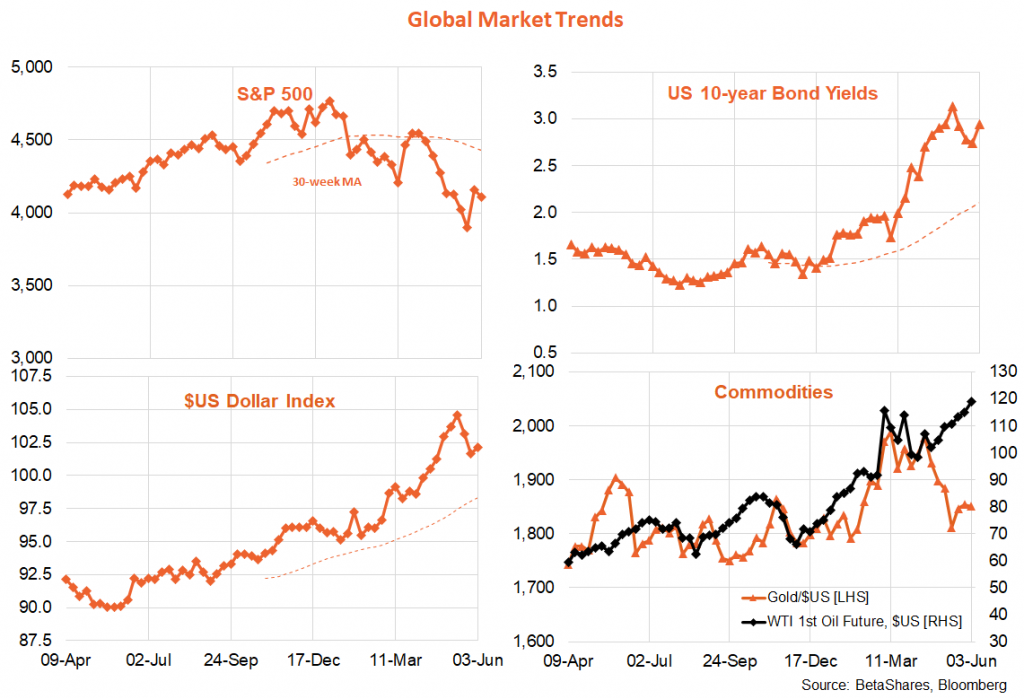

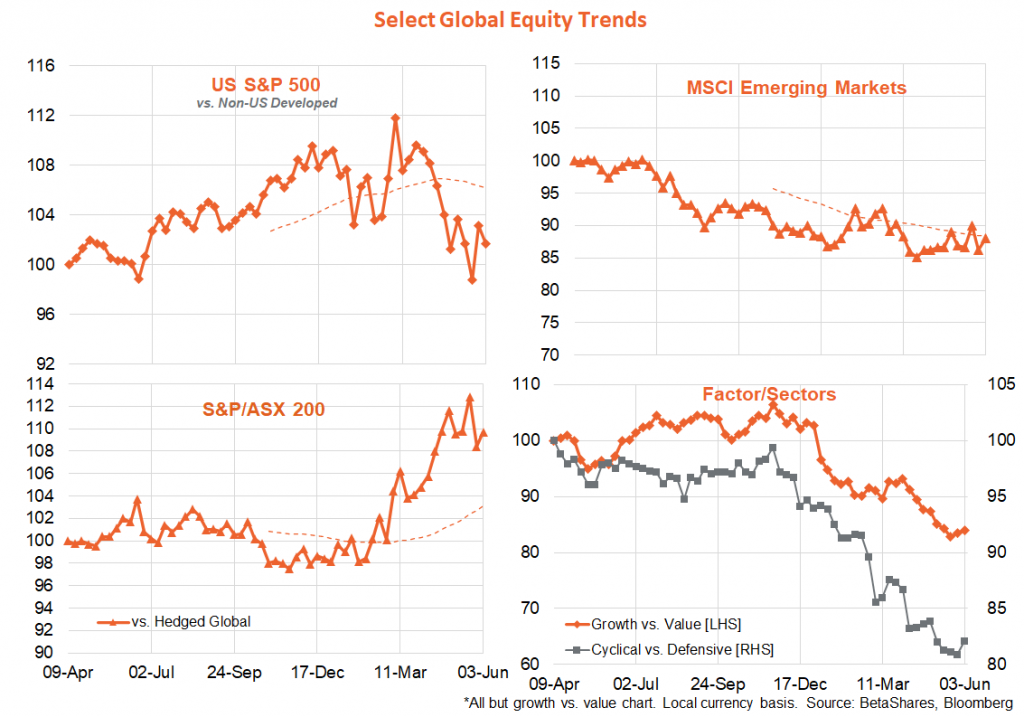

Global markets

Global equities had a modest pullback last week after a strong rebound the previous week, with bond yields also rebounding. U.S. 10-year bond yields have leapt back closer to 3% and have broken their downtrend line from their recent peak of 3.2% on May 9.

The key market driver was lingering nervousness over how far the Fed will raise interest rates given continued solid U.S. economic growth indicators – such as last week’s report on U.S. manufacturing and employment. Also notable was the range of Fed speakers who failed to validate market hopes that emerged in the previous week that the Fed was thinking of pausing the rate hike schedule in September – after two further 0.5% hikes this month and next month.

In short, they indicated they simply don’t know whether they’d agree to a pause in September – it depends on how quickly inflation falls over the next few months.

On that score, we’ll learn more with the key piece of economic data this week – the U.S. CPI on Friday. Annual growth in the core CPI is expected to slow modestly to a (still high) 5.9% from 6.2%, while headline inflation is expected to remain stubbornly stuck at 8.3%. Results in line with the market imply inflation, while easing, remains uncomfortably high – and won’t stand in the way of a 0.5% rate hike at next week’s Fed meeting.

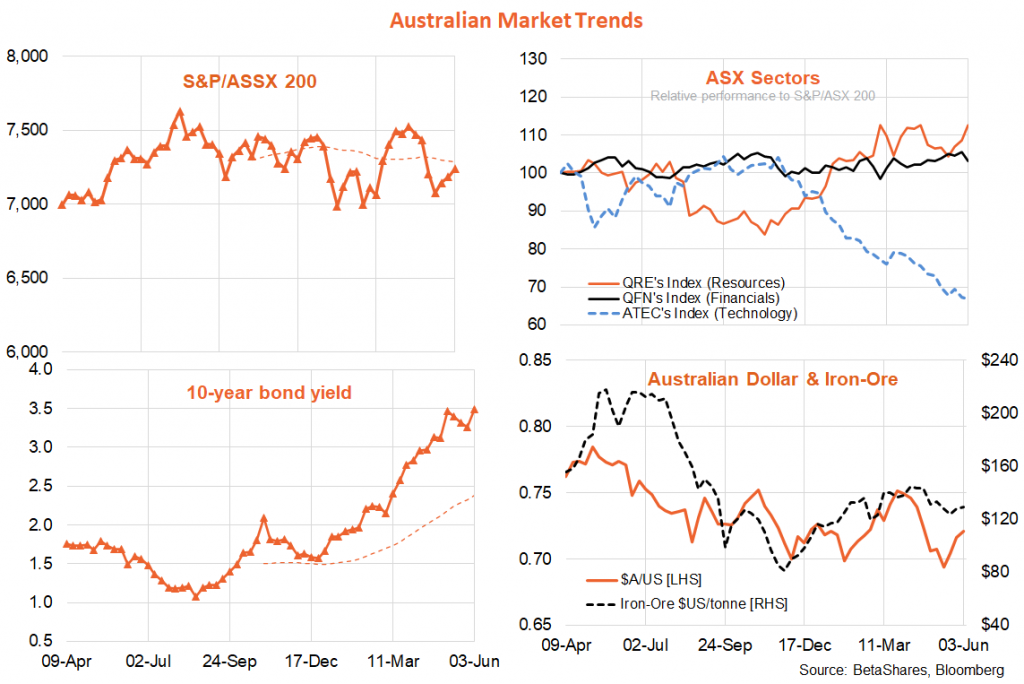

Australian market

The local highlight last week was the stronger than expected Q1 GDP result, with growth of 0.8% and 3.3% over the year. It was an impressive result considering the headwinds of Omicron and weather-related disruptions to exports and construction – and was largely thanks to the continued strength in consumer spending. House prices, meanwhile, have started to correct with the Core-Logic estimate of national prices down 0.1% in May. Prices in the largest and most expensive cities of Sydney and Melbourne fell the most, with declines of 1.0% and 0.7% respectively. Prices in Brisbane and Adelaide continued to rise, but that seems unlikely to last for much longer.

The highlight this week will of course be tomorrow’s RBA meeting. While there is no question the RBA will lift interest rates, the debate centres on whether it will be 0.25%, 0.4% or even 0.5%. To my mind, the RBA should and will deliver only a 0.25% hike – consistent with its return to pre-pandemic “business as usual” 0.25% incremental rate hikes.

Indeed, if the RBA could not justify hiking rates by 0.4% last month, I can’t see what justifies such a large move this month – especially given headline inflation remains much more contained than evident in peer countries in such as the U.S., Canada, New Zealand and even Germany. Contrary to some reports, moreover, most estimates of wage growth remain relatively benign. A large move also risks appearing panicked and could unnecessarily hurt business and consumer sentiment, and might perversely heighten inflation fears.

Have a great week!

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.