David Bassanese

Betashares Chief Economist David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

4 minutes reading time

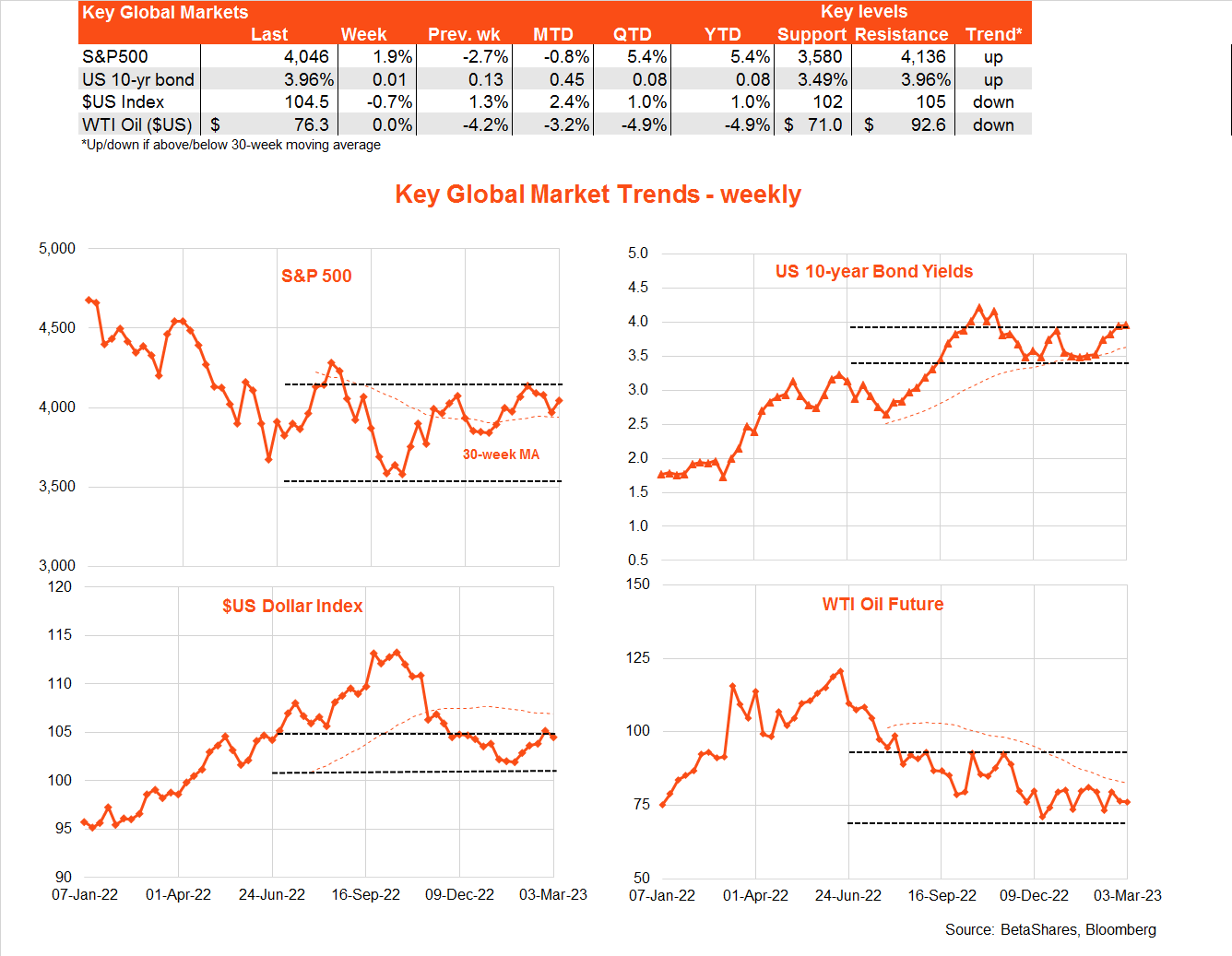

Global markets

Global markets enjoyed somewhat of a reprieve last week, with steadier bond yields helping stocks lift for the first time in three weeks. The $US also eased. That said, US 10-year bond yields did briefly break above 4% last week for the first time since November.

In a fairly data-light week, markets appeared to latch onto comments from a few Fed officials suggesting that the bout of recent strong US inflation and activity data likely won’t prompt the Fed to lift rates by 0.5% at the March 21-22 policy meeting – instead it may well stick with the smaller 0.25% move seen back in January.

That said, most Fed officials are suggesting rates may need to stay “higher for longer”, with possibly more than the two further rate hikes implied by the Fed’s December projections.

The US data released last week generally remained firm – with January core durable goods orders and pending home sales both stronger than expected. In Europe, meanwhile, French consumer inflation for February surprised on the high side.

Key global highlights this week include two bouts of Congressional testimony by Fed chair Powell. Markets are likely to be laser focused on two issues: whether he hints at a 0.25% or 0.5% rate rise later this month and/or any upward revision to the Fed’s currently anticipated terminal Fed funds rate range of 5 to 5.25% (which, as noted, above implies only two further 0.25% rate hikes).

In likely mixed messages for the market, I suspect Powell only has a 0.25% rate hike in mind for this month (so won’t suggest otherwise), though he may well warn of a potential upgrade to the Fed’s expected terminal rate.

Of course, the other highlight this week – which could still leave a 0.5% March Fed rate hike on the table – is Friday’s US February payrolls report. Markets anticipate a smaller but still solid 200k gain in jobs, following the blockbuster 500k gain in January. Also on the firm side, while the monthly gain in average hourly earnings is expected to remain steady at 0.3%, this would imply an increase in the annual rate from 4.4% to 4.7%.

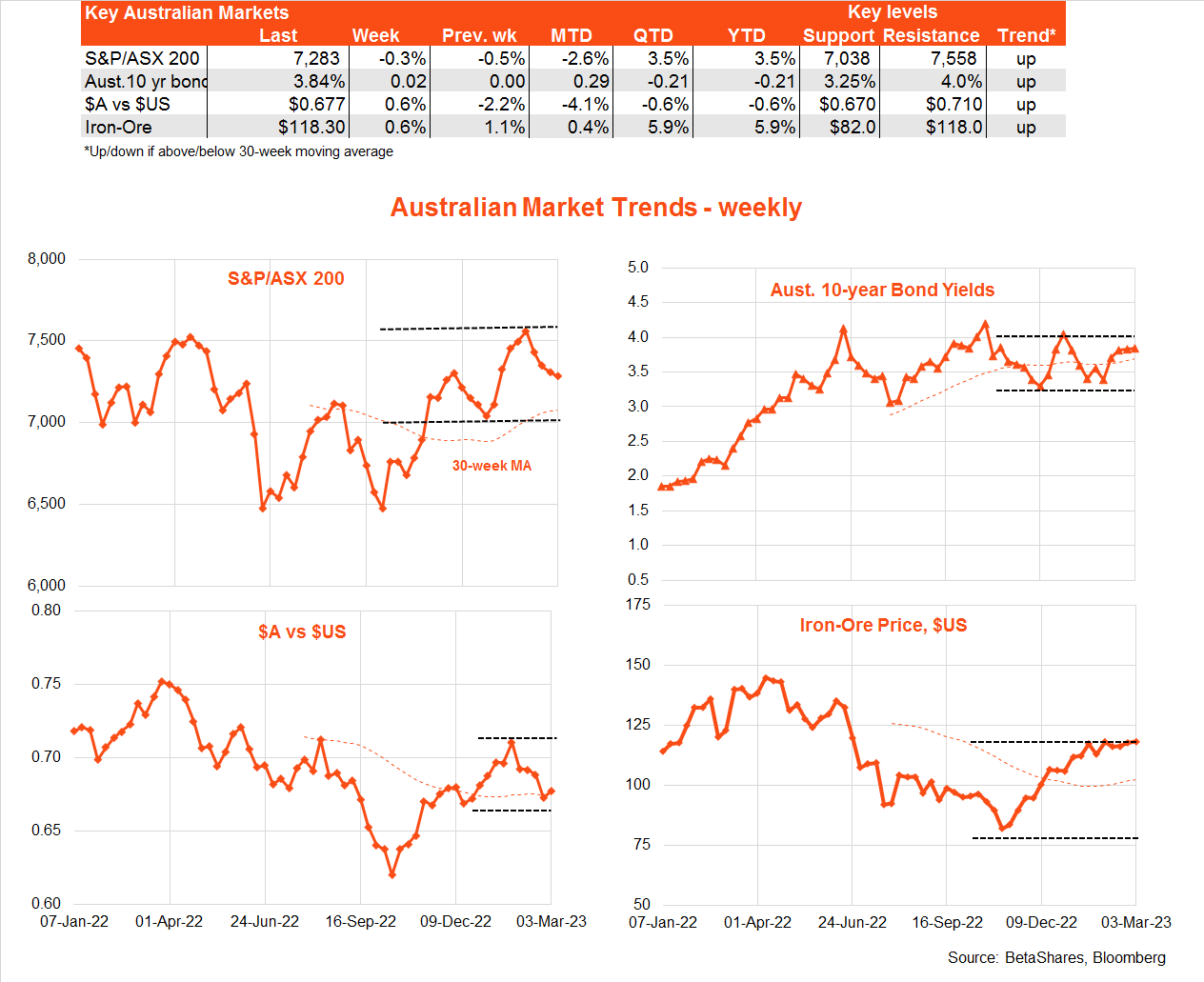

Australian markets

In Australia we got a bunch of relevant data last week, which all remained generally consistent with the view that higher interest rates are starting to take their toll on the economy. Most importantly, Q4 GDP was softer than expected, rising by only 0.5%, reflecting a weak 0.3% gain in consumer spending, which in turn reflected weak disposable income growth.

The monthly CPI for January (with caveats due to its apparent volatility) was also softer than expected, while building approvals also slumped by a lot more than expected.

Partly offsetting these signs of softness, the January bounce back in retail spending was a little stronger than expected, while house prices levelled off in February.

All up, while it seems likely the RBA will press ahead with a 0.25% rate increase at tomorrow’s policy meeting, the run of recent soft data could see it issue a somewhat more dovish policy statement. Indeed, market focus will be on whether the RBA repeats last month’s hawkish phrase “the Board expects that further increases in interest rates will be needed over the months ahead”.

Unless the RBA strongly anticipates at least two further rate hikes will be needed, some alteration to this sentence will be required – which could get the markets excited about a potential pause sometime soon.

Either way, if markets misinterpret the RBA Statement tomorrow, RBA Governor Lowe will have a chance to rectify matters in a key speech on Wednesday.

David is responsible for developing economic insights and portfolio construction strategies for adviser and retail clients. He was previously an economic columnist for The Australian Financial Review and spent several years as a senior economist and interest rate strategist at Bankers Trust and Macquarie Bank. David also held roles at the Commonwealth Treasury and Organisation for Economic Co-operation and Development (OECD) in Paris, France.

Read more from David.