Bitcoin and the rest of the crypto market suffered a precipitous decline last week. The macroeconomic environment continued to set the tone for markets with US inflation hitting a 41-year high of 8.6% which sent both equity and crypto markets reeling. The entire digital market capitalisation has now dipped below $1 trillion after hitting a high of almost $3T last year. At the time of writing, bitcoin is at US$18,396 and for the first time in its history, has fallen below its previous cycle’s high of $19,783 in December 2017.

Ethereum’s performance was no better returning -34.79% vs bitcoin’s -33.32% over the week.

Bitcoin’s market cap fell to $350.8B, while the total crypto market sits at $817.9B. Bitcoin’s market dominance decreased to 42.8%

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $18,396 | $26,795 | $17,708 | -33.32% |

| ETH (in US$) | $957 | $1,448 | $896 | -34.79% |

Source: CoinMarketCap. As at 19 June 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

News we’re watching

Crypto platform Celsius pauses withdrawals and transfers

Adding to crypto volatility, lending and trading platform Celsius Network announced it was “pausing all withdrawals, swaps, and transfers between accounts”, citing extreme market conditions. The firm reportedly had about $12 billion in customer assets as of May across 1.7 million users, as reported by the Financial Times. Celsius’ issues seem to be stemming from a combination of illiquidity and leverage. A portion of the assets’ illiquidity on its platform stems from ETH 2.0 staking. In a note to clients, Celsius stated: “Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals…We are taking this action today to put Celsius in a better position to honour, over time, its withdrawal obligations.”1

Coinbase to cut staff by about 18%

After expanding to about 5000 employees, Coinbase has announced that it will cut staff by about 18%. In a letter to employees, CEO Brian Armstrong wrote: “As we operate in this highly uncertain period in the world, we want to ensure we can successfully navigate a prolonged downturn…Our employee costs are too high to effectively manage this uncertain market. The actions we are taking today will allow us to more confidently manage through this period even if it is severely prolonged.”2 Coinbase isn’t the only crypto company to downsize due to macroeconomic conditions. Other firms include BlockFi, laying off 20% of its 850 employees. Additionally, Crypto.com, Robinhood, and Gemini have revealed downsizing plans in recent months of roughly 5%, 9%, and 10% respectively.

Microstrategy leads crypto-related stocks lower

One of the biggest losing crypto equities last Monday was MicroStrategy, which saw its stock fall 25.18% before recovering slightly through the week. The company currently owns 129,218 BTC across two corporate entities. At a price of $22,960, MicroStrategy would be down more than $1 billion on its bitcoin bet. A bitcoin price of $21,000 had been talked about as a point at which the company could face a margin call, but CEO Michael Saylor explained in a tweet that “MicroStrategy has a $205M term loan and needs to maintain $410M as collateral. Microstrategy has 115,109 BTC that it can pledge. If the price of BTC falls below $3,562 the company could post some other collateral.”3

On-chain metrics

Bitcoin (BTC): Realised Price

Realised Price is the average cost basis for all coins on the network. The realised price is interesting to look at as it can act as a support level. However, there is also the possibility that as investors trend towards their cost basis and/or slightly below it, they may sell in order to limit or prevent further losses, turning this level into a capitulation point.

Looking at data from on-chain analytics company Glassnode, the price of BTC now sits below the realised price of $22,637.

Source: Glassnode. Past performance is not indicative of future performance.

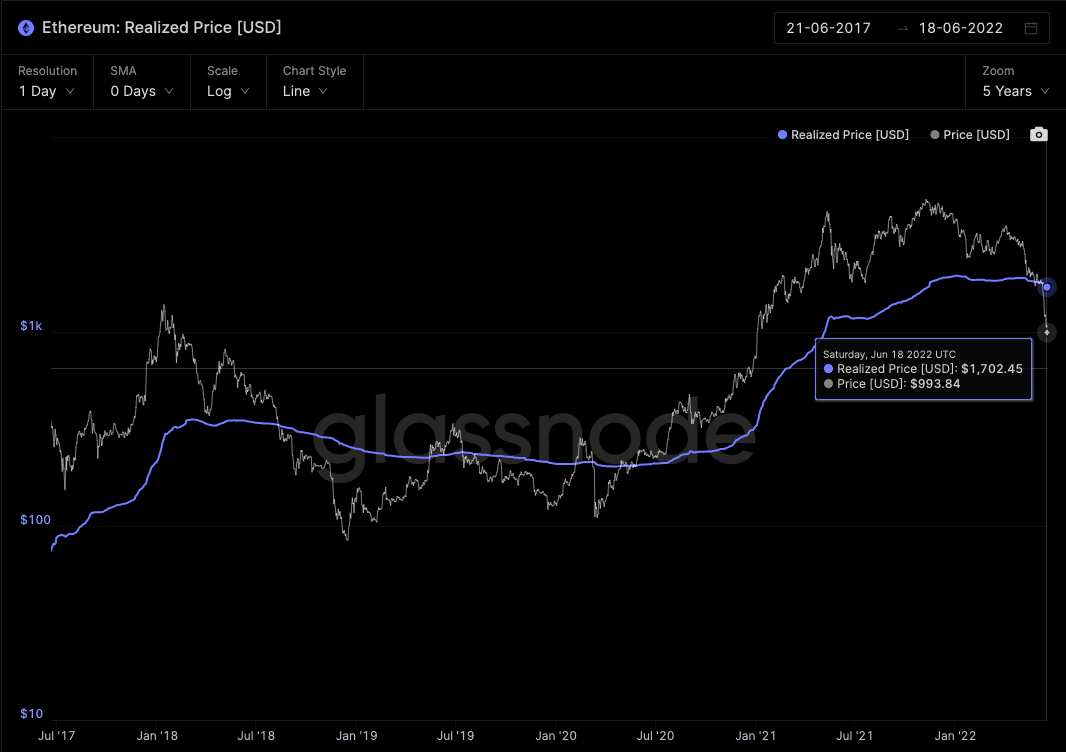

Ethereum (ETH): Realised Price

Looking at the realised price data for Ethereum, ETH has fared even worse than BTC. Pressure from bearish investors has pushed the price of ETH way below its realised price of $1,702 and has fallen below $1,000 for the first time in 18 months, increasing losses for most of the network.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoins, stablecoin Tether (USDT) issued an official statement to deny claims that the backing for its US Dollar stablecoin is exposed to 85% Chinese or Asian commercial paper and is being traded at a 30% discount. Tether called such allegations “completely false,” and reiterated that more than 47% of total USDT reserves are now in United States Treasuries. The firm expects to further reduce its exposure to commercial paper to $8.4 billion by the end of June 2022, eventually aiming to clear out its commercial paper backing. In a statement Tether said: “This will gradually decrease to zero without any incurrences of losses. All commercial papers are expiring and will be rolled into U.S. Treasuries with a short maturity.”4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.cnbc.com/2022/06/13/crypto-lender-celsius-pauses-withdrawals-bitcoin-slides.html

2. https://blog.coinbase.com/a-message-from-coinbase-ceo-and-cofounder-brian-armstrong-578d76eedb12

3. https://www.thestreet.com/investing/cryptocurrency/billionaire-saylors-microstrategy-loses-over-1-2-billion-in-the-bitcoin-crash

4. https://crypto.news/tether-denies-false-rumors-regarding-its-commercial-paper-holdings-exposure-to-celsius/

Off the Chain will be published every Tuesday, and provide the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.