Bitcoin and the rest of the crypto market took a breather and was relatively flat over the last week. Despite hitting its highest price in eight weeks, Bitcoin fell slightly over the course of the week, and at the time of writing is trading at US$22,992.

Ethereum performed slightly better, down -0.82% vs bitcoin’s -2.93% for the week.

Bitcoin’s market cap sits at US$439.5B, with the total crypto market holding steady at $1.09T. Bitcoin’s market dominance is now at 40.42%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $22,992 | $24,121 | $22,485 | -2.93% |

| ETH (in US$) | $1,682 | $1,745 | $1,567 | -0.82% |

Source: CoinMarketCap. As at 7 August 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements. Source: Glassnode. Past performance is not indicative of future performance.

Source: Glassnode. Past performance is not indicative of future performance.

News we’re watching

Crypto market expansion

Coinbase, one of the largest crypto exchanges, has announced a deal with the world’s largest asset manager, BlackRock. The partnership will make it easier for BlackRock’s institutional clients to manage and trade bitcoin. Aladdin, which is the investment management system used by BlackRock’s institutional clients, will connect to Coinbase Prime, the institutional trading platform for Coinbase, which provides crypto trading, custody, prime brokerage and reporting capabilities. The move by BlackRock will give traditional finance firms deeper access to crypto. The first token available will be bitcoin, but the offering may expand based on client demand.

Joseph Chalom, global head of strategic ecosystem partnerships at BlackRock, said: “Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational life cycle of these assets.”1

Kucoin to offer NFT ETFs

Kucoin, a cryptocurrency exchange, will be offering retail investors fractional ownership of large non-fungible tokens (NFT) projects. The ownership will be in the form of an exchange-traded fund (ETF) and will be open to all customers. Kucoin claims to be the first large exchange to offer an ETF over NFTs. The exchange’s suite of ETFs are denominated in the stablecoin USDT, and the NFT ETF is being offered in partnership with Fracton Protocol, a service dedicated to fractionalising valuable NFTs into fungible Ethereum-based ERC-20 tokens, the companies said.

The ERC-20 tokens contained within KuCoin’s NFT funds represent 1/1,000,000 ownership of the BAYC collection, for example, denoted by a hiBAYC token. To start, KuCoin’s ‘NFT ETF Trading Zone’ will first list five NFT ETFs covering blue-chip collections. As well as lowering the bar for retail investors, using the fund removes the need to manage NFT infrastructure elements, such as wallets and smart contracts, KuCoin added.2

Solana wallets drained

It has been reported that approximately 8000 ‘hot’ wallets (wallets connected to the internet) have been compromised. The attack targeted mainly Phantom, Slope and Trust wallets, draining them of Solana (SOL) tokens and the stablecoin USD Coin (USDC). It is estimated that around $8 million has been stolen.

The twitter account for Solana Status confirmed the attack and said: “An exploit allowed a malicious actor to drain funds from a number of wallets on Solana. As of (Aug 3rd) 5am UTC approximately 7,767 wallets have been affected. Solana stressed that the current investigation indicates that there is ‘no evidence’ that the network is at fault for the breach.”3 The source of the attack remains unknown and an investigation continues.

On-chain metrics

Bitcoin (BTC): Bitcoin: Number of Active Addresses (7d Moving Average)

Number of Active Addresses (7d Moving Average) looks at the number of unique addresses that were active in successful transactions in the network either as a sender or receiver. Looking at active addresses gives us an idea of new demand as more users enter the network. Bullish impulses are signalled by sustained upticks and elevated on-chain activity as older investors sell, and new demand absorbs these coins. The opposite can be said for bearish impulses.

Looking at data from on-chain analytics company Glassnode, Bitcoin active addresses remain firmly within a well-defined downtrend channel. With the exception of a few activity spikes higher during major capitulation events, the current network activity suggests that there is little influx of new demand as yet.

Source: Glassnode. Past performance is not indicative of future performance.

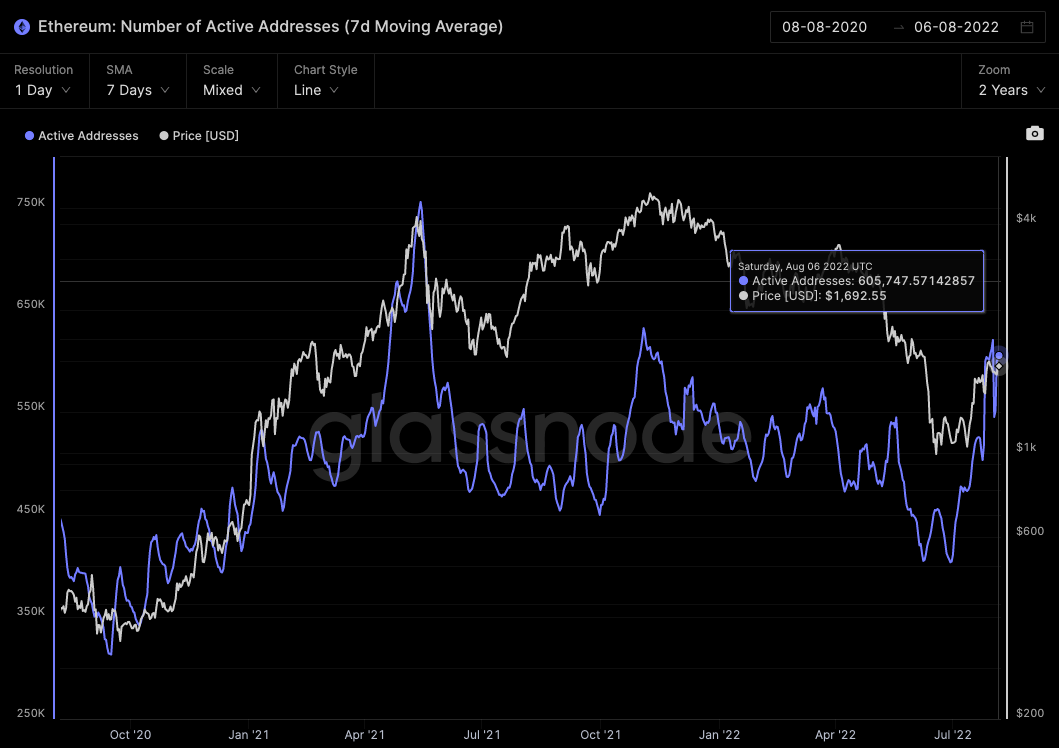

Ethereum (ETH): Ethereum: Number of Active Addresses (7d Moving Average)

Looking at data for Ethereum active addresses, you can see that compared to Bitcoin, the data is more bullish and healthier, which reflects the much better performance of ETH over the last four weeks. The anticipation of the upcoming ‘Merge’, where Ethereum will transition from proof-of-work (POW) to proof-of-stake (POS), has resulted in rising and elevated on-chain activity, with significantly more users entering the network since the price potentially bottomed at just under $1000.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, the token Flow (FLOW) jumped after Meta CEO, Mark Zuckerberg, announced that Instagram had expanded its NFT support to 100 more countries. The expansion follows the initial NFT test launch in May, which was only available to select creators in the US. Flow is the blockchain that supports Instagram’s NFT features. The ability to use NFTs on the platform by 100 more countries in Asia, Africa, and the Middle East should increase the adoption of the blockchain and the use of the FLOW token.

According to the Flow website: “Flow is a fast, decentralised, and developer-friendly blockchain, designed as the foundation for a new generation of games, apps, and the digital assets that power them. It is based on a unique, multi-role architecture, and designed to scale without sharding, allowing for massive improvements in speed and throughput while preserving a developer-friendly, ACID-compliant environment.”4

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.bloomberg.com/news/articles/2022-08-04/blackrock-teams-up-with-coinbase-in-crypto-market-expansion?sref=6EQWk76O2. https://www.coindesk.com/business/2022/07/29/kucoin-claims-bragging-rights-as-first-exchange-to-offer-nft-etfs/?fbclid=IwAR2Qwy9IjoDYUqtD2uHZF5jVOy_90rY33Pcm5bPM3W6NBE9-_yE_eBN5m4Q&fs=e&s=cl3. https://techcrunch.com/2022/08/03/solana-wallet-hack/4. https://cryptopotato.com/meta-integrated-flow-blockchain-and-rolled-out-nft-support-in-100-countries/5. https://www.onflow.org/primer

Off the Chain will be published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

This article mentions the following funds

Written by

Justin Arzadon

Director, Adviser Services & Head of Digital Assets.

C4 Certified Bitcoin Professional (CBP) and Blockchain Council Certified Bitcoin Expert™ with over 18 years’ experience in the ETF market. Passionate about the future of money.

Read more from Justin.